The Effects of Conflicted Investment Advice on Retirement Savings

The Effects of Conflicted Investment Advice on Retirement Savings is a 31-page legal document that was released by the Executive Office of the President of the United States on February 1, 2015 and used nation-wide.

FAQ

Q: What is conflicted investment advice?

A: Conflicted investment advice is advice provided by financial advisors who have a financial interest in recommending certain investment products.

Q: How does conflicted investment advice affect retirement savings?

A: Conflicted investment advice may result in individuals making investment decisions that are not in their best interest, potentially leading to lower returns on their retirement savings.

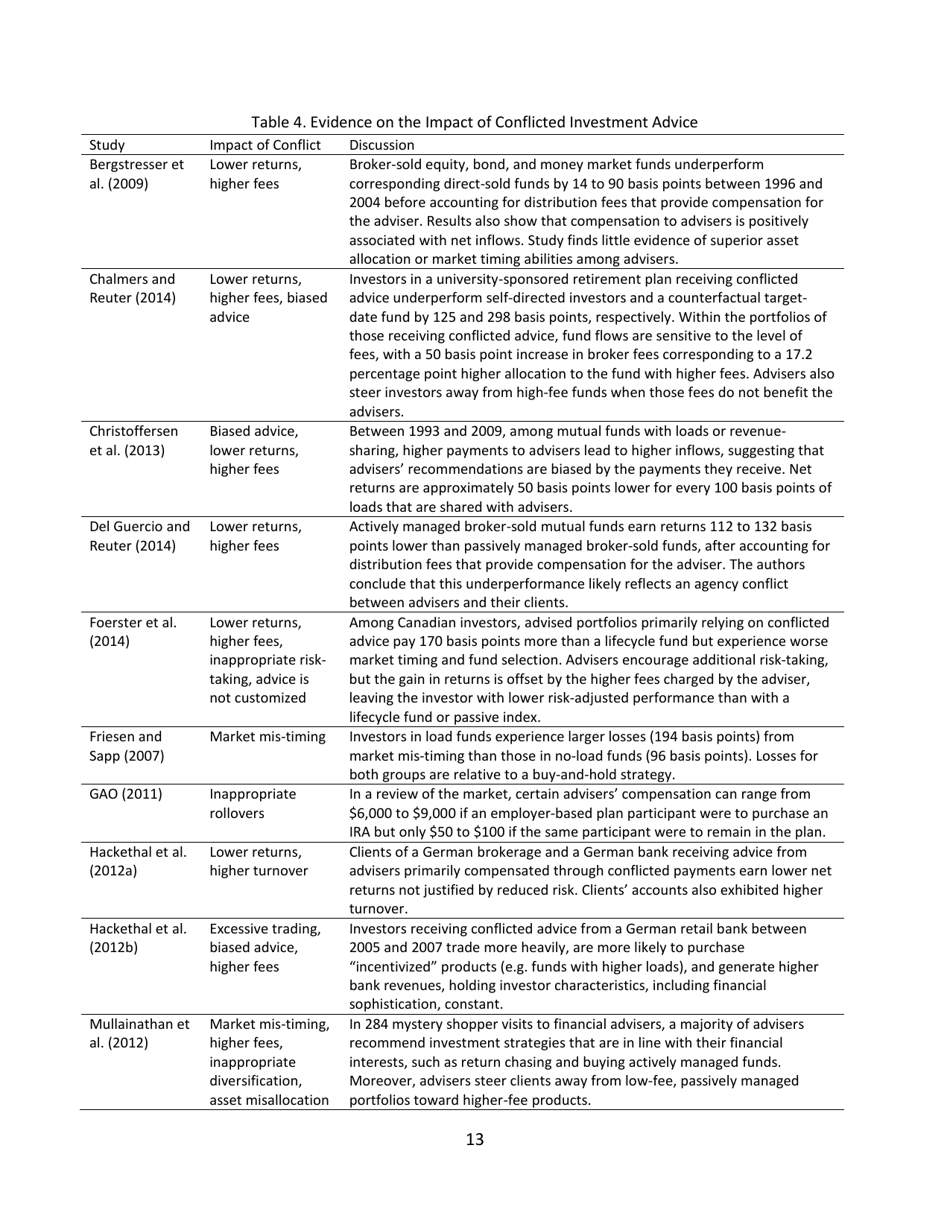

Q: What are examples of conflicted investment advice?

A: Examples of conflicted investment advice include advisors recommending high-cost mutual funds or annuities that pay them commissions.

Q: Can conflicted investment advice be legal?

A: Conflicted investment advice can be legal as long as it is disclosed, but it may still be detrimental to individuals' retirement savings.

Q: What is the Department of Labor's fiduciary rule?

A: The Department of Labor's fiduciary rule requires financial advisors who work with retirement accounts to act in their clients' best interest and avoid conflicts of interest.

Q: Has the Department of Labor's fiduciary rule been fully implemented?

A: No, the Department of Labor's fiduciary rule has faced legal challenges and its full implementation has been delayed.

Q: What are some tips for avoiding conflicted investment advice?

A: Some tips for avoiding conflicted investment advice include working with fee-only financial advisors, asking about any potential conflicts of interest, and doing your own research before making investment decisions.

Q: How can individuals protect their retirement savings from conflicted investment advice?

A: To protect their retirement savings from conflicted investment advice, individuals should be cautious when receiving advice from financial advisors and ensure that the advice aligns with their best interests.

Q: What actions can individuals take if they believe they have received conflicted investment advice?

A: If individuals believe they have received conflicted investment advice, they can file a complaint with their state securities regulator or seek legal assistance to pursue any potential legal remedies.

Form Details:

- The latest edition currently provided by the Executive Office of the President of the United States;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.