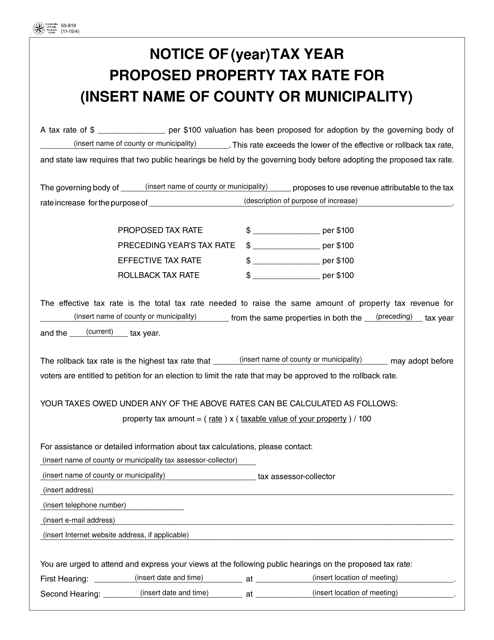

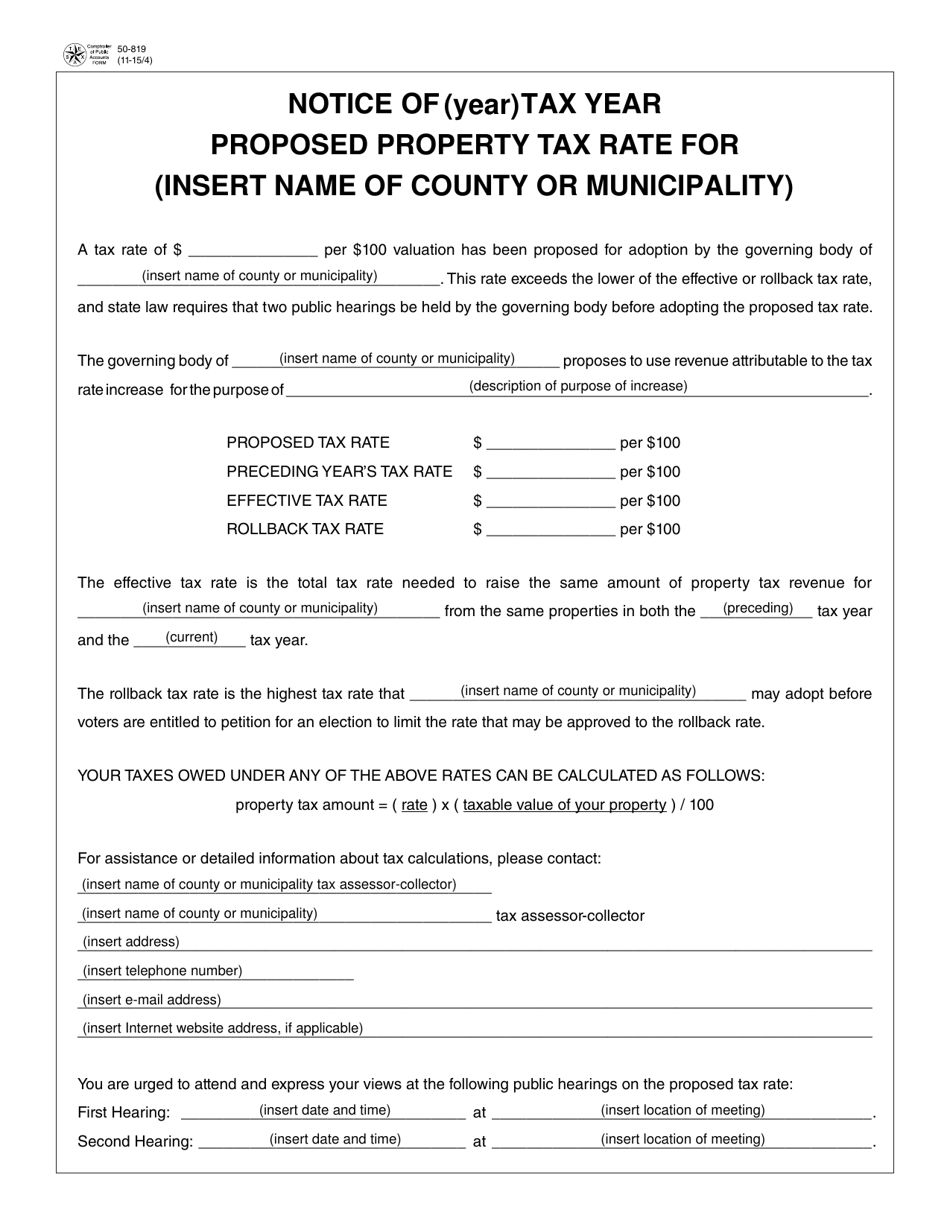

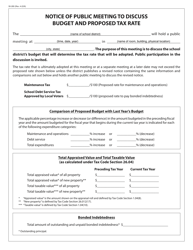

Form 50-819 Notice of Proposed Property Tax Rate - Texas

What Is Form 50-819?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-819?

A: Form 50-819 is a Notice of Proposed Property Tax Rate in Texas.

Q: What is the purpose of Form 50-819?

A: The purpose of Form 50-819 is to notify property owners in Texas about the proposed property tax rate for their area.

Q: Who is required to file Form 50-819?

A: Local taxing units in Texas, such as counties, cities, and school districts, are required to file Form 50-819.

Q: When is Form 50-819 filed?

A: Form 50-819 is typically filed by local taxing units in Texas before adopting their annual property tax rate.

Q: Can I challenge the proposed property tax rate?

A: Yes, you have the right to challenge the proposed property tax rate by attending public hearings or contacting your elected officials.

Q: What happens after Form 50-819 is filed?

A: After filing Form 50-819, the local taxing unit will hold public hearings to gather input from property owners before adopting the final property tax rate.

Q: Is Form 50-819 specific to Texas?

A: Yes, Form 50-819 is specific to Texas and is used to notify property owners about the proposed property tax rate in the state.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-819 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.