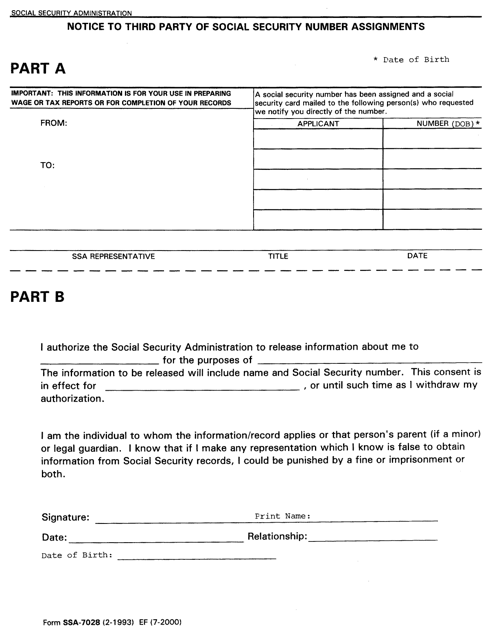

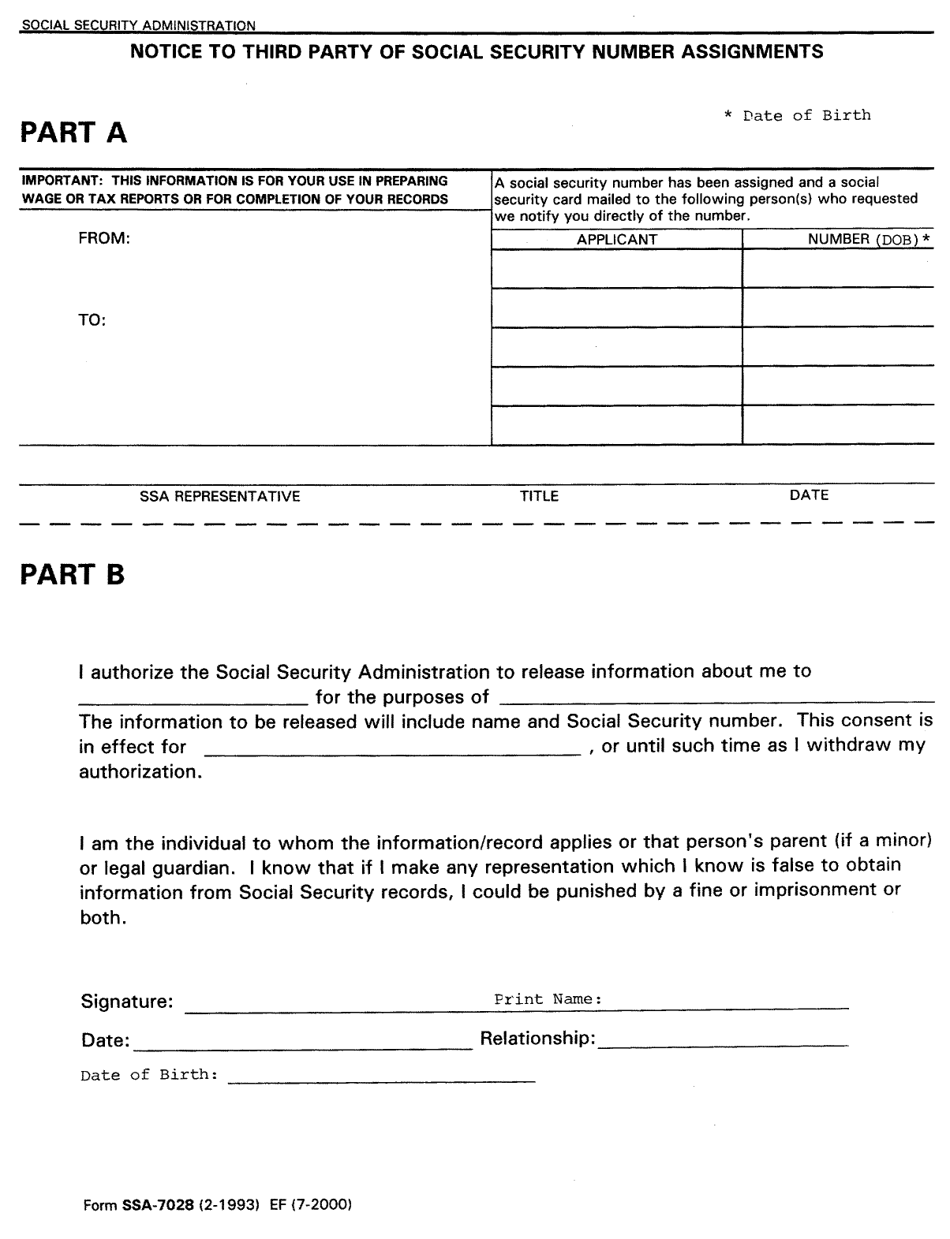

Form SSA-7028 Notice to Third Party of Social Security Number Assignments

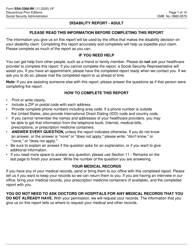

What Is Form SSA-7028?

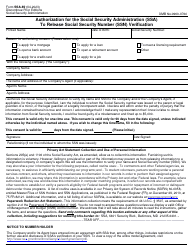

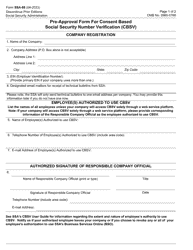

Form SSA-7028, Notice to Third Party of Social Security Number Assignments , is a form used to authorize the U.S. Social Security Administration (SSA) to release information about an individual to a third party for the purpose of preparing a wage or tax report or completing the individual's record. This information includes the individual's Social Security Number (SSN).

Alternate Name:

- SSA Form 7028.

The latest edition of the form was released on February 1, 1993 . Download an up-to-date Form SSA-7028 in PDF format through the link below or look it up on the SSA website. Form SSA-7028 can be filed by an individual or their parent or guardian if the subject of the released information is a minor.

Form SSA-7028 Instructions

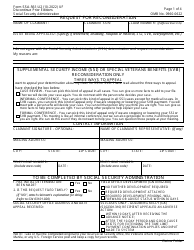

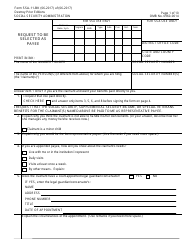

Form SSA-7028 is filed for the employees or students who have not been issued a social security card. This form is also necessary to validate the SSN of an individual if their current SSN is incorrect or missing.

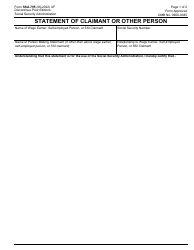

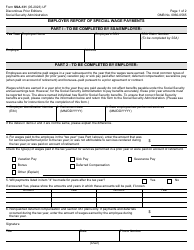

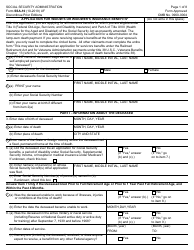

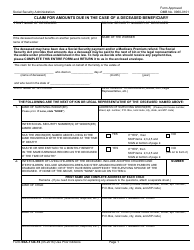

The form consists of two parts. Part A is filled by the SSA representative, confirming that the social security number was assigned and a card was mailed to the individual. The SSA representative provides its title and dates the form. Part B is filled by the applicant, providing information about the third-party organization, the purpose of the release, and the duration of the authorization. The authorization can be withdrawn if need be. If this form is filled out by a representative, this part should contain the relationship between them and the person they represent.

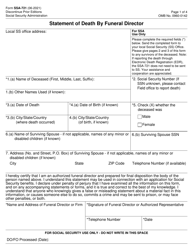

Form SSA-7028 or IRS 147C Letter - What Is the Difference?

IRS Letter 147C is a form containing an Employer Identification Number (EIN). The EIN is a tax identification for a business, even if the business does not have any employees. Small business owners can use an EIN instead of their SSN. The letter is requested by calling the Internal Revenue Service (IRS) Business and Specialty Tax Line. To request an EIN, the individual has to file an application form.

The IRS 147C can be requested by a third party, but the business owner has to provide their consent. They will also have to provide the third party with certain information about their business for security purposes. This form will also be necessary if the EIN is incorrect and needs to be validated. While SSA Form 7028 is filed regarding SSN and its assignment, the IRS 147C contains an EIN. The letter is not filed, because the IRS mails it upon request when the EIN is already assigned, and a confirmation is necessary for business purposes or in cases when the number is lost.

Both these numbers are Taxpayer Identification Numbers (TIN) and these forms are necessary if the TIN is incorrect. If the number contains more than 9 digits or less, or the number contains an alpha character, the number is considered missing. If the number does not match the name or is not found in the IRS or SSA files, it is considered incorrect. If a TIN is missing or incorrect, the individual will receive a notice about the incorrect name or TIN.