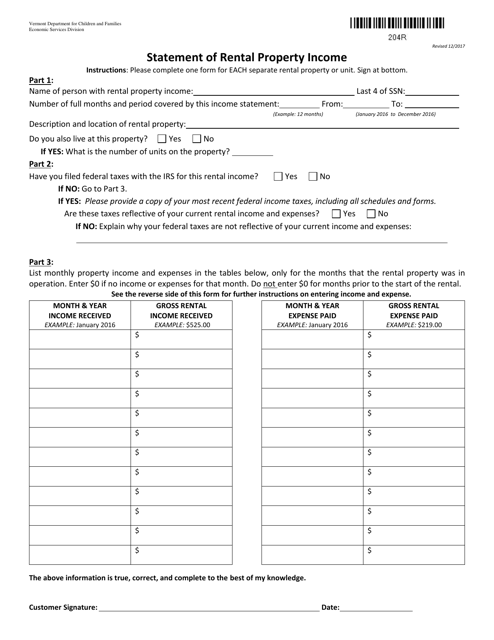

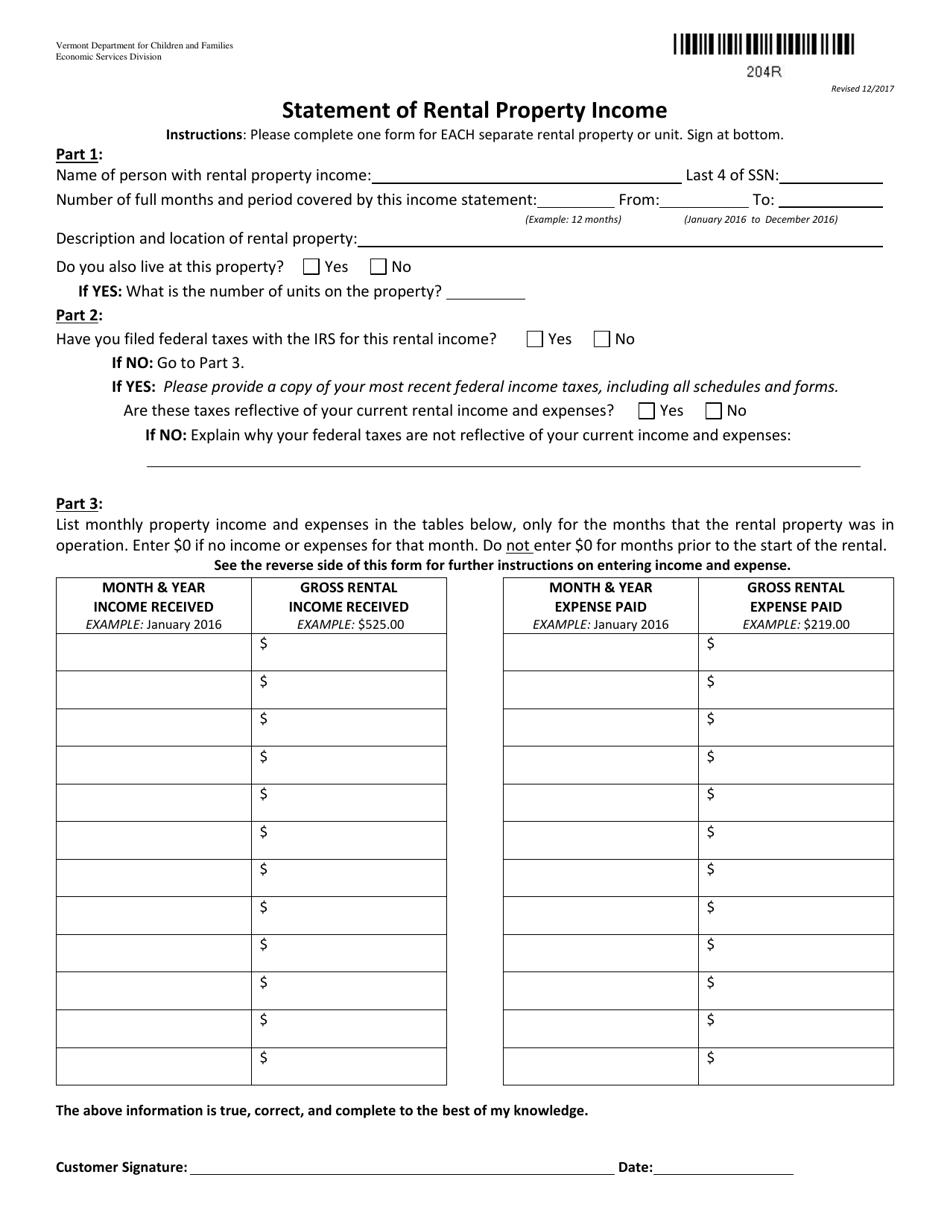

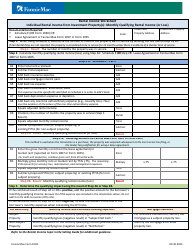

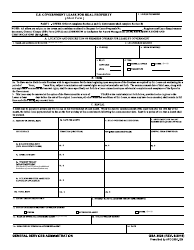

Form 204R Statement of Rental Property Income - Vermont

What Is Form 204R?

This is a legal form that was released by the Vermont Department of Children and Families - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 204R?

A: Form 204R is a statement used for reporting rental property income in Vermont.

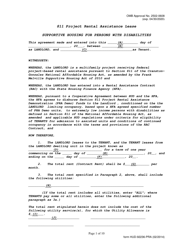

Q: Who needs to file Form 204R?

A: Individuals who earn rental income from properties in Vermont need to file Form 204R.

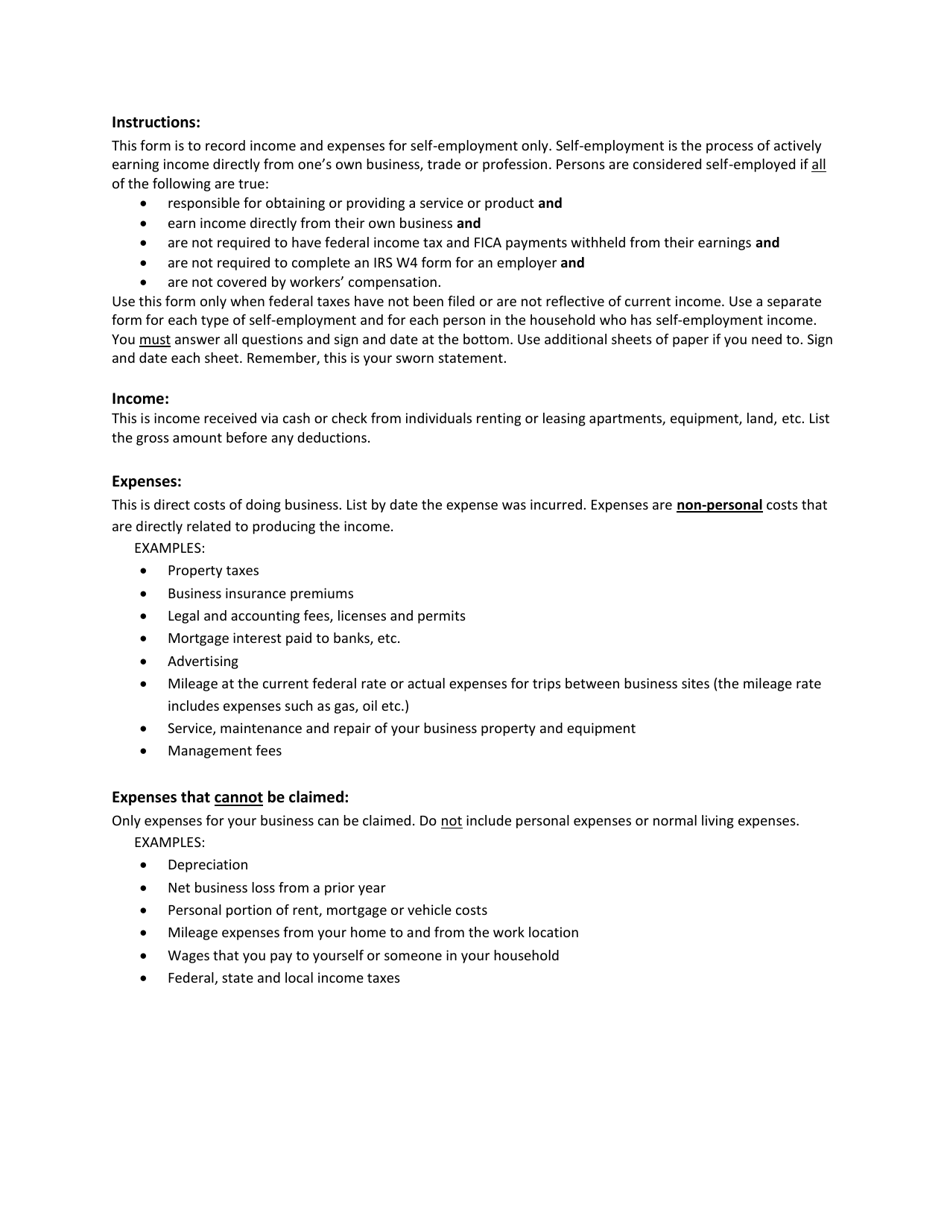

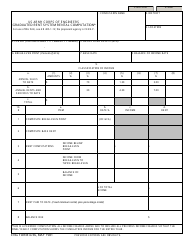

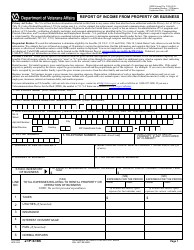

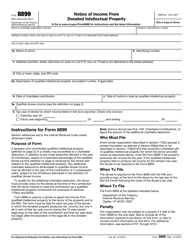

Q: What information is required on Form 204R?

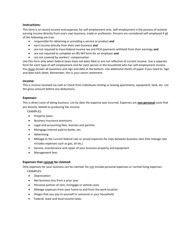

A: Form 204R requires you to report details of your rental income, expenses, and deductions related to your rental properties.

Q: When is the deadline for filing Form 204R?

A: The deadline for filing Form 204R is typically April 15th, or the next business day if it falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form 204R?

A: Yes, there may be penalties for late filing of Form 204R, so it's important to submit your form on time.

Q: Can I e-file Form 204R?

A: No, currently e-filing is not available for Form 204R in Vermont. It must be filed via mail or in person.

Q: What if I have multiple rental properties in Vermont?

A: If you have multiple rental properties in Vermont, you will need to report the income and expenses for each property separately on Form 204R.

Q: Is rental income taxable in Vermont?

A: Yes, rental income is generally taxable in Vermont and must be reported on your state tax return.

Q: Can I deduct expenses related to my rental property?

A: Yes, you can deduct certain expenses related to your rental property, such as mortgage interest, property taxes, and maintenance costs.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Vermont Department of Children and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 204R by clicking the link below or browse more documents and templates provided by the Vermont Department of Children and Families.