Last Will and Testament Template - North Dakota

A North Dakota Last Will and Testament is an important tool for any individual who wants to control how their assets will be distributed after they pass away. When writing a will the individual - also referred to as the Testator - can leave important instructions regarding inheritance, guardianship over children and pets, charitable donations and the distribution of valuables and family heirlooms.

A Last Will is a must if the individual has specific beneficiaries in mind and does not want their property to go to the state, has no living relatives or has minor children that will need to be taken care of in the event of the Testator's death.

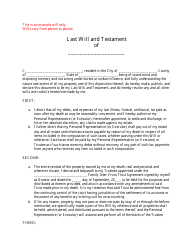

The North Dakota Last Will is defined by 30.1-01-06(60) and regulated by Chapter 30.1-08 (Wills) . The document must be signed by the Testator and attested by at least two (2) Witnesses. Click on this link to make your own form with our online form builder or download a ready-made template below.

What Is a Last Will and Testament in North Dakota?

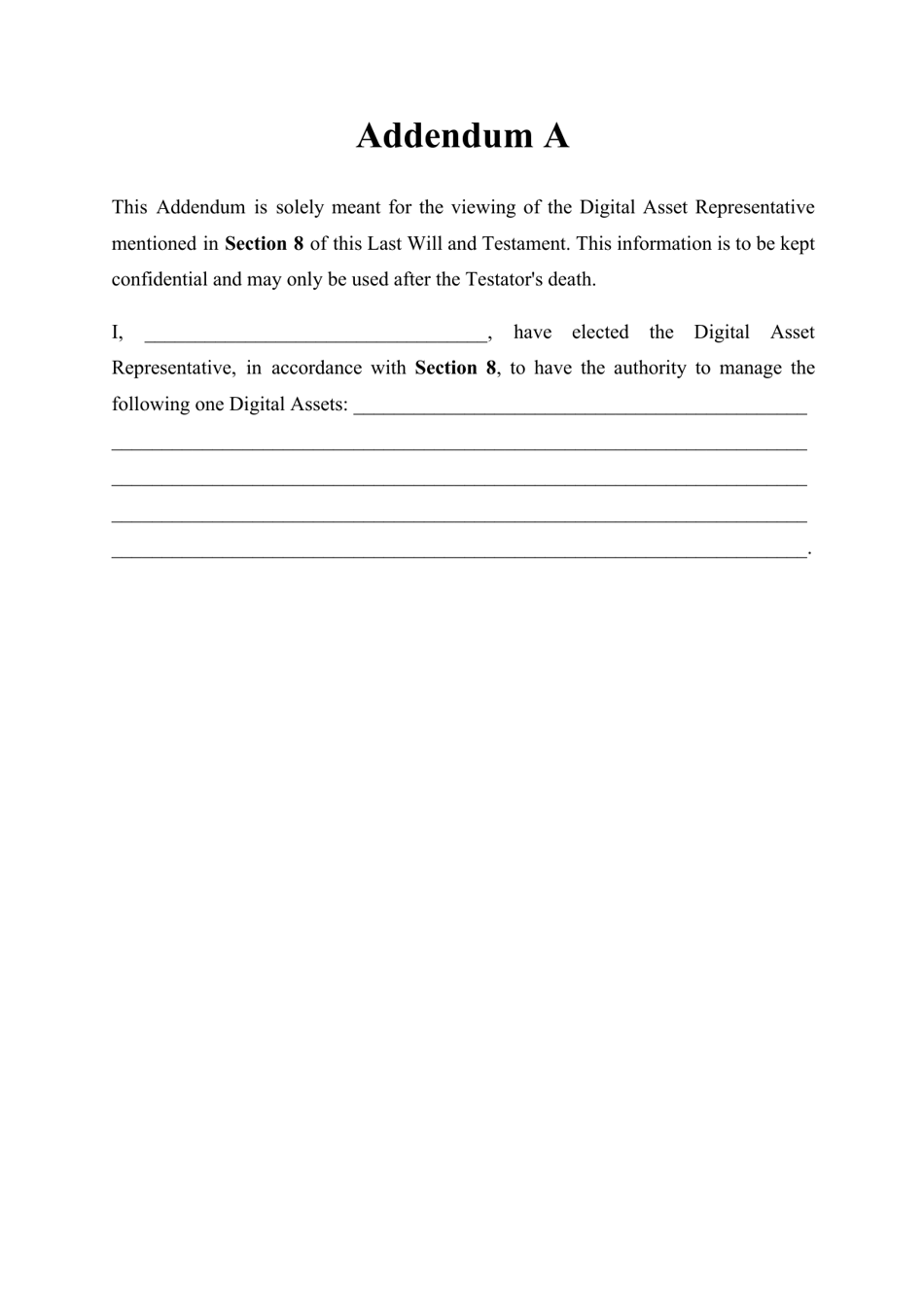

The Last Will gives the Testator the opportunity to distribute their estate, property and digital assets between spouses, children, partners, friends, relatives, and organizations. The Testator has the option to select the estate's Executor. The Executor is the person - either a close friend or a professional accountant or consultant - who will be responsible for carrying out the provisions of the will.

There are several types of wills:

- A Testamentary Will is a formally prepared document signed in the presence of witnesses.

- A Holographic Will is a written unwitnessed will that rarely holds up in court.

- An Oral Will is a spoken testament given before witnesses.

How to Write a Last Will and Testament in North Dakota?

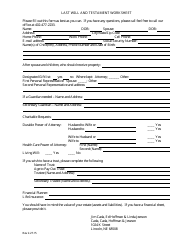

Every Testator is eligible to choose what to include in their will. However, several important topics are universally recommended for a Last Will and Testament.

The Testator has to take the following steps when creating their will:

- Decide what property to include in a will. List significant assets and choose the ones that are to be distributed.

- Decide who will inherit the aforementioned property. Alternate (contingent) beneficiaries must be mentioned in case the first choices do not survive the Testator.

- Choose an executor to handle the estate. The Executor must be a person who is willing to carry out the terms of the will.

- Choose a guardian for children and a caregiver for pets. This guardian must be willing to manage the children's property if the property is left to underage children or young adults.

- Sign the will in front of witnesses. The Testator's signature must be notarized as well.

- Store the will safely. The Testator must instruct their Executor on how to get access to the will when the time comes.