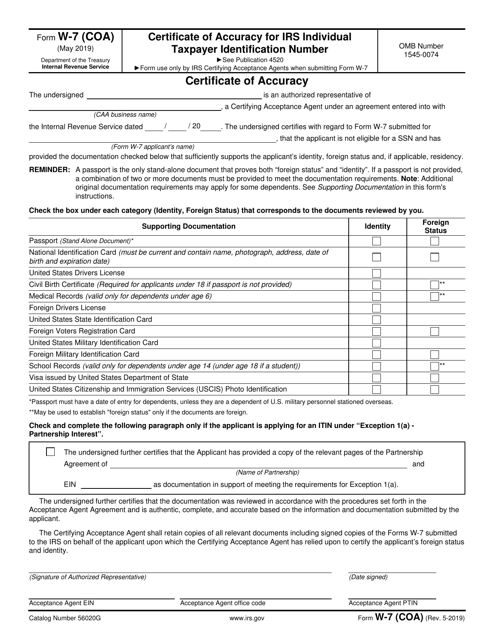

IRS Form W-7 (COA) Certificate of Accuracy for IRS Individual Taxpayer Identification Number

What Is IRS Form W-7 (COA)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

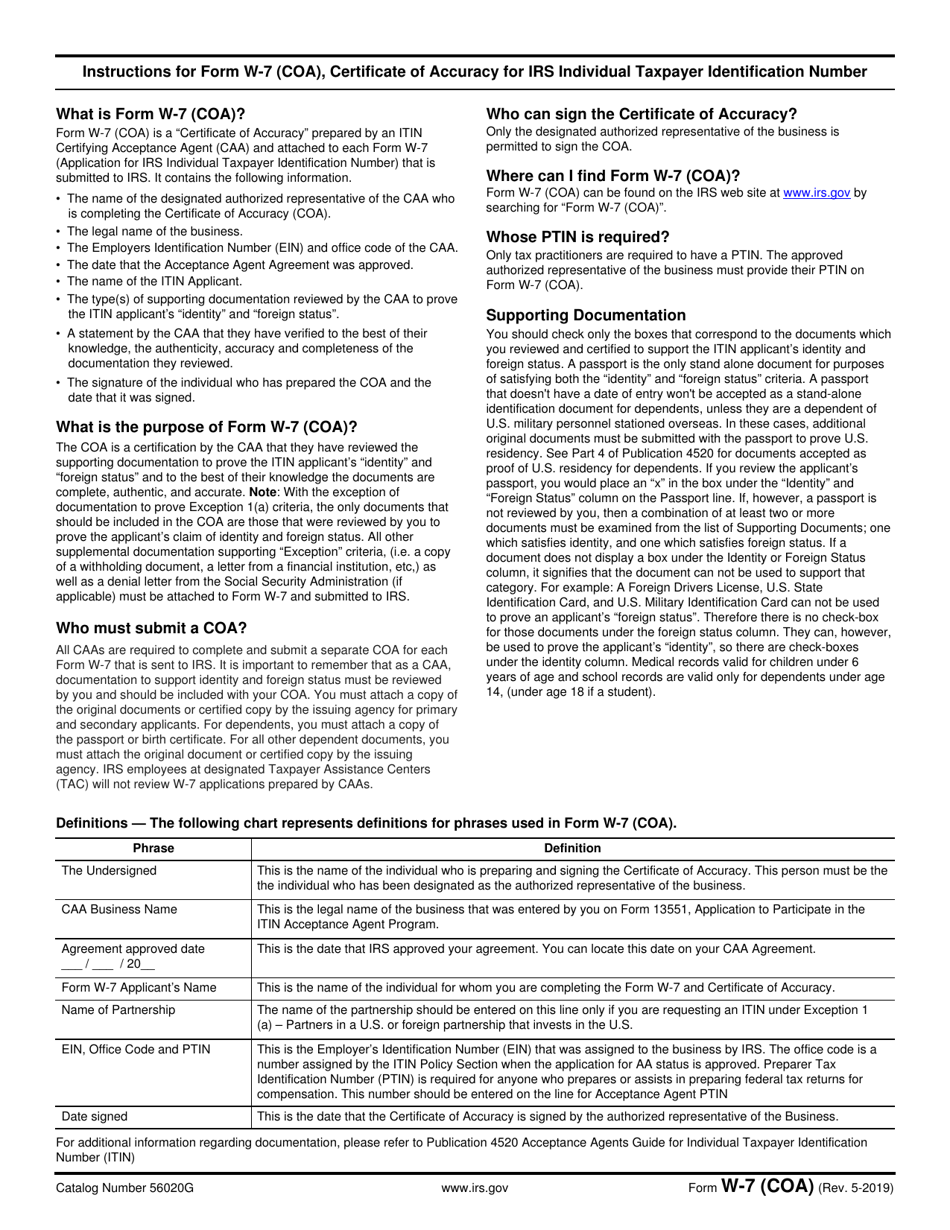

Q: What is IRS Form W-7 (COA)?

A: IRS Form W-7 (COA) stands for Certificate of Accuracy for IRS Individual Taxpayer Identification Number.

Q: What is the purpose of Form W-7 (COA)?

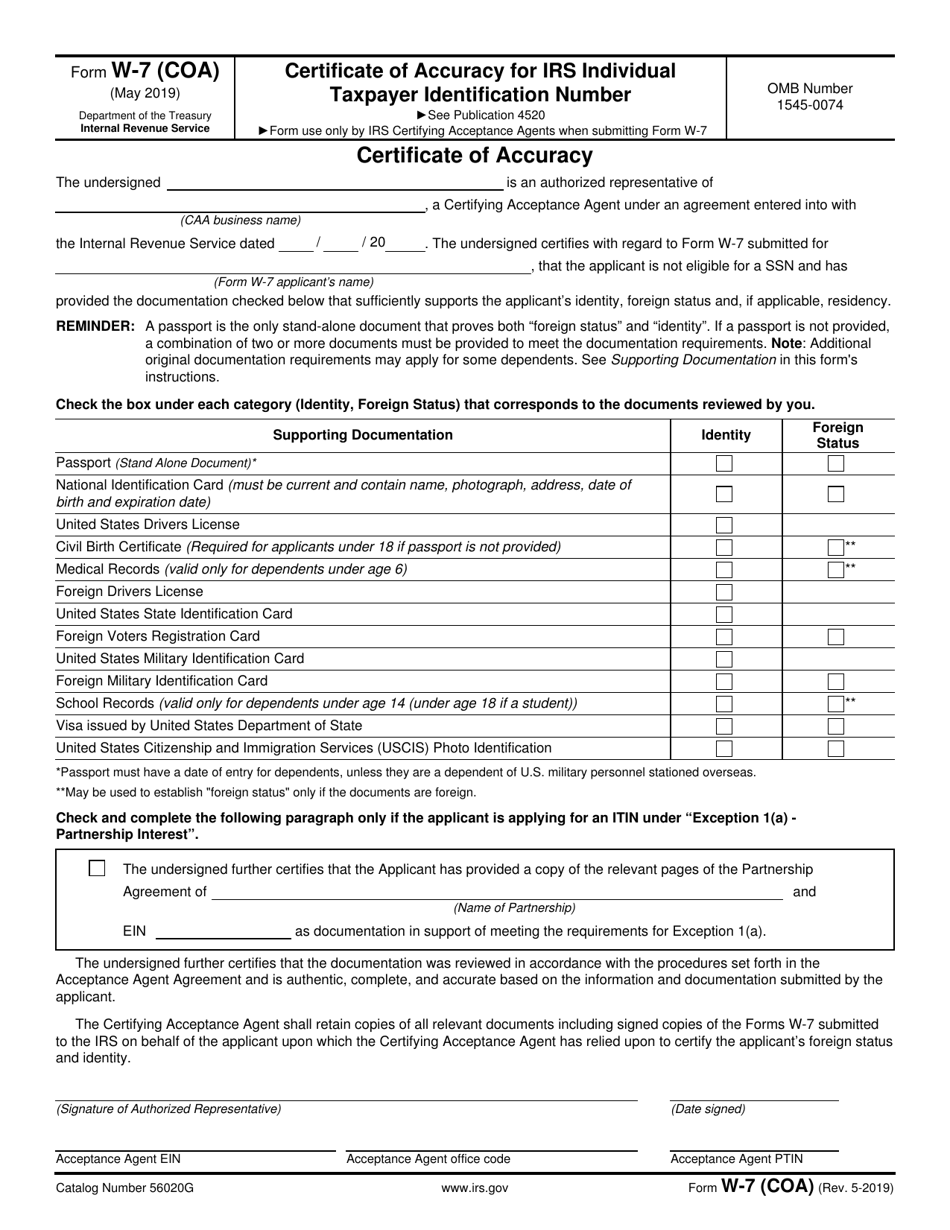

A: The purpose of Form W-7 (COA) is to provide a supporting document for an Individual Taxpayer Identification Number (ITIN) application.

Q: Who needs to submit Form W-7 (COA)?

A: Individuals who are submitting an application for an ITIN and do not have a United States federal income tax return need to submit Form W-7 (COA).

Q: What information is required on Form W-7 (COA)?

A: Form W-7 (COA) requires the following information: name, mailing address, date of birth, foreign status, country of birth, and reason for submitting the form.

Q: What supporting documents need to be included with Form W-7 (COA)?

A: Supporting documents for Form W-7 (COA) may include a certified copy of a foreign birth certificate, a foreign voter's registration card, or a valid, unexpired passport.

Q: Is there a fee for submitting Form W-7 (COA)?

A: No, there is no fee for submitting Form W-7 (COA).

Q: How long does it take to process Form W-7 (COA)?

A: The processing time for Form W-7 (COA) can vary, but it generally takes about 7 weeks.

Q: Can Form W-7 (COA) be submitted electronically?

A: No, Form W-7 (COA) cannot be submitted electronically. It must be mailed to the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-7 (COA) through the link below or browse more documents in our library of IRS Forms.