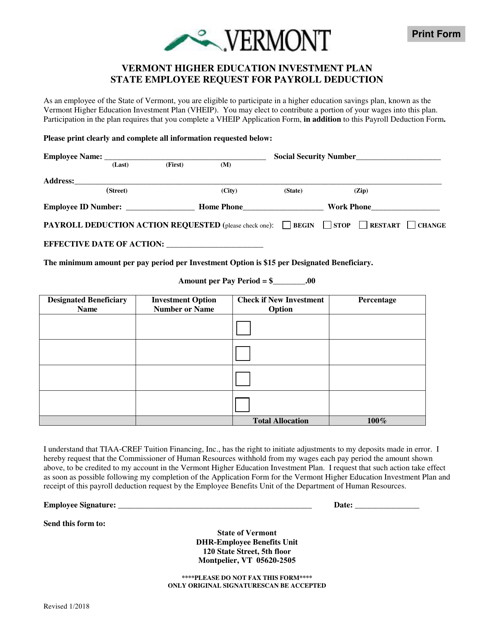

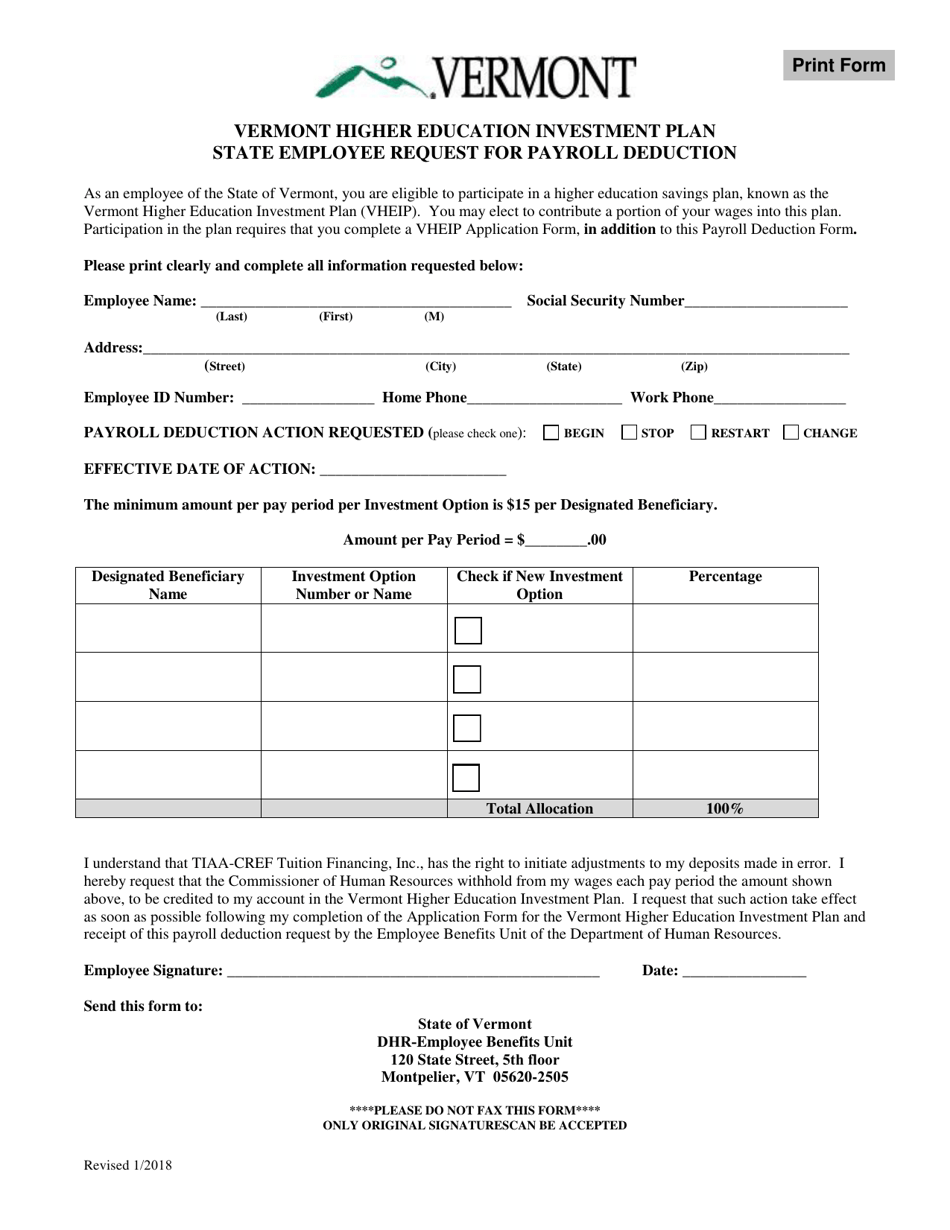

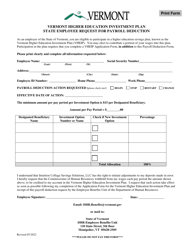

Vermont Higher Education Investment Plan State Employee Request for Payroll Deduction - Vermont

Vermont Request for Payroll Deduction is a legal document that was released by the Vermont Department of Human Resources - a government authority operating within Vermont.

FAQ

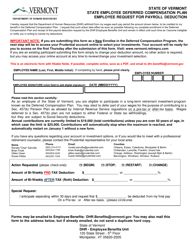

Q: What is the Vermont Higher Education Investment Plan?

A: The Vermont Higher Education Investment Plan is a program that helps residents of Vermont save for future higher education expenses.

Q: Who can participate in the Vermont Higher Education Investment Plan?

A: Residents of Vermont, including state employees, can participate in the plan.

Q: What is the purpose of the State Employee Request for Payroll Deduction?

A: The State Employee Request for Payroll Deduction allows state employees to have a portion of their salary automatically deducted and contribute it to their Vermont Higher Education Investment Plan account.

Q: How does payroll deduction work with the Vermont Higher Education Investment Plan?

A: Through payroll deduction, a portion of a state employee's salary is deducted before taxes and contributed to their Vermont Higher Education Investment Plan account.

Q: Can state employees change their payroll deduction amount?

A: Yes, state employees can change their payroll deduction amount at any time by submitting a new State Employee Request for Payroll Deduction form.

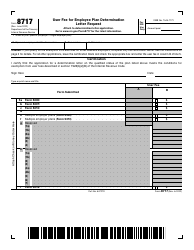

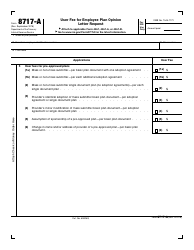

Form Details:

- Released on January 1, 2018;

- The latest edition currently provided by the Vermont Department of Human Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Human Resources.