Last Will and Testament Template - Montana

A Montana Last Will and Testament is an important tool for any individual who wants to control how their assets will be distributed after they pass away. When writing a will the individual - also referred to as the Testator - can leave important instructions regarding inheritance, guardianship over children and pets, charitable donations and the distribution of valuables and family heirlooms.

The document is a must if the individual has specific beneficiaries in mind and does not want their property to go to the state, has no living relatives or has minor children that will need to be taken care of in the event of the Testator's death.

The Montana Last Will is defined by § 72-1-103(56) and regulated by Title 72 (Estates, Trusts, and Fiduciary Relationships) . The document must be signed by two (2) credible witnesses. Click on this link to create your own form with our online form builder or download a ready-made one below.

What Is a Last Will and Testament in Montana?

A Last Will and Testament is a legal document that is written by a Testator to ensure that their estate will be distributed according to their wishes after their death. A Testator has to comply with certain requirements in order to be able to create a will.

- Age. A person must be over the age of 18 or an emancipated minor to legally be able to make a will.

- Testamentary capacity. A Testator must be of sound mind when composing their will. Having testamentary capacity means that the Testator has an understanding of what they are signing and are aware of the general nature and amount of property they own.

- Witnesses. All Last Wills must be signed and certified by a notary. Most states also require a legal will to be witnessed by least two people present during the signing of the document.

How to Write a Will and Testament in Montana?

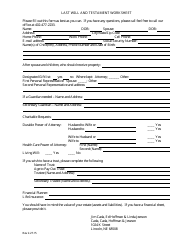

Testators are free to decide on the contents of their will. In Montana a Last Will and Testament must cover the following topics:

- Executor. An executor is an elected lawyer or accountant tasked with carrying out the Testator's wishes concerning their estate. If the Testator decides to hire a professional Executor, they'll need to set aside funds for their payments.

- Assets. A Testator's assets may include anything from their real estate, pensions and bank accounts to vehicles, valuables, artwork and family heirlooms. Any of these assets can be left to a person or organization if specified in the will.

- Beneficiaries. The Testator's will needs to contain information about the beneficiaries that will receive an inheritance after the Testator's death. Any individual or organization can be a beneficiary. Spouses, children, relatives, close friends or organizations such as your church or professional club can all receive the Testator's property and possessions if listed in their will.

- Debts. The appointed Executor will be in charge of settling the Testator's debt after their death. Any assets and property will go towards covering the cost of probate and funeral expenses, debts and mortgages before being split between the appointed beneficiaries.