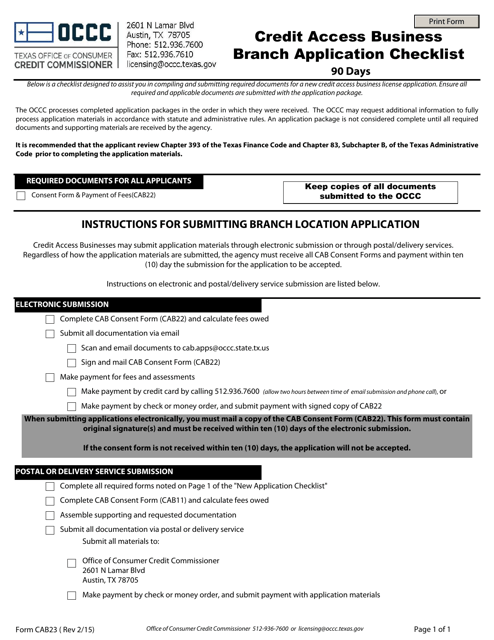

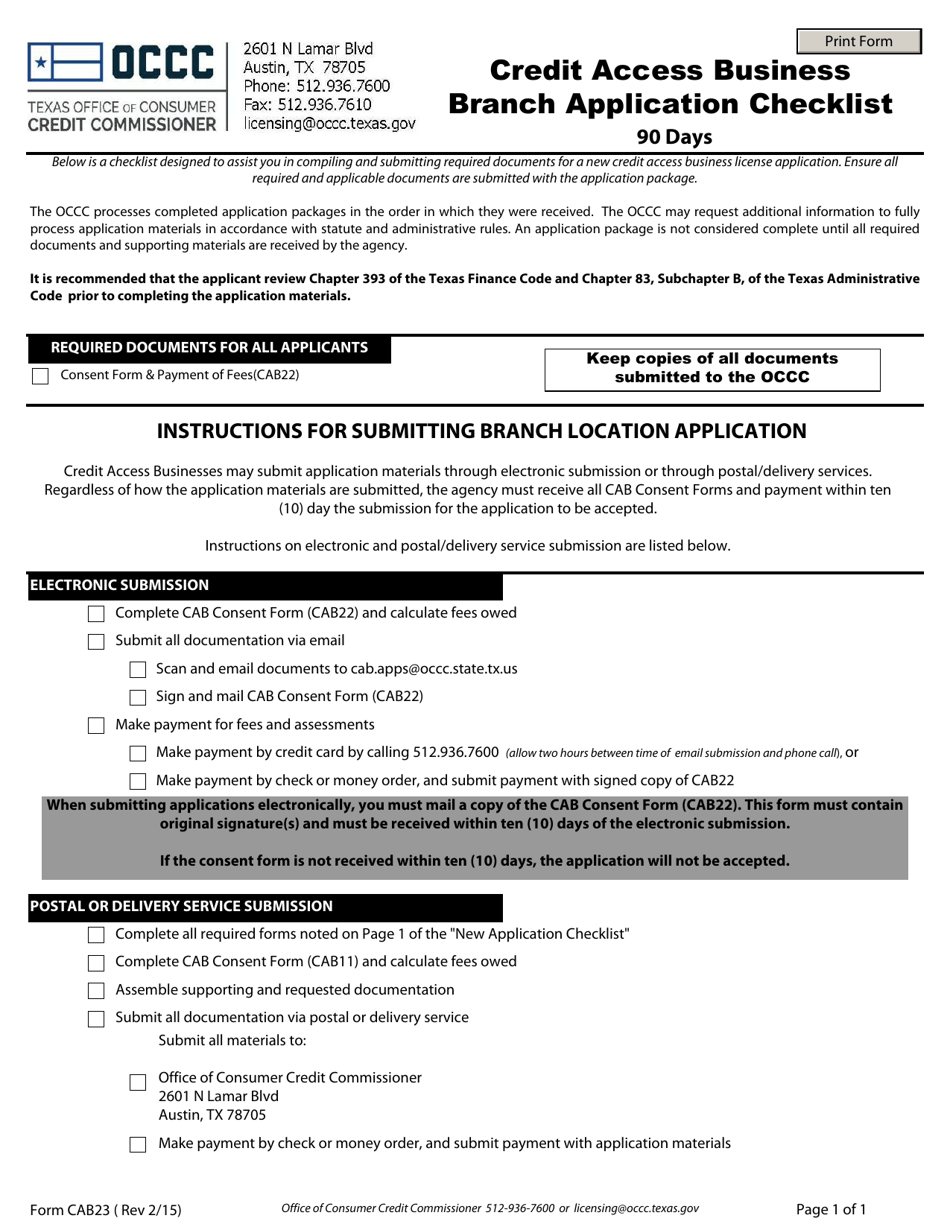

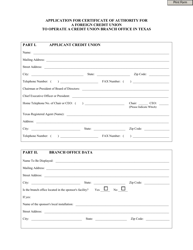

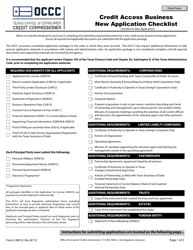

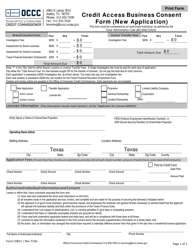

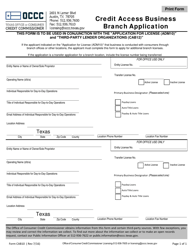

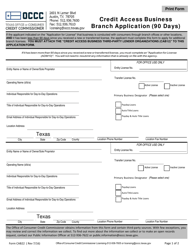

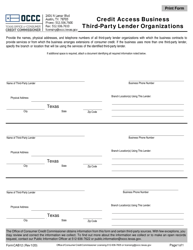

Form CAB23 Credit Access Business Branch Application Checklist (90 Days) - Texas

What Is Form CAB23?

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB23 Credit Access Business Branch Application Checklist?

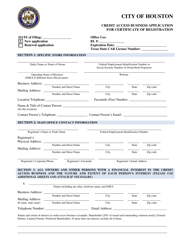

A: CAB23 Credit Access Business Branch Application Checklist is a document required for submitting an application to open a Credit Access Business branch in Texas.

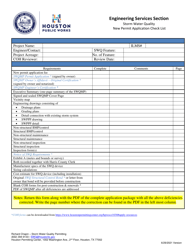

Q: What is the time period for completing the checklist?

A: The checklist must be completed within 90 days.

Q: What is a Credit Access Business?

A: A Credit Access Business is a company that offers payday loans, installment loans, or title loans to consumers.

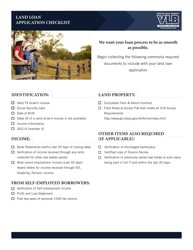

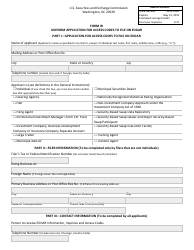

Q: What are the requirements for opening a credit access business branch in Texas?

A: The requirements include completing the CAB23 Credit Access Business Branch Application Checklist, providing necessary documentation, and meeting all regulatory requirements.

Q: Are there any additional requirements apart from the checklist?

A: Yes, apart from the checklist, you will need to provide other documentation as specified by the regulatory authority.

Q: What happens after completing the checklist and submitting the application?

A: After completing the checklist and submitting the application, the regulatory authority will review your application and determine whether to approve or deny it.

Q: Can I open a Credit Access Business branch without completing the checklist?

A: No, completing the CAB23 Credit Access Business Branch Application Checklist is a mandatory requirement for opening a branch in Texas.

Q: What should I do if my application gets denied?

A: If your application gets denied, you can review the reasons for denial and address any deficiencies before reapplying.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB23 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.