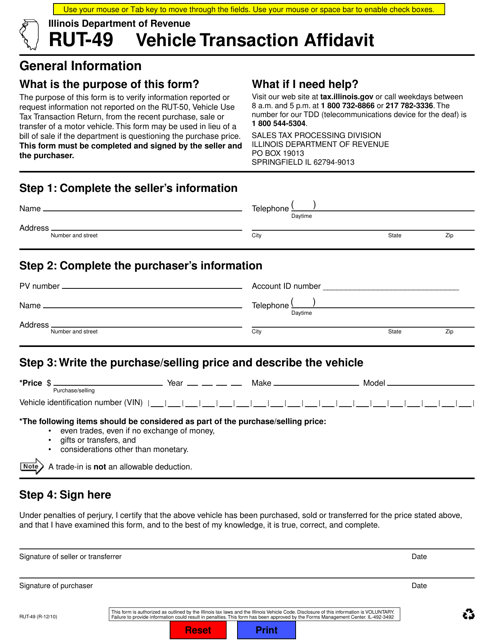

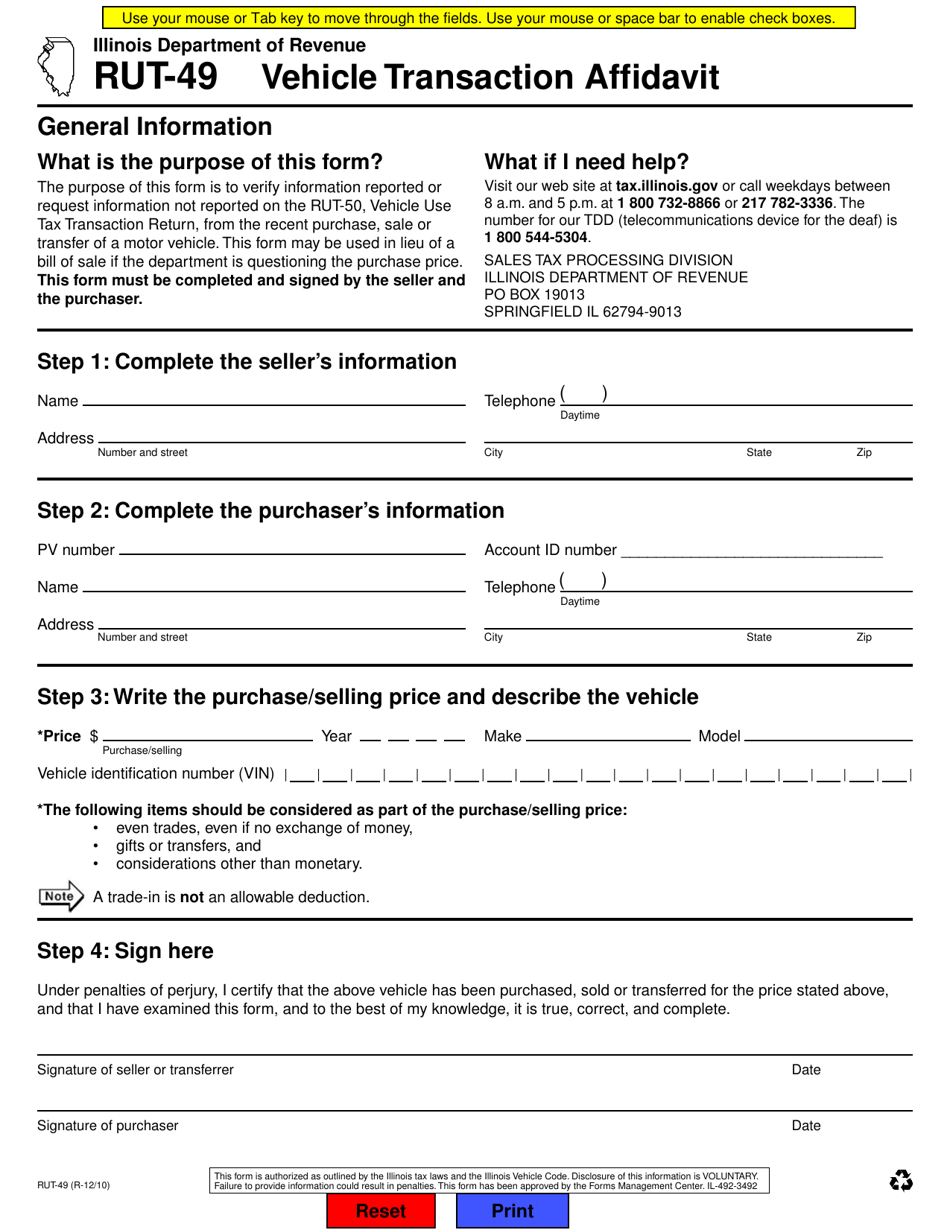

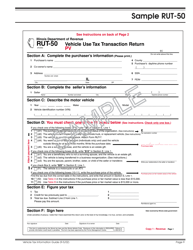

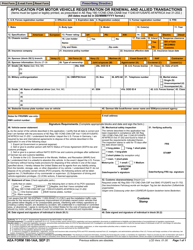

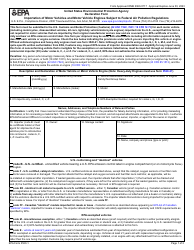

Form RUT-49 Vehicle Transaction Affidavit - Illinois

What Is Form RUT-49?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RUT-49?

A: Form RUT-49 is a Vehicle Transaction Affidavit used in Illinois.

Q: What is the purpose of Form RUT-49?

A: The purpose of Form RUT-49 is to record vehicle transactions in Illinois.

Q: When should I use Form RUT-49?

A: You should use Form RUT-49 when you buy or sell a vehicle in Illinois.

Q: Do I need to fill out Form RUT-49 for all vehicle transactions?

A: Yes, Form RUT-49 is required for all vehicle transactions in Illinois.

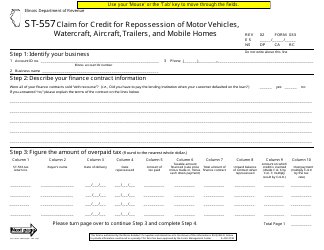

Q: What information do I need to provide on Form RUT-49?

A: You need to provide the vehicle's information, buyer's information, seller's information, and other details like the purchase price.

Q: Are there any fees associated with filing Form RUT-49?

A: Yes, there is a fee for filing Form RUT-49, and the amount depends on the purchase price of the vehicle.

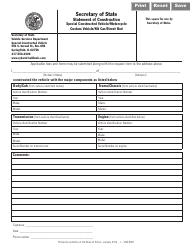

Q: What should I do after completing Form RUT-49?

A: After completing Form RUT-49, you should submit the form to the Illinois Secretary of State's office and pay the required fees.

Q: Is Form RUT-49 the same as the title transfer form?

A: No, Form RUT-49 is not the same as the title transfer form. Form RUT-49 is an additional form required for vehicle transactions in Illinois.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-49 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.