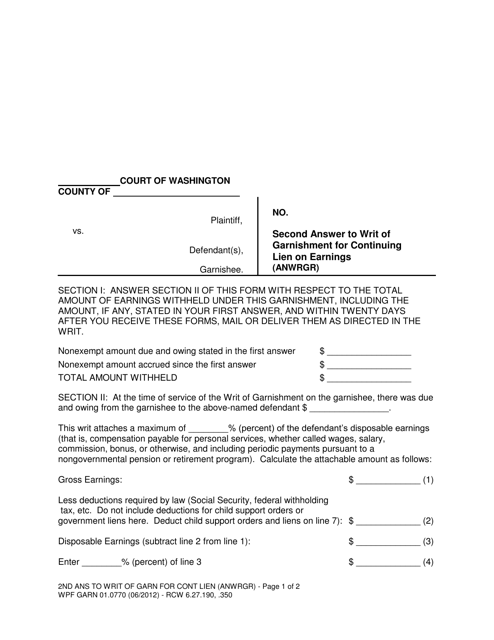

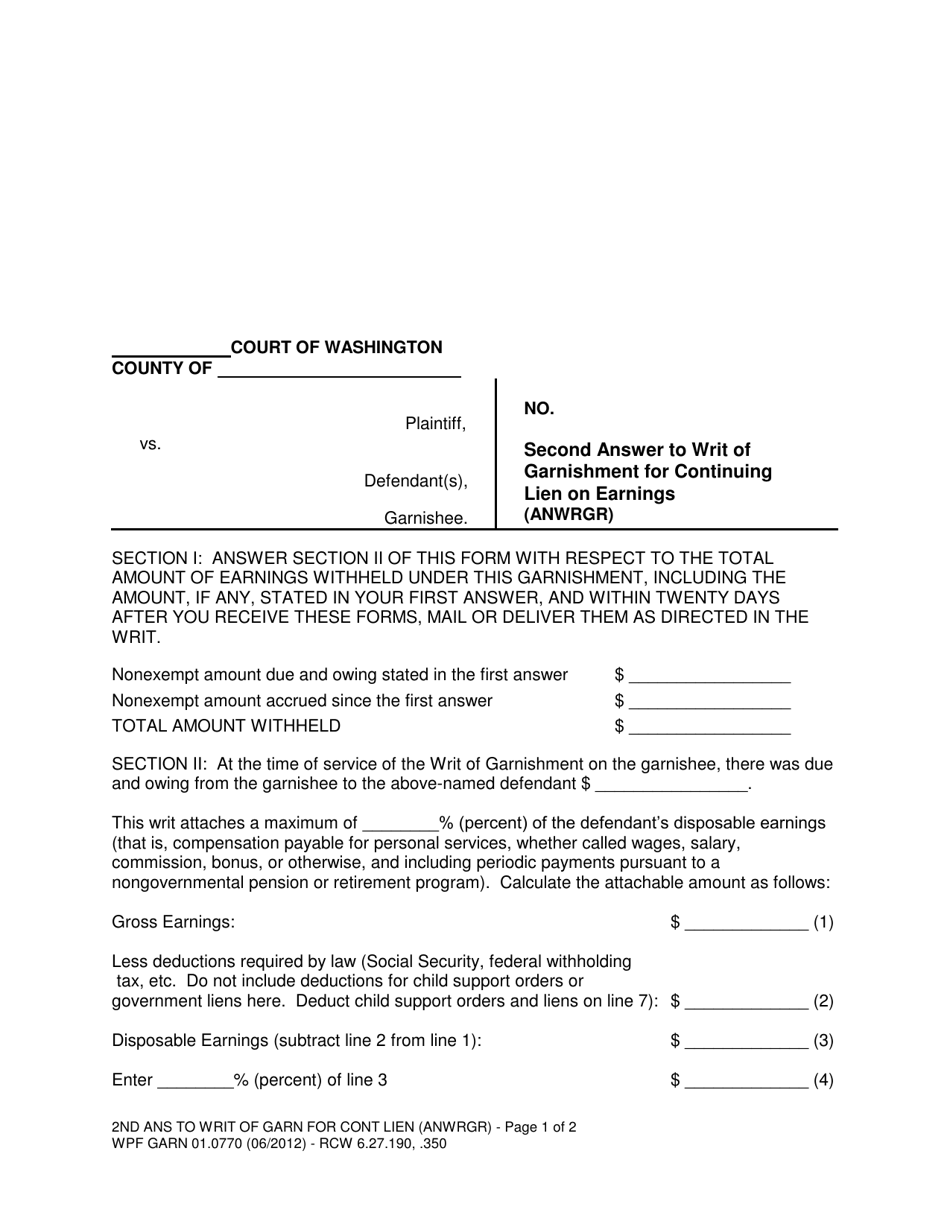

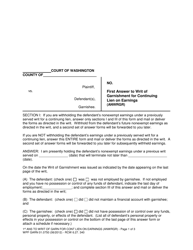

Form WPF GARN01.0770 Second Answer to Writ of Garnishment for Continuing Lien on Earnings - Washington

What Is Form WPF GARN01.0770?

This is a legal form that was released by the Washington State Courts - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WPF GARN01.0770?

A: Form WPF GARN01.0770 is the Second Answer to Writ of Garnishment for Continuing Lien on Earnings specific to Washington.

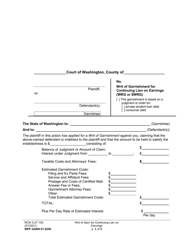

Q: What is a Writ of Garnishment?

A: A Writ of Garnishment is a legal order to withhold a portion of a person's wages or assets to satisfy a debt.

Q: What is a Continuing Lien on Earnings?

A: A Continuing Lien on Earnings is a type of garnishment that allows for ongoing wage withholding until the debt is fully paid.

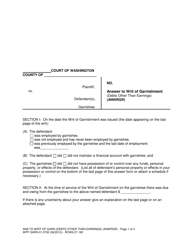

Q: Who uses Form WPF GARN01.0770?

A: Form WPF GARN01.0770 is typically used by employers who have received a Writ of Garnishment and need to provide a response to the court.

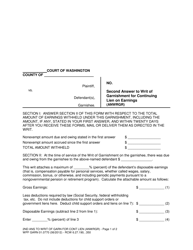

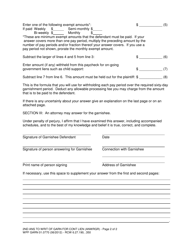

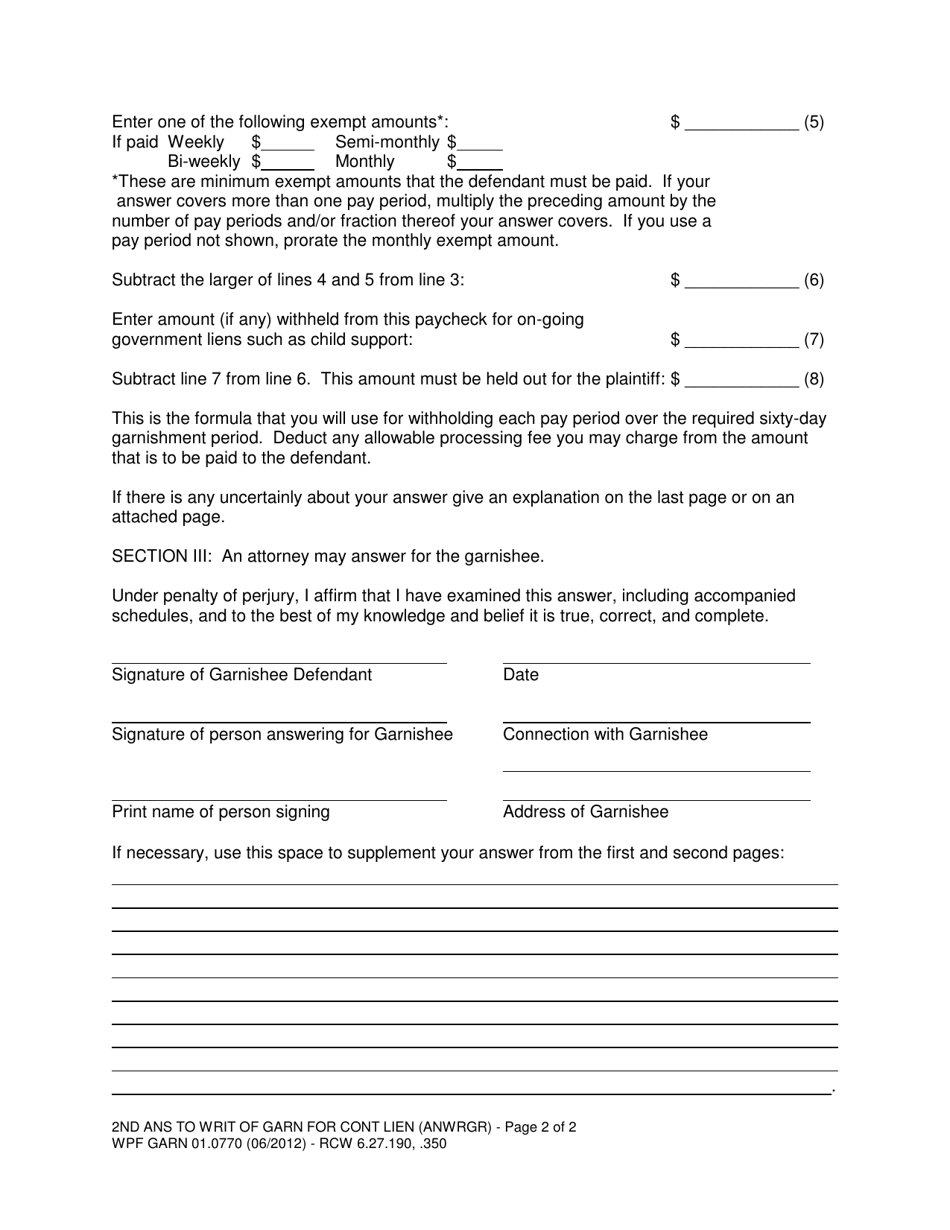

Q: What information should be included in the Second Answer to Writ of Garnishment?

A: The Second Answer to Writ of Garnishment should include details about the employee's earnings, deductions, and any exemptions they may be eligible for.

Q: Is Form WPF GARN01.0770 specific to Washington State?

A: Yes, Form WPF GARN01.0770 is specific to Washington State.

Q: What should I do if I receive a Writ of Garnishment?

A: If you receive a Writ of Garnishment, it is important to respond promptly and accurately. Consult with an attorney or refer to the court instructions for guidance.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the Washington State Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WPF GARN01.0770 by clicking the link below or browse more documents and templates provided by the Washington State Courts.