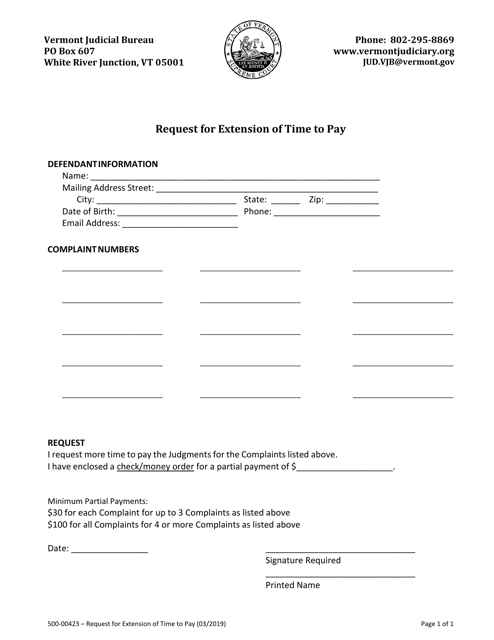

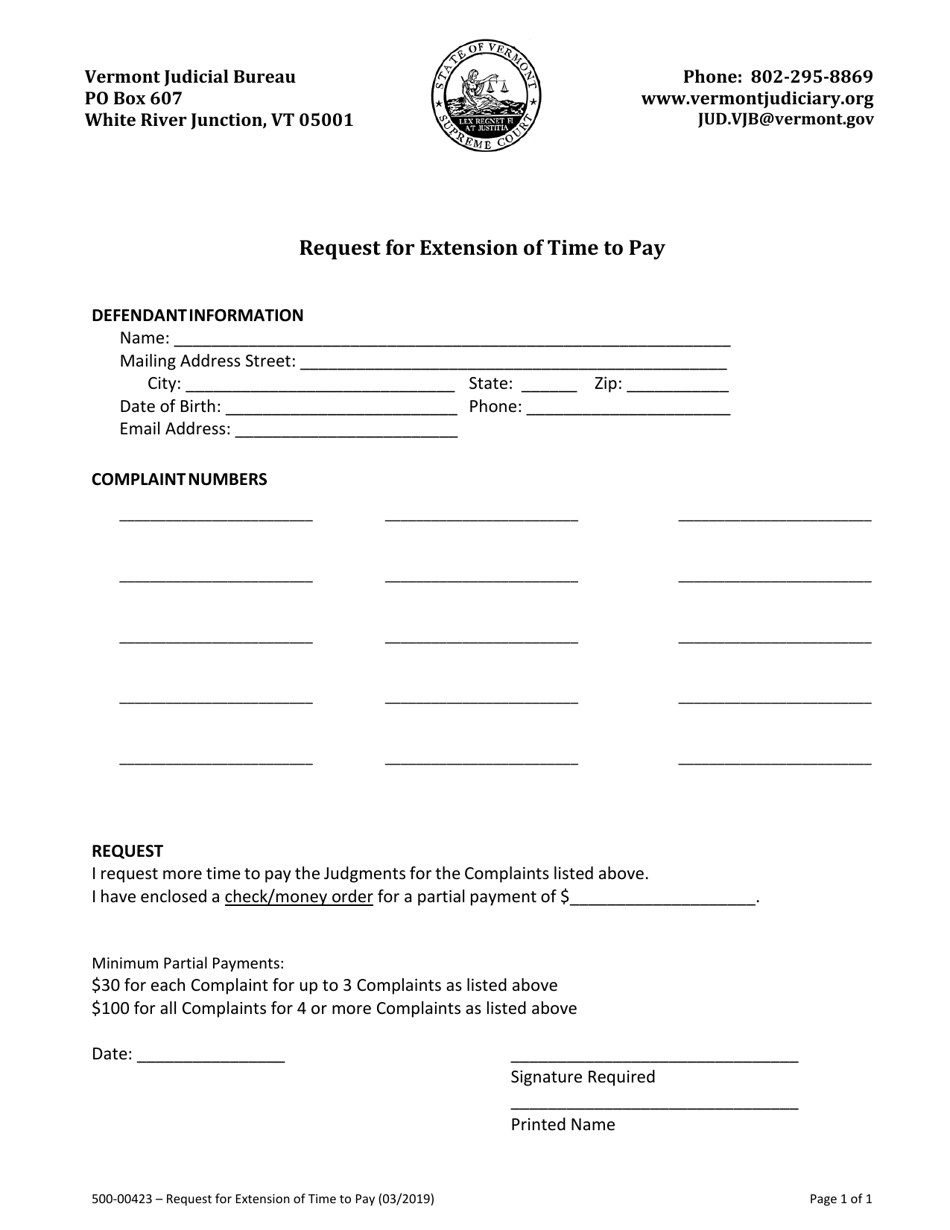

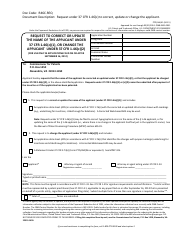

Form 500-00423 Request for Extension of Time to Pay - Vermont

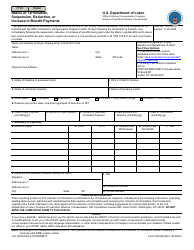

What Is Form 500-00423?

This is a legal form that was released by the Vermont Judiciary - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 500-00423?

A: Form 500-00423 is the Request for Extension of Time to Pay specifically for the state of Vermont.

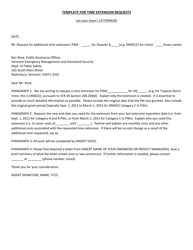

Q: What is the purpose of Form 500-00423?

A: The purpose of Form 500-00423 is to request an extension of time to pay taxes owed to the state of Vermont.

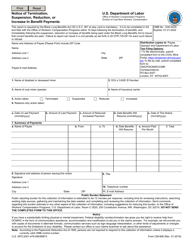

Q: Who can use Form 500-00423?

A: Form 500-00423 can be used by individuals or businesses who need more time to pay their taxes to the state of Vermont.

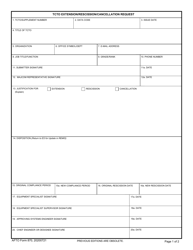

Q: How do I fill out Form 500-00423?

A: You will need to provide your personal information, tax year, amount owed, and the reason for requesting an extension on Form 500-00423.

Q: Is there a fee for requesting an extension?

A: No, there is no fee for requesting an extension with Form 500-00423 in Vermont.

Q: What happens after I submit Form 500-00423?

A: The Vermont Department of Taxes will review your request and notify you of their decision regarding your extension request.

Q: Can I request multiple extensions with Form 500-00423?

A: No, Form 500-00423 is only used for requesting one extension of time to pay taxes.

Q: What if I don't file Form 500-00423 and miss the deadline?

A: If you don't file Form 500-00423 and miss the deadline, you may be subject to penalties and interest on the unpaid amount.

Q: Is there a specific deadline to submit Form 500-00423?

A: Yes, Form 500-00423 must be submitted before the original tax payment deadline specified by the Vermont Department of Taxes.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Vermont Judiciary;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 500-00423 by clicking the link below or browse more documents and templates provided by the Vermont Judiciary.