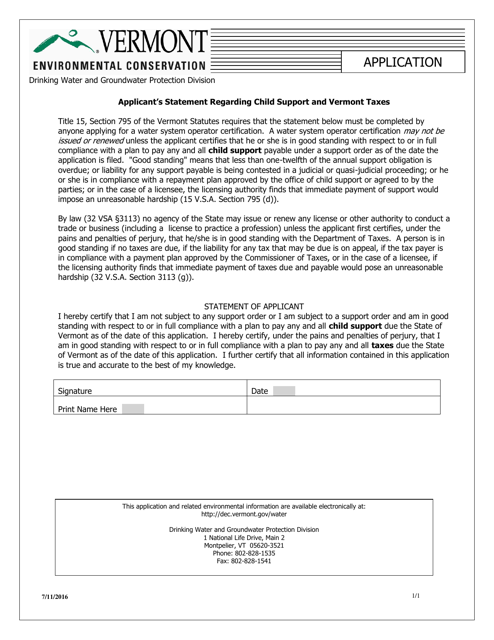

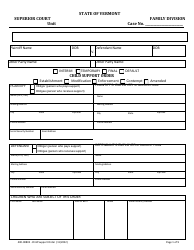

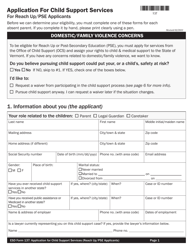

Applicant's Statement Regarding Child Support and Vermont Taxes - Vermont

Applicant's Statement Regarding Child Support and Vermont Taxes is a legal document that was released by the Vermont Department of Environmental Conservation - a government authority operating within Vermont.

FAQ

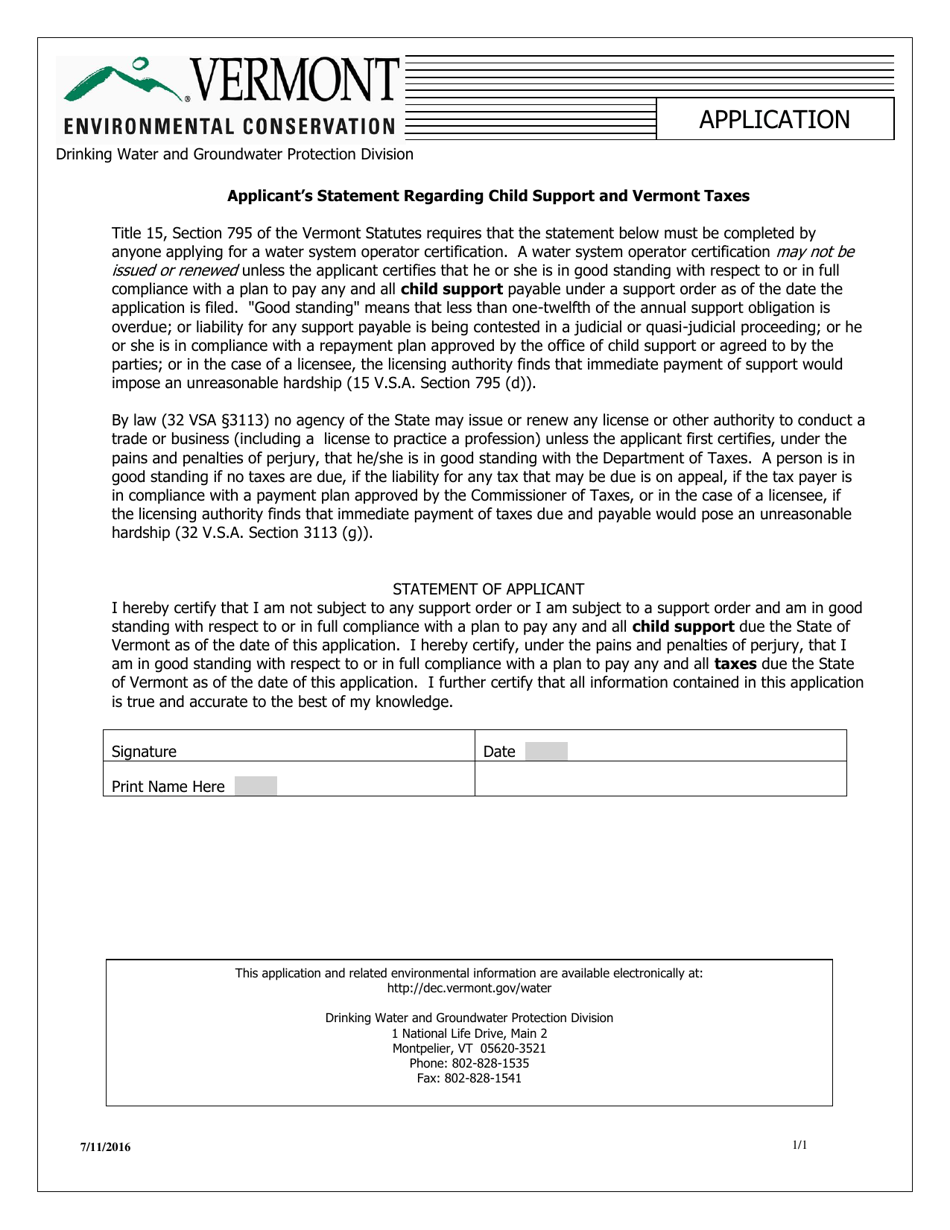

Q: What is the Applicant's Statement Regarding Child Support and Vermont Taxes?

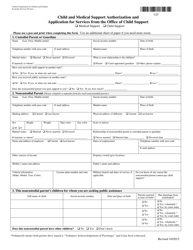

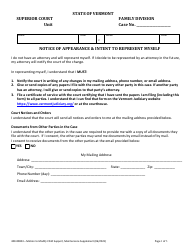

A: The Applicant's Statement Regarding Child Support and Vermont Taxes is a document that must be completed by individuals seeking certain benefits or services in Vermont.

Q: Who needs to complete the Applicant's Statement Regarding Child Support and Vermont Taxes?

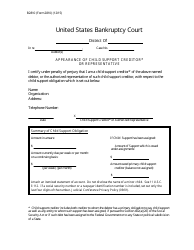

A: Individuals who are applying for benefits or services in Vermont and have a child support obligation need to complete this statement.

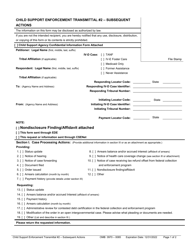

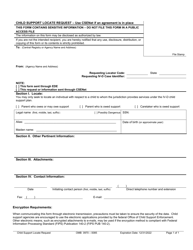

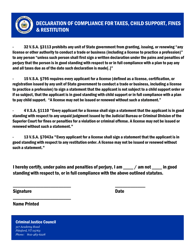

Q: What information is required in the Applicant's Statement Regarding Child Support and Vermont Taxes?

A: The statement requires information about the individual's child support obligations, including the amount of child support paid or received and any arrearages.

Q: Why is the Applicant's Statement Regarding Child Support and Vermont Taxes necessary?

A: The statement is necessary to determine the individual's eligibility for benefits or services and to ensure compliance with child support obligations in Vermont.

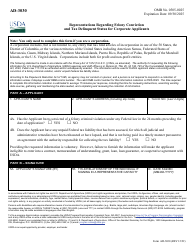

Form Details:

- Released on July 11, 2016;

- The latest edition currently provided by the Vermont Department of Environmental Conservation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Environmental Conservation.