This version of the form is not currently in use and is provided for reference only. Download this version of

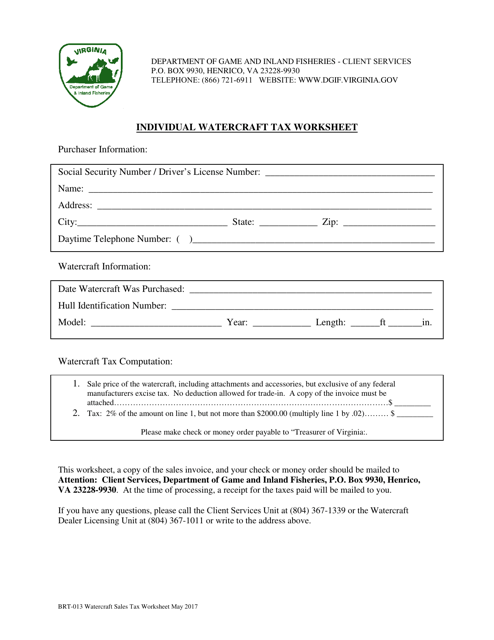

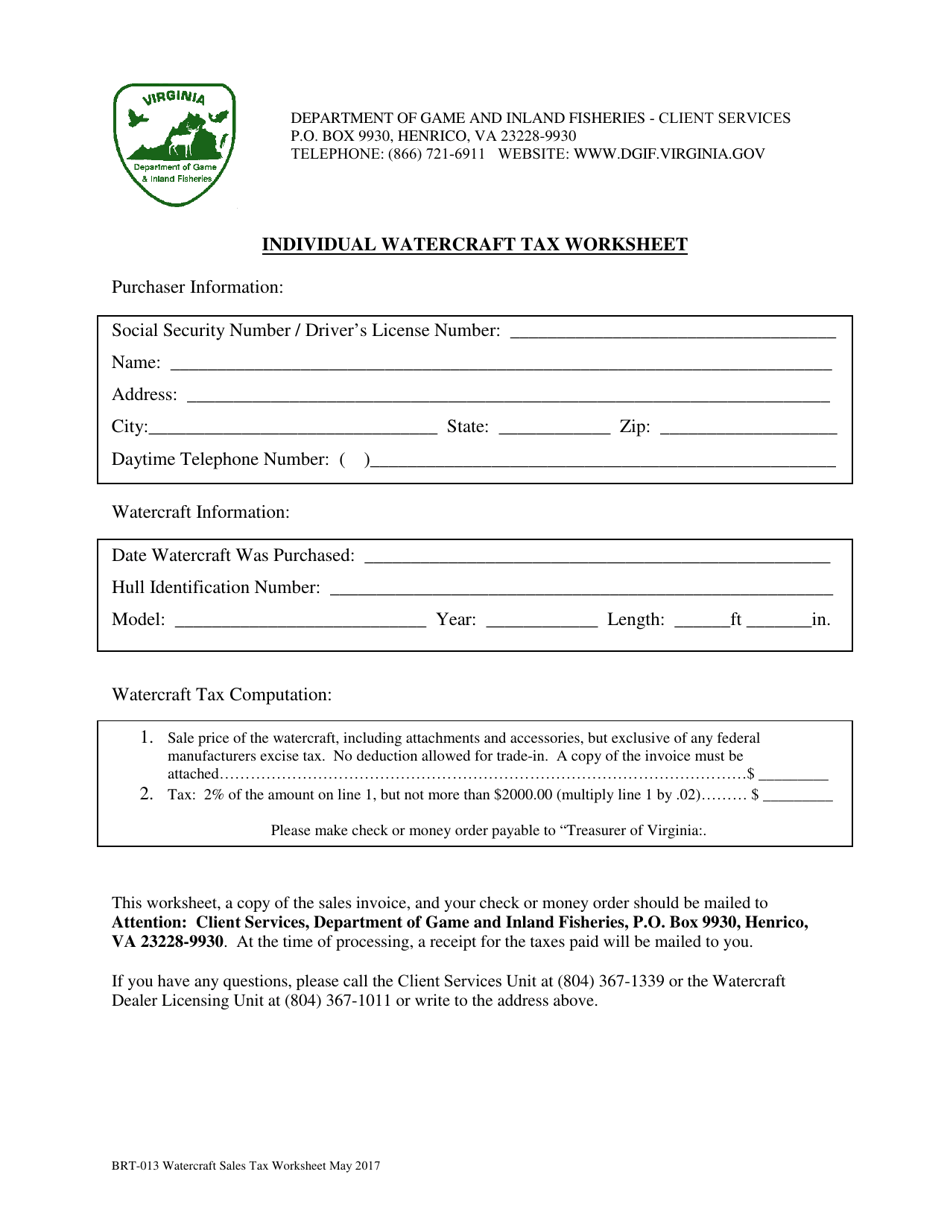

Form BRT-013

for the current year.

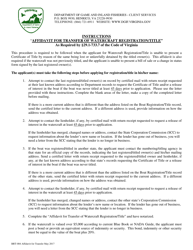

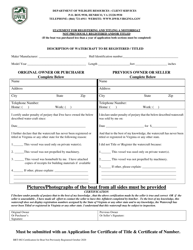

Form BRT-013 Individual Watercraft Tax Worksheet - Virginia

What Is Form BRT-013?

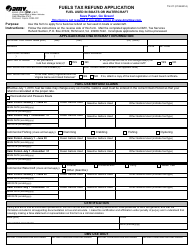

This is a legal form that was released by the Virginia Department of Wildlife Resources - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

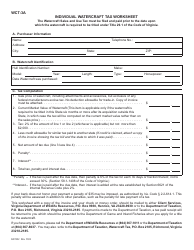

Q: What is the BRT-013 Individual Watercraft Tax Worksheet?

A: The BRT-013 Individual Watercraft Tax Worksheet is a form used in Virginia to calculate tax owed on individual watercraft.

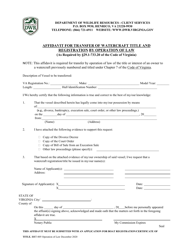

Q: Who needs to use the BRT-013 Individual Watercraft Tax Worksheet?

A: Owners of individual watercraft in Virginia need to use the BRT-013 Individual Watercraft Tax Worksheet to calculate their tax liability.

Q: What information is required on the BRT-013 Individual Watercraft Tax Worksheet?

A: The BRT-013 Individual Watercraft Tax Worksheet requires information such as the number of watercraft owned, the purchase price, and any applicable deductions.

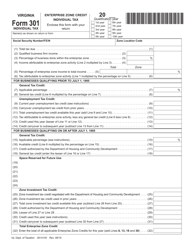

Q: How do I calculate the tax owed using the BRT-013 Individual Watercraft Tax Worksheet?

A: To calculate the tax owed, you will need to follow the instructions provided on the worksheet, which involve multiplying the purchase price by the tax rate and applying any deductions.

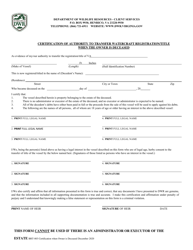

Q: When is the BRT-013 Individual Watercraft Tax Worksheet due?

A: The due date for the BRT-013 Individual Watercraft Tax Worksheet varies, but it is typically due around the same time as your annual income tax return.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Virginia Department of Wildlife Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BRT-013 by clicking the link below or browse more documents and templates provided by the Virginia Department of Wildlife Resources.