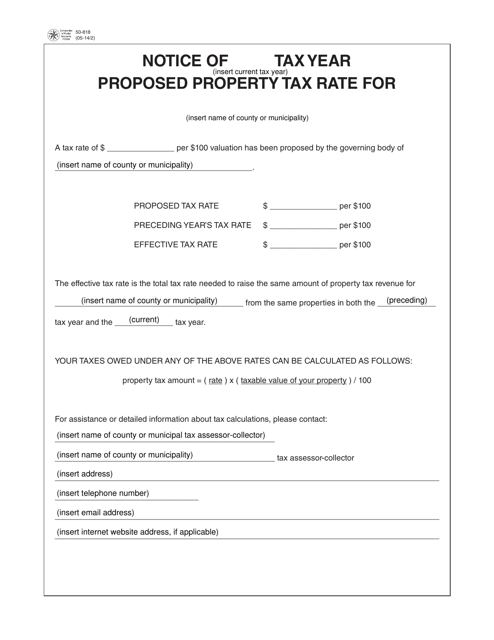

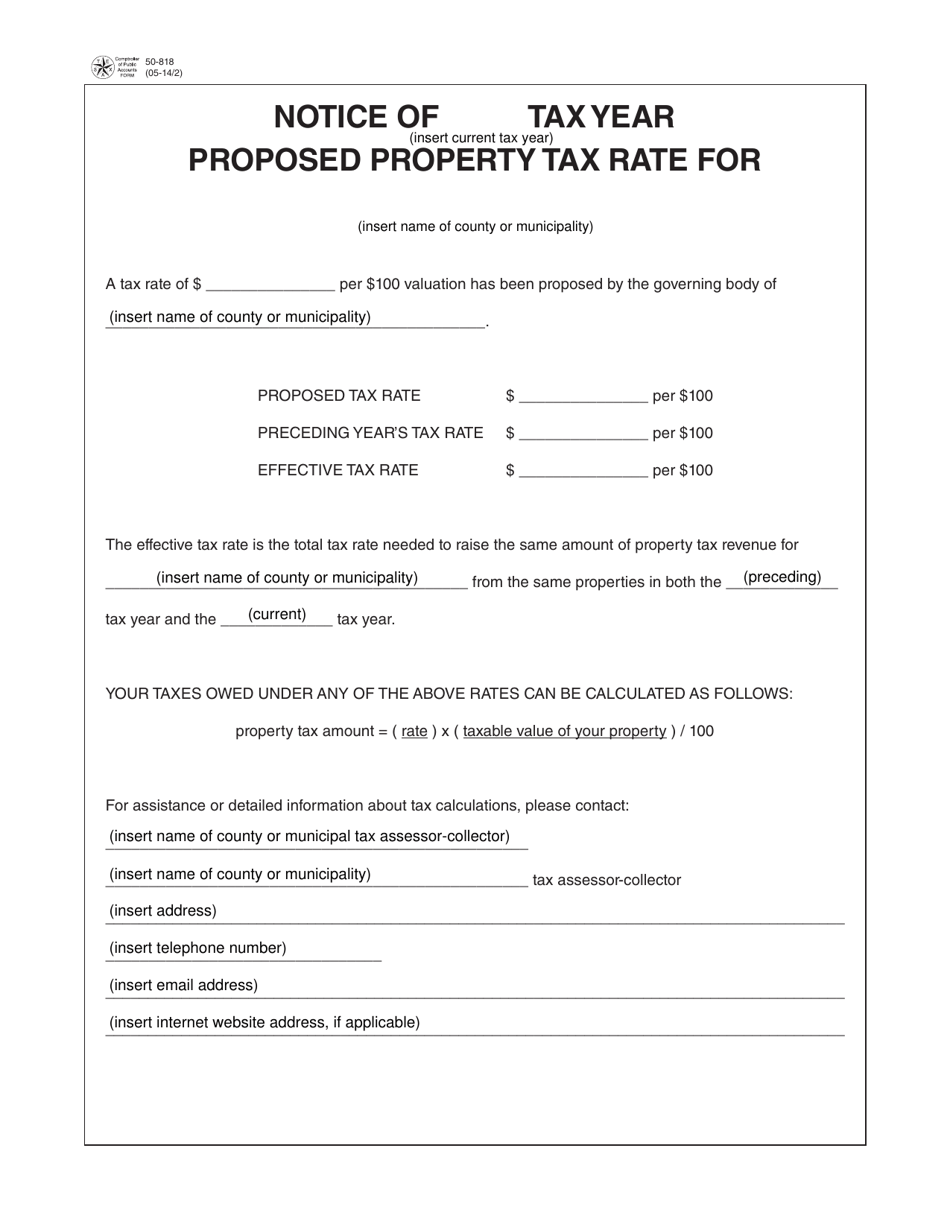

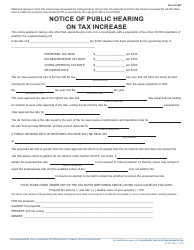

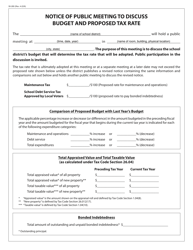

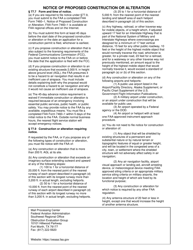

Form 50-818 Notice of Proposed Tax Rate - Texas

What Is Form 50-818?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-818?

A: Form 50-818 is the Notice of Proposed Tax Rate for Texas.

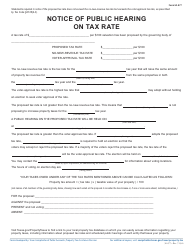

Q: Who is required to file Form 50-818?

A: Local taxing units in Texas, such as counties, cities, school districts, etc., are required to file Form 50-818.

Q: What is the purpose of Form 50-818?

A: The purpose of Form 50-818 is to notify taxpayers of the proposed tax rate for the upcoming tax year.

Q: When is Form 50-818 due?

A: Form 50-818 is due on or before September 15th of each year.

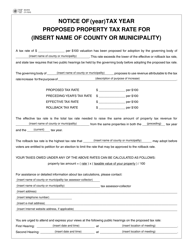

Q: What information is required on Form 50-818?

A: Form 50-818 requires information such as the name of the taxing unit, the proposed tax rate, and the date and time of the public hearing on the tax rate.

Q: What happens after Form 50-818 is filed?

A: After Form 50-818 is filed, the taxing unit must hold a public hearing to allow taxpayers to provide input on the proposed tax rate.

Q: Can taxpayers object to the proposed tax rate?

A: Yes, taxpayers have the right to object to the proposed tax rate during the public hearing.

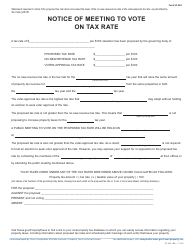

Q: Is the proposed tax rate final?

A: No, the proposed tax rate is not final. The final tax rate is determined after the public hearing and may be different from the proposed rate.

Q: What happens if the proposed tax rate is increased?

A: If the proposed tax rate is increased, taxpayers may be subject to higher property taxes.

Q: Are there any exemptions or deductions available?

A: Yes, there may be exemptions or deductions available depending on the taxpayer's circumstances. It is recommended to consult with a tax professional or the local taxing unit for more information.

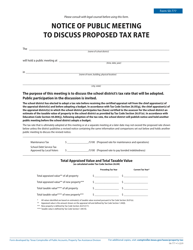

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-818 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.