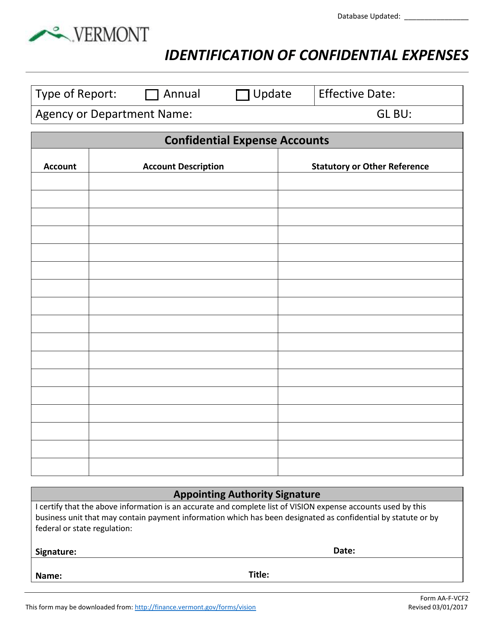

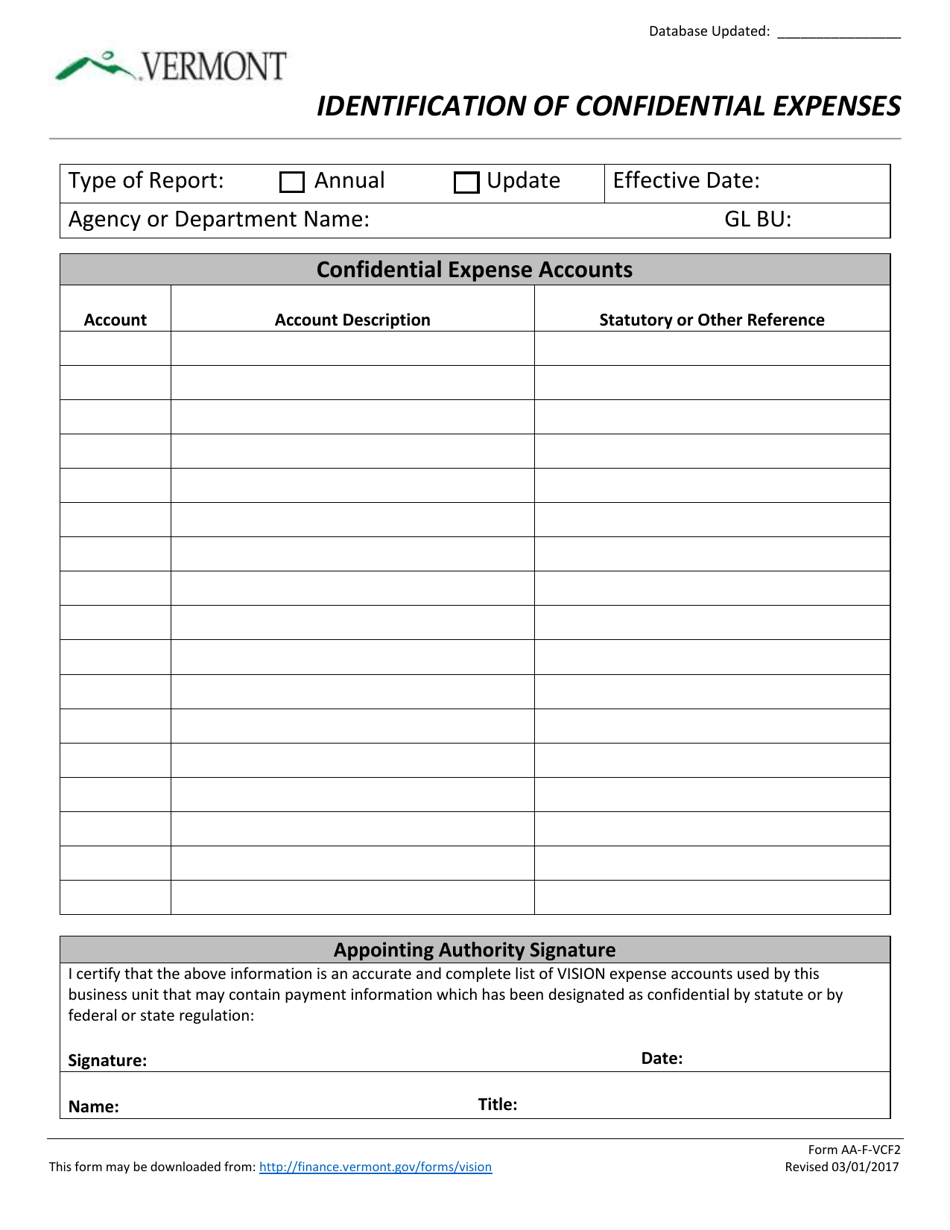

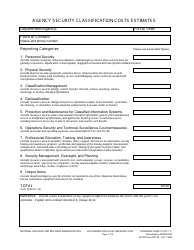

Form AA-F-VCF2 Identification of Confidential Expenses - Vermont

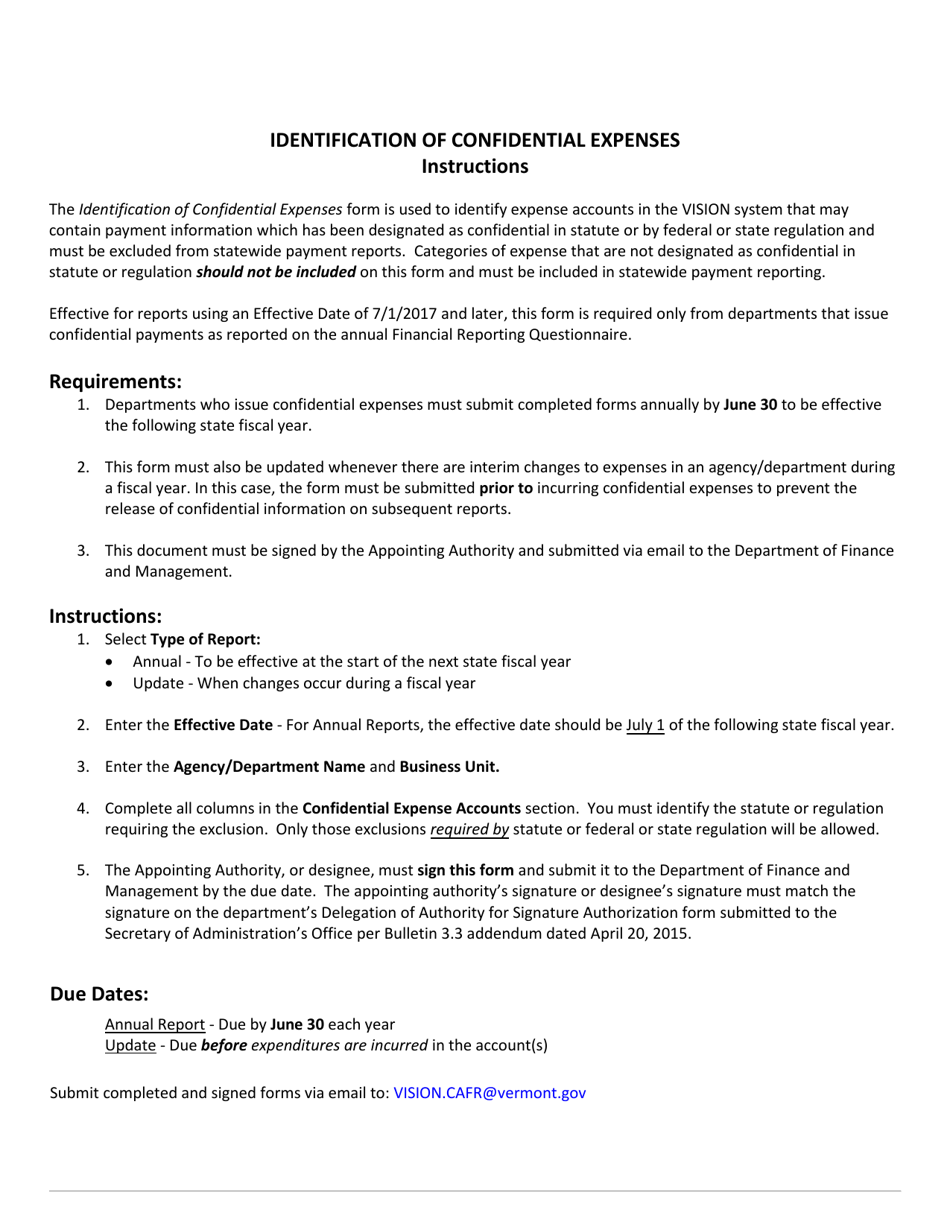

What Is Form AA-F-VCF2?

This is a legal form that was released by the Vermont Department of Finance & Management - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AA-F-VCF2?

A: Form AA-F-VCF2 is the Identification of Confidential Expenses form specific to Vermont.

Q: What is the purpose of Form AA-F-VCF2?

A: The purpose of Form AA-F-VCF2 is to identify confidential expenses.

Q: Who is required to file Form AA-F-VCF2?

A: Any individual or business entity in Vermont that has confidential expenses must file Form AA-F-VCF2.

Q: What are confidential expenses?

A: Confidential expenses refer to expenses that are deemed confidential by the taxpayer.

Q: How should Form AA-F-VCF2 be filled out?

A: Form AA-F-VCF2 should be filled out by providing the necessary information regarding the confidential expenses, including description and amount.

Q: When is Form AA-F-VCF2 due?

A: Form AA-F-VCF2 is typically due at the same time as the taxpayer's annual tax return, which is April 15th for most individuals.

Q: Are there any penalties for not filing Form AA-F-VCF2?

A: Yes, failure to file Form AA-F-VCF2 or providing false information may result in penalties and interest.

Q: Is Form AA-F-VCF2 confidential?

A: Yes, the information provided on Form AA-F-VCF2 is considered confidential and is not subject to public disclosure.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Vermont Department of Finance & Management;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AA-F-VCF2 by clicking the link below or browse more documents and templates provided by the Vermont Department of Finance & Management.