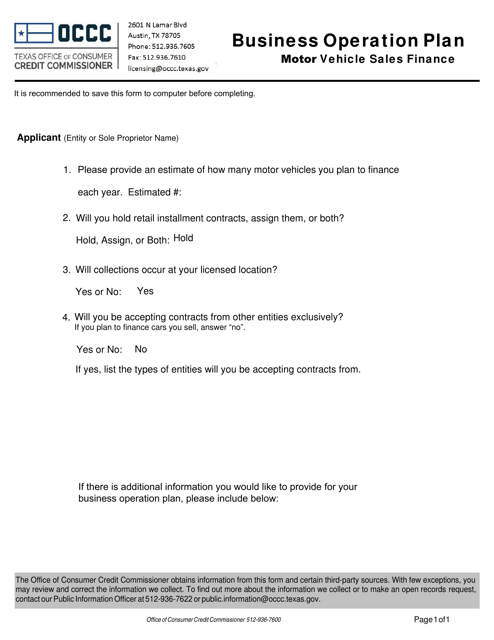

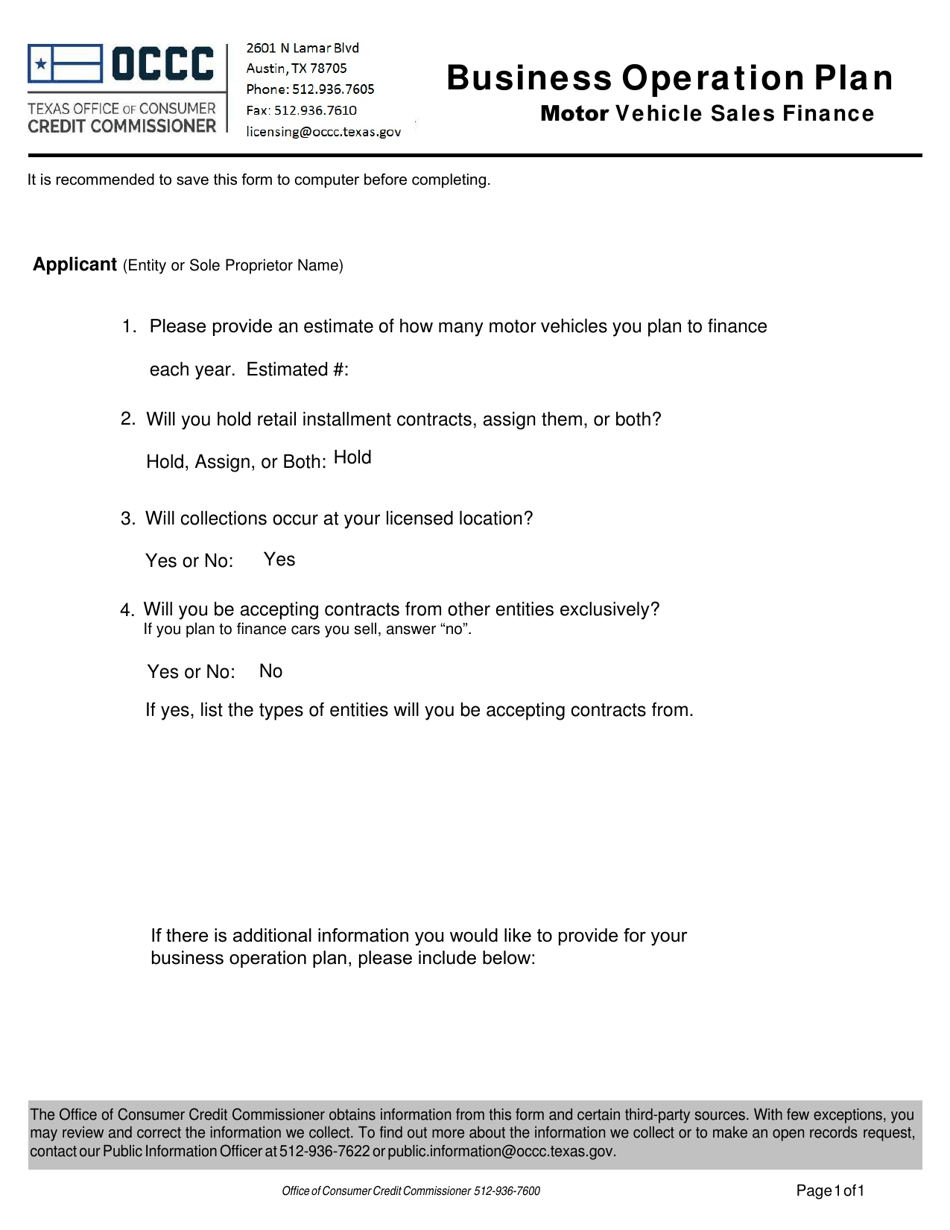

Business Operation Plan - Motor Vehicle Sales Finance - Texas

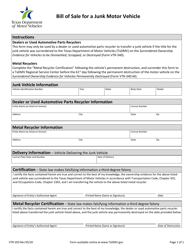

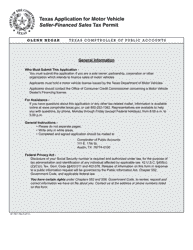

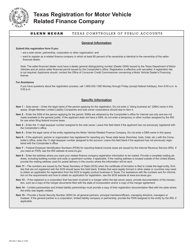

Business Vehicle Sales Finance is a legal document that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas.

FAQ

Q: What is a motor vehicle sales finance business?

A: A motor vehicle sales finance business is a business that provides financing to consumers for the purchase of motor vehicles.

Q: Is a license required to operate a motor vehicle sales finance business in Texas?

A: Yes, a license is required to operate a motor vehicle sales finance business in Texas.

Q: How do I obtain a license to operate a motor vehicle sales finance business in Texas?

A: To obtain a license, you need to submit an application to the Texas Office of Consumer Credit Commissioner (OCCC) and meet certain requirements and qualifications.

Q: What are the requirements to obtain a license for a motor vehicle sales finance business in Texas?

A: The requirements include completing an application, providing financial and background information, paying the necessary fees, and meeting certain net worth and surety bond requirements.

Q: What is the role of the Texas Office of Consumer Credit Commissioner (OCCC) in regulating motor vehicle sales finance businesses?

A: The OCCC is responsible for issuing licenses, enforcing compliance with laws and regulations, and providing oversight to ensure consumer protection in the motor vehicle sales finance industry.

Q: Are there any restrictions on interest rates that can be charged by motor vehicle sales finance businesses in Texas?

A: Yes, there are regulations that set limits on the interest rates that can be charged, and these limits vary depending on the amount financed.

Q: Are there any specific disclosures that motor vehicle sales finance businesses in Texas are required to provide to consumers?

A: Yes, motor vehicle sales finance businesses are required to provide consumers with certain disclosures, including information about interest rates, fees, and payment terms.

Q: What are some of the consumer protections offered by the Texas laws governing motor vehicle sales finance businesses?

A: Some consumer protections include limits on interest rates, requirements for disclosure of terms and fees, and provisions for addressing unfair or deceptive practices.

Q: Do motor vehicle sales finance businesses need to maintain records of their transactions?

A: Yes, motor vehicle sales finance businesses are required to maintain records of their transactions for a specified period of time.

Q: Is there a complaint process for consumers who have issues with motor vehicle sales finance businesses?

A: Yes, consumers who have issues with motor vehicle sales finance businesses can file a complaint with the Texas Office of Consumer Credit Commissioner (OCCC) or pursue legal action if necessary.

Form Details:

- The latest edition currently provided by the Texas Office of Consumer Credit Commissioner;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.