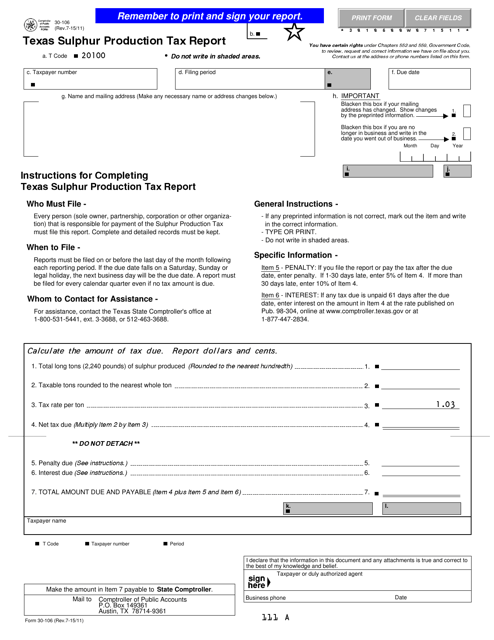

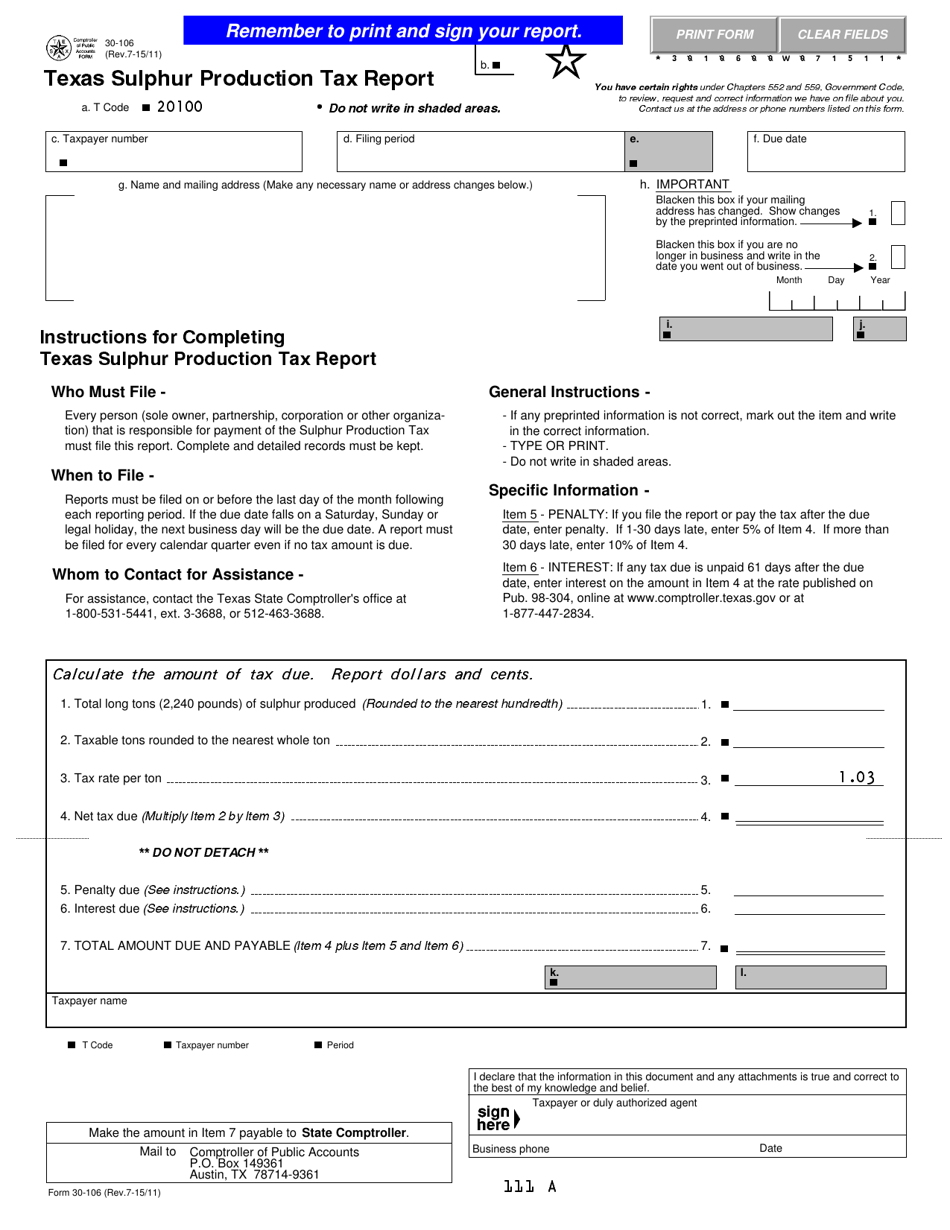

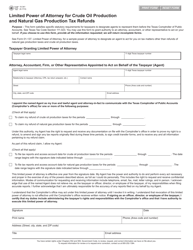

Form 30-106 Sulphur Production Tax Report - Texas

What Is Form 30-106?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 30-106?

A: Form 30-106 is the Sulphur Production Tax Report required by the state of Texas.

Q: Who needs to file form 30-106?

A: Companies or individuals engaged in sulphur production in Texas need to file this form.

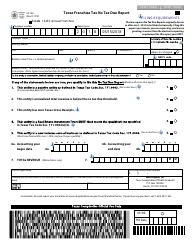

Q: What is the purpose of the Sulphur Production Tax Report?

A: The purpose of this report is to calculate and report the amount of sulphur produced in Texas, in order to determine the tax owed.

Q: When is form 30-106 due?

A: Form 30-106 is due annually on or before the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of form 30-106?

A: Yes, there are penalties for late filing, including interest charges and possible legal actions.

Q: Is there a minimum amount of sulphur production that requires filing form 30-106?

A: Yes, if you produce and sell less than 10 tons of sulphur per year, you are exempt from filing this report.

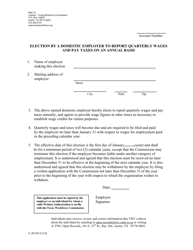

Q: What if I have multiple sulphur production locations in Texas?

A: You must file a separate form 30-106 for each production location.

Q: Can I file form 30-106 electronically?

A: Yes, electronic filing is available for form 30-106.

Q: What information is required on form 30-106?

A: The form requires information such as the taxpayer's name, production location details, production volumes, and tax calculations.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 30-106 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.