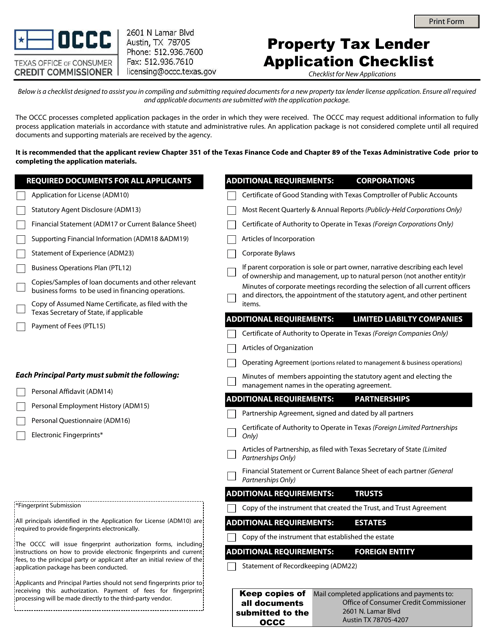

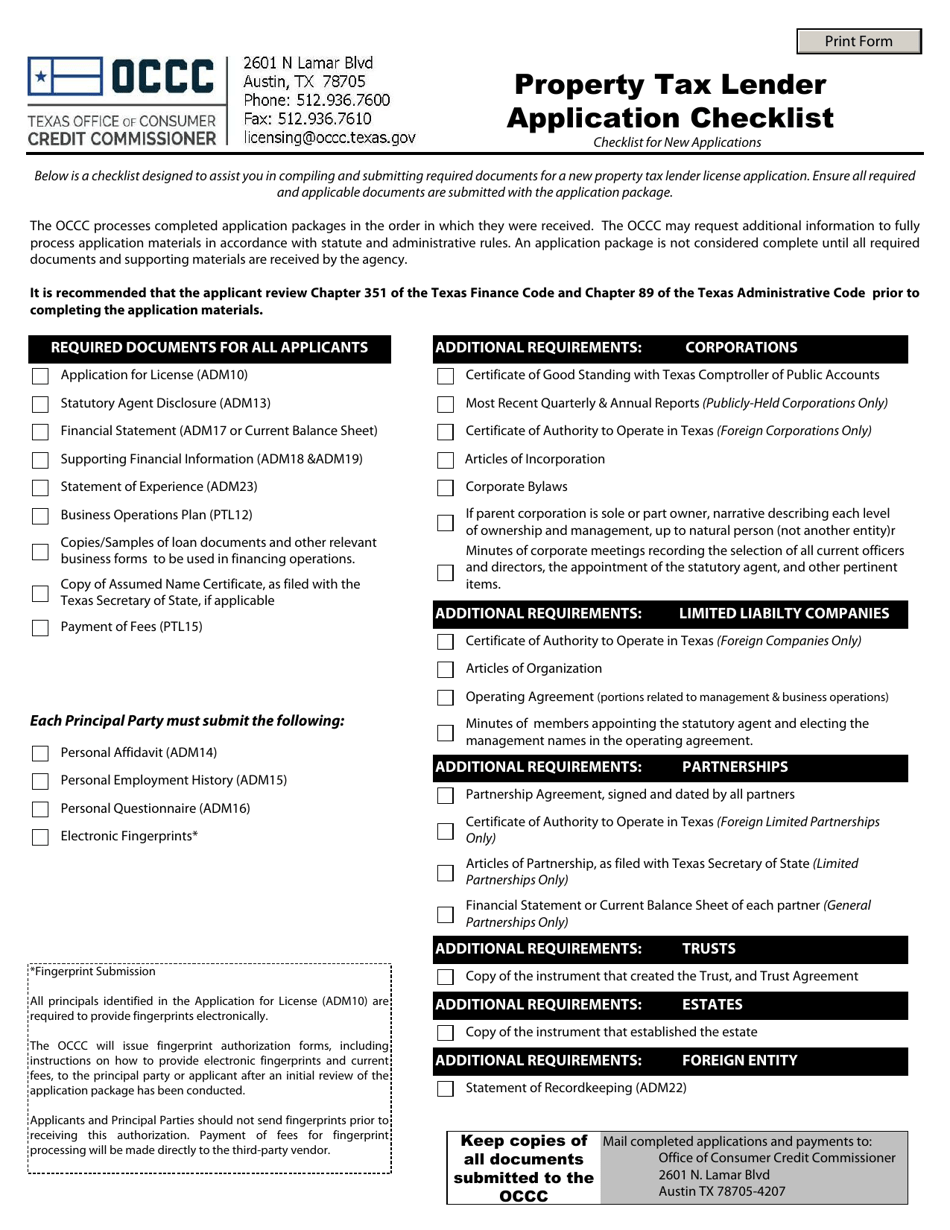

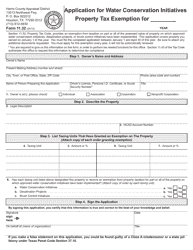

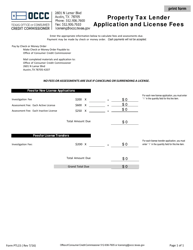

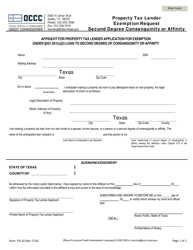

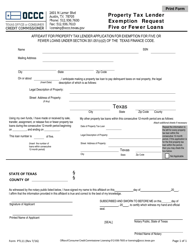

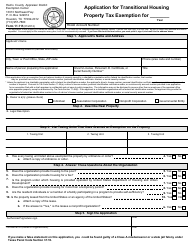

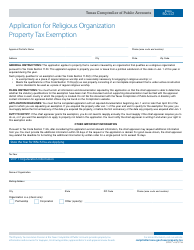

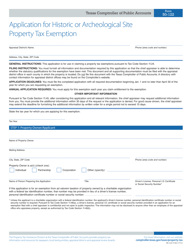

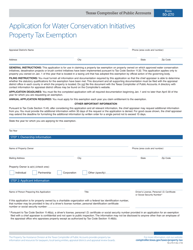

Property Tax Lender Application Checklist - Texas

Property Tax Lender Application Checklist is a legal document that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas.

FAQ

Q: What is a property tax lender application?

A: A property tax lender application is a form used to apply for a loan to pay property taxes.

Q: Who can apply for a property tax lender application in Texas?

A: Property owners in Texas can apply for a property tax lender application.

Q: Why would someone apply for a property tax lender application?

A: Someone may apply for a property tax lender application if they are unable to pay their property taxes and need a loan to do so.

Q: What documents are needed for a property tax lender application in Texas?

A: The required documents may vary, but commonly include proof of property ownership, identification documents, and financial information.

Q: How long does it take to process a property tax lender application in Texas?

A: The processing time for a property tax lender application can vary, but it generally takes a few days to weeks.

Q: What happens if a property tax lender application is approved?

A: If a property tax lender application is approved, the lender will pay the property taxes on behalf of the applicant, and the applicant will repay the loan to the lender.

Q: What happens if a property tax lender application is denied?

A: If a property tax lender application is denied, the applicant will need to explore other options for paying their property taxes.

Q: Are property tax loans available in all counties in Texas?

A: Property tax loans are generally available in most counties in Texas, but availability may vary.

Q: Can I apply for a property tax lender application if I have a bad credit score?

A: Some property tax lenders may consider applicants with bad credit scores, but it ultimately depends on the lender's criteria.

Q: Is there a limit on the amount that can be borrowed through a property tax lender application?

A: The maximum amount that can be borrowed through a property tax lender application may vary depending on the lender and the value of the property.

Q: What are the repayment terms for a property tax lender loan?

A: The repayment terms for a property tax lender loan will be determined by the lender and may vary, but they typically include monthly payments over a certain period of time.

Q: Can I use a property tax lender loan for other purposes besides paying property taxes?

A: No, property tax lender loans are specifically designed to be used for paying property taxes and cannot be used for other purposes.

Form Details:

- The latest edition currently provided by the Texas Office of Consumer Credit Commissioner;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.