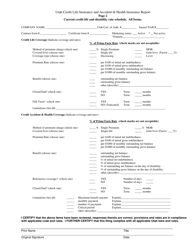

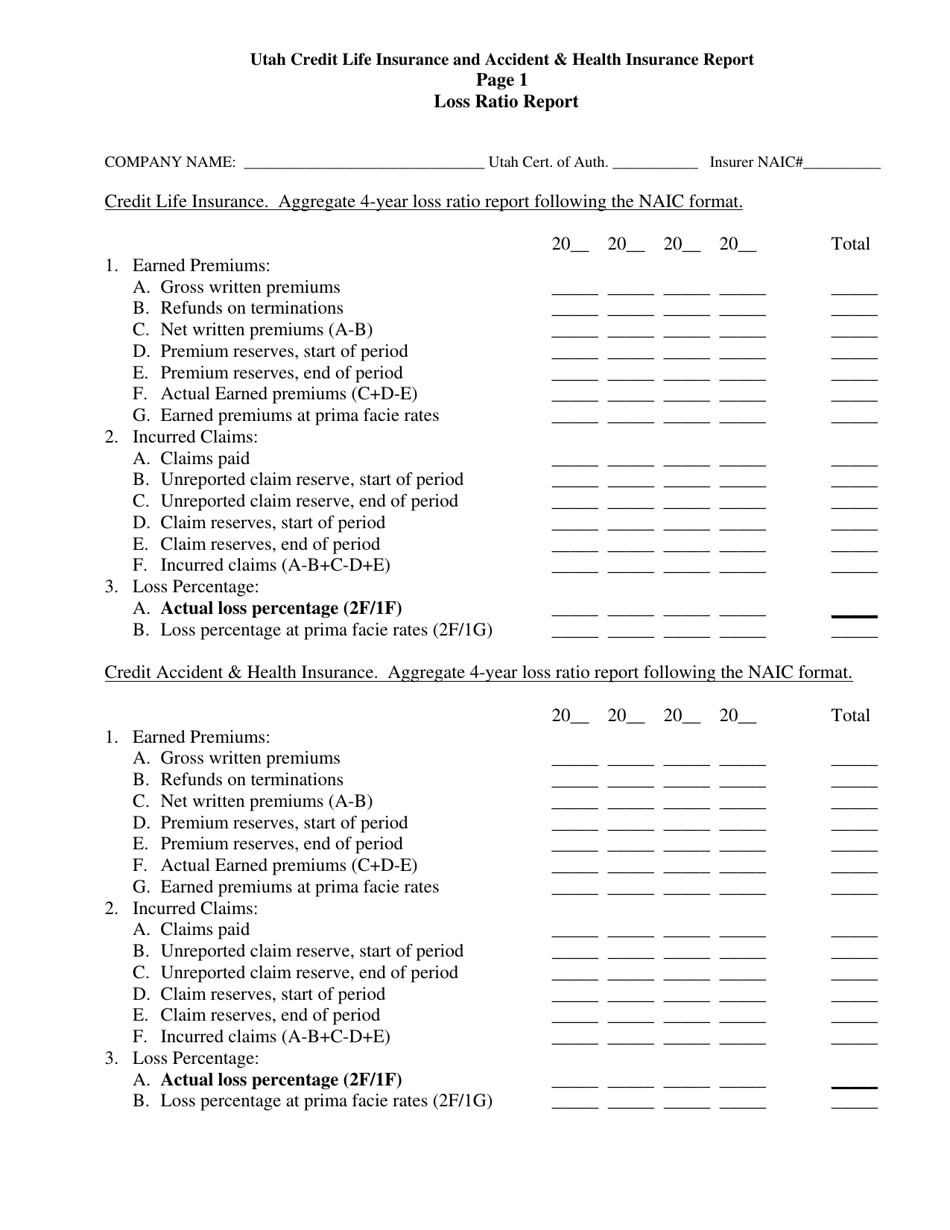

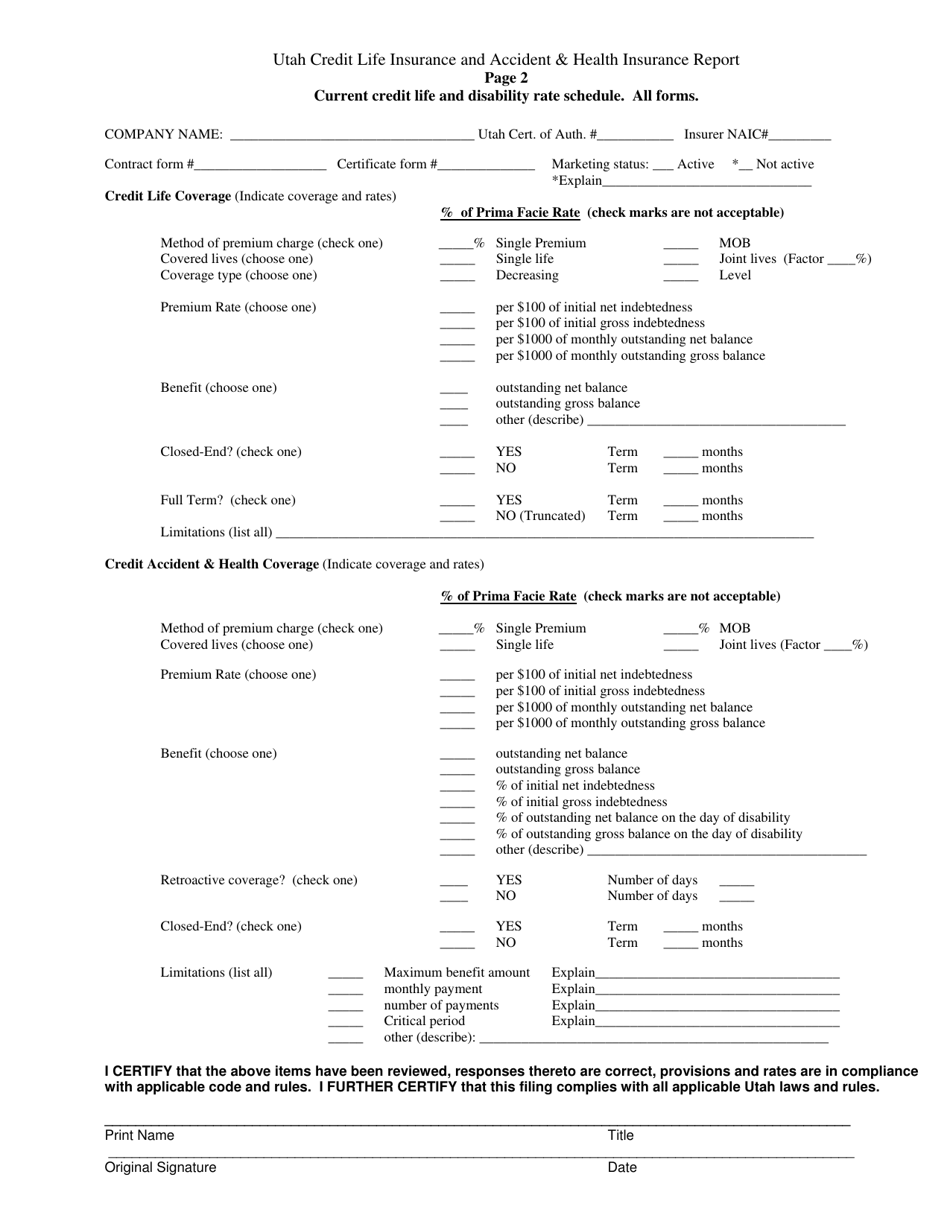

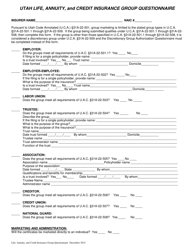

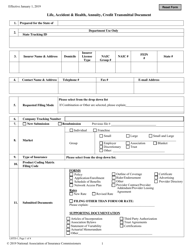

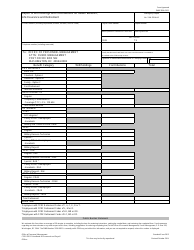

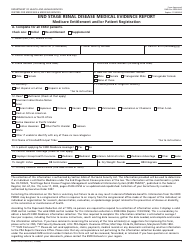

Credit Life Insurance and Credit Accident & Health Insurance Report - Utah

Credit Life Insurance and Credit Accident & Health Insurance Report is a legal document that was released by the Utah Insurance Department - a government authority operating within Utah.

FAQ

Q: What is Credit Life Insurance?

A: Credit Life Insurance is a type of insurance that pays off a borrower's loan balance in the event of their death.

Q: What is Credit Accident & Health Insurance?

A: Credit Accident & Health Insurance is a type of insurance that provides coverage for medical expenses or lost wages in the event of an accident or illness affecting the insured borrower.

Q: Is Credit Life Insurance mandatory in Utah?

A: No, Credit Life Insurance is not mandatory in Utah.

Q: Is Credit Accident & Health Insurance mandatory in Utah?

A: No, Credit Accident & Health Insurance is not mandatory in Utah.

Q: Can a borrower choose whether to purchase Credit Life Insurance or Credit Accident & Health Insurance?

A: Yes, borrowers have the option to purchase either one or both types of insurance, or they can choose not to purchase any insurance.

Q: Are there any legal restrictions on the cost of Credit Life Insurance or Credit Accident & Health Insurance in Utah?

A: Yes, Utah law places limitations on the premiums that can be charged for Credit Life Insurance or Credit Accident & Health Insurance.

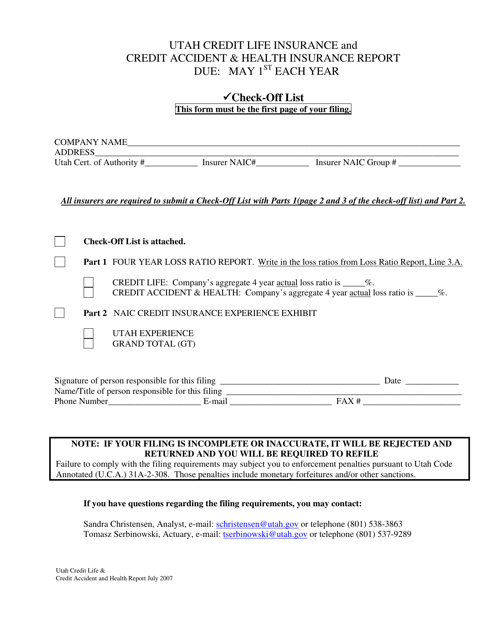

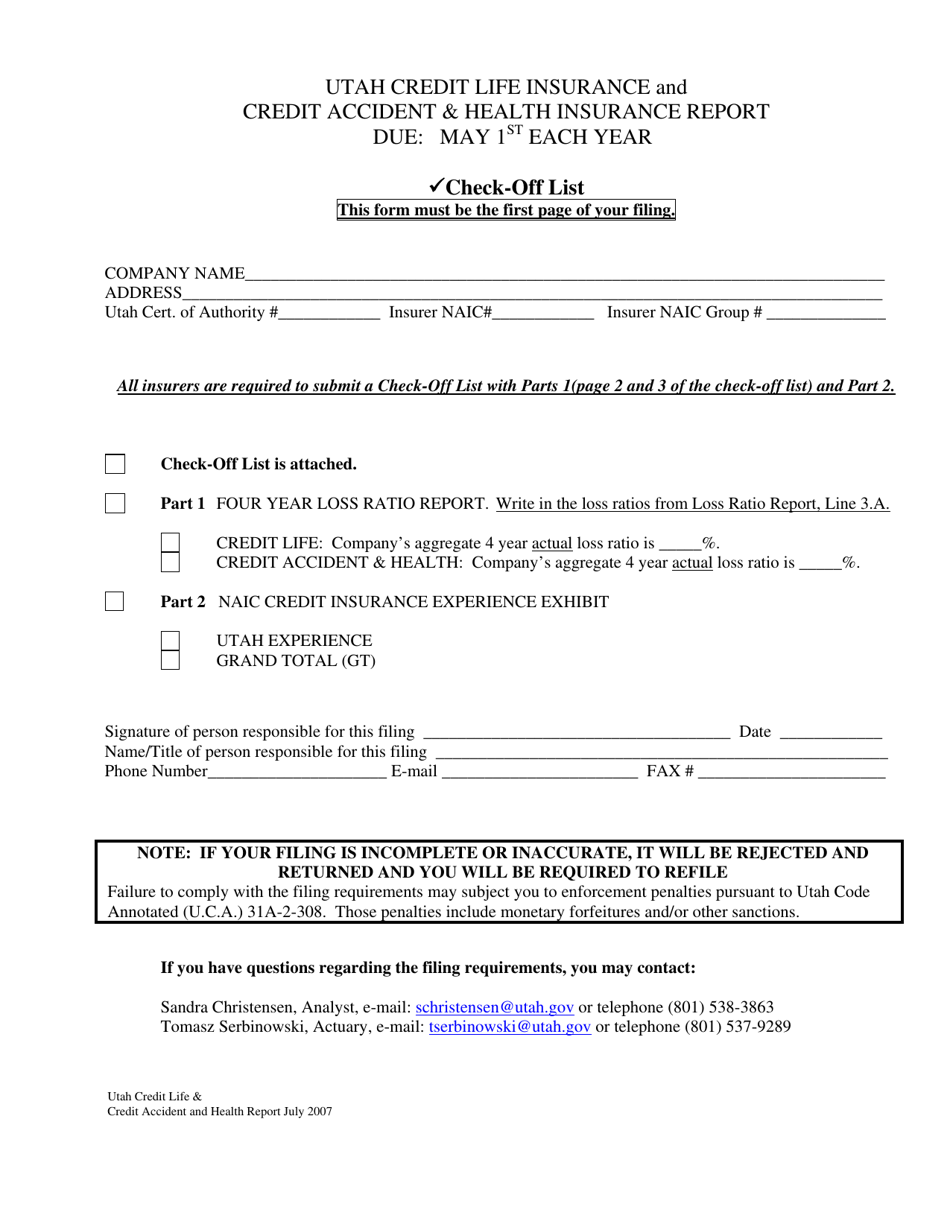

Form Details:

- Released on July 1, 2007;

- The latest edition currently provided by the Utah Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Utah Insurance Department.