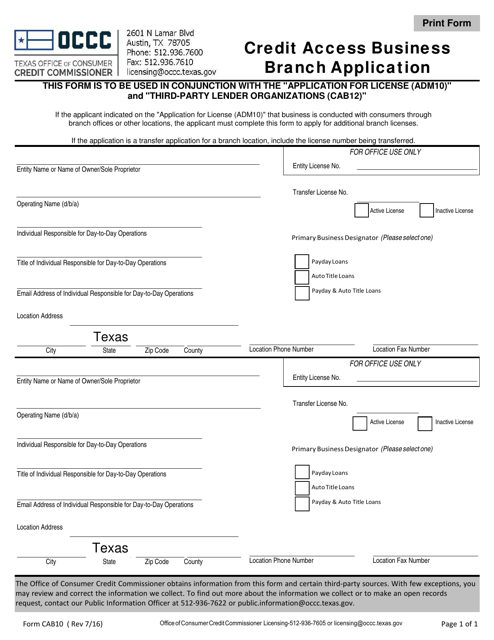

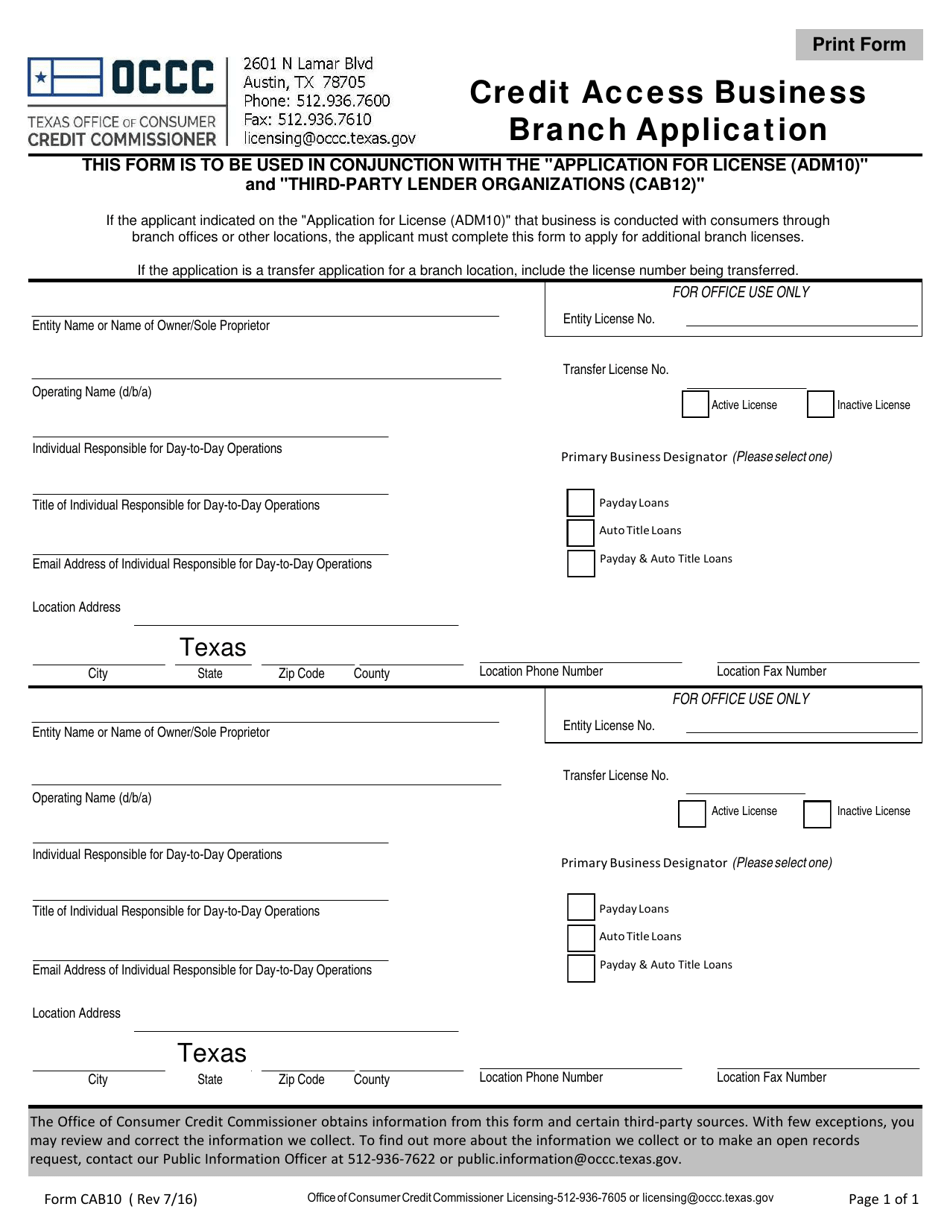

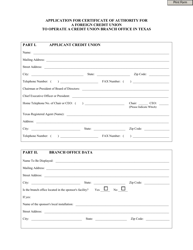

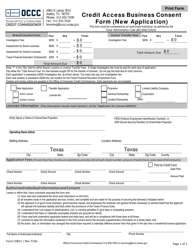

Form CAB10 Credit Access Business Branch Application - Texas

What Is Form CAB10?

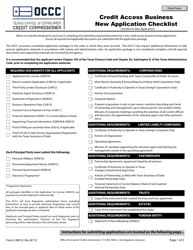

This is a legal form that was released by the Texas Office of Consumer Credit Commissioner - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CAB?

A: A CAB stands for Credit Access Business. It is a company that offers payday loans and other types of short-term, high-interest loans.

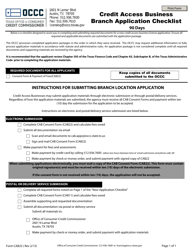

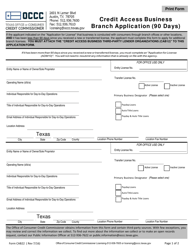

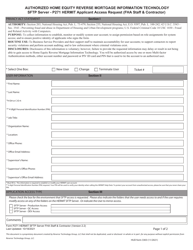

Q: What is the CAB10 Credit Access Business Branch Application?

A: The CAB10 Credit Access Business Branch Application is a form used in Texas to apply for a license to operate as a Credit Access Business.

Q: Who needs to submit the CAB10 Credit Access Business Branch Application?

A: Any company in Texas that wants to operate as a Credit Access Business needs to submit the CAB10 Credit Access Business Branch Application.

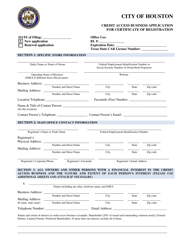

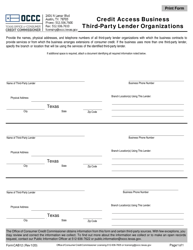

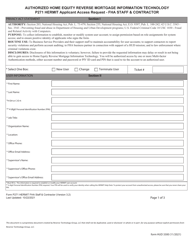

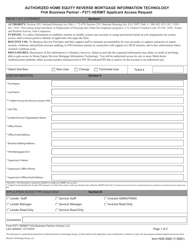

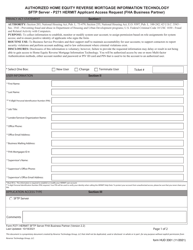

Q: What information is required on the CAB10 Credit Access Business Branch Application?

A: The CAB10 Credit Access Business Branch Application asks for information such as the company's legal name, address, contact information, and details about its owners and employees.

Q: What happens after submitting the CAB10 Credit Access Business Branch Application?

A: After submitting the CAB10 Credit Access Business Branch Application, it will be reviewed by the Texas Office of Consumer Credit Commissioner. If approved, the company will receive a license to operate as a Credit Access Business in Texas.

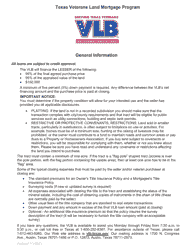

Q: Are there any additional requirements for operating as a Credit Access Business in Texas?

A: Yes, there are additional requirements for operating as a Credit Access Business in Texas. These include maintaining a physical location in Texas, prominently displaying fee information, and complying with certain advertising and disclosure requirements.

Q: Can a company operate as a Credit Access Business in Texas without a license?

A: No, it is illegal to operate as a Credit Access Business in Texas without a license. Violators may face legal penalties and fines.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Texas Office of Consumer Credit Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB10 by clicking the link below or browse more documents and templates provided by the Texas Office of Consumer Credit Commissioner.