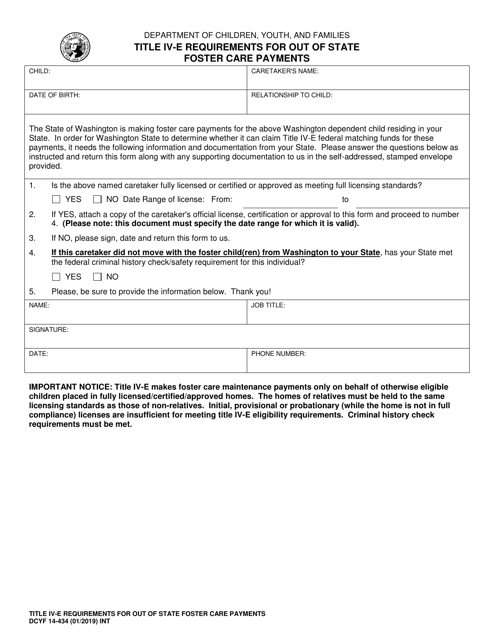

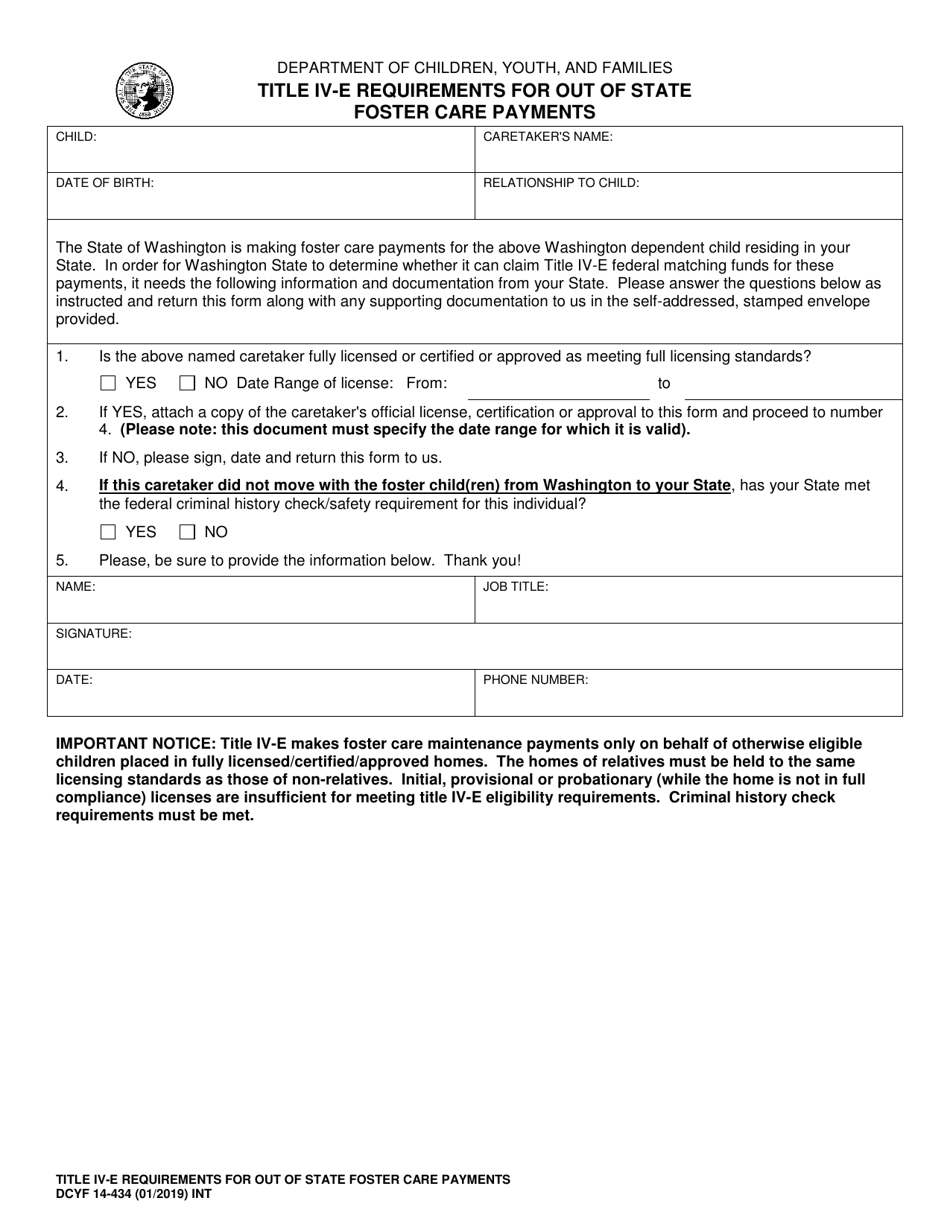

DCYF Form 14-434 Title IV-E Requirements for out of State Foster Care Payments - Washington

What Is DCYF Form 14-434?

This is a legal form that was released by the Washington State Department of Children, Youth, and Families - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 14-434?

A: Form 14-434 is a document used by the Washington Department of Children, Youth, and Families (DCYF) to determine eligibility for out-of-state foster care payments.

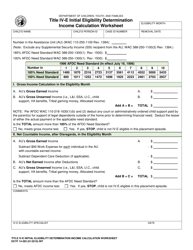

Q: What are Title IV-E requirements?

A: Title IV-E requirements refer to the federal guidelines outlined in the Social Security Act that govern the funding of foster care payments.

Q: Why are out-of-state foster care payments important?

A: Out-of-state foster care payments are important because they ensure that children placed in foster care outside of Washington State receive financial support.

Q: Who is eligible for out-of-state foster care payments?

A: Eligibility for out-of-state foster care payments is determined based on the child's need for placement, the availability of family resources, and compliance with Title IV-E requirements.

Q: What information is required on Form 14-434?

A: Form 14-434 requires information about the child's foster care placement, including the reasons for the placement, the names of the child and the caregivers, and the anticipated length of the placement.

Q: How long does it take to process Form 14-434?

A: The processing time for Form 14-434 varies, but it typically takes several weeks to determine eligibility and issue out-of-state foster care payments.

Q: What if my Form 14-434 is denied?

A: If your Form 14-434 is denied, you can request a review of the decision and provide additional information or documentation to support your eligibility for out-of-state foster care payments.

Q: Are out-of-state foster care payments taxable?

A: Out-of-state foster care payments are generally not taxable, but it is recommended to consult with a tax professional for specific guidance.

Q: Can out-of-state foster care payments be used for any expenses?

A: Out-of-state foster care payments are intended to cover the basic needs of the child, including food, clothing, and shelter. Specific expenses may vary depending on individual circumstances.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Washington State Department of Children, Youth, and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DCYF Form 14-434 by clicking the link below or browse more documents and templates provided by the Washington State Department of Children, Youth, and Families.