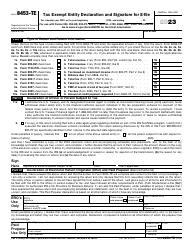

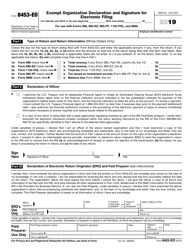

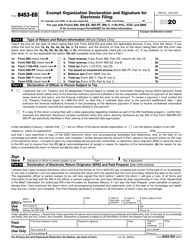

IRS Form 990-N Electronic Notice (E-Postcard)

What Is IRS Form 990-N?

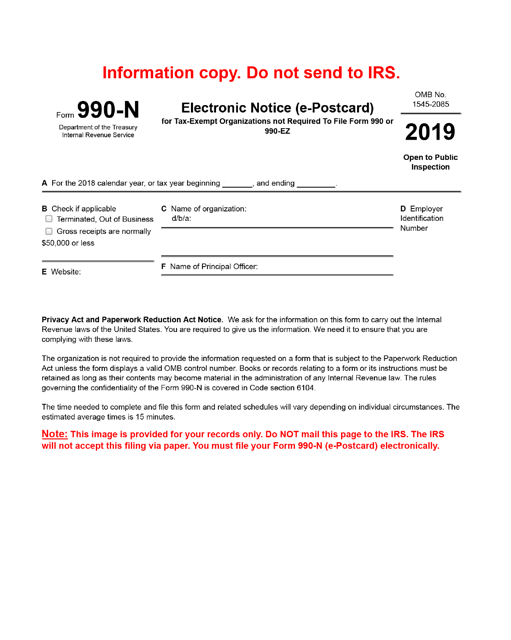

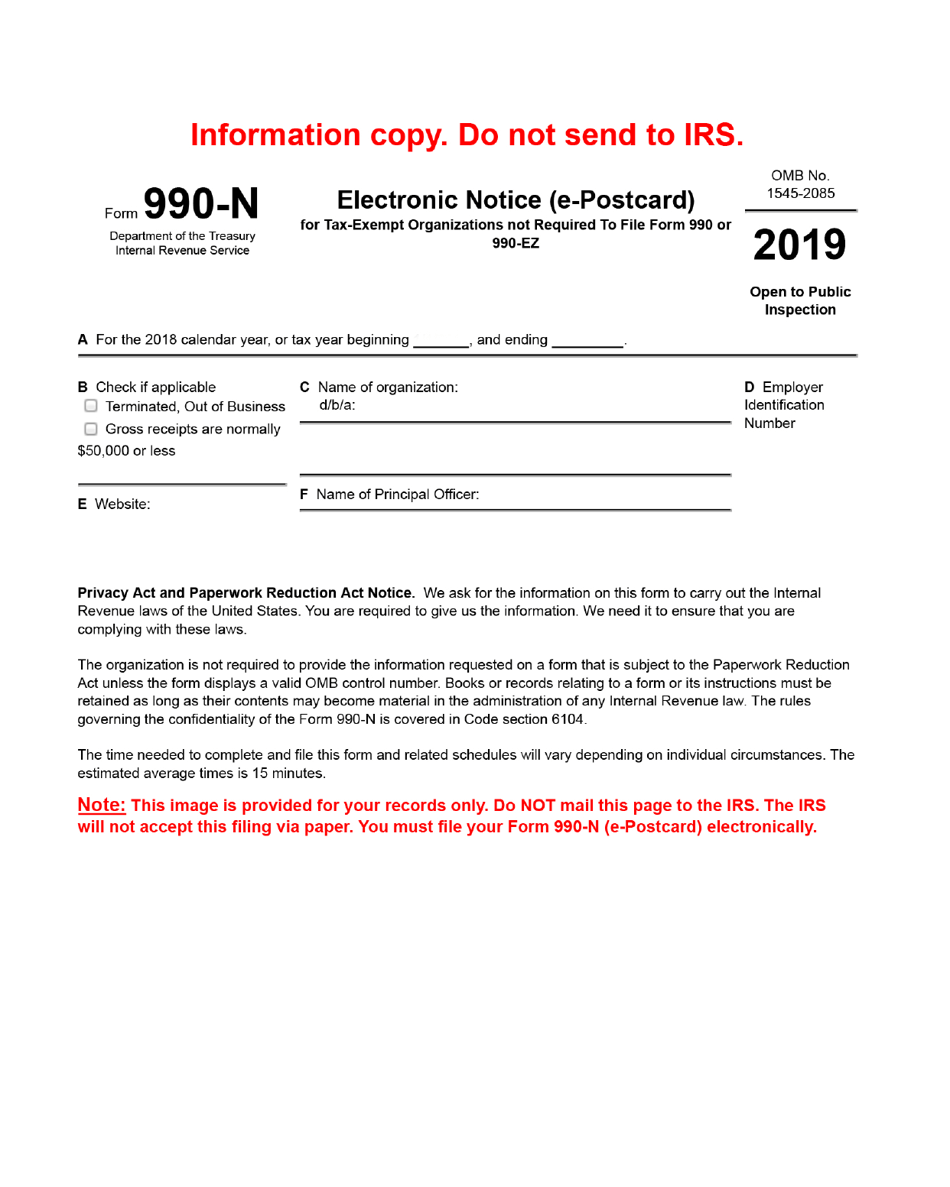

IRS Form 990-N, Electronic Notice (e-Postcard) is an annual report form used by the small tax-exempt organizations not required to file Form 990 or Form 990-EZ. IRS Form 990-N, also known as the "IRS annual electronic notice e-postcard", is filed online with no paper forms available.

The fillable Form 990-N issued by the Internal Revenue Service (IRS) was moved from the Urban Institute's website to the IRS website in February 2016. Use the link below to download the form.

Who Can File Form 990-N?

File this document to report information about small nonprofit organizations. To be eligible to use this form, the annual gross receipt of the organization must be $50,000 or less, excluding:

- Churches, conventions or associations of churches, and their integrated auxiliaries;

- Subordinate organizations in a group exemption that are included in the parent's group return;

- Organizations that must file a different return form.

The organizations eligible to file Form 990-N can choose to submit Form 990 or Form 990-EZ instead.

IRS Form 990-N Instructions

Form 990-N filing requirements include a one-time registration on the IRS website. Next year you will be able to file your e-Postcard without registration. To avoid technical issues, do not register or file this form using your smartphone and close multiple browsers before registration.

To fill out the form, you will need the following information:

- The legal name of your organization. If you have changed the legal name of your organization, inform the IRS about it before filing the e-Postcard;

- Other names your organization uses. If the organization uses or is known by other names, you must list them in the form;

- The current mailing address of your organization;

- Your organization's website, if it has one;

- Employer Identification Number (EIN) of the organization. The EIN is the unique nine-digit number that identifies your organization to the IRS. Your organization must obtain EIN, even if it does not have any employees;

- Name and address of the principal officer in your organization. The principal officer is often specified by the organization's by-laws. It can be a president, vice president, treasurer, or secretary;

- The annual tax year of the organization. A tax-exempt organization, just like any other organization, must keep records and file returns based on the accounting period called a tax year. The tax year consists of two consecutive months and can be either fiscal or calendar year. The type of tax year used by your organization is usually indicated in the organization's by-laws;

After you file all the required information, you will have to specify if the gross receipts of your organization do not exceed $50,000 and if your organization is liquidated.

The due date for Form 990-N is the 15th day of the 5th month after the end of your organization's tax year. Do not file the e-Postcard until the tax year is closed. If the filing deadline falls on a legal holiday, Saturday, or Sunday, submit your form on the next business day. If you are late with the filing, the IRS will send you a notice to the last address they received. The IRS does not charge any penalty for failure to file the form on time. However, if your organization fails to file Form 990, Form 990-EZ, or Form 990-N for three consecutive years, it will lose its tax-exempt status automatically. The tax-exempt status will be revoked on the filing due date of the third year.

IRS 990-N Related Forms

The tax form 990-N has the following related forms: