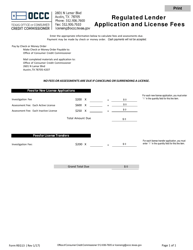

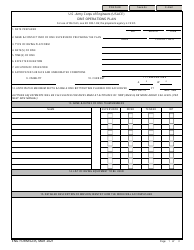

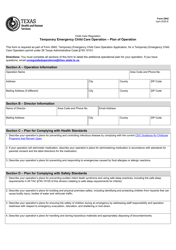

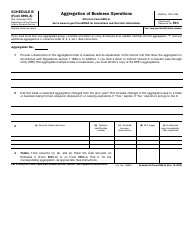

Form REG10 Business Operation Plan - Regulated Lenders - Texas

What Is Form REG10?

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

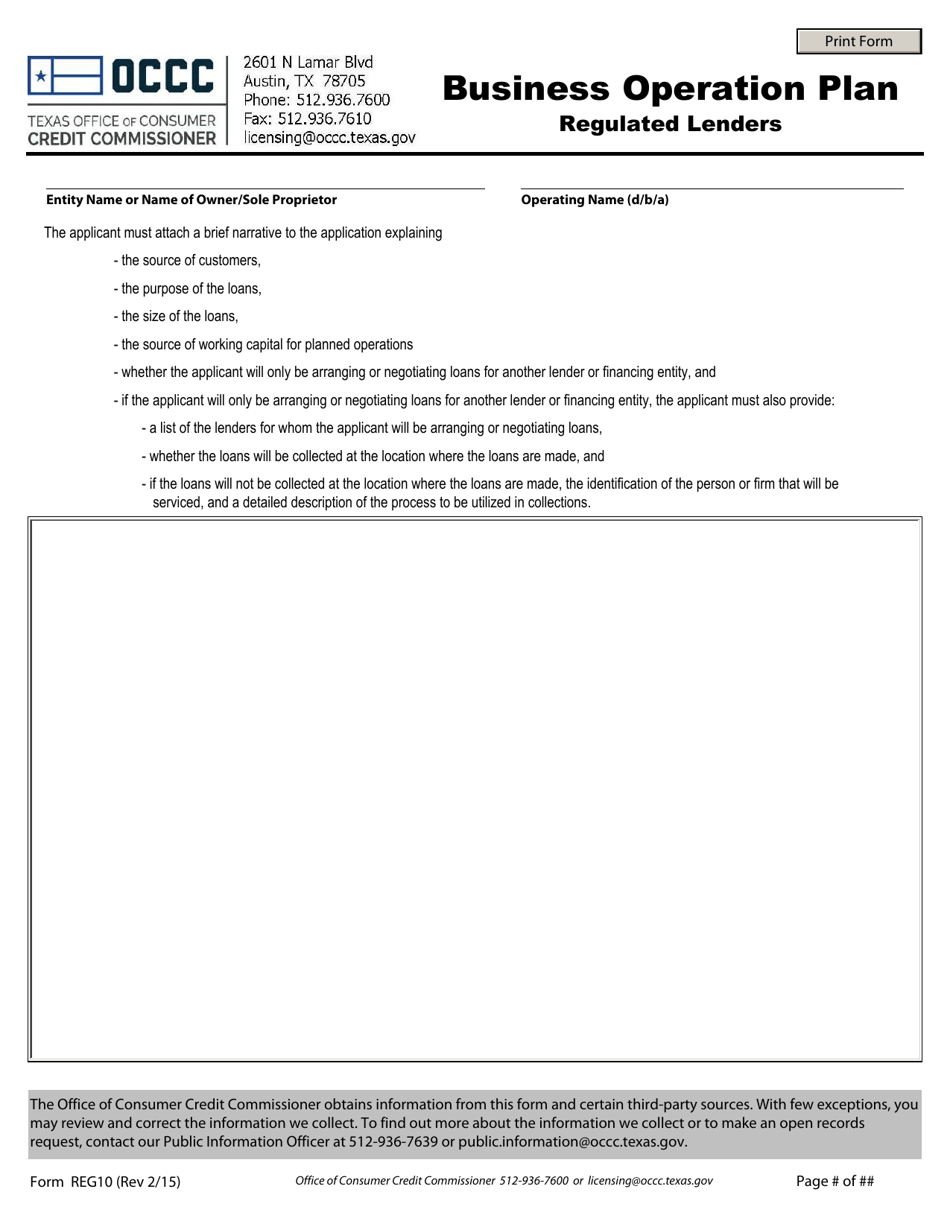

Q: What is a REG10 Business Operation Plan?

A: REG10 Business Operation Plan is a plan required for regulated lenders in Texas.

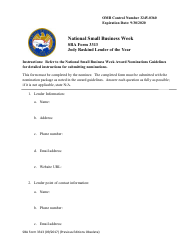

Q: Who needs to submit a REG10 Business Operation Plan?

A: Regulated lenders in Texas need to submit a REG10 Business Operation Plan.

Q: What is the purpose of a REG10 Business Operation Plan?

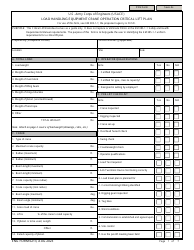

A: The purpose of a REG10 Business Operation Plan is to provide information about the lender's operations and assist in the regulation and oversight process.

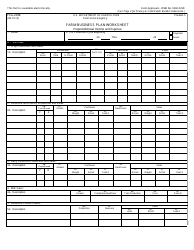

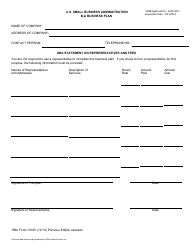

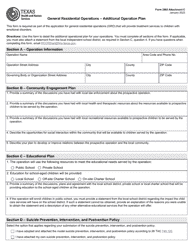

Q: What information should be included in a REG10 Business Operation Plan?

A: A REG10 Business Operation Plan should include information about the lender's organizational structure, management, policies and procedures, risk management, and financial information.

Q: How often should a REG10 Business Operation Plan be submitted?

A: A REG10 Business Operation Plan should be submitted initially when applying for a license and then updated annually or as requested by the regulatory authority.

Q: Is there a fee for submitting a REG10 Business Operation Plan?

A: There may be a fee associated with submitting a REG10 Business Operation Plan, which should be paid according to the instructions provided by the regulatory authority.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG10 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.