Form OC95-4 Fact Sheet: Effect of Nonpay Status on Your Tsp Account

What Is Form OC95-4?

This is a legal form that was released by the Thrift Savings Plan on February 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form OC95-4 Fact Sheet?

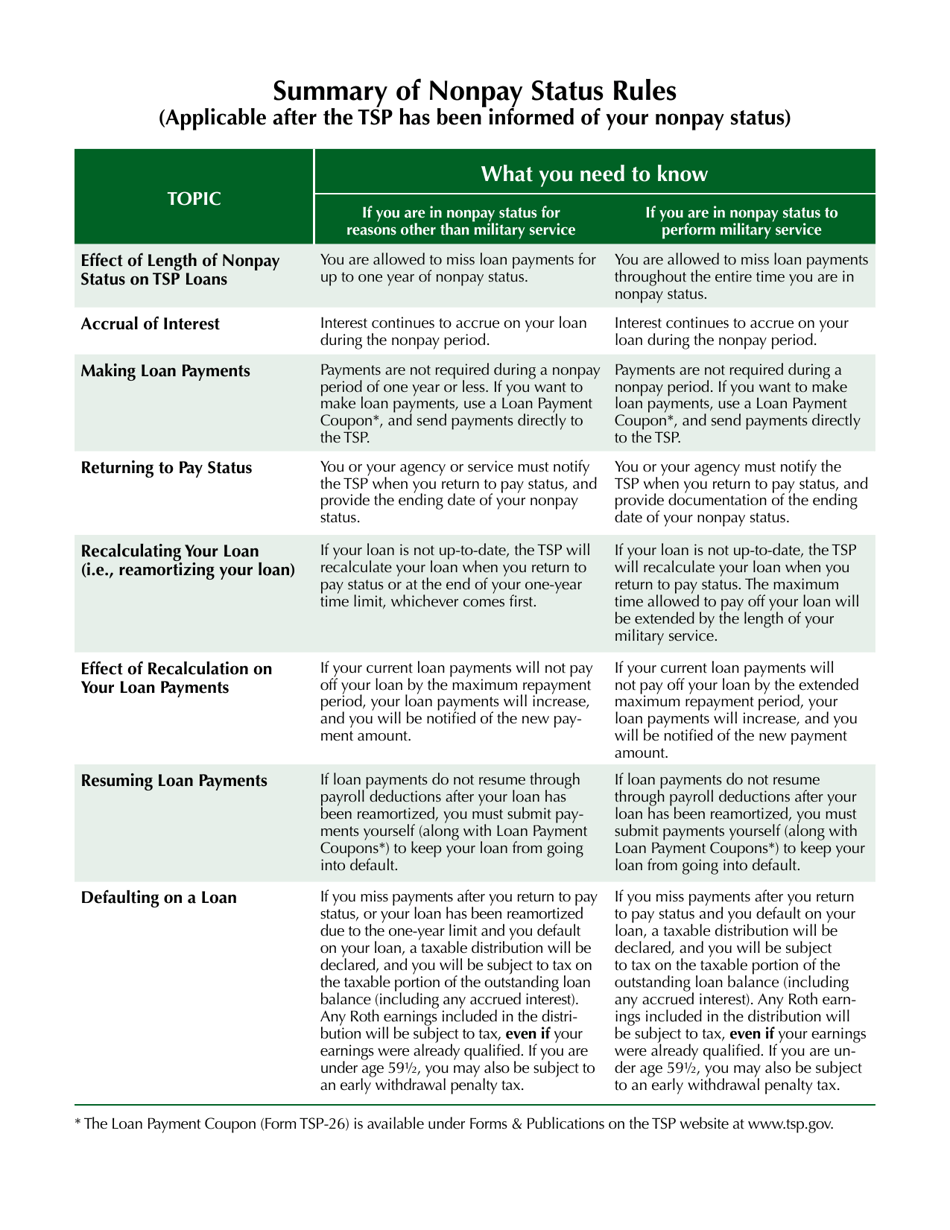

A: The Form OC95-4 Fact Sheet provides information on the effect of nonpay status on your TSP account.

Q: What is nonpay status?

A: Nonpay status refers to a situation where you are not receiving regular pay from your employer.

Q: How does nonpay status affect my TSP account?

A: Nonpay status may affect your ability to make contributions to your TSP account.

Q: Can I continue making contributions to my TSP account while on nonpay status?

A: Yes, you may still be able to make contributions to your TSP account while on nonpay status.

Q: Are there any restrictions on contributions during nonpay status?

A: There may be restrictions on the amount and type of contributions you can make while on nonpay status.

Q: Will my agency continue to contribute to my TSP account while I am on nonpay status?

A: Agency contributions to your TSP account may be affected while you are on nonpay status.

Q: What should I do if I am going on nonpay status?

A: If you are going on nonpay status, you should contact your agency's human resources or payroll office for more information about the impact on your TSP account.

Q: Can I withdraw money from my TSP account while on nonpay status?

A: Yes, you may still be able to make withdrawals from your TSP account while on nonpay status, but there may be restrictions and tax implications.

Form Details:

- Released on February 1, 2013;

- The latest available edition released by the Thrift Savings Plan;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OC95-4 by clicking the link below or browse more documents and templates provided by the Thrift Savings Plan.