This version of the form is not currently in use and is provided for reference only. Download this version of

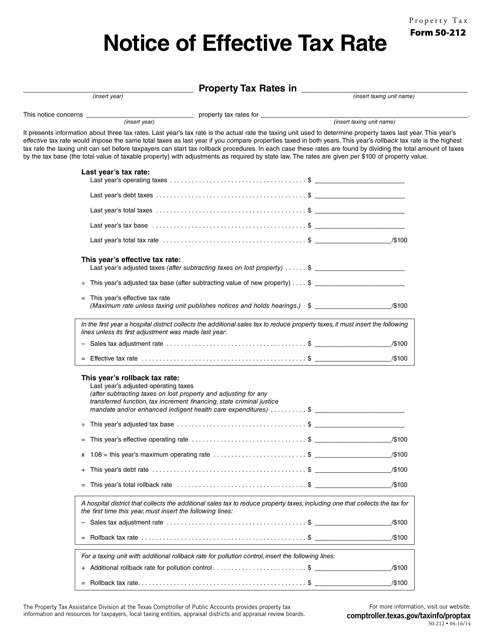

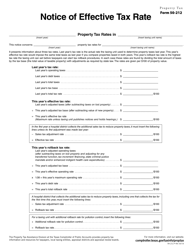

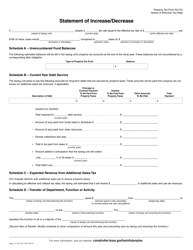

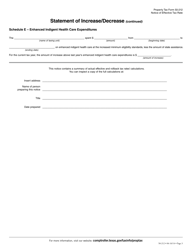

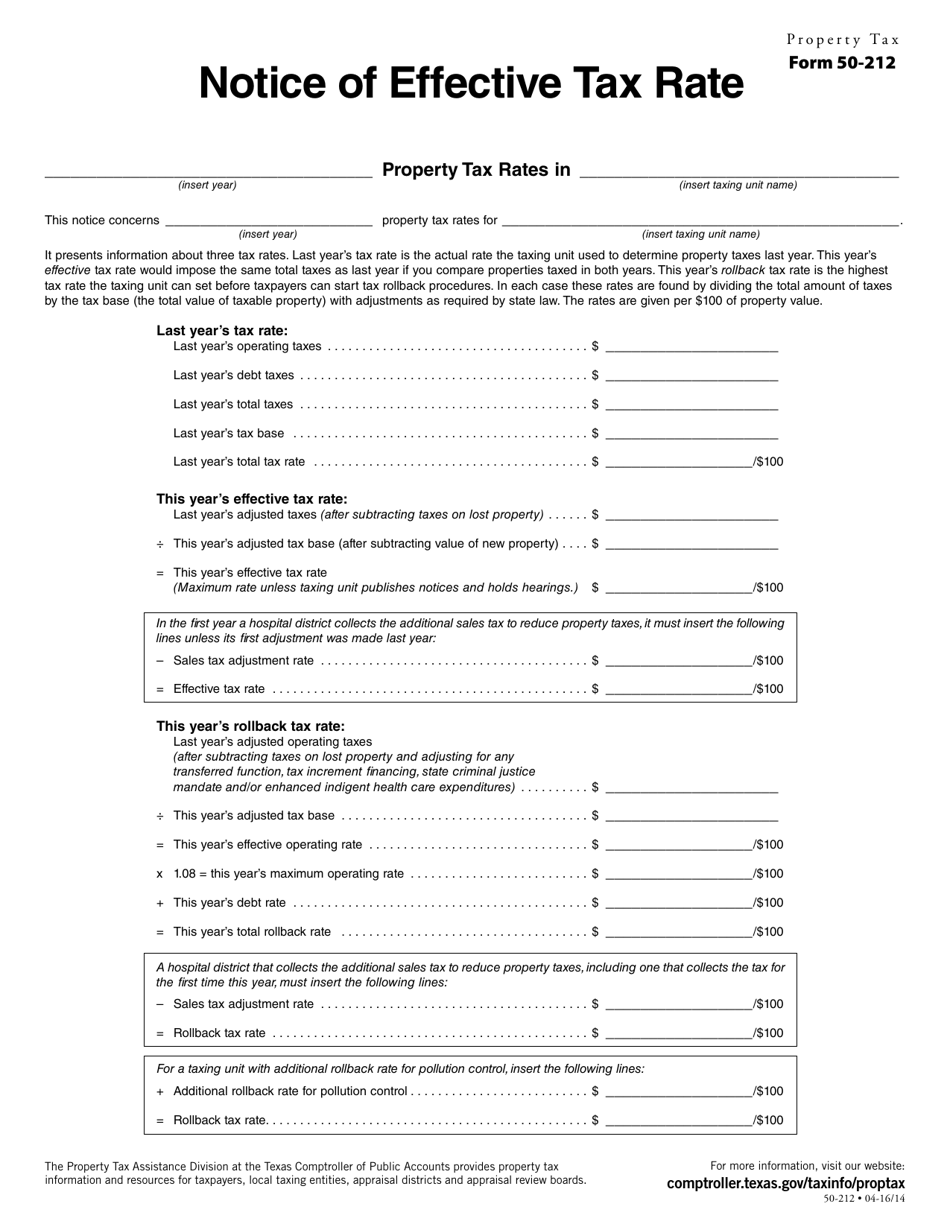

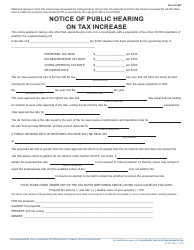

Form 50-212

for the current year.

Form 50-212 Notice of Effective Tax Rate - Texas

What Is Form 50-212?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-212?

A: Form 50-212 is the Notice of Effective Tax Rate in Texas.

Q: Who needs to fill out Form 50-212?

A: Texas taxing units, such as counties, cities, school districts, etc., are required to fill out Form 50-212.

Q: What is the purpose of Form 50-212?

A: The purpose of Form 50-212 is to provide taxpayers with information about the tax rates set by taxing units in Texas.

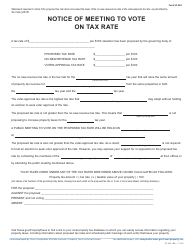

Q: When is Form 50-212 due?

A: Form 50-212 is due by September 30th of each year.

Q: Is Form 50-212 applicable to both residential and commercial properties?

A: Yes, Form 50-212 applies to both residential and commercial properties in Texas.

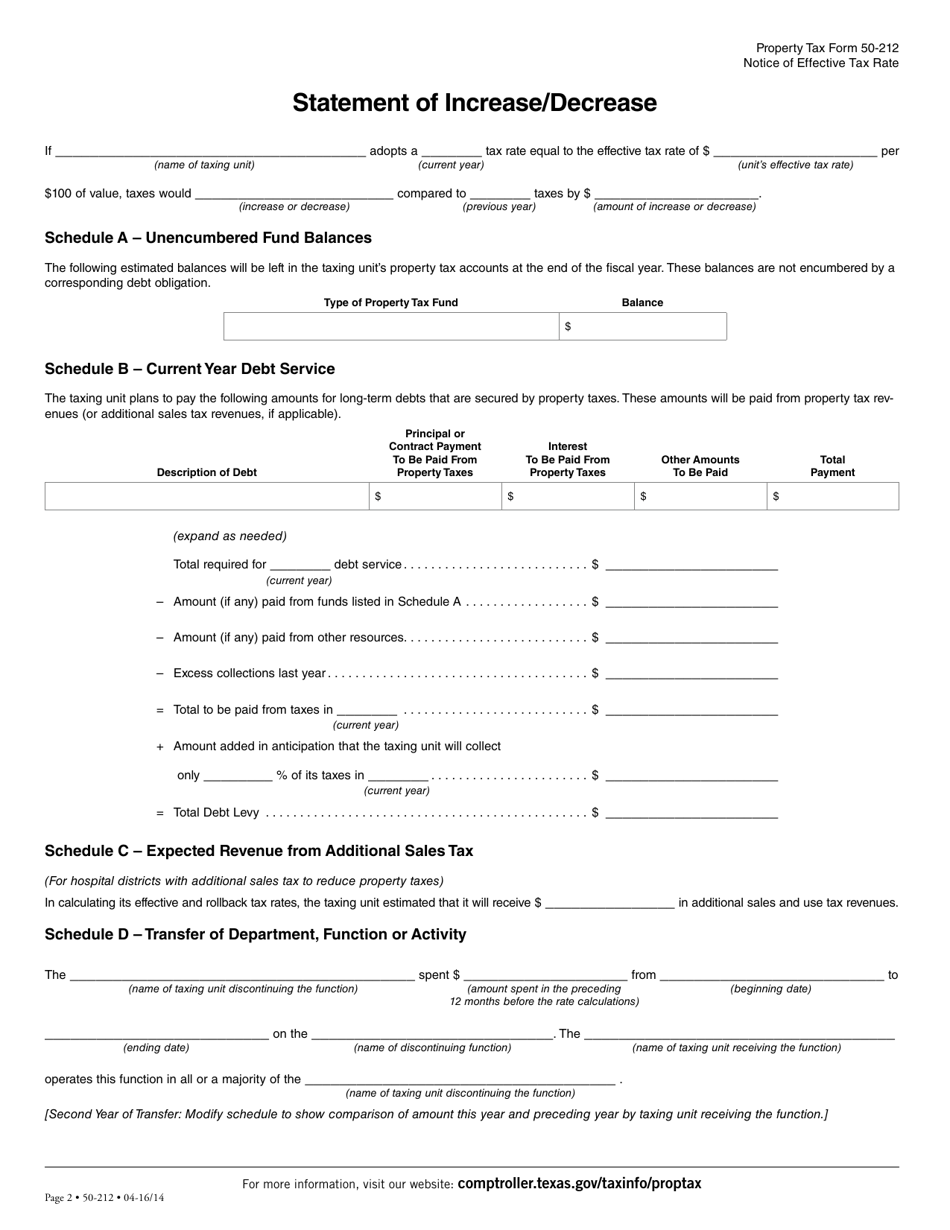

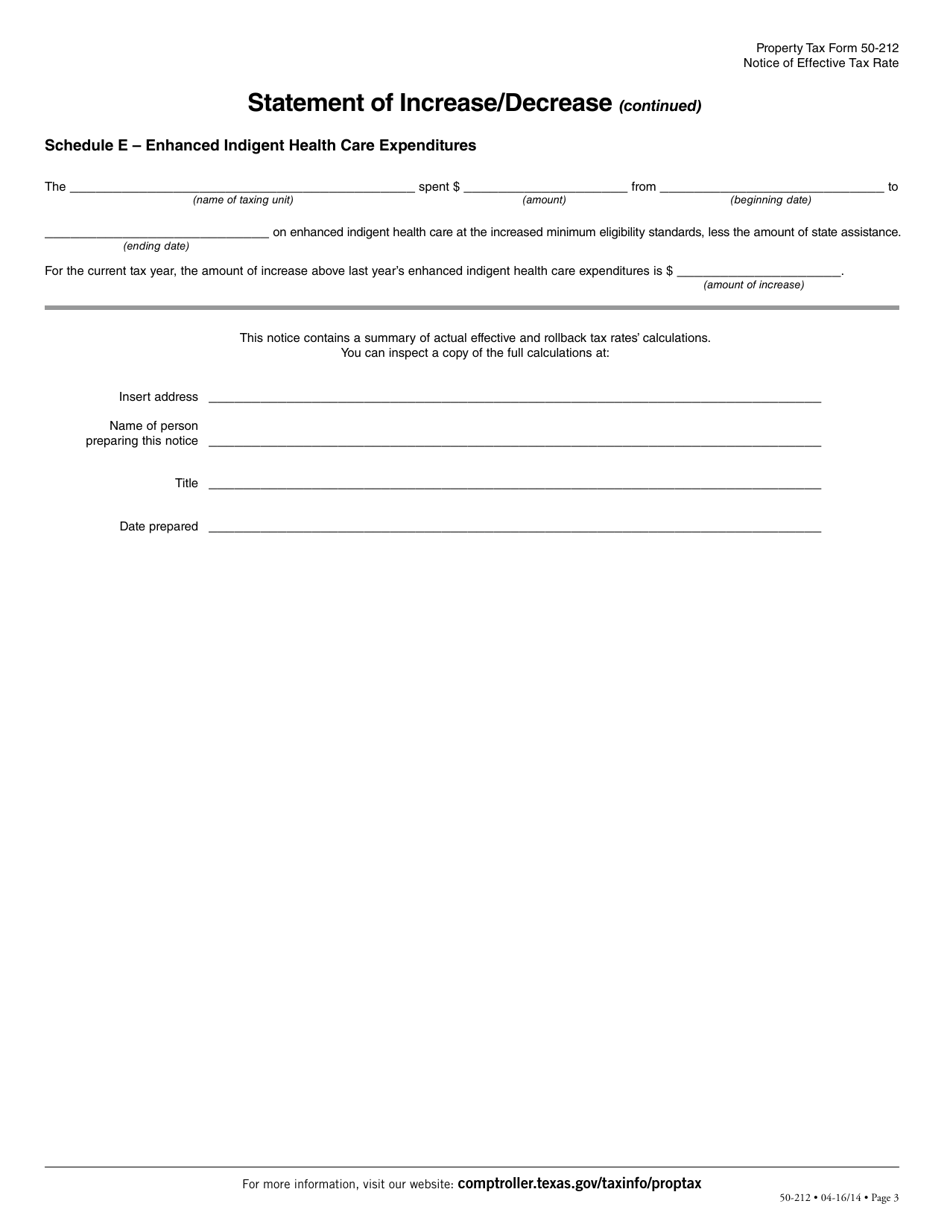

Q: What information is required on Form 50-212?

A: Form 50-212 requires information such as the taxing unit's name, tax rates, and other related financial information.

Q: Are there any penalties for not filing Form 50-212?

A: Yes, there may be penalties for not filing Form 50-212, such as the loss of state funding for the taxing unit.

Q: Can individual taxpayers file Form 50-212?

A: No, Form 50-212 is only for taxing units and not individual taxpayers.

Q: Is Form 50-212 specific to Texas?

A: Yes, Form 50-212 is specific to the state of Texas and is not applicable in other states.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-212 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.