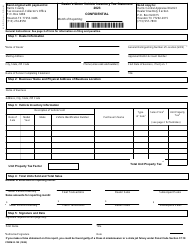

This version of the form is not currently in use and is provided for reference only. Download this version of

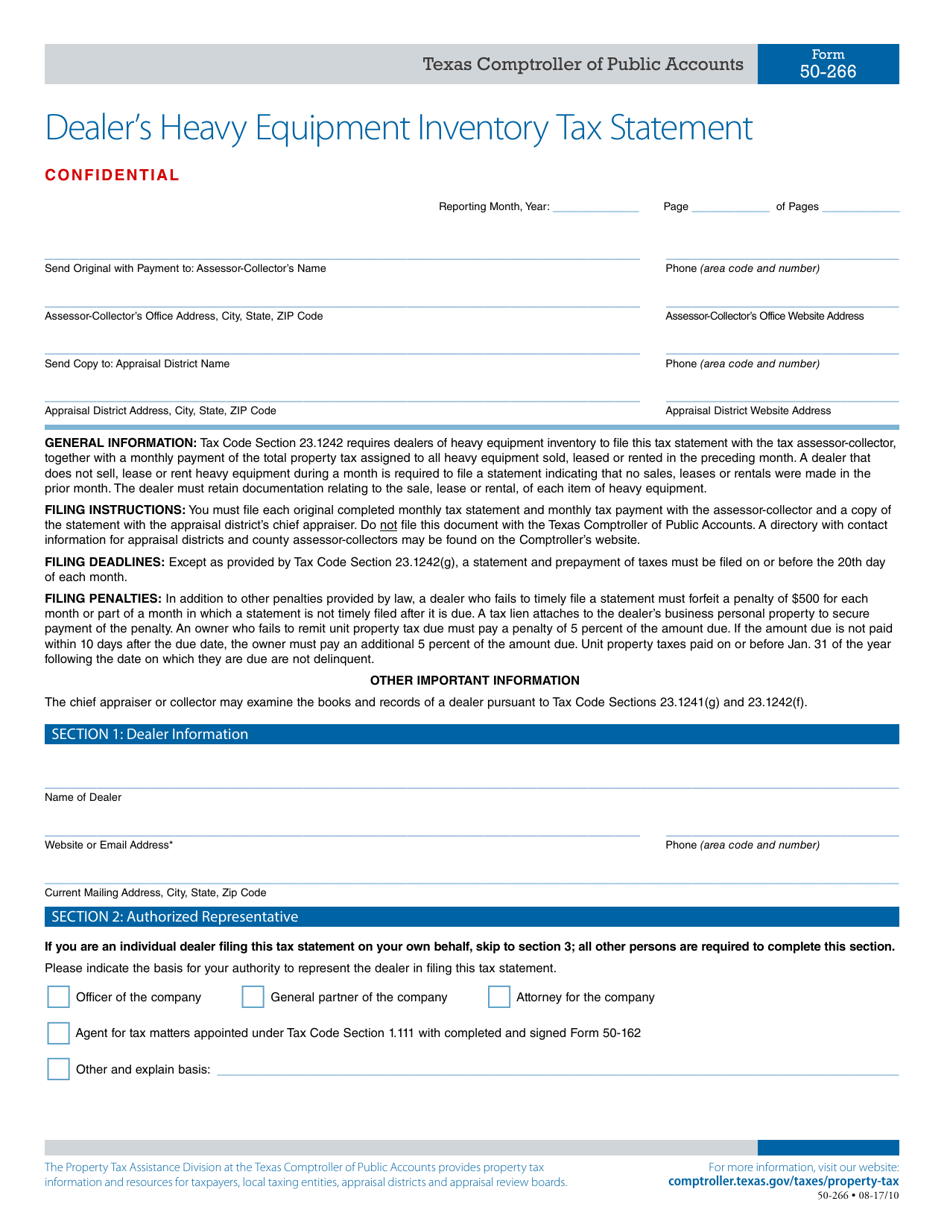

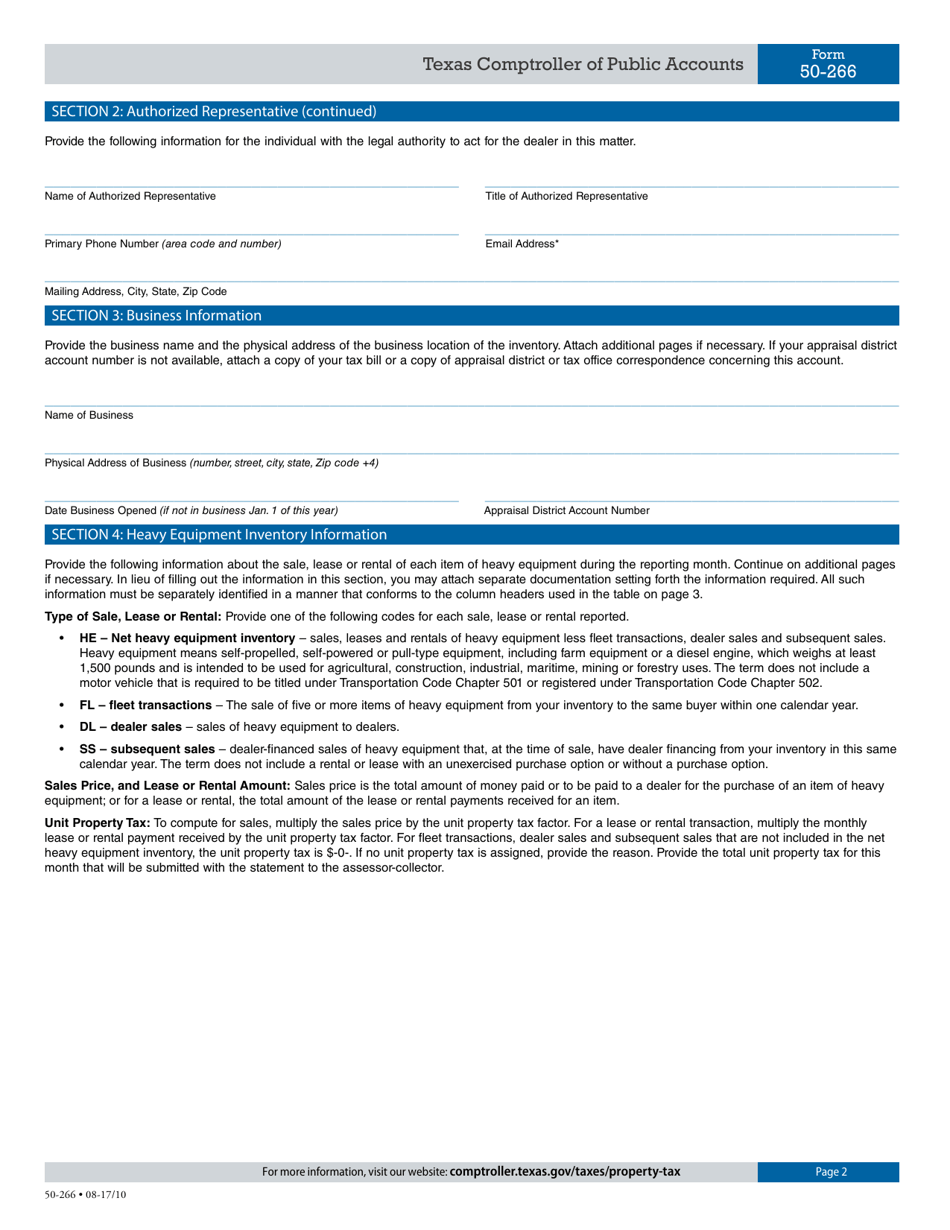

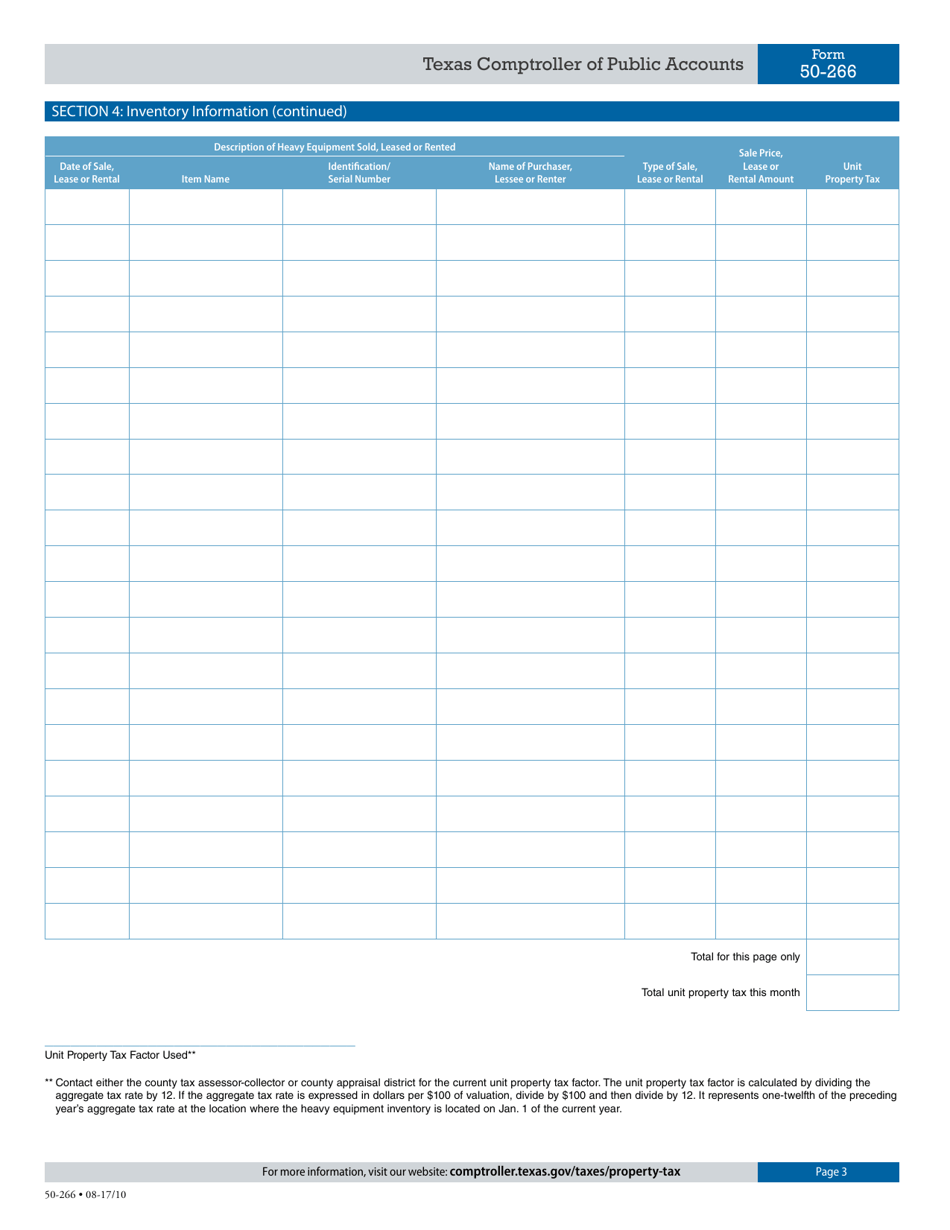

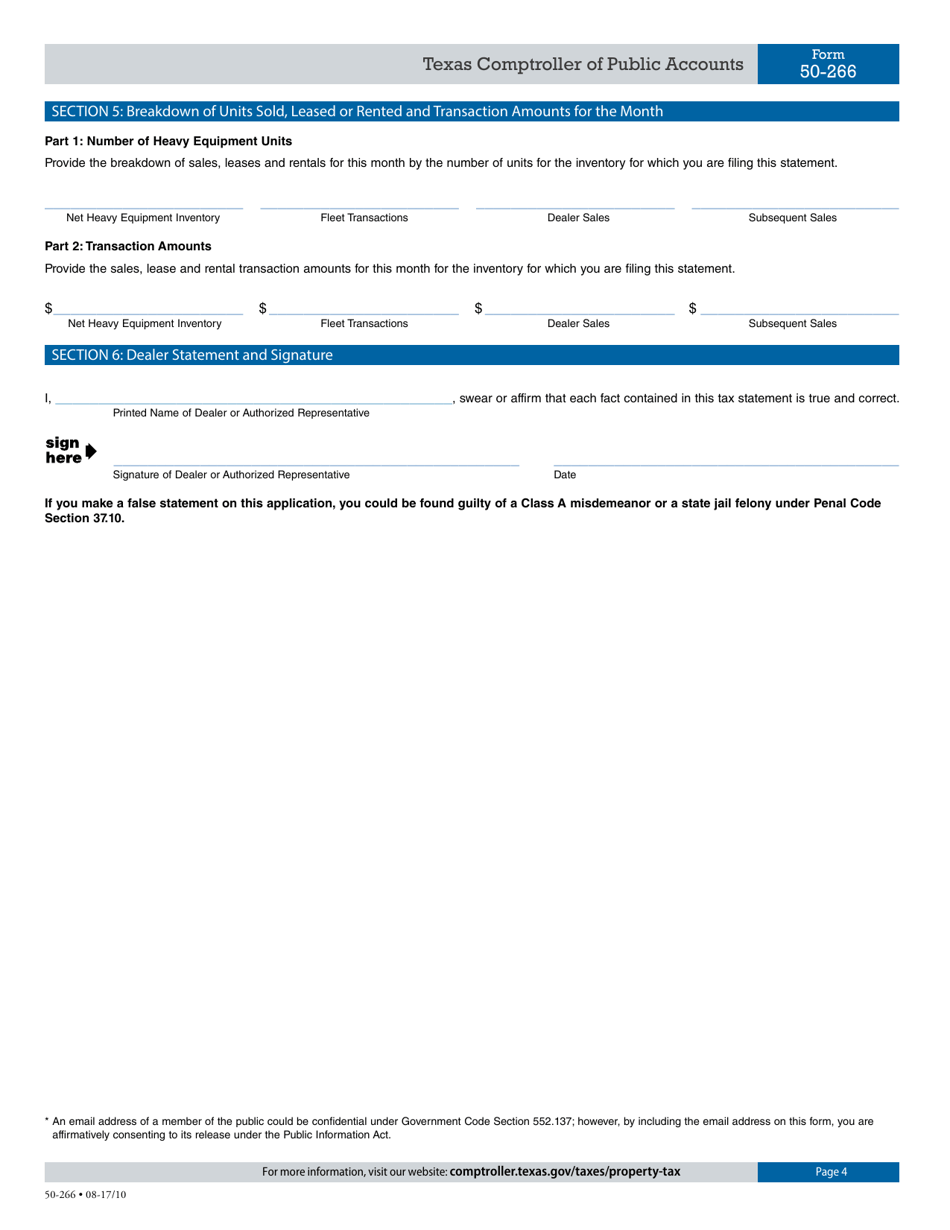

Form 50-266

for the current year.

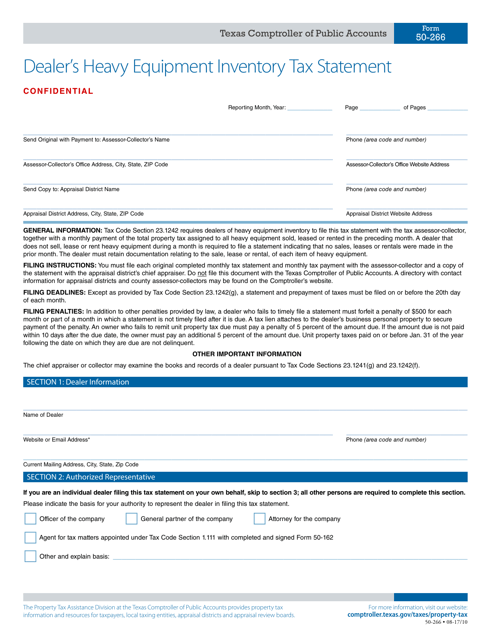

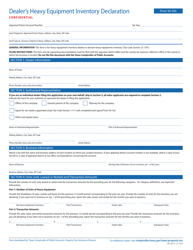

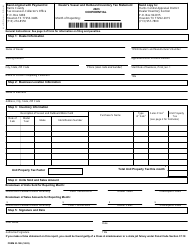

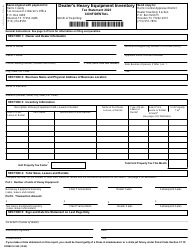

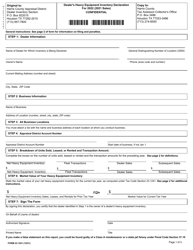

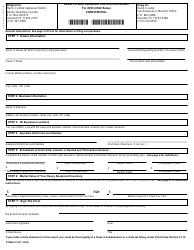

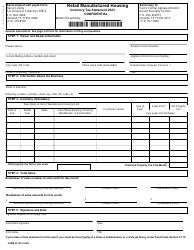

Form 50-266 Dealer's Heavy Equipment Inventory Tax Statement - Texas

What Is Form 50-266?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-266?

A: Form 50-266 is the Dealer's Heavy Equipment Inventory Tax Statement in Texas.

Q: Who needs to file Form 50-266?

A: Dealers of heavy equipment in Texas need to file Form 50-266.

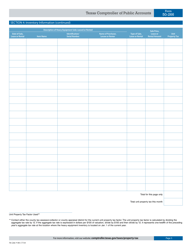

Q: What is the purpose of Form 50-266?

A: The purpose of Form 50-266 is to report the inventory of heavy equipment held by dealers for tax assessment.

Q: When is Form 50-266 due?

A: Form 50-266 is due on April 1st each year.

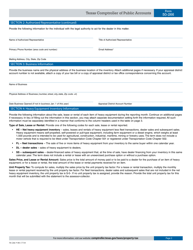

Q: Is there a fee for filing Form 50-266?

A: Yes, there is a fee associated with filing Form 50-266. The fee amount varies based on the dealer's county and is used to fund local governments and schools.

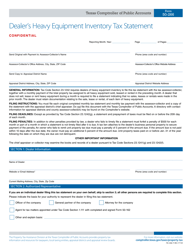

Q: Are there any penalties for late or incorrect filing of Form 50-266?

A: Yes, there are penalties for late or incorrect filing of Form 50-266. It is important to adhere to the filing deadline and provide accurate information to avoid penalties.

Q: What should I do if I need help with Form 50-266?

A: If you need assistance with Form 50-266, you can contact the Texas Comptroller's office for guidance and support.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-266 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.