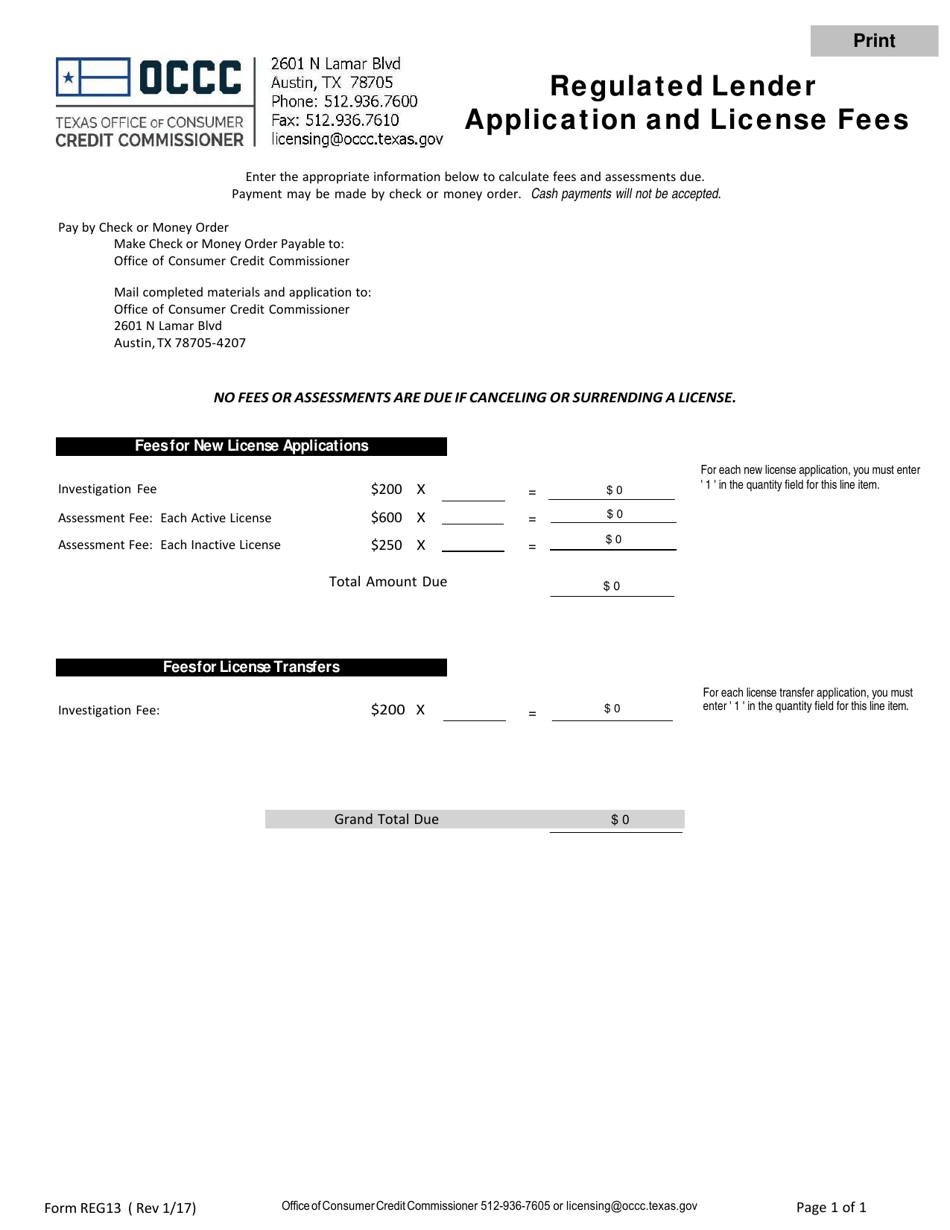

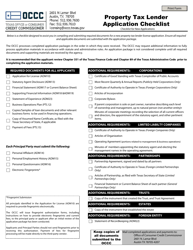

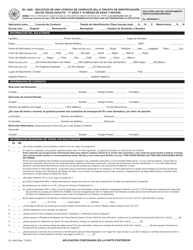

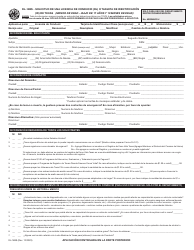

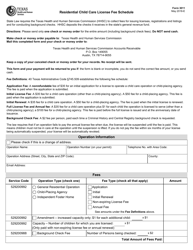

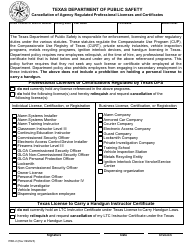

Form REG13 Regulated Lender Application and License Fees - Texas

What Is Form REG13?

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REG13?

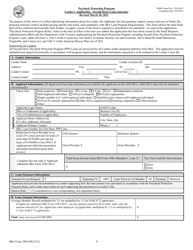

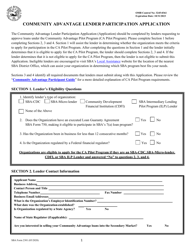

A: Form REG13 is the application form for regulated lender license in Texas.

Q: What is a regulated lender license?

A: A regulated lender license is a license issued by the state of Texas to lenders who comply with the state's regulations.

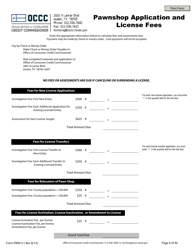

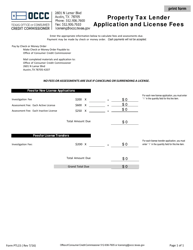

Q: What are the application and license fees for Form REG13?

A: The application and license fees for Form REG13 vary and can be found on the form itself.

Q: Do I need a license to be a lender in Texas?

A: Yes, you need a regulated lender license in Texas to legally operate as a lender.

Q: What are the requirements to obtain a regulated lender license in Texas?

A: The requirements to obtain a regulated lender license in Texas include meeting certain financial and character requirements, submitting an application, and paying the required fees.

Q: How long does it take to process a regulated lender license application?

A: The processing time for a regulated lender license application in Texas can vary, but it typically takes several weeks to months.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG13 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.