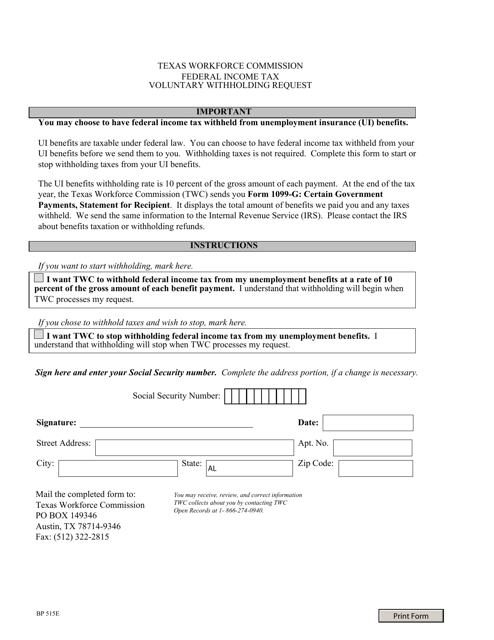

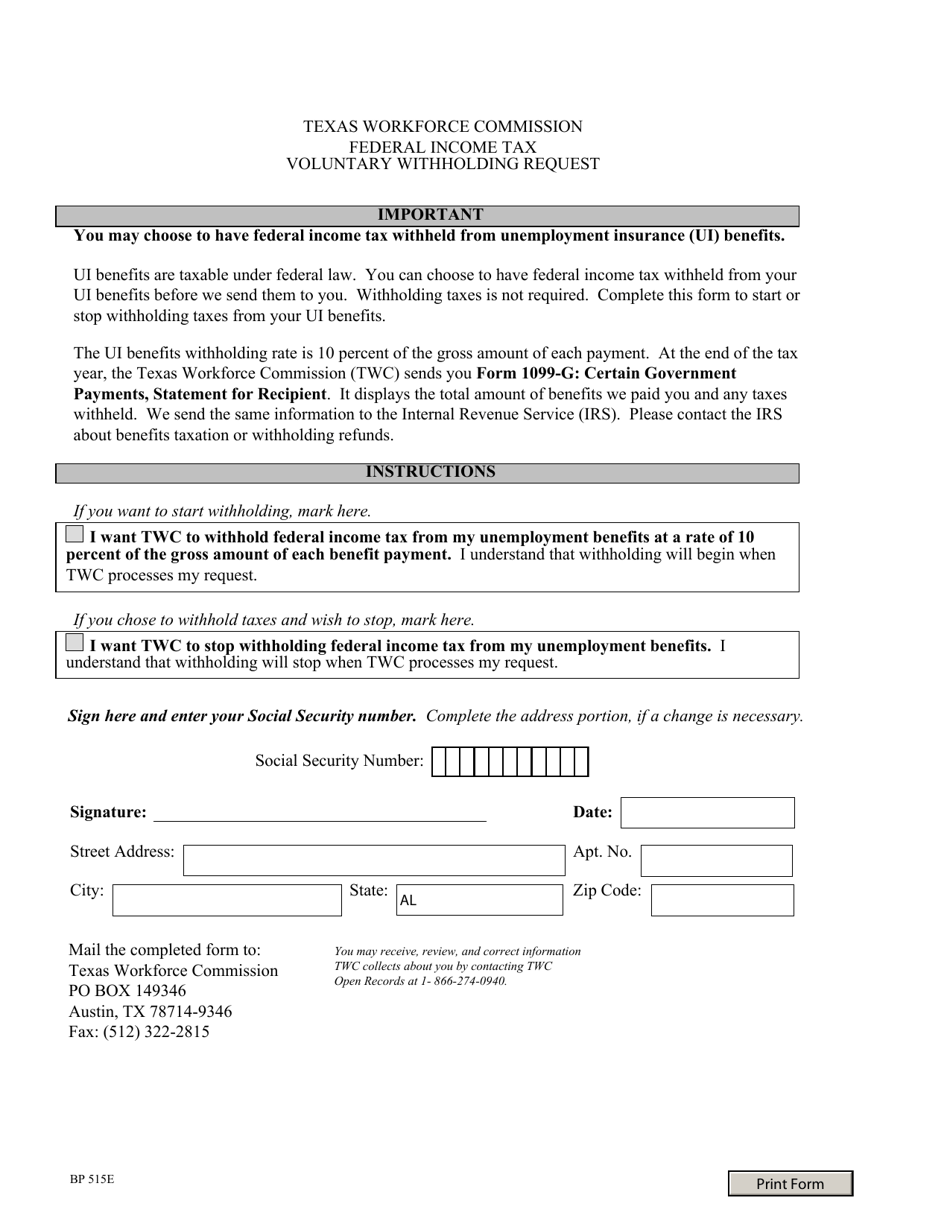

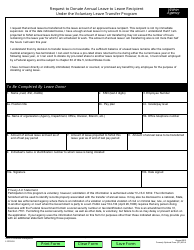

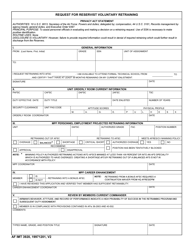

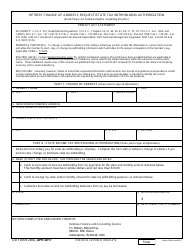

Form BP515 E Voluntary Withholding Request - Texas

What Is Form BP515 E?

This is a legal form that was released by the Texas Workforce Commission - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BP515?

A: Form BP515 is a Voluntary Withholding Request form specifically for the state of Texas.

Q: What is the purpose of Form BP515?

A: The purpose of Form BP515 is to request voluntary withholding from payments made by the State of Texas.

Q: Who should use Form BP515?

A: Form BP515 should be used by individuals who want to have taxes withheld from payments made by the State of Texas.

Q: What kind of payments can be subject to withholding using Form BP515?

A: Form BP515 can be used to request voluntary withholding from various payments such as wages, contracts, lease payments, and more.

Form Details:

- The latest edition provided by the Texas Workforce Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BP515 E by clicking the link below or browse more documents and templates provided by the Texas Workforce Commission.