This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5500-SF

for the current year.

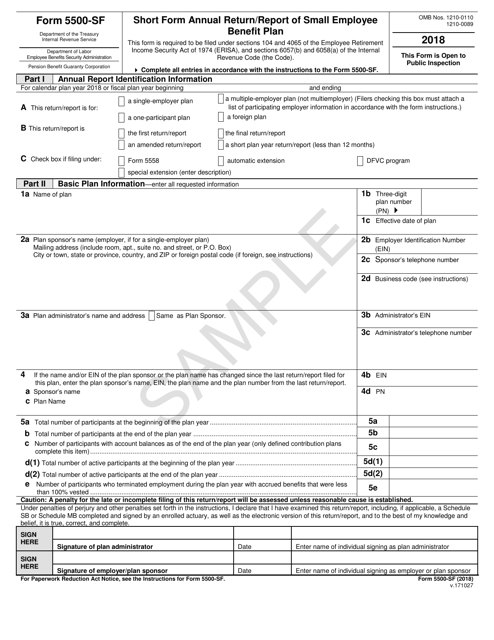

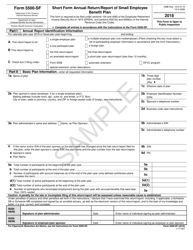

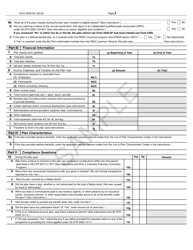

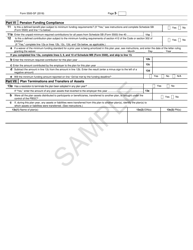

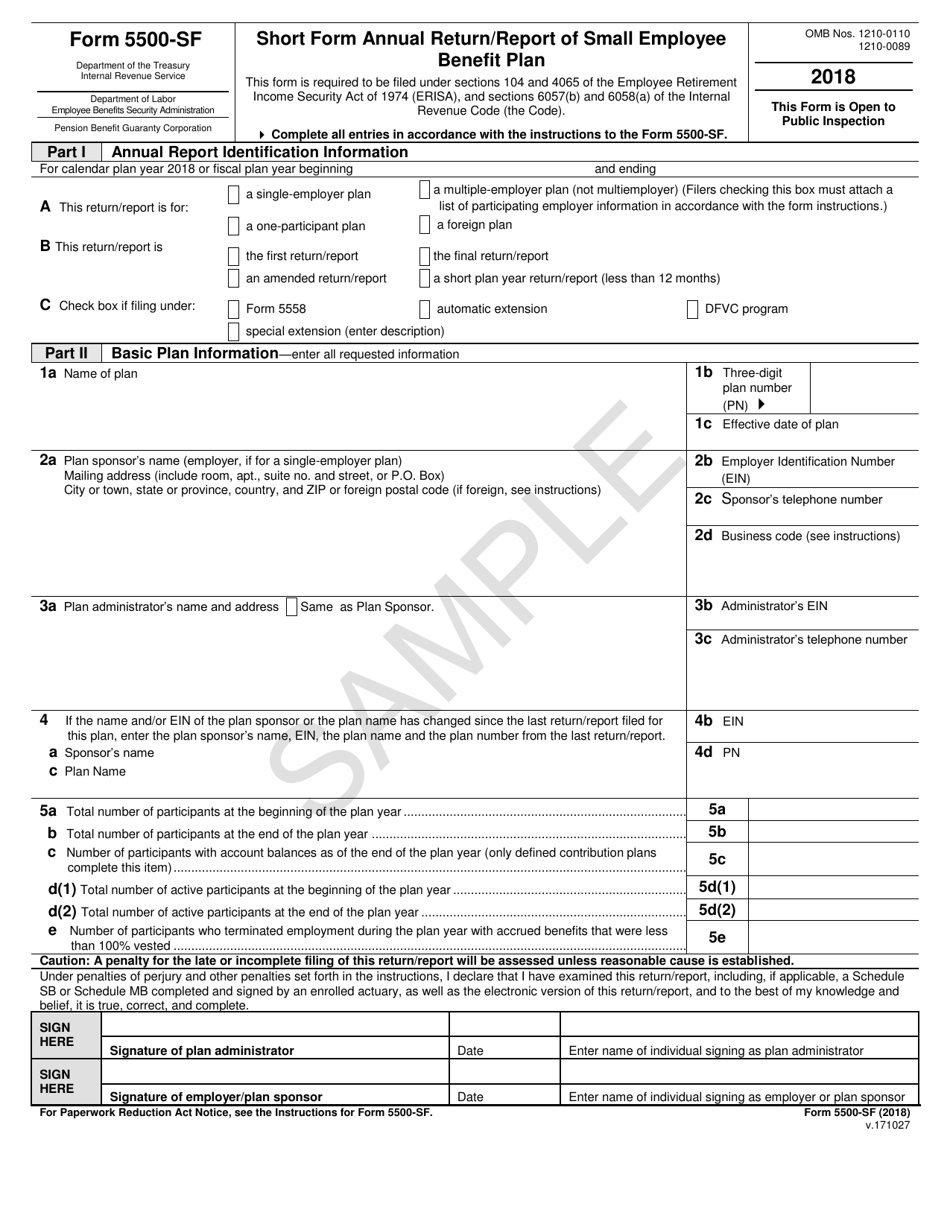

Form 5500-SF Short Form Annual Return / Report of Small Employee Benefit Plan

What Is IRS Form 5500-SF?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500-SF?

A: IRS Form 5500-SF is a short form annual return/report that small employee benefit plans need to file.

Q: Who needs to file IRS Form 5500-SF?

A: Small employee benefit plans with fewer than 100 participants need to file IRS Form 5500-SF.

Q: What is the purpose of filing IRS Form 5500-SF?

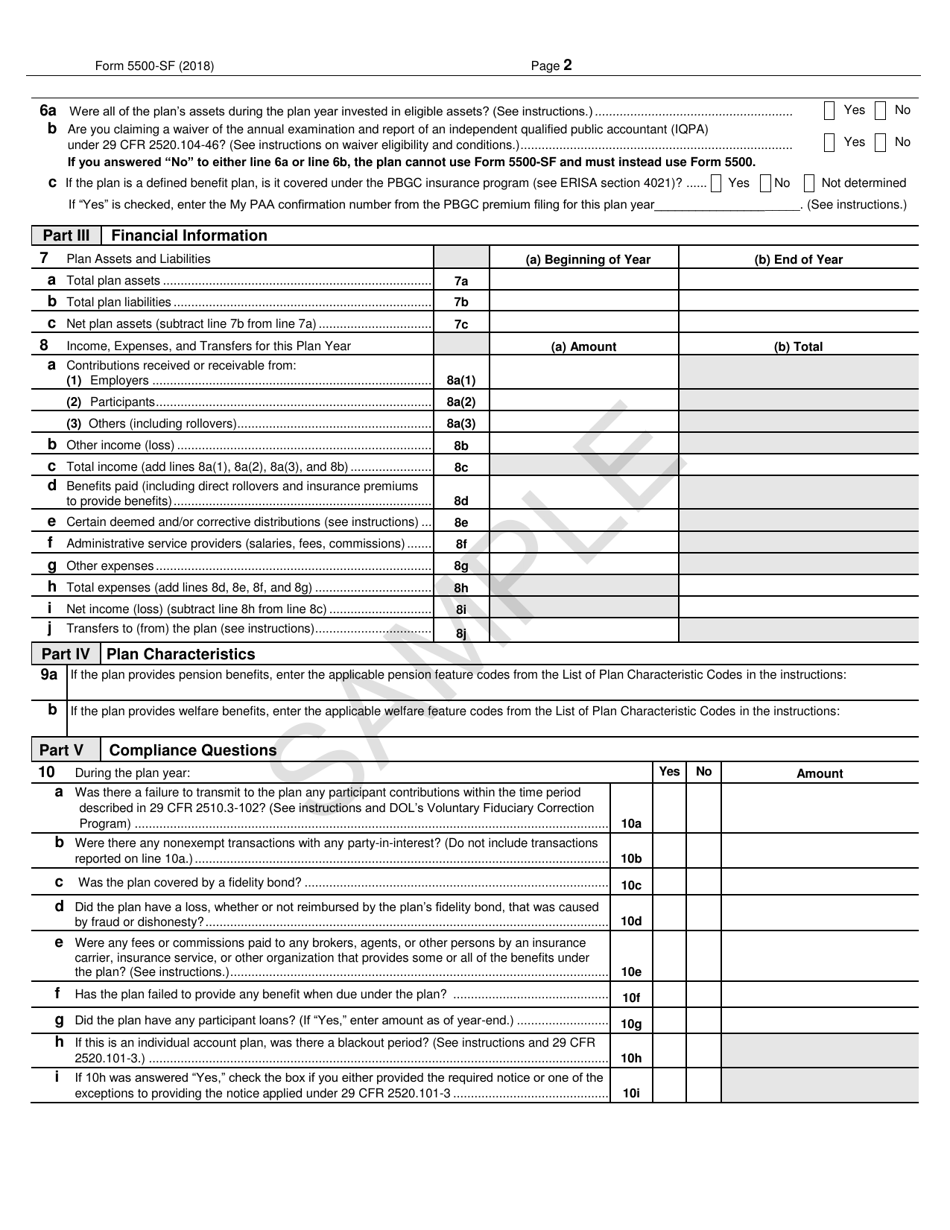

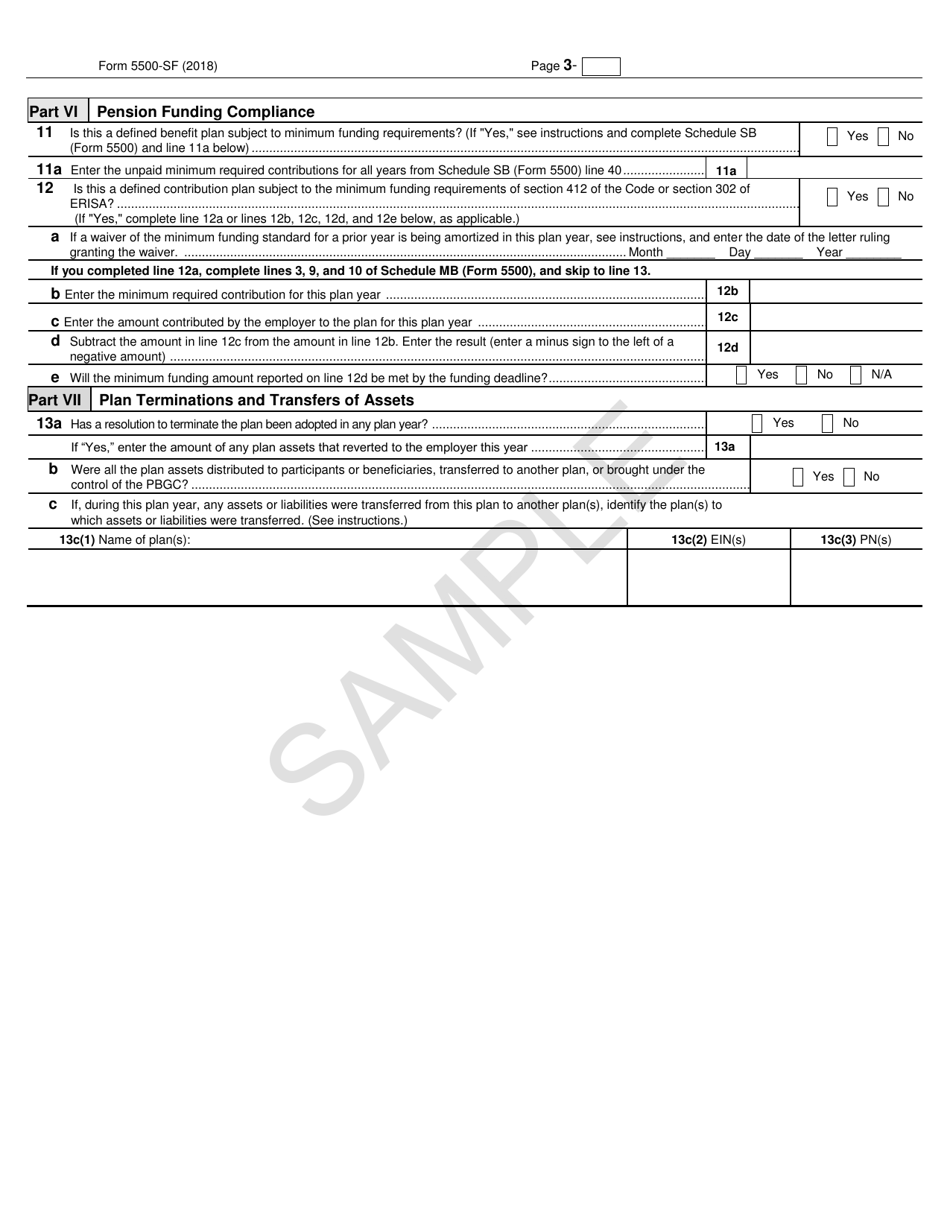

A: The purpose of filing IRS Form 5500-SF is to provide information about the financial condition, investments, and operations of the employee benefit plan.

Q: What information is required to be reported on IRS Form 5500-SF?

A: IRS Form 5500-SF requires reporting of information such as plan assets, contributions, distributions, and participant demographics.

Q: When is the deadline to file IRS Form 5500-SF?

A: The deadline to file IRS Form 5500-SF is the last day of the seventh month after the plan year ends.

Q: Are there any penalties for late or non-filing of IRS Form 5500-SF?

A: Yes, there are penalties for late or non-filing of IRS Form 5500-SF, which can range from $300 per day to $1,100 per day, depending on the size of the plan.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500-SF through the link below or browse more documents in our library of IRS Forms.