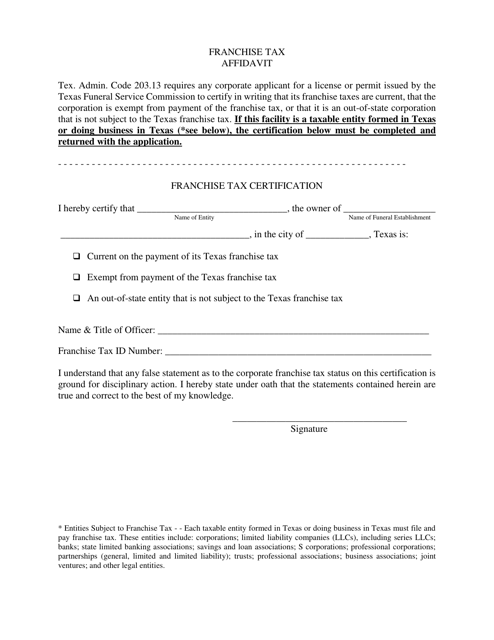

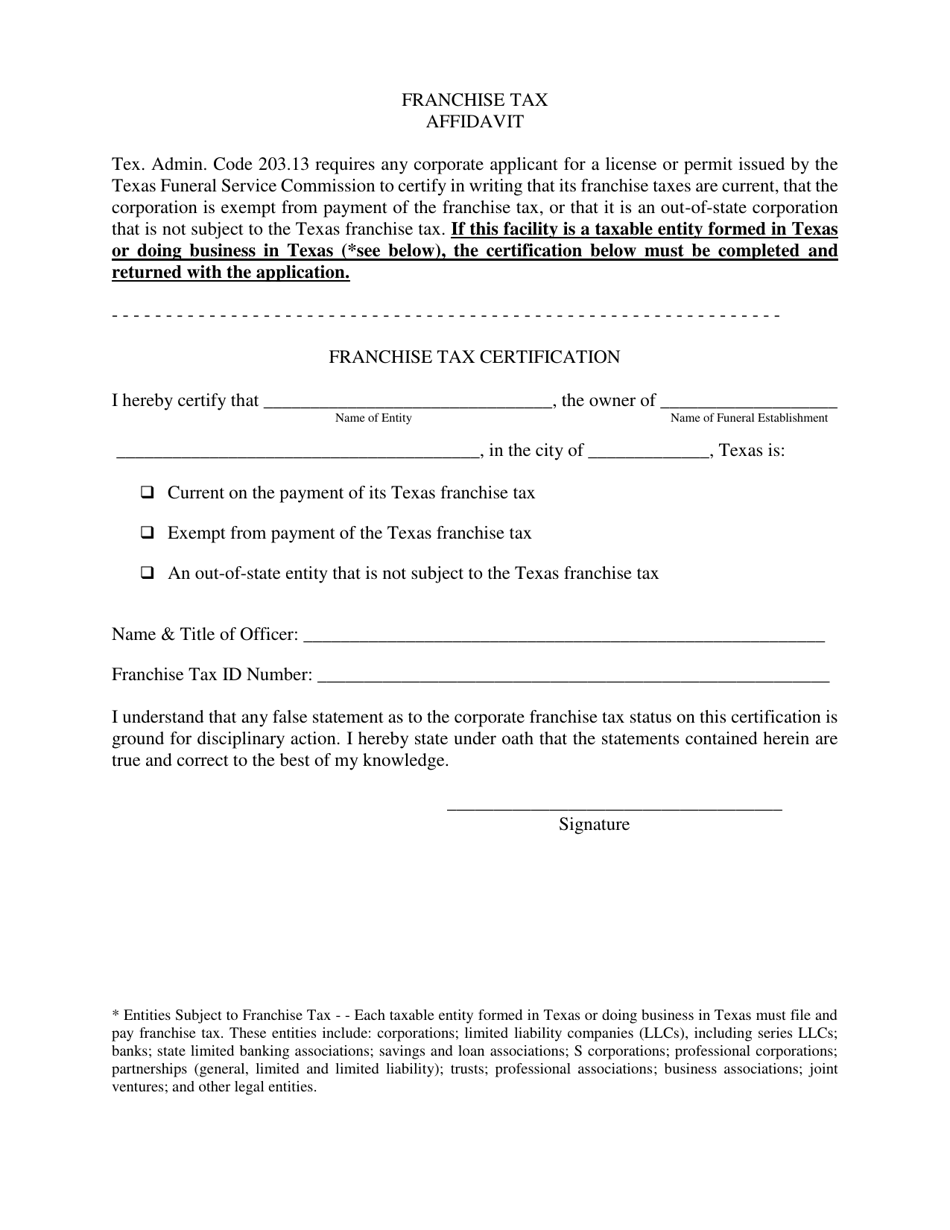

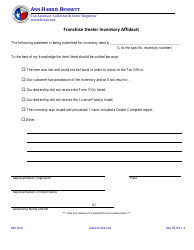

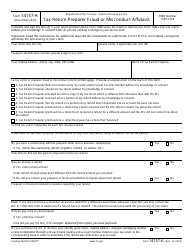

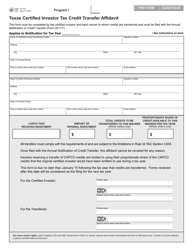

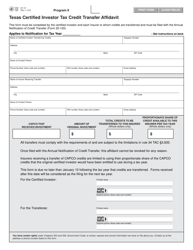

Franchise Tax Affidavit Form - Texas

Franchise Tax Affidavit Form is a legal document that was released by the Texas Funeral Service Commission - a government authority operating within Texas.

FAQ

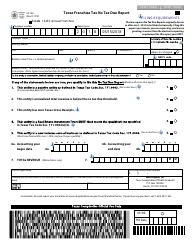

Q: What is a Franchise Tax Affidavit Form?

A: The Franchise Tax Affidavit Form is a document used in Texas to report and pay franchise taxes by corporations, limited liability companies, and other entities.

Q: Who needs to file a Franchise Tax Affidavit Form?

A: Corporations, limited liability companies, and other entities doing business in Texas are generally required to file a Franchise Tax Affidavit Form.

Q: When is the Franchise Tax Affidavit Form due?

A: The due date for the Franchise Tax Affidavit Form varies depending on the entity's fiscal year-end. It is generally due on May 15th or the 15th day of the fifth month after the end of the entity's fiscal year.

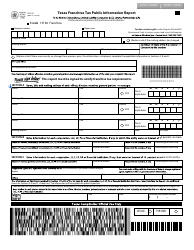

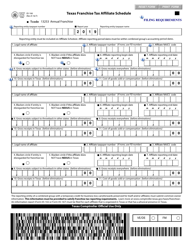

Q: What information is required on the Franchise Tax Affidavit Form?

A: The Franchise Tax Affidavit Form requires information such as the entity's name, address, total revenue, and taxable margin.

Q: What happens if I don't file the Franchise Tax Affidavit Form?

A: Failure to file the Franchise Tax Affidavit Form by the due date may result in penalties and interest being assessed by the Texas Comptroller's Office.

Form Details:

- The latest edition currently provided by the Texas Funeral Service Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Funeral Service Commission.