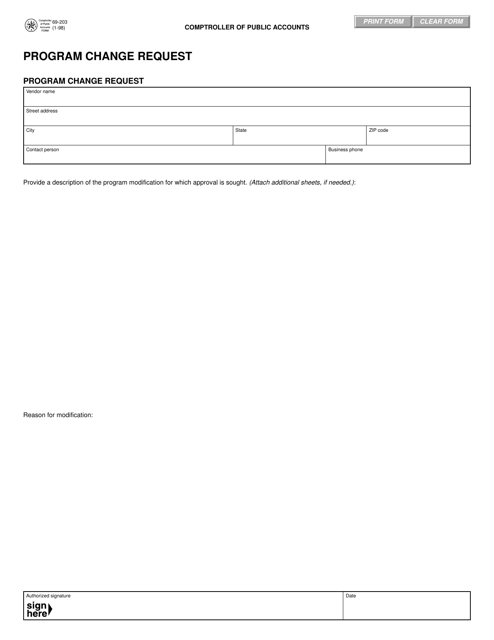

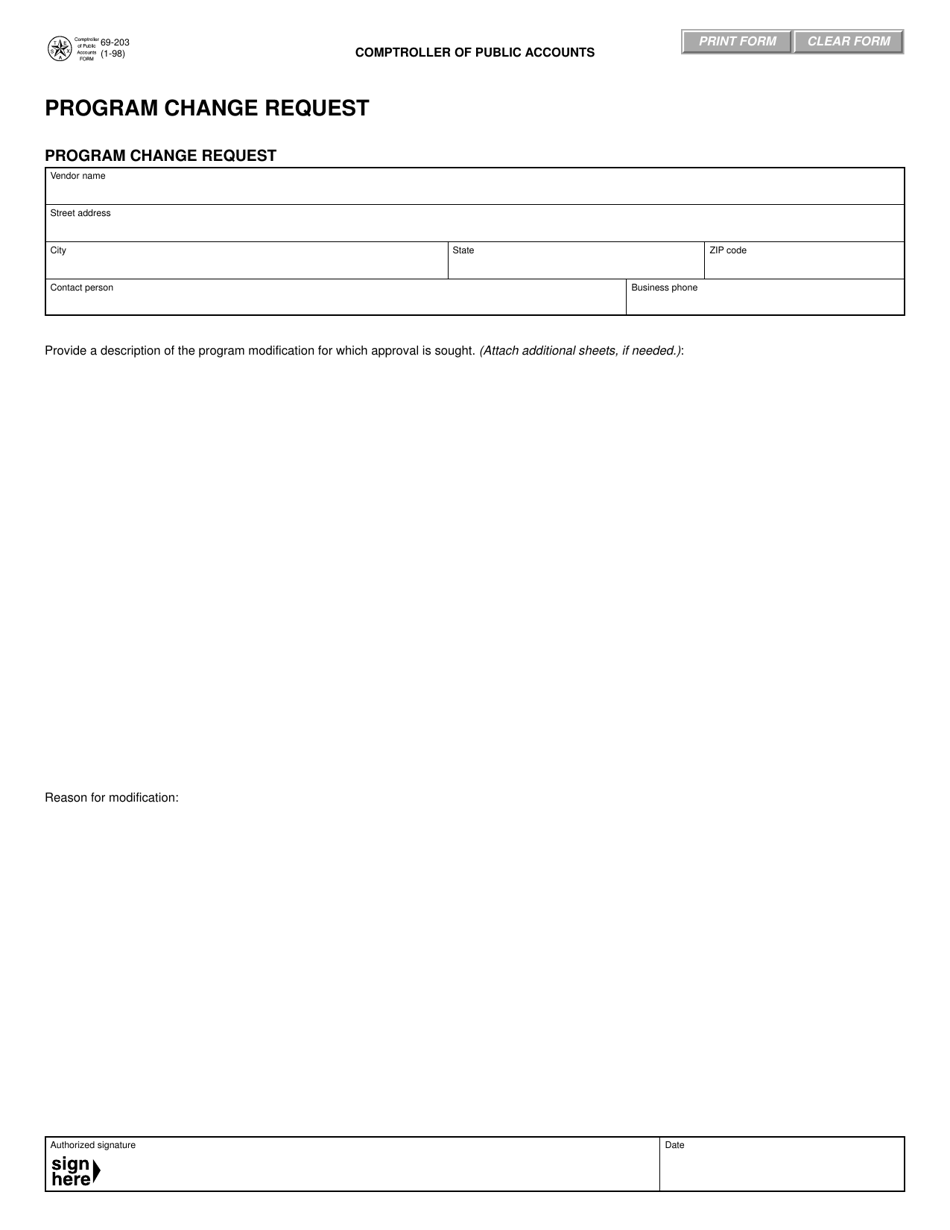

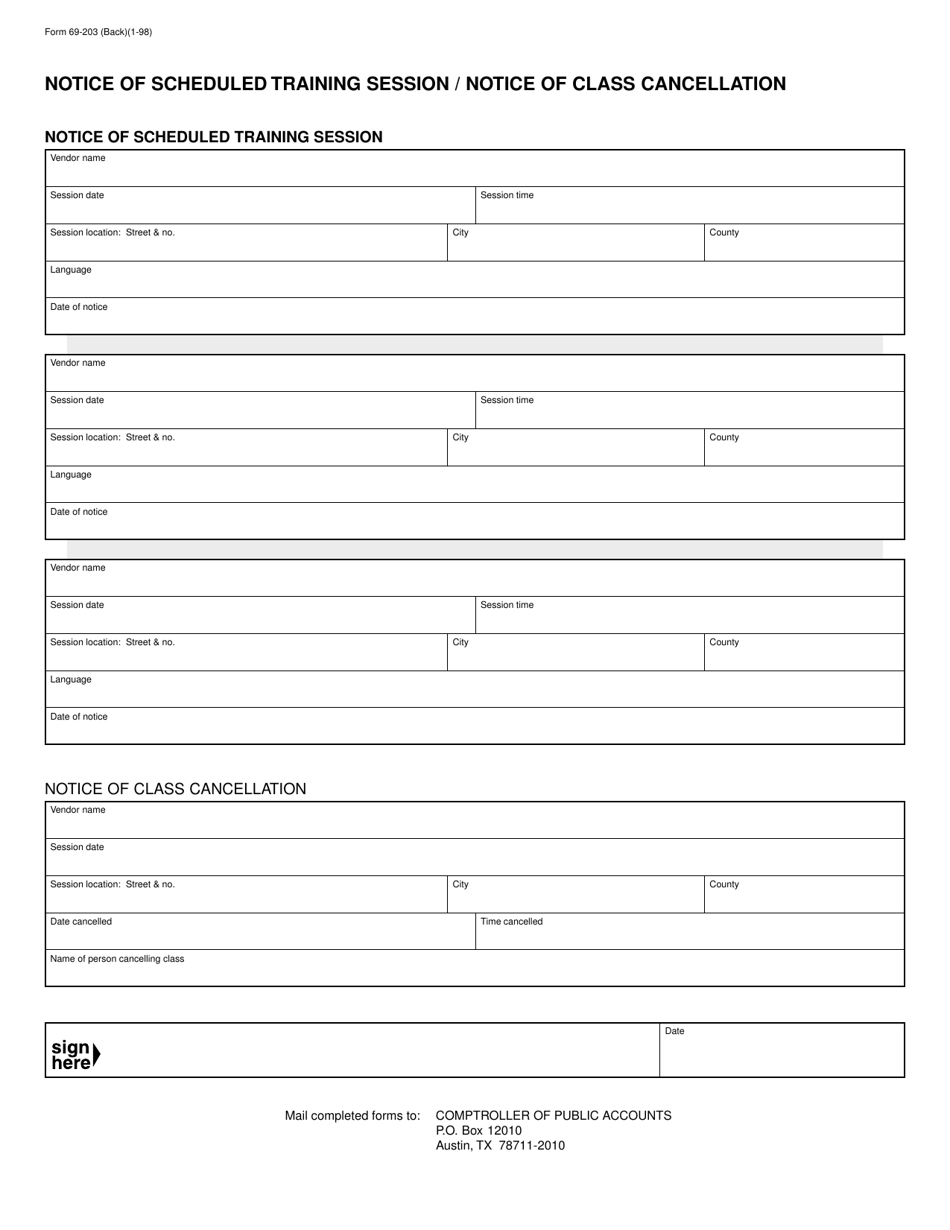

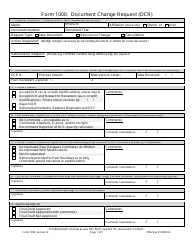

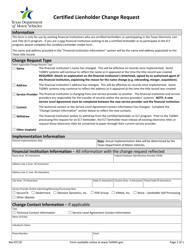

Form 69-203 Program Change Request - Texas

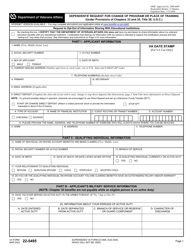

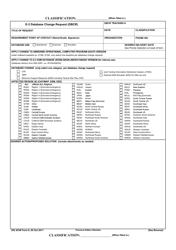

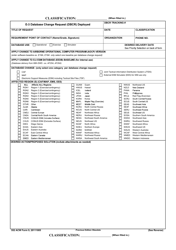

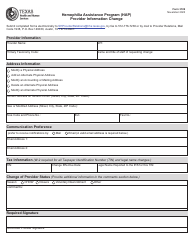

What Is Form 69-203?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 69-203?

A: Form 69-203 is the Program Change Request form for Texas.

Q: What is the purpose of Form 69-203?

A: The purpose of Form 69-203 is to request changes to a program in the state of Texas.

Q: What information do I need to provide on Form 69-203?

A: You will need to provide information about the program and the requested changes, as well as any supporting documentation.

Q: Are there any fees associated with submitting Form 69-203?

A: There may be fees associated with submitting Form 69-203, depending on the specific program and agency.

Q: What happens after I submit Form 69-203?

A: After you submit Form 69-203, the Texas state agency will review your request and determine whether to approve or deny the changes.

Q: How long does it take to process Form 69-203?

A: The processing time for Form 69-203 can vary depending on the specific program and agency, so it is best to contact them directly for an estimated timeline.

Q: Can I appeal if my request on Form 69-203 is denied?

A: Yes, you may have the option to appeal if your request on Form 69-203 is denied. You will need to follow the agency's appeal process.

Q: Are there any specific guidelines for filling out Form 69-203?

A: Yes, it is important to read and follow the instructions provided on Form 69-203 and any accompanying guidelines from the Texas state agency.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 69-203 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.