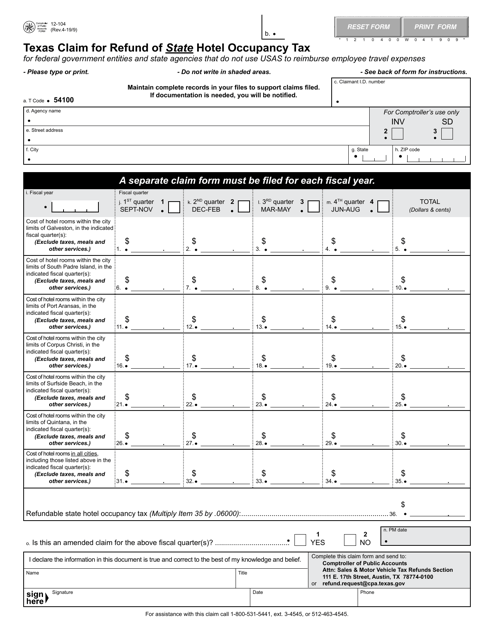

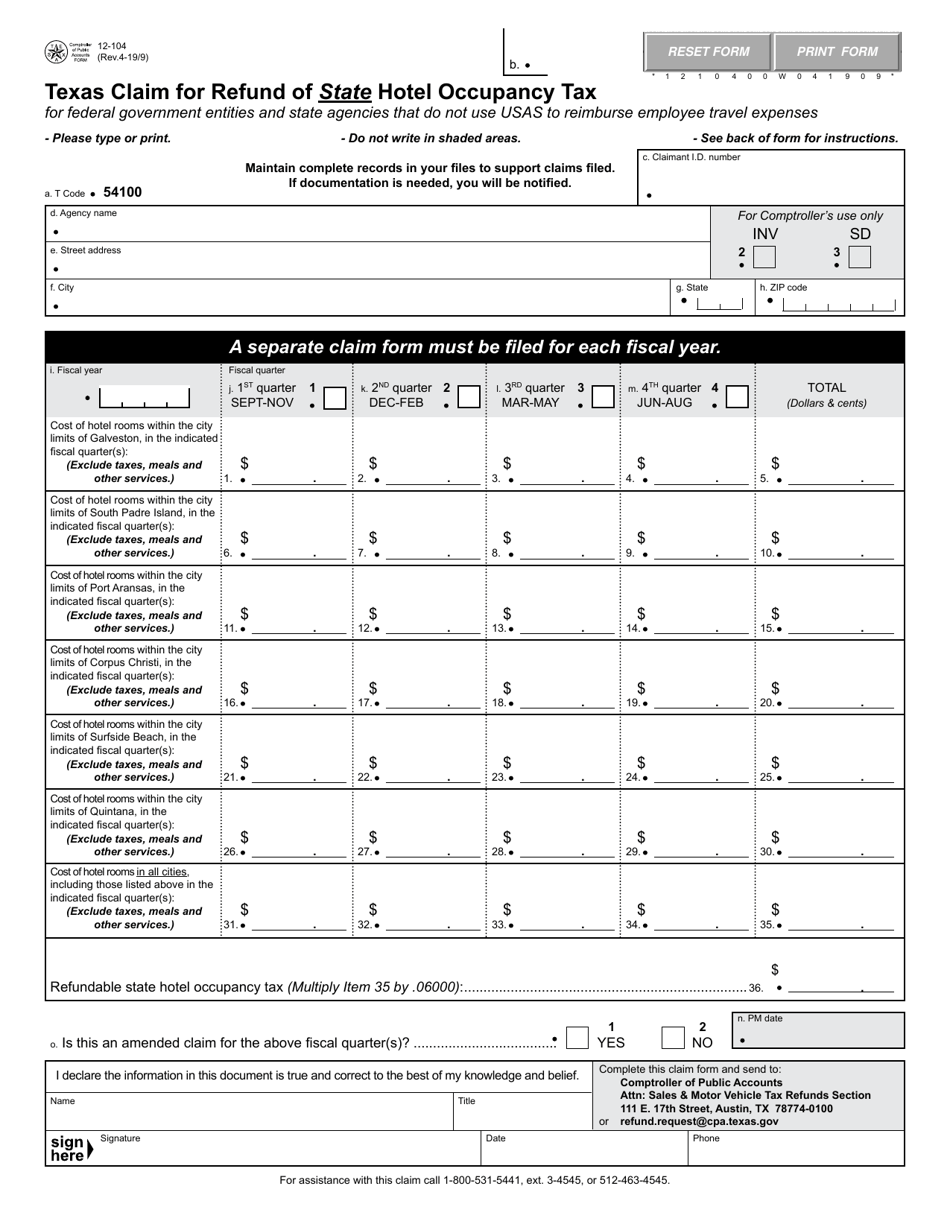

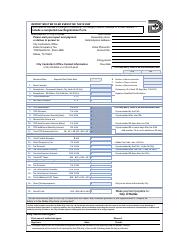

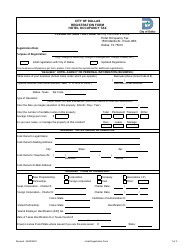

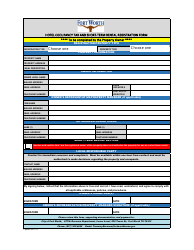

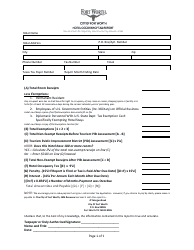

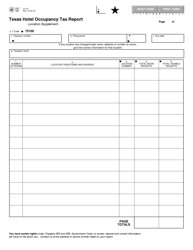

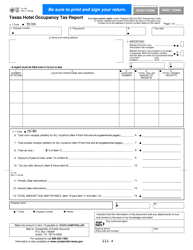

Form 12-104 Texas Claim for Refund of State Hotel Occupancy Tax - Texas

What Is Form 12-104?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 12-104?

A: Form 12-104 is the official form in Texas for claiming a refund of state hotel occupancy tax.

Q: Who can use Form 12-104?

A: Form 12-104 can be used by individuals or businesses who have paid state hotel occupancy tax in Texas and are eligible for a refund.

Q: What is the purpose of Form 12-104?

A: The purpose of Form 12-104 is to request a refund of the state hotel occupancy tax that has been overpaid or incorrectly paid.

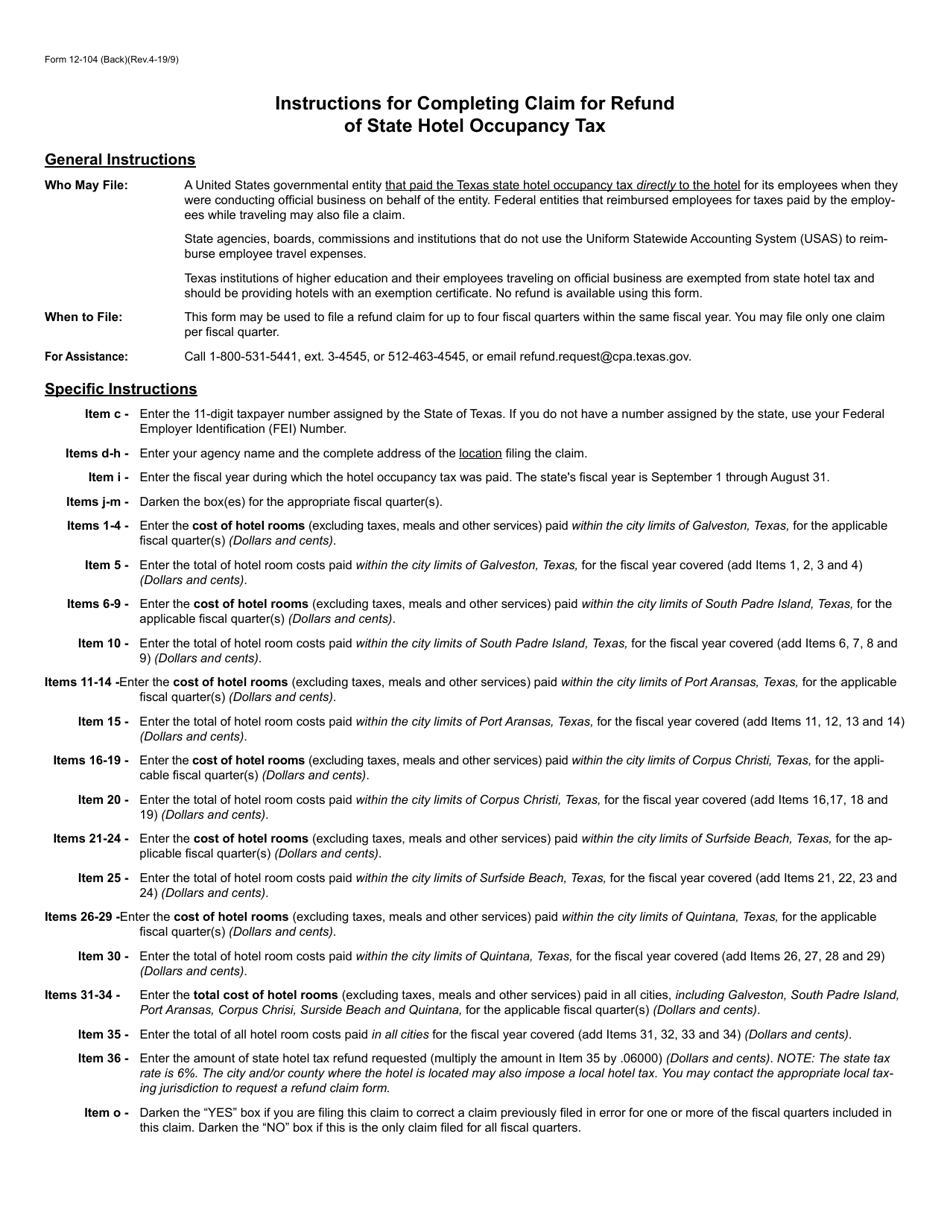

Q: What documents do I need to include with Form 12-104?

A: You may need to include supporting documentation such as receipts, invoices, or other proof of payment along with Form 12-104.

Q: When should I submit Form 12-104?

A: Form 12-104 should be submitted within four years from the date of payment of the tax or within four years from the date the tax was due, whichever is later.

Q: How long does it take to process a claim using Form 12-104?

A: The processing time for a claim using Form 12-104 can vary, but it generally takes around 60 to 90 days for the refund to be issued.

Q: Is there a fee for filing Form 12-104?

A: No, there is no fee for filing Form 12-104.

Q: What if my claim using Form 12-104 is denied?

A: If your claim using Form 12-104 is denied, you have the right to appeal the decision within 30 days.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 12-104 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.