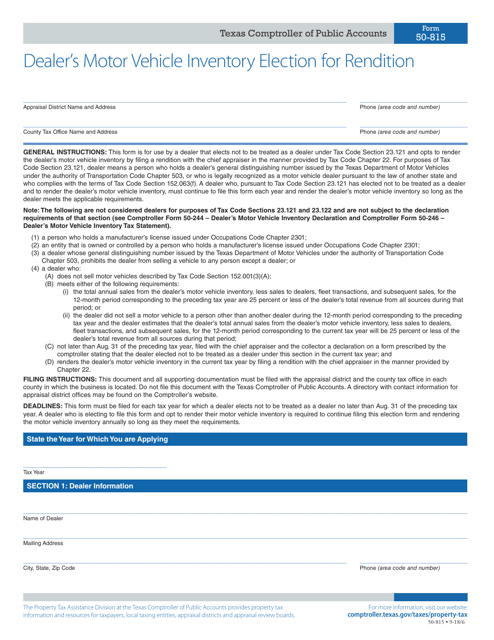

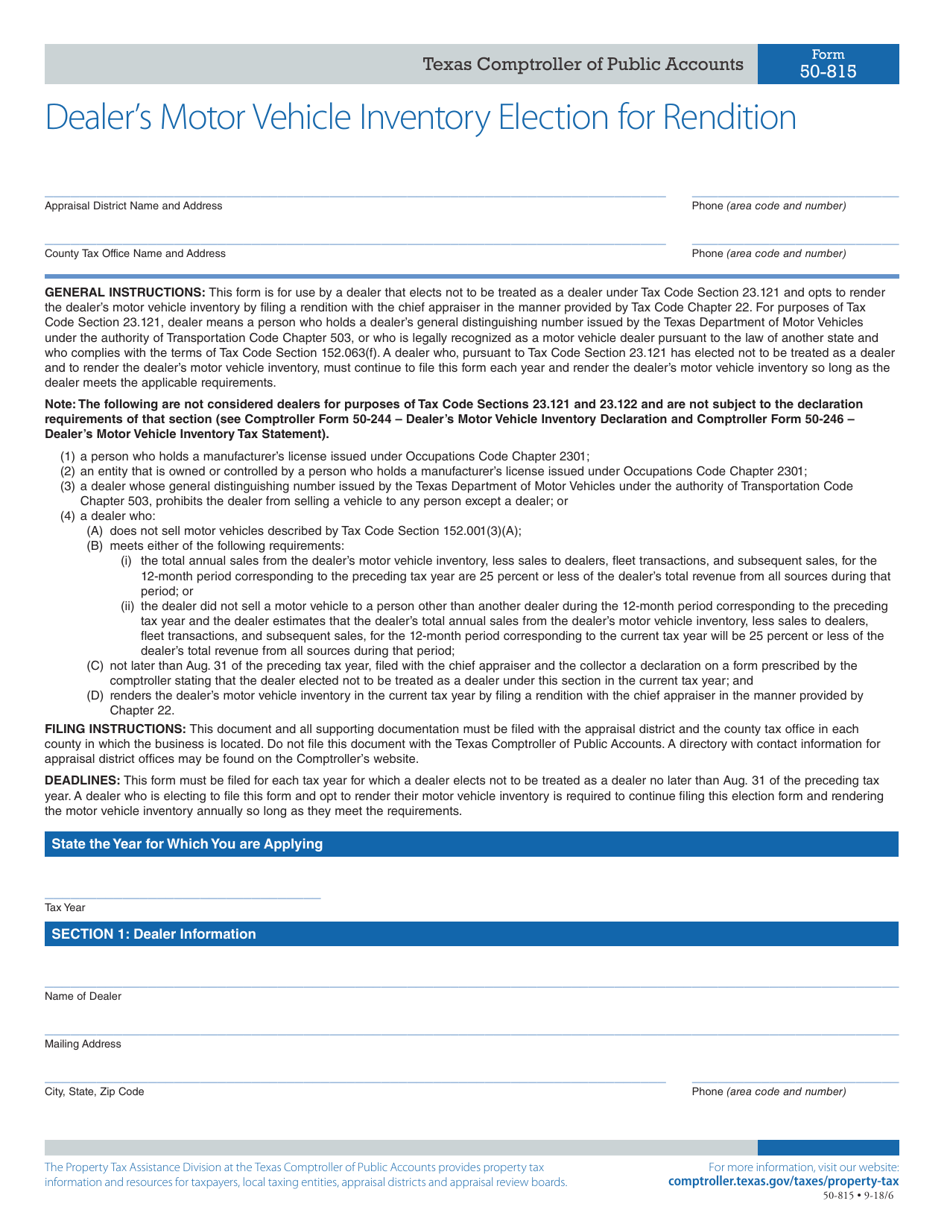

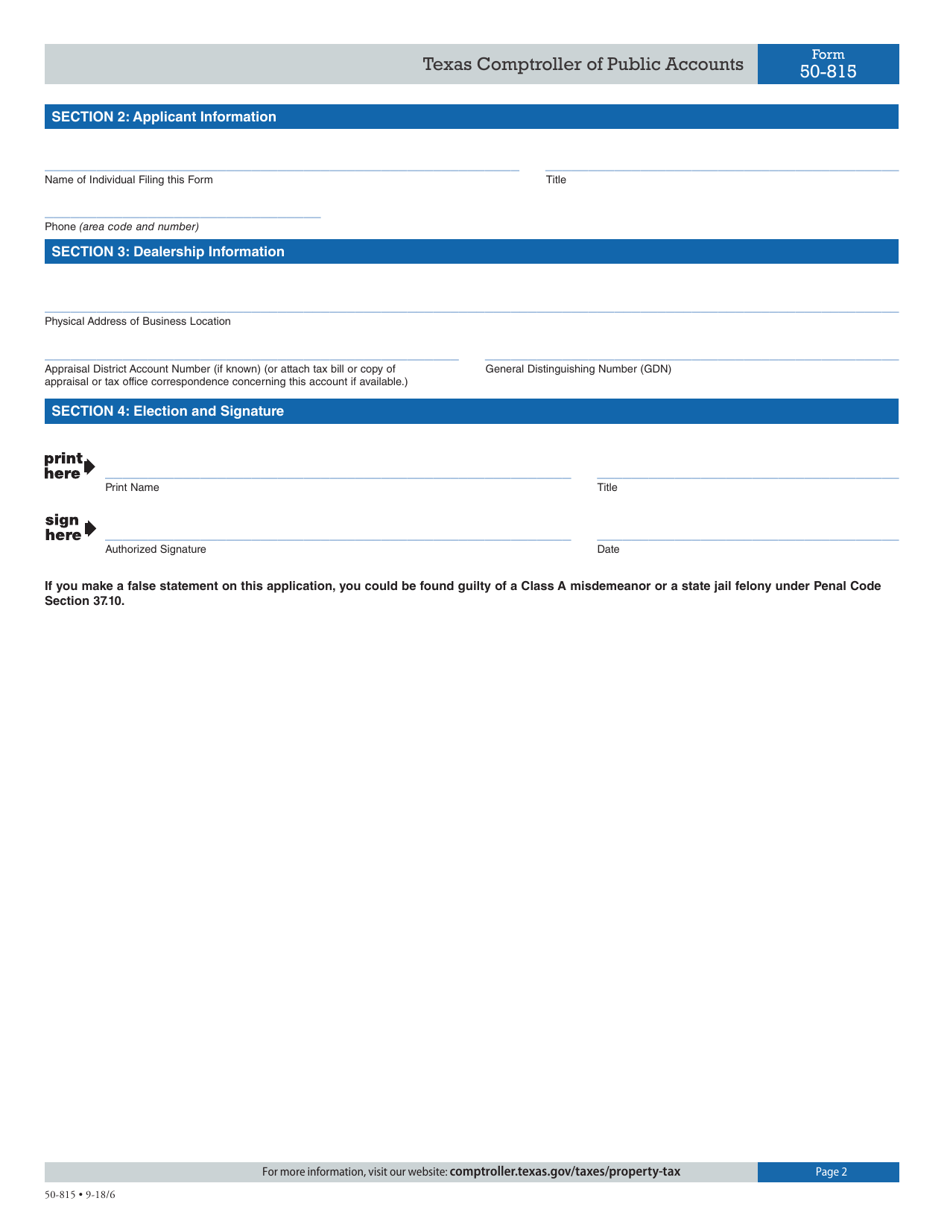

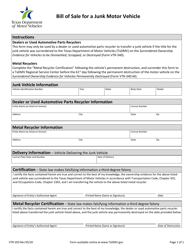

Form 50-815 Dealer's Motor Vehicle Inventory Election for Rendition - Texas

What Is Form 50-815?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-815?

A: Form 50-815 is the Dealer's Motor Vehicle Inventory Election for Rendition in Texas.

Q: Who needs to file Form 50-815?

A: Dealers who are engaged in the business of selling motor vehicles in Texas need to file Form 50-815.

Q: What is the purpose of Form 50-815?

A: The purpose of Form 50-815 is to allow dealers to elect the manner in which they will render inventory for property tax purposes.

Q: When is Form 50-815 due?

A: Form 50-815 is due on April 15th of each year.

Q: Are there any penalties for not filing Form 50-815?

A: Yes, failure to timely file Form 50-815 may result in penalties and interest being assessed.

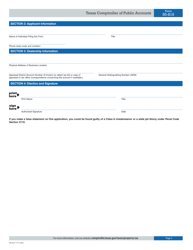

Q: What information is required on Form 50-815?

A: Form 50-815 requires information such as the dealer's name, address, inventory location, and the method of inventory valuation.

Q: What if my inventory has changed after filing Form 50-815?

A: If your inventory has changed, you must file an amended Form 50-815 to reflect the updated information.

Q: Are there any exemptions from filing Form 50-815?

A: Yes, certain dealers may be exempt from filing Form 50-815. You should check with the Texas Comptroller of Public Accounts for more information.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-815 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.