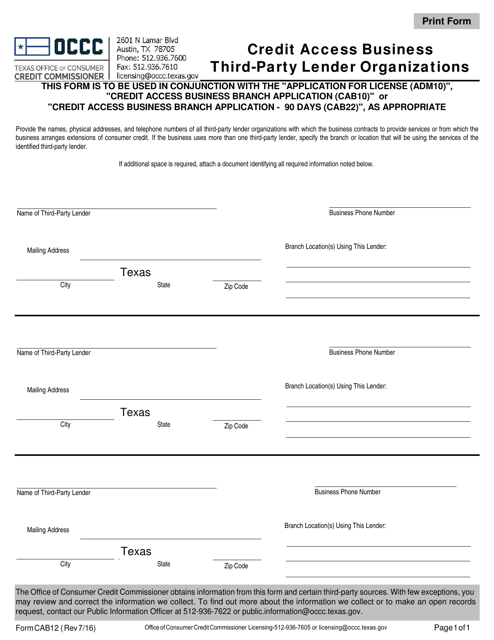

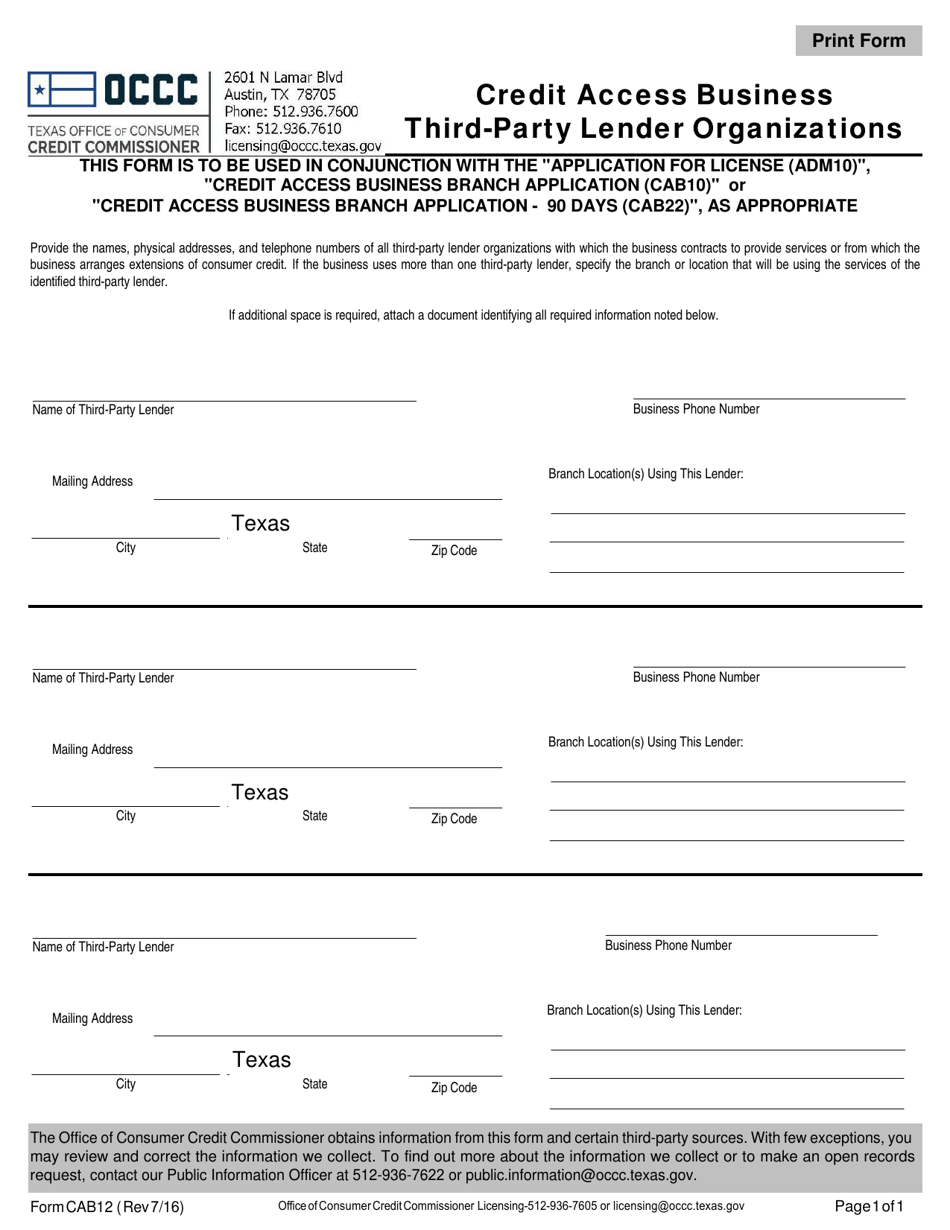

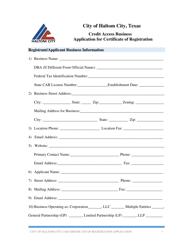

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CAB12

for the current year.

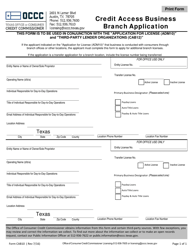

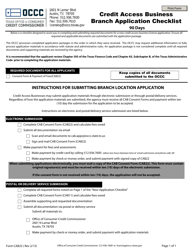

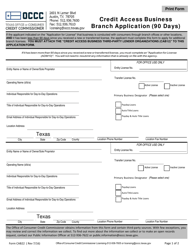

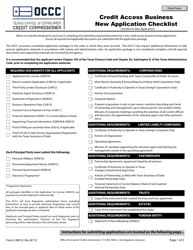

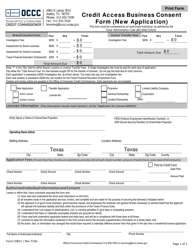

Form CAB12 Credit Access Business Third-Party Lender Organizations - Texas

What Is Form CAB12?

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB12?

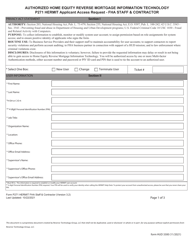

A: CAB12 refers to Credit Access Business Third-Party Lender Organizations in Texas.

Q: What does CAB12 do?

A: CAB12 is responsible for regulating and overseeing Credit Access Businesses that operate as third-party lenders in Texas.

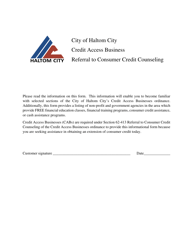

Q: What is a Credit Access Business?

A: A Credit Access Business is an organization that provides loans or other financial services to consumers in exchange for fees or interest.

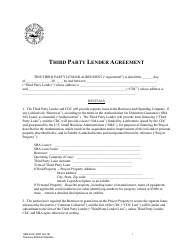

Q: What are third-party lenders?

A: Third-party lenders are lenders that provide funds to consumers through Credit Access Businesses, instead of directly lending to consumers.

Q: What is the role of CAB12?

A: CAB12's role is to ensure that Credit Access Businesses and third-party lenders comply with the laws and regulations in Texas to protect consumers.

Q: What are some examples of Credit Access Businesses?

A: Examples of Credit Access Businesses include payday lenders, title loan companies, and installment loan providers.

Q: Why is CAB12 important?

A: CAB12 is important to protect consumers from predatory lending practices and to regulate the operations of Credit Access Businesses.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB12 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.