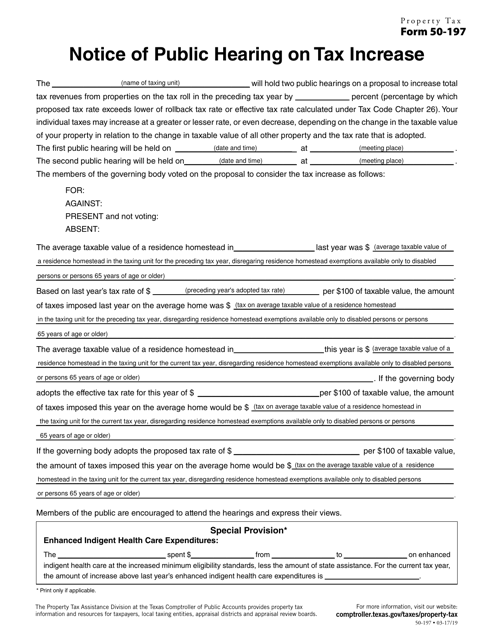

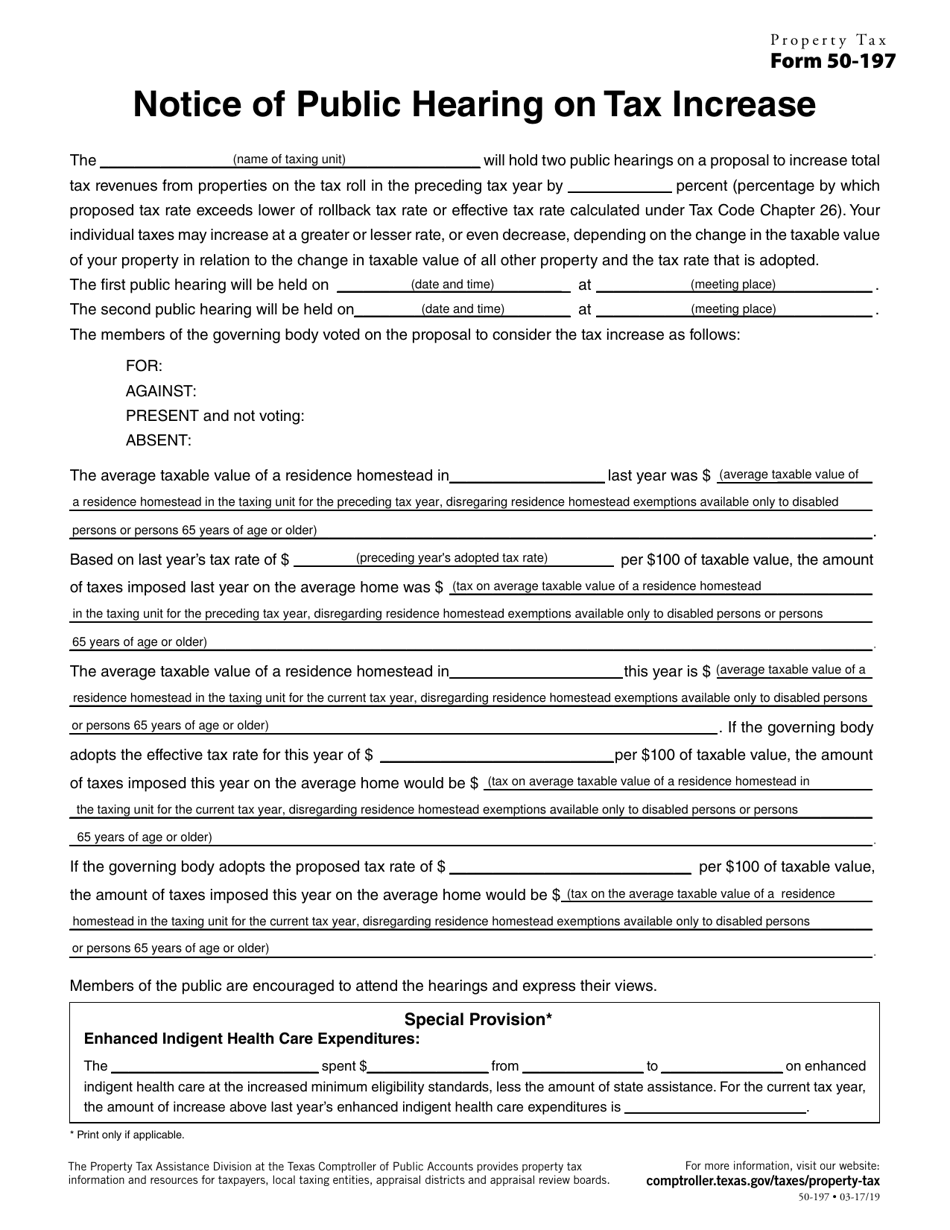

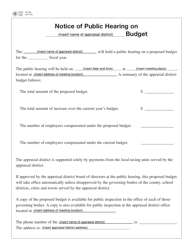

Form 50-197 Notice of Public Hearing on Tax Increase - Texas

What Is Form 50-197?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-197?

A: Form 50-197 is the Notice of Public Hearing on Tax Increase in Texas.

Q: What is the purpose of Form 50-197?

A: The purpose of Form 50-197 is to notify the public about a proposed tax increase.

Q: Who is required to submit Form 50-197?

A: Local taxing entities in Texas are required to submit Form 50-197 if they are proposing a tax increase.

Q: What information is included in Form 50-197?

A: Form 50-197 includes details about the proposed tax increase, including the reason for the increase and the date, time, and location of the public hearing.

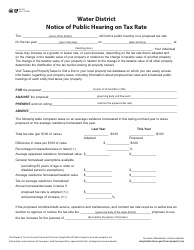

Q: Why is a public hearing required for a tax increase?

A: A public hearing is required for a tax increase to provide an opportunity for the public to voice their opinions and concerns about the proposed increase.

Q: Are there any deadlines for submitting Form 50-197?

A: Yes, Form 50-197 must be submitted at least 20 days before the date of the public hearing.

Q: Can I attend the public hearing if I have concerns about the tax increase?

A: Yes, the public hearing is open to the public, and you can attend to voice your concerns about the tax increase.

Q: Is the tax increase final after the public hearing?

A: No, the tax increase is not final after the public hearing. The taxing entity will consider the feedback received during the hearing before making a final decision.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-197 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.