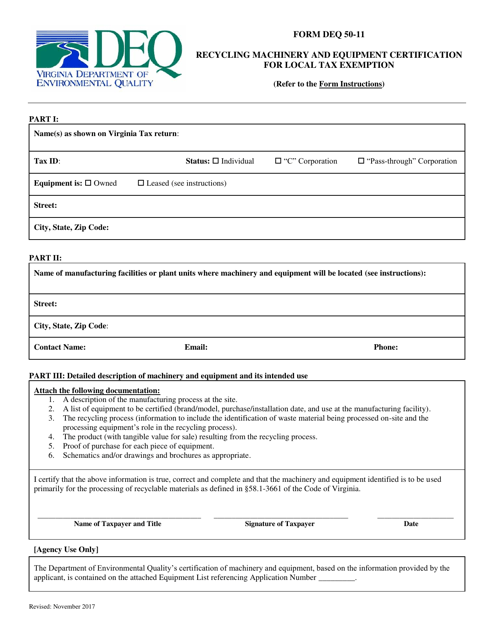

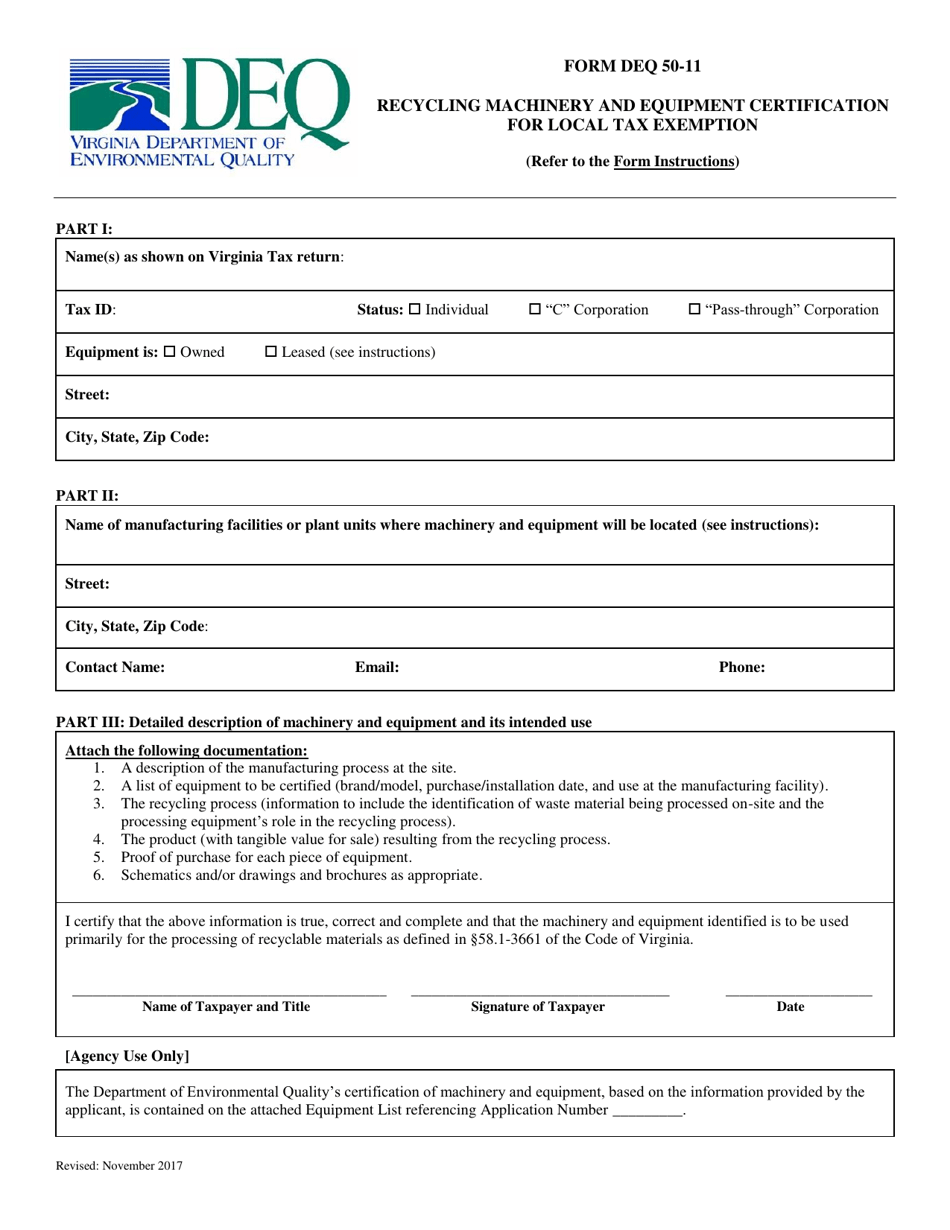

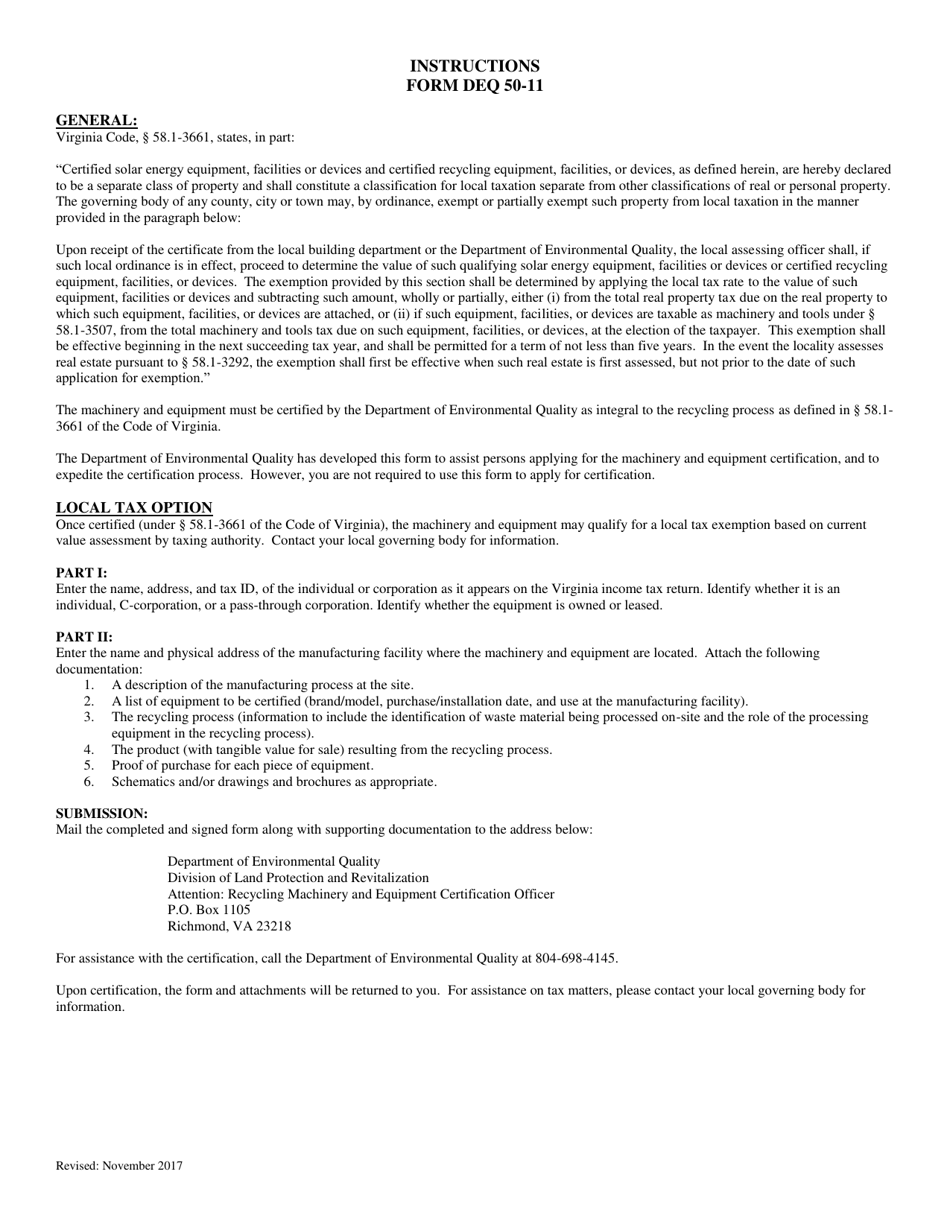

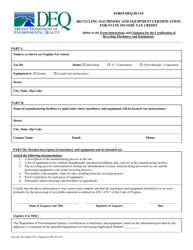

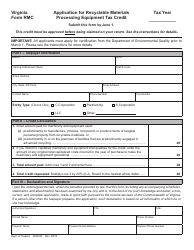

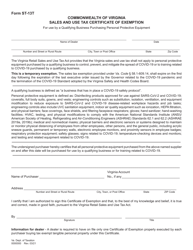

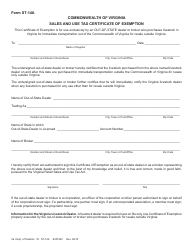

Form DEQ50-11 Recycling Machinery and Equipment Certification for Local Tax Exemption - Virginia

What Is Form DEQ50-11?

This is a legal form that was released by the Virginia Department of Environmental Quality - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DEQ50-11?

A: Form DEQ50-11 is the Recycling Machinery and Equipment Certification for Local Tax Exemption in Virginia.

Q: What is the purpose of Form DEQ50-11?

A: The purpose of Form DEQ50-11 is to certify that machinery and equipment used for recycling activities are eligible for local tax exemption in Virginia.

Q: Who needs to complete Form DEQ50-11?

A: Businesses or organizations engaged in recycling activities in Virginia need to complete Form DEQ50-11.

Q: What are the requirements for tax exemption?

A: To qualify for tax exemption, the machinery and equipment must be used predominantly for recycling activities.

Q: Are there any fees associated with submitting Form DEQ50-11?

A: No, there are no fees associated with submitting Form DEQ50-11.

Q: What should I do after completing Form DEQ50-11?

A: Once the form is completed, it should be submitted to the local commissioner of revenue along with any required supporting documentation.

Q: What is the deadline for submitting Form DEQ50-11?

A: The form should be submitted to the local commissioner of revenue by March 1st of the tax year for which the exemption is requested.

Q: Can I claim tax exemption for previously purchased machinery and equipment?

A: Yes, tax exemption can be claimed for previously purchased machinery and equipment as long as they meet the eligibility requirements.

Q: Who should I contact for more information about Form DEQ50-11?

A: For more information about Form DEQ50-11, you can contact the Virginia Department of Environmental Quality (DEQ) or the local commissioner of revenue.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Virginia Department of Environmental Quality;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DEQ50-11 by clicking the link below or browse more documents and templates provided by the Virginia Department of Environmental Quality.