This version of the form is not currently in use and is provided for reference only. Download this version of

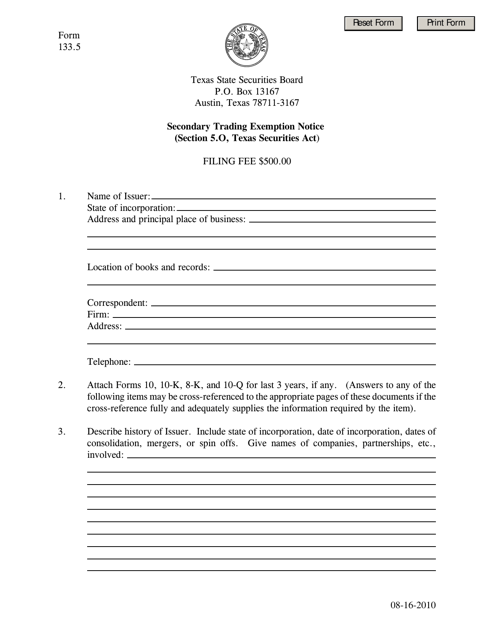

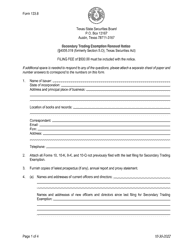

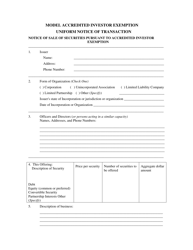

Form 133.5

for the current year.

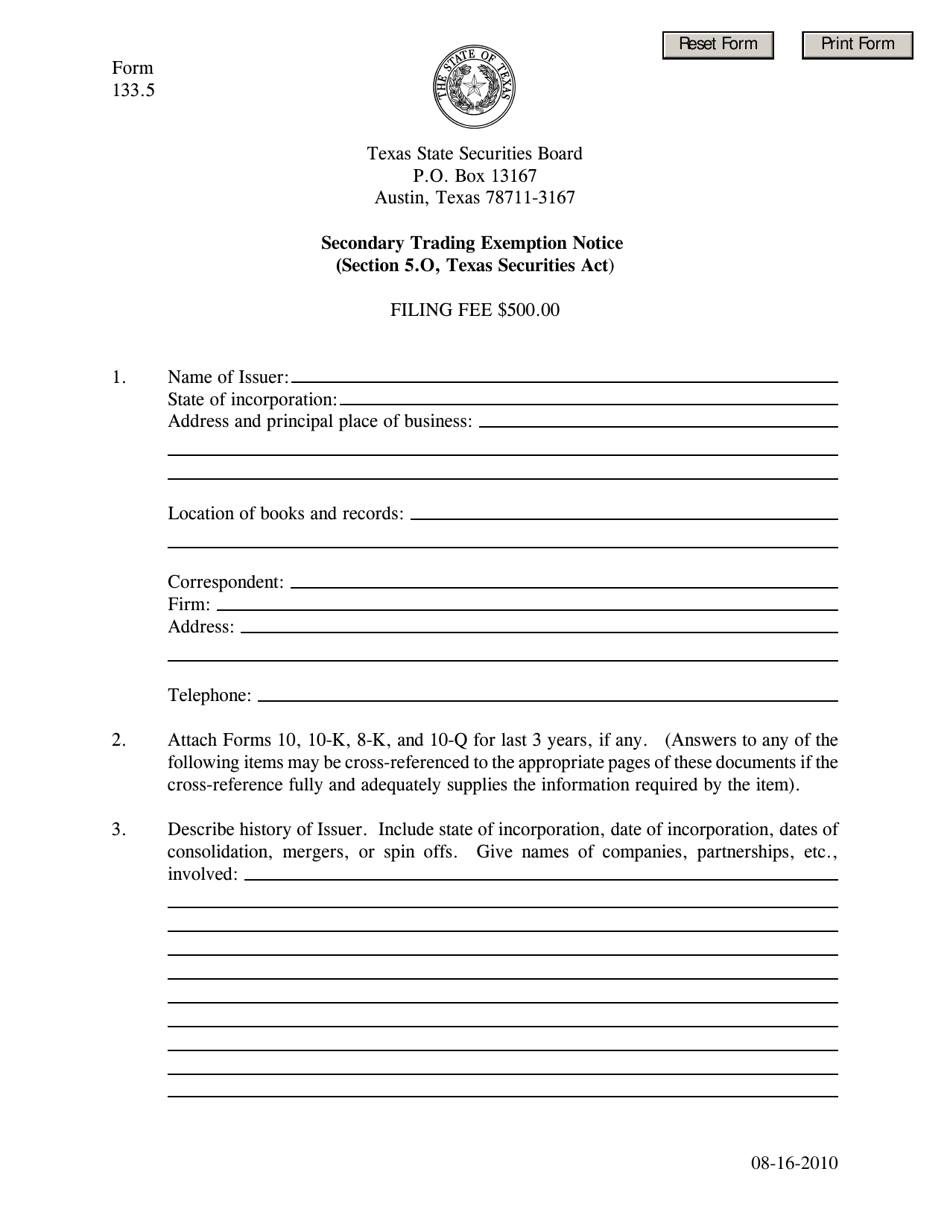

Form 133.5 Secondary Trading Exemption Notice - Texas

What Is Form 133.5?

This is a legal form that was released by the Texas State Securities Board - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 133.5?

A: Form 133.5 is a Secondary Trading Exemption Notice for Texas.

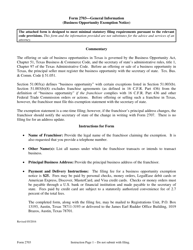

Q: What is the purpose of Form 133.5?

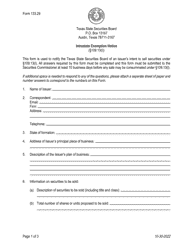

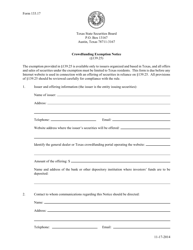

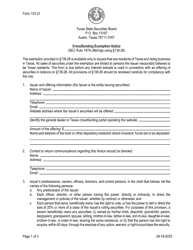

A: The purpose of Form 133.5 is to provide notice of an exemption from registration for secondary trading of securities in Texas.

Q: Who needs to file Form 133.5?

A: Individuals or entities engaging in secondary trading of securities in Texas may need to file Form 133.5.

Q: What is secondary trading?

A: Secondary trading refers to buying or selling previously-issued securities between investors, rather than from the original issuer.

Q: Is filing Form 133.5 mandatory?

A: Yes, filing Form 133.5 is mandatory for individuals or entities engaging in secondary trading of securities in Texas.

Q: Are there any fees associated with filing Form 133.5?

A: The filing fee for Form 133.5 may vary. It is best to check with the regulatory authority for the current fee schedule.

Q: When should Form 133.5 be filed?

A: Form 133.5 should be filed at least 10 days prior to engaging in secondary trading of securities in Texas.

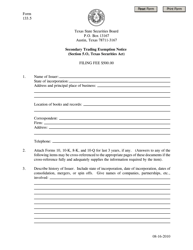

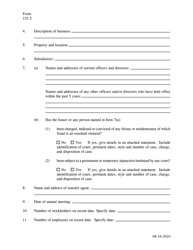

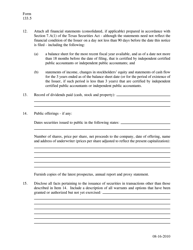

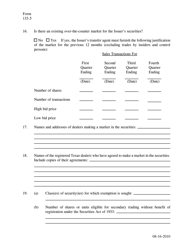

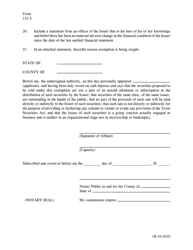

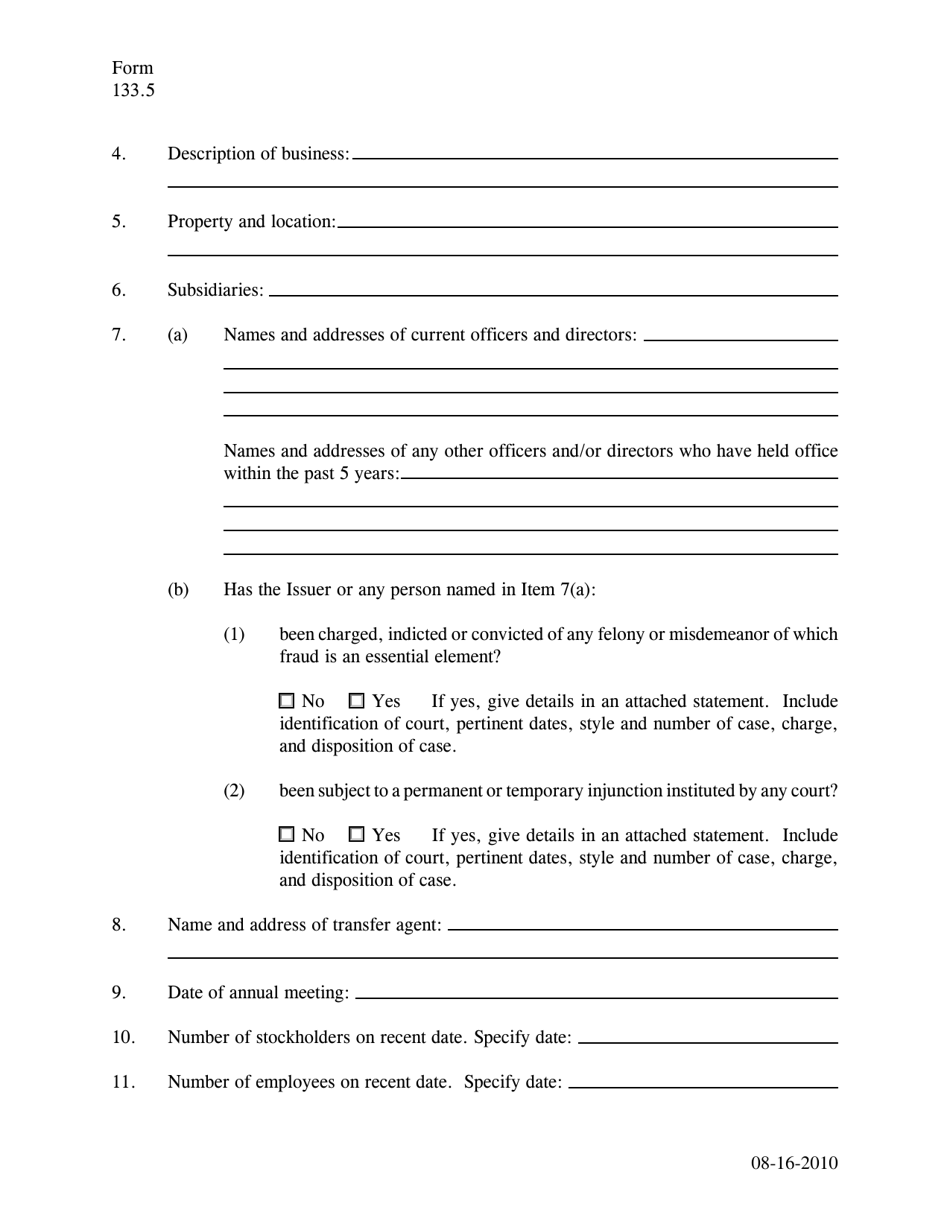

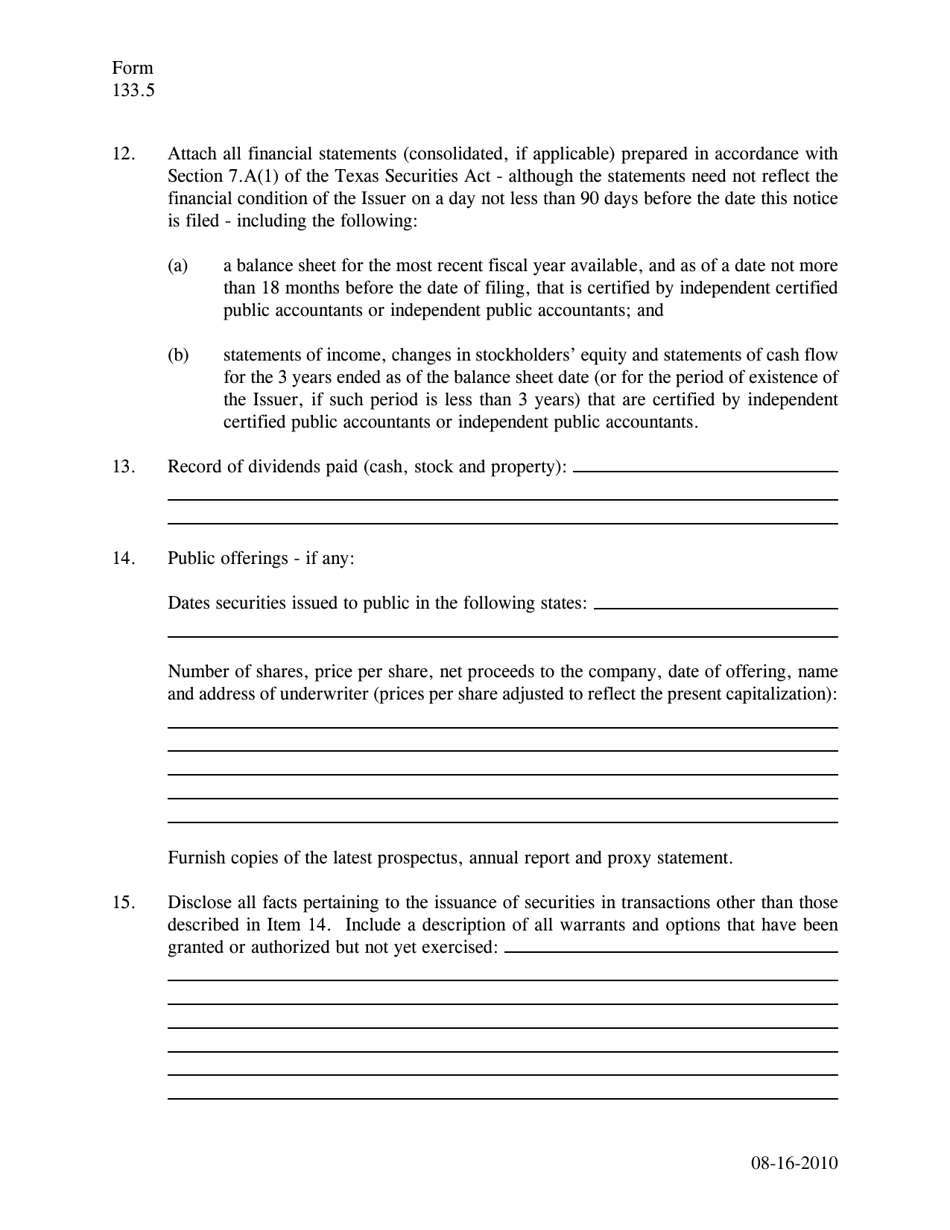

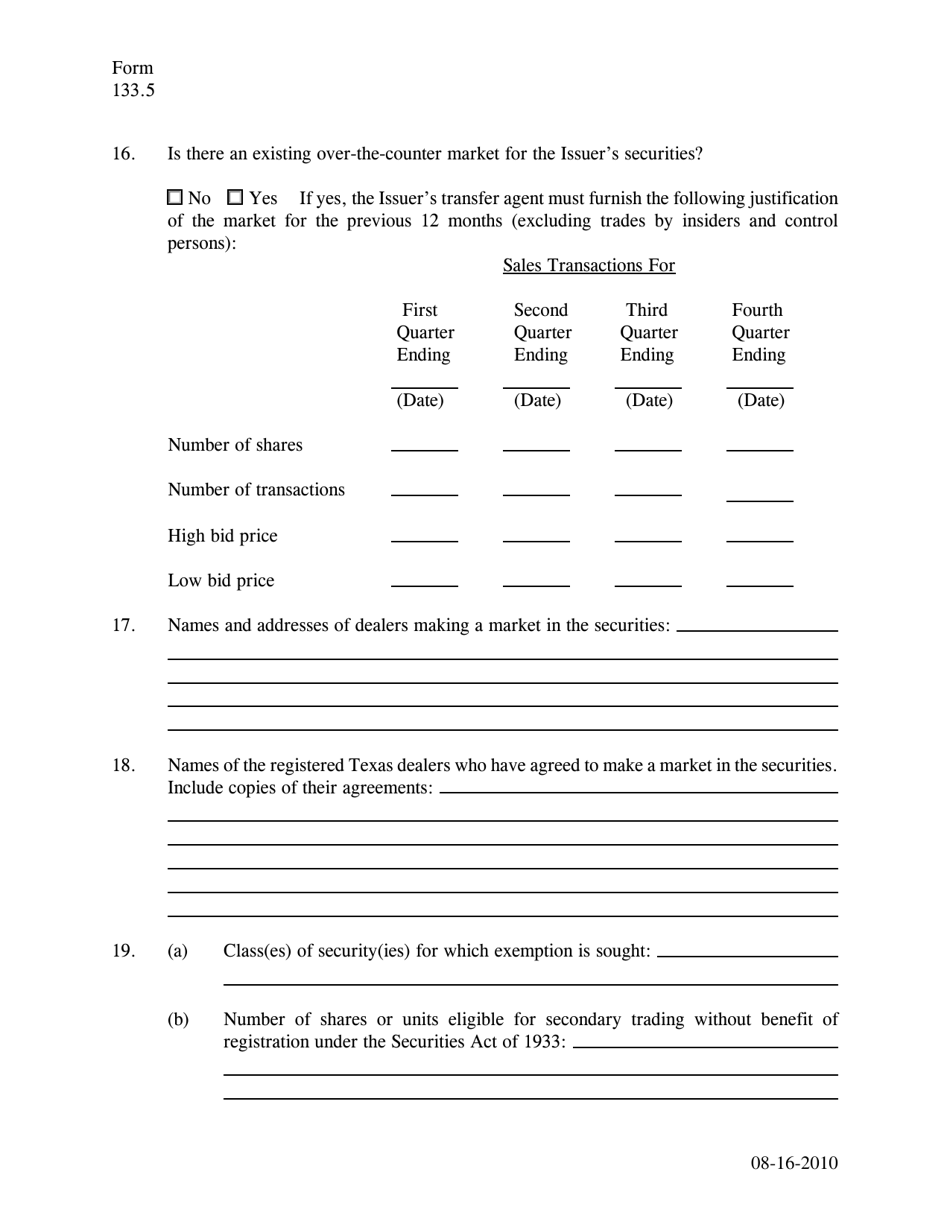

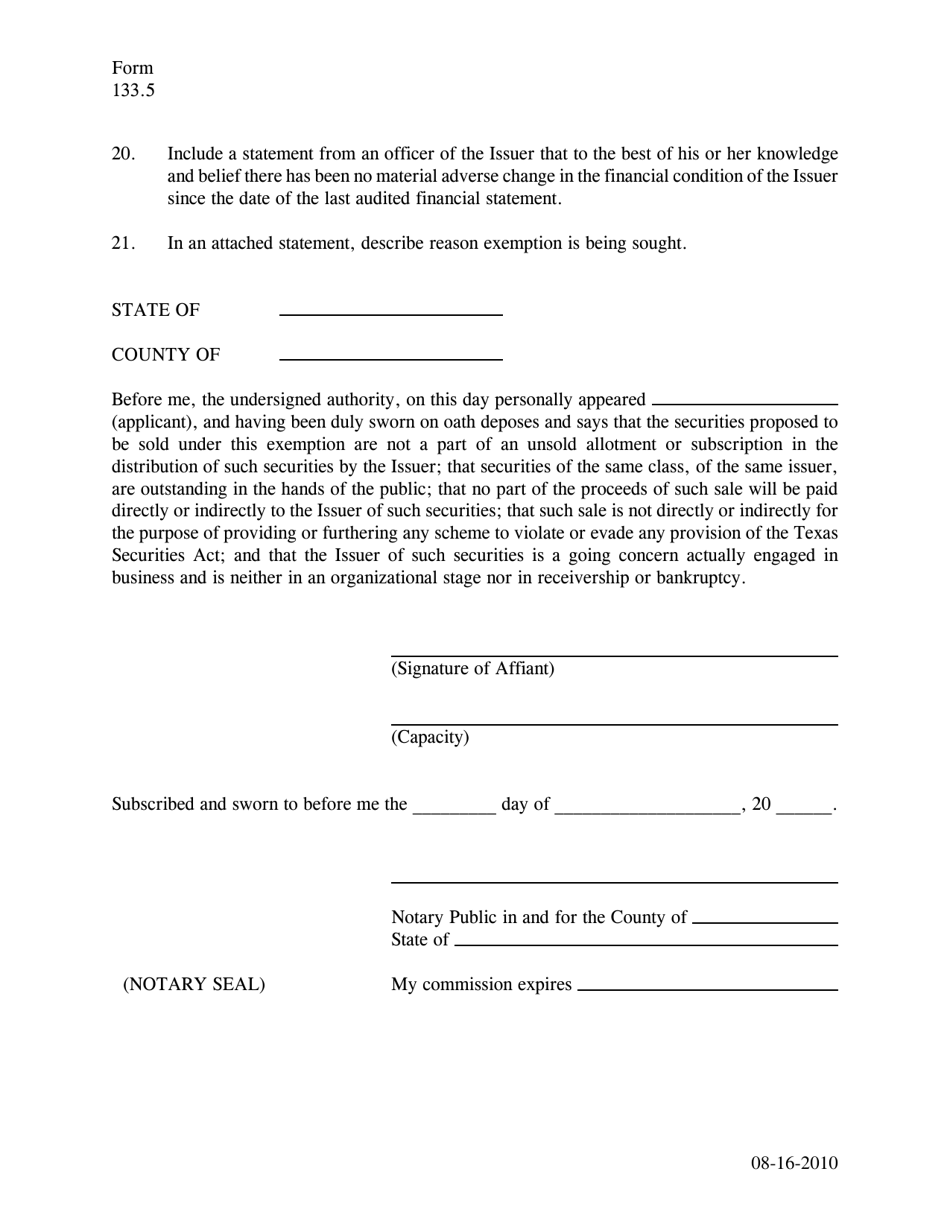

Q: What information is required on Form 133.5?

A: Form 133.5 requires information about the securities being traded, the individuals or entities involved, and any exemptions being relied upon.

Q: What happens after filing Form 133.5?

A: After filing Form 133.5, the regulatory authority will review the notice and may request additional information or documentation.

Q: Is Form 133.5 specific to Texas?

A: Yes, Form 133.5 is specific to the state of Texas and its securities laws.

Form Details:

- Released on August 16, 2010;

- The latest edition provided by the Texas State Securities Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 133.5 by clicking the link below or browse more documents and templates provided by the Texas State Securities Board.