This version of the form is not currently in use and is provided for reference only. Download this version of

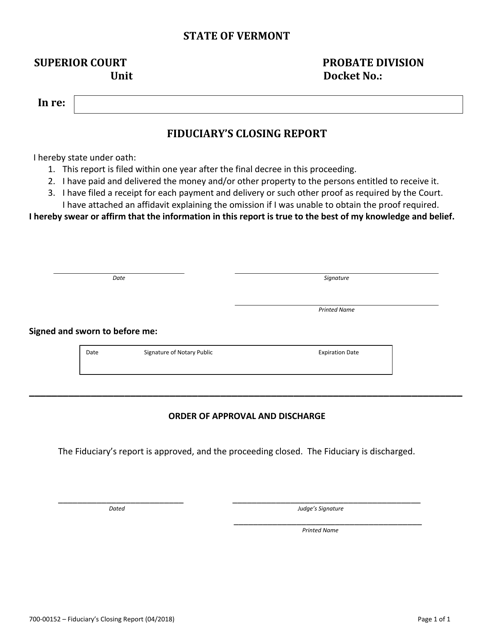

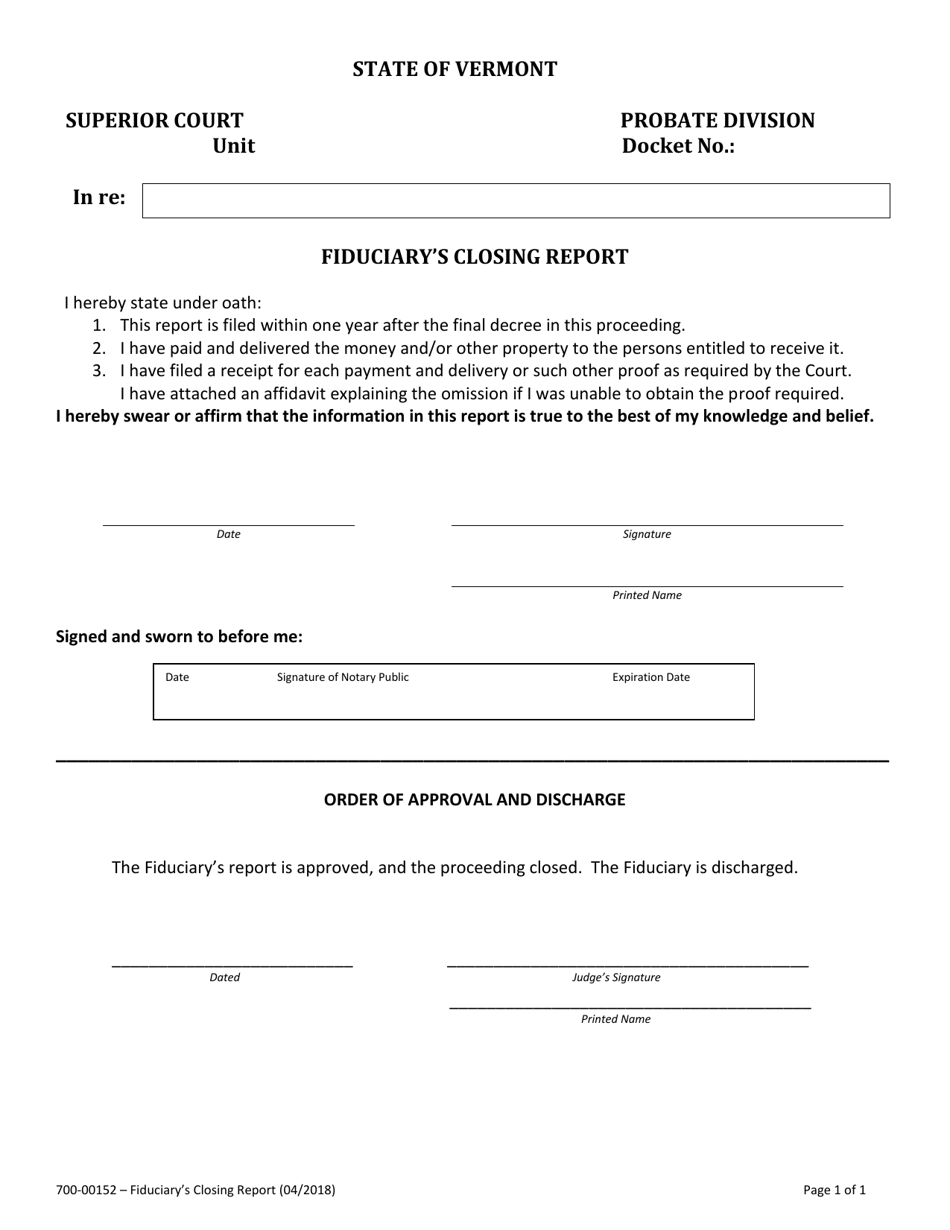

Form 700-00152

for the current year.

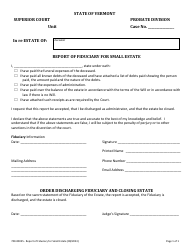

Form 700-00152 Fiduciary's Closing Report - Vermont

What Is Form 700-00152?

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 700-00152?

A: Form 700-00152 is the Fiduciary's Closing Report in Vermont.

Q: Who needs to file Form 700-00152?

A: Form 700-00152 must be filed by fiduciaries who are closing an estate in Vermont.

Q: What information is required on Form 700-00152?

A: Form 700-00152 requires information about the estate assets, income, expenses, distributions, and any taxes owed.

Q: When is the deadline to file Form 700-00152?

A: The deadline to file Form 700-00152 is within 30 days after the closing of the estate.

Q: Are there any fees associated with filing Form 700-00152?

A: There are no fees associated with filing Form 700-00152.

Q: What if I don't file Form 700-00152?

A: Failure to file Form 700-00152 may result in penalties and interest.

Q: Are there any instructions available for completing Form 700-00152?

A: Yes, the Vermont Department of Taxes provides instructions for completing Form 700-00152.

Q: Can I request an extension to file Form 700-00152?

A: Yes, you can request an extension to file Form 700-00152 by contacting the Vermont Department of Taxes.

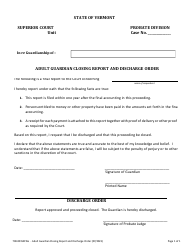

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 700-00152 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.