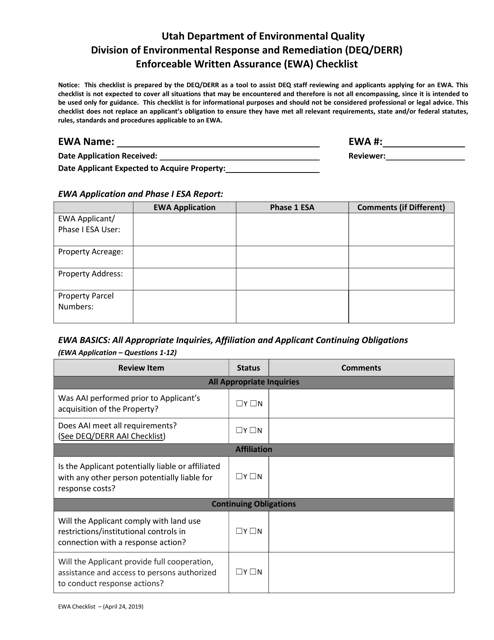

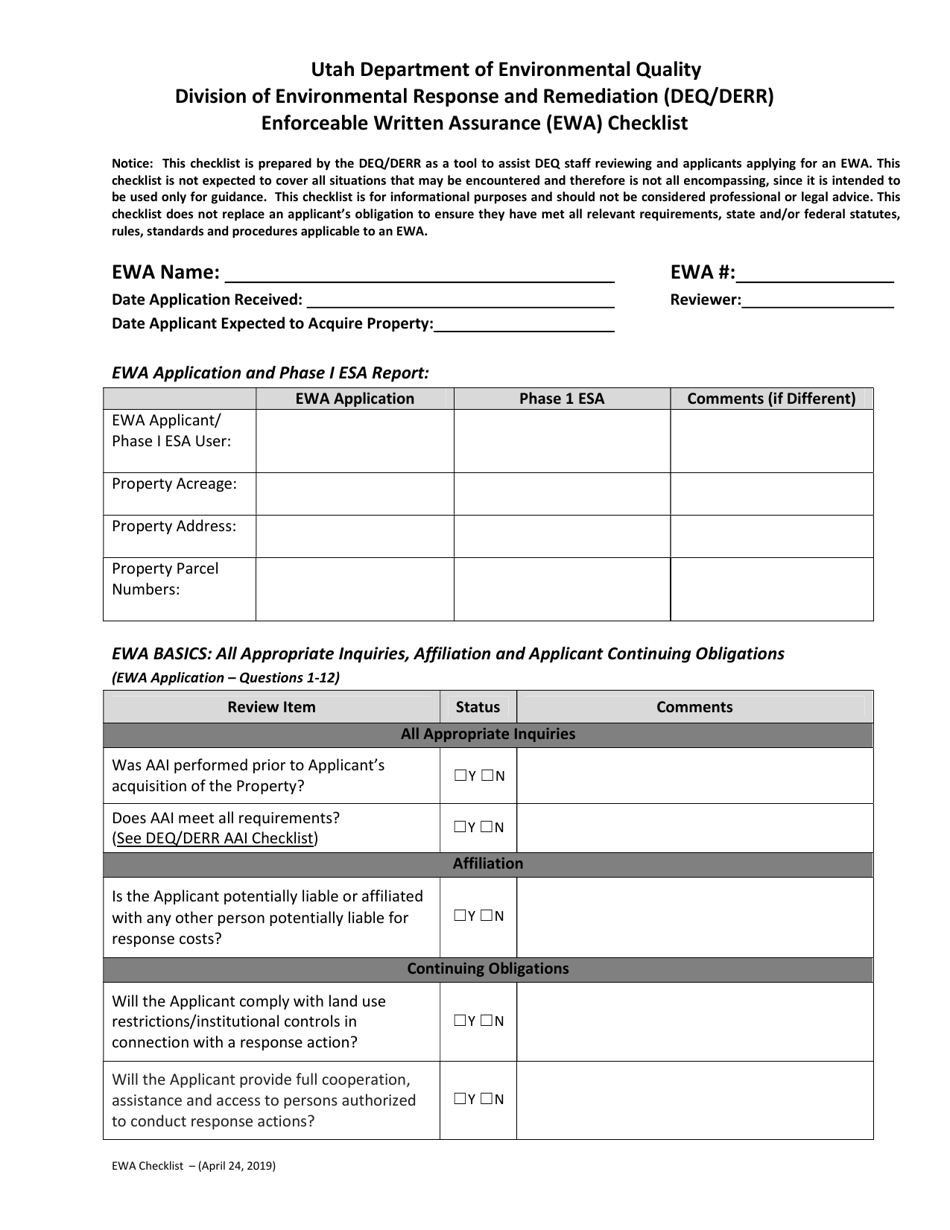

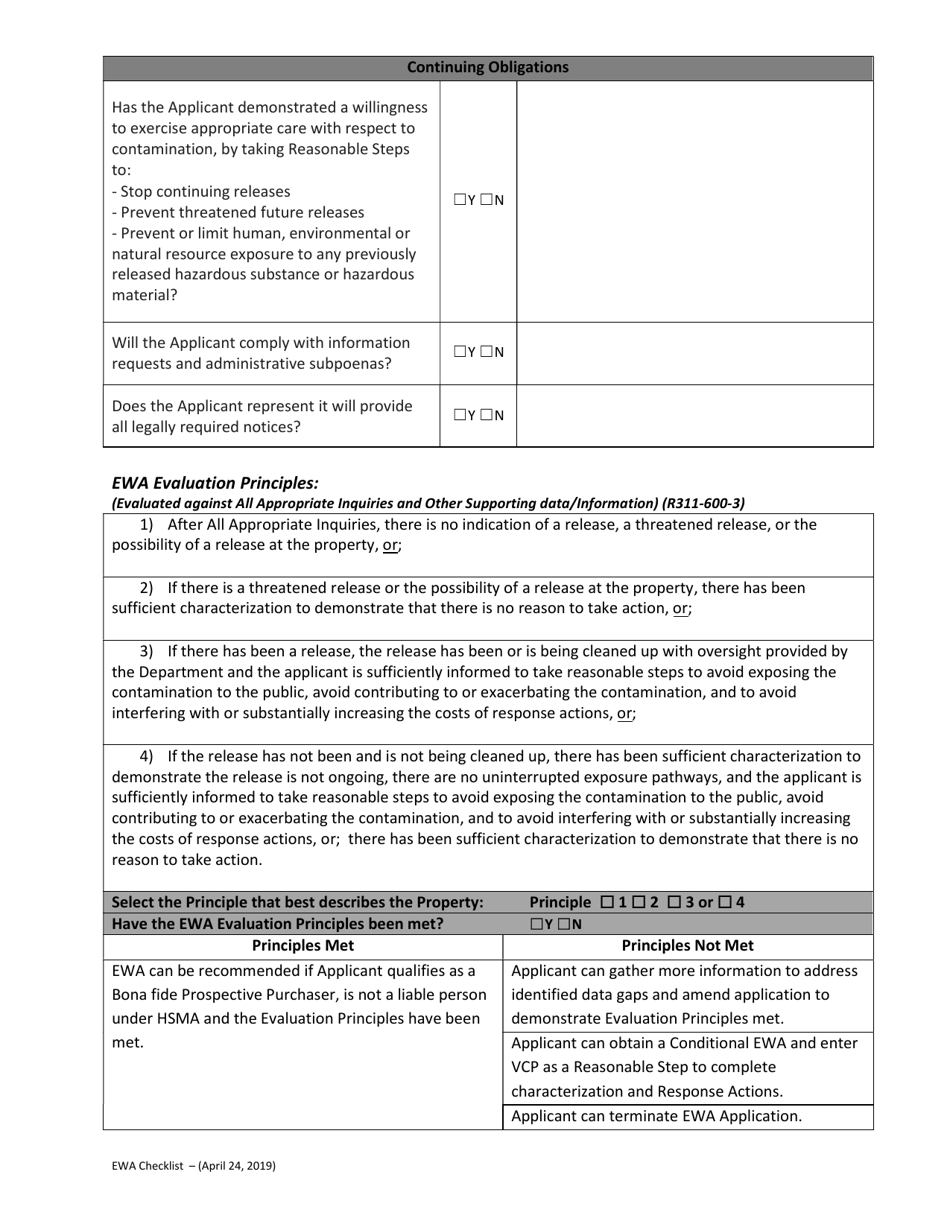

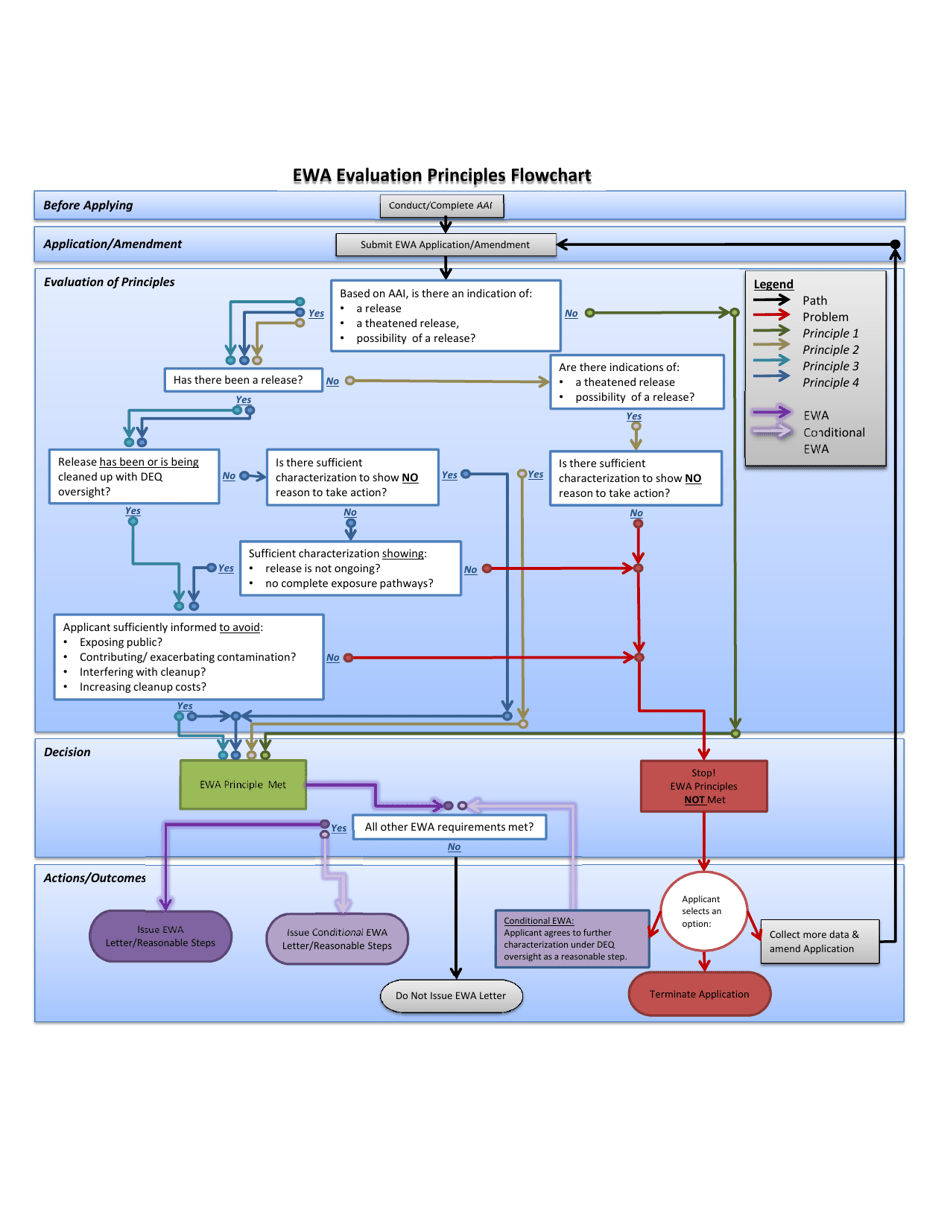

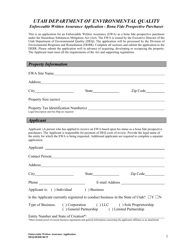

Enforceable Written Assurance (Ewa) Checklist - Utah

Enforceable Written Assurance (Ewa) Checklist is a legal document that was released by the Utah Department of Environmental Quality - a government authority operating within Utah.

FAQ

Q: What is an Enforceable Written Assurance (EWA)?

A: An Enforceable Written Assurance (EWA) is a document that outlines the terms and conditions agreed upon between a taxpayer and the Utah State Tax Commission to resolve a tax liability.

Q: When is an EWA used?

A: An EWA is used when a taxpayer wants to establish an agreement with the Utah State Tax Commission to pay off a tax liability in installments or settle the liability for a lesser amount.

Q: How can I request an EWA?

A: To request an EWA in Utah, you need to complete and submit Form TC-803, Enforceable Written Assurance Request, along with supporting documentation and payment of any required fees.

Q: What are the eligibility requirements for an EWA?

A: To be eligible for an EWA in Utah, you must have a delinquent tax liability, be compliant with filing and payment requirements for the current tax period, and demonstrate a financial hardship.

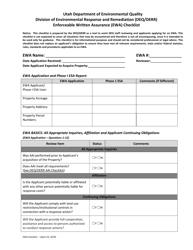

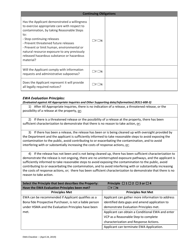

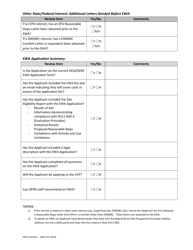

Q: What is the purpose of the EWA checklist?

A: The EWA checklist is a tool provided by the Utah State Tax Commission to help taxpayers gather the necessary information and documents required to request an Enforceable Written Assurance.

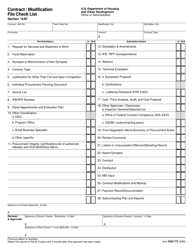

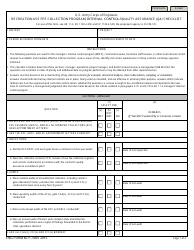

Form Details:

- Released on April 24, 2019;

- The latest edition currently provided by the Utah Department of Environmental Quality;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Environmental Quality.