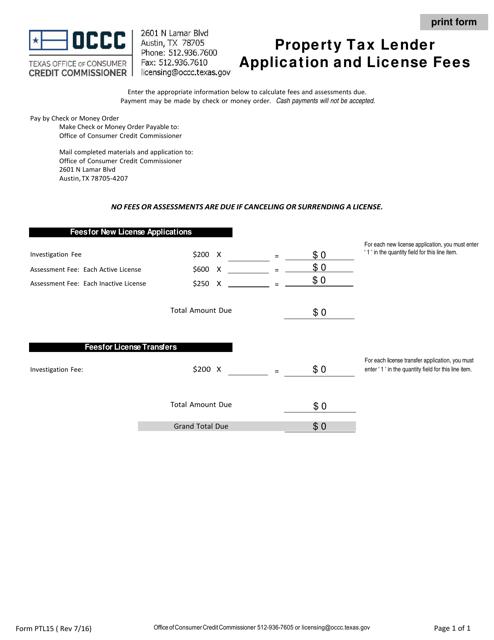

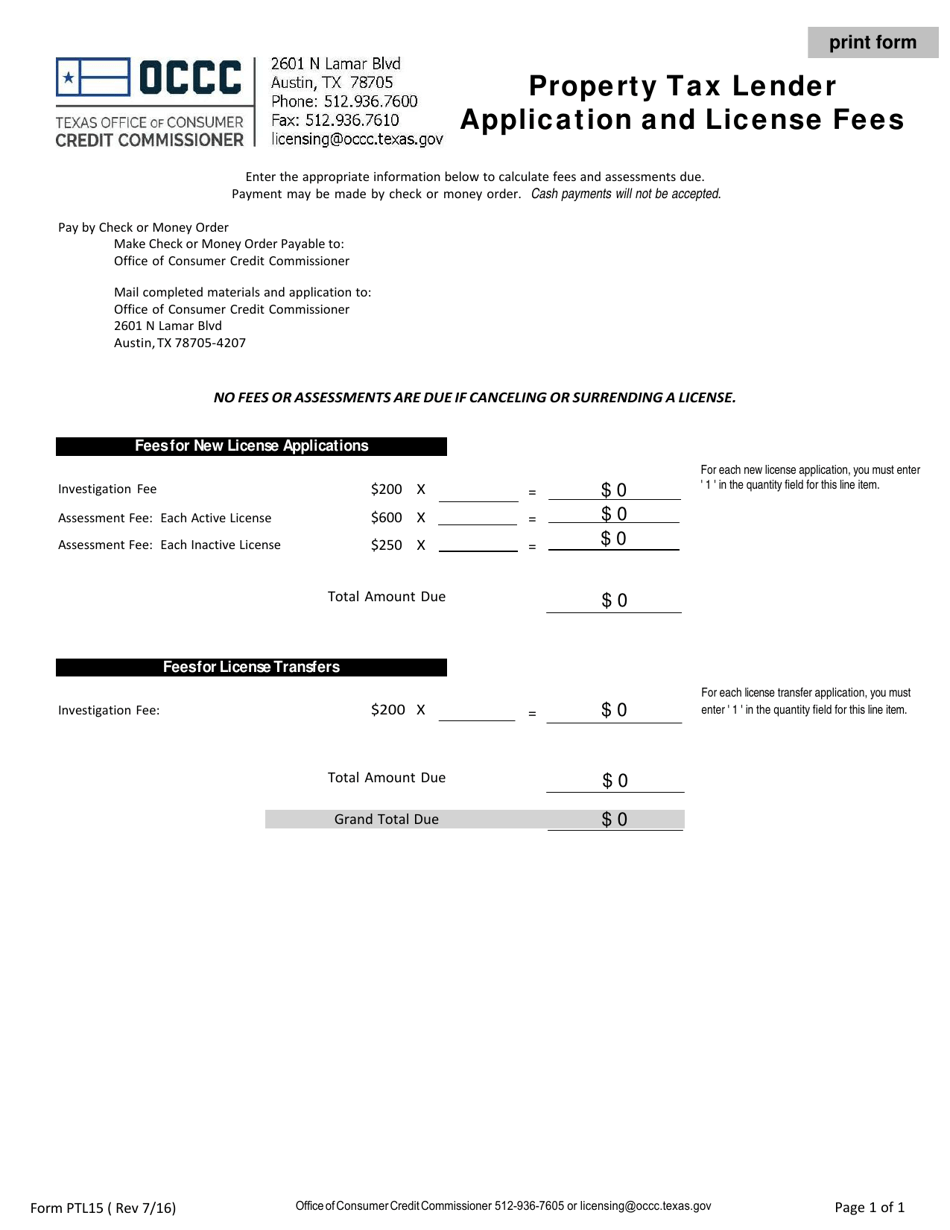

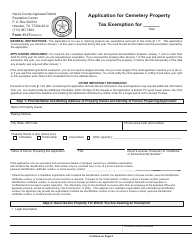

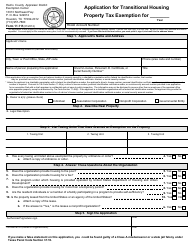

Form PTL15 Property Tax Lender Application and License Fees - Texas

What Is Form PTL15?

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a PTL15 Property Tax Lender Application?

A: The PTL15 Property Tax Lender Application is a form used to apply for a property tax lender license in Texas.

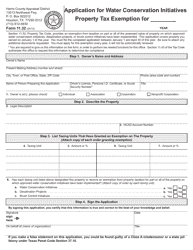

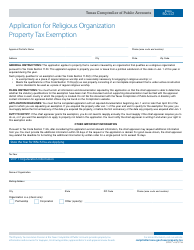

Q: What are license fees for a property tax lender in Texas?

A: The license fees for a property tax lender in Texas are specified in the PTL15 Application instructions and may vary depending on the type of license being applied for.

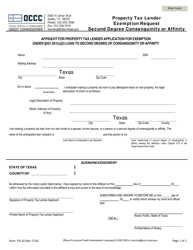

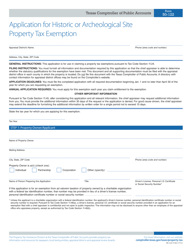

Q: What is the purpose of a property tax lender license?

A: A property tax lender license allows the licensee to make loans to property owners for the payment of property taxes.

Q: Are there any specific requirements to obtain a property tax lender license in Texas?

A: Yes, there are specific requirements outlined in the PTL15 Application instructions, such as financial and criminal background checks, surety bond, and more.

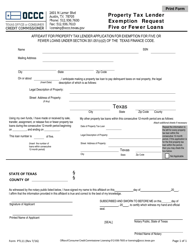

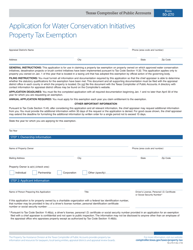

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTL15 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.