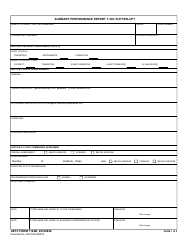

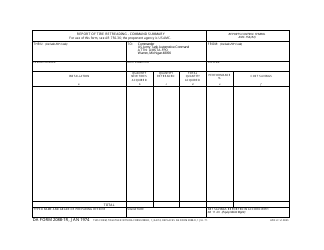

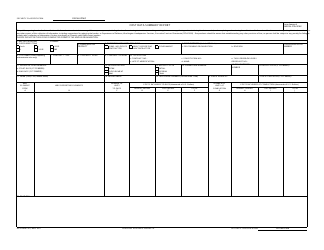

This version of the form is not currently in use and is provided for reference only. Download this version of

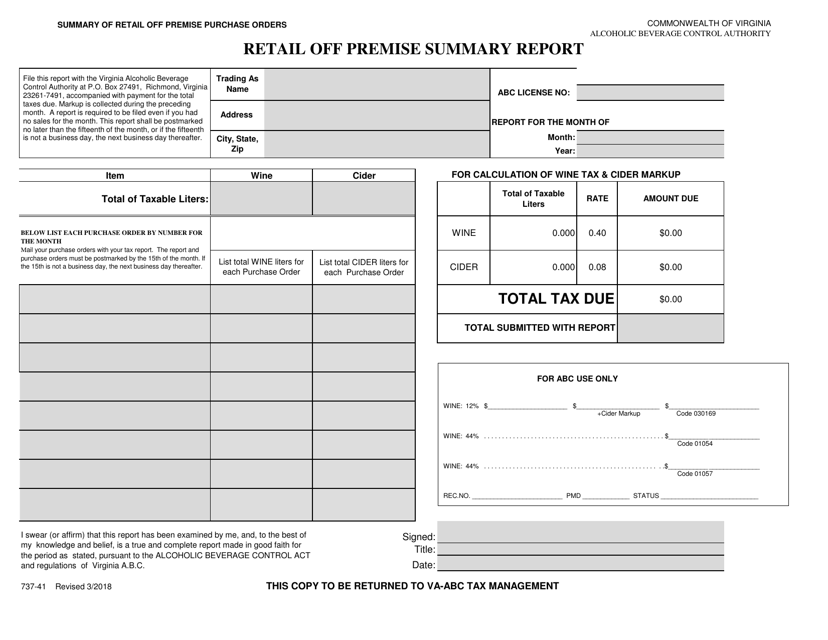

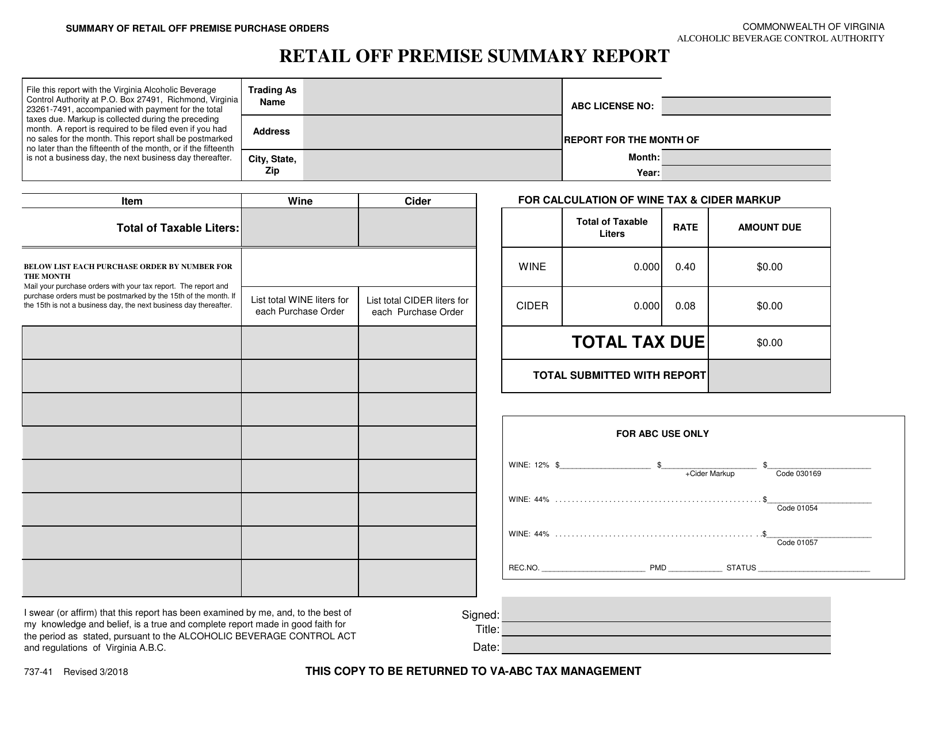

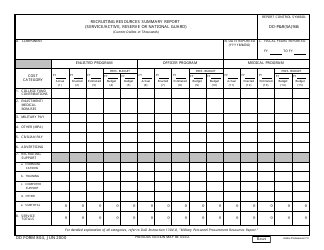

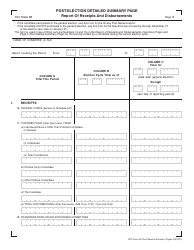

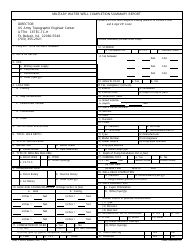

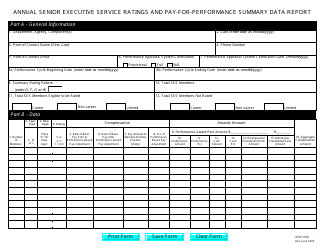

Form 737-41

for the current year.

Form 737-41 Retail off Premise Summary Report - Virginia

What Is Form 737-41?

This is a legal form that was released by the Virginia Alcoholic Beverage Control Authority - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 737-41?

A: Form 737-41 is the Retail off Premise Summary Report.

Q: What is the purpose of Form 737-41?

A: The purpose of Form 737-41 is to report summary information for retail off premise sales in Virginia.

Q: Who needs to file Form 737-41?

A: Any business engaged in retail off premise sales in Virginia needs to file Form 737-41.

Q: What information does Form 737-41 require?

A: Form 737-41 requires information such as the total sales, total purchases, and inventory information for retail off premise sales.

Q: When is Form 737-41 due?

A: Form 737-41 is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form 737-41?

A: Yes, there may be penalties for late filing of Form 737-41. It is important to file the form on time to avoid any penalties or interest charges.

Q: Is Form 737-41 only applicable for businesses in Virginia?

A: Yes, Form 737-41 is specifically for businesses engaged in retail off premise sales in Virginia.

Q: Are there any exemptions from filing Form 737-41?

A: There may be exemptions depending on the specific circumstances. It is recommended to consult with the Virginia Department of Taxation for any exemptions.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Virginia Alcoholic Beverage Control Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 737-41 by clicking the link below or browse more documents and templates provided by the Virginia Alcoholic Beverage Control Authority.