This version of the form is not currently in use and is provided for reference only. Download this version of

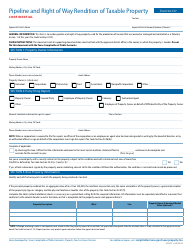

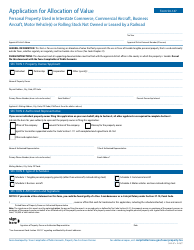

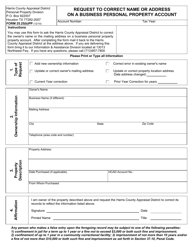

Form 50-144

for the current year.

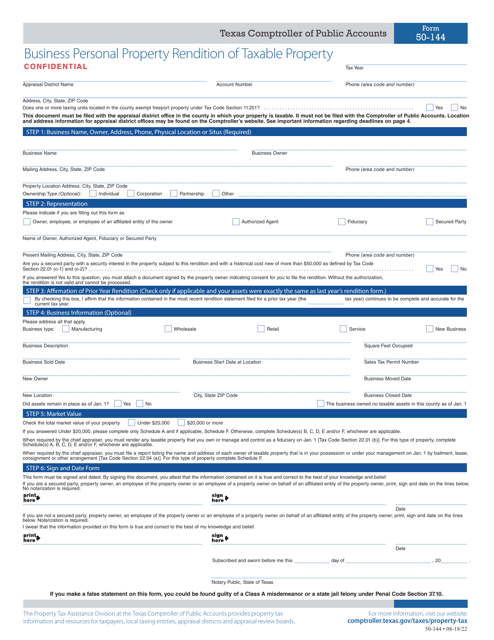

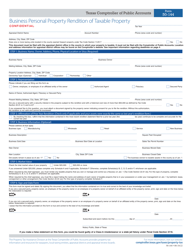

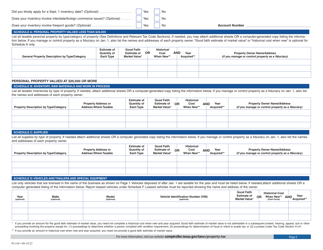

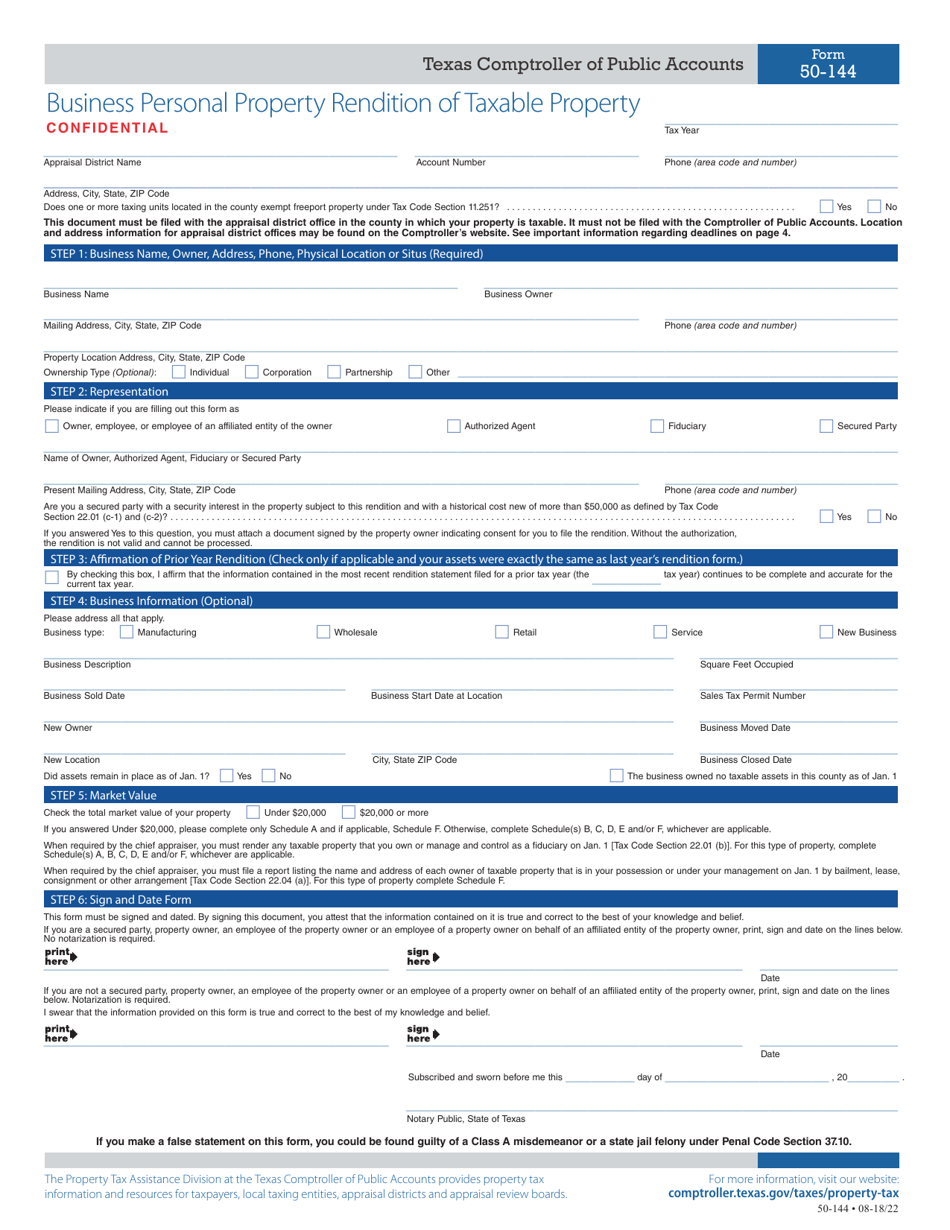

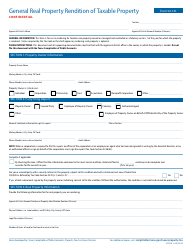

Form 50-144 Business Personal Property Rendition of Taxable Property - Texas

What Is Form 50-144?

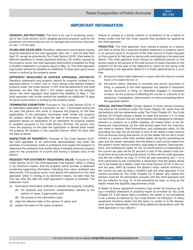

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-144?

A: Form 50-144 is the Business Personal Property Rendition of Taxable Property in Texas.

Q: Who is required to file Form 50-144?

A: All businesses in Texas that own tangible personal property used or held for business purposes must file Form 50-144.

Q: What is the purpose of Form 50-144?

A: The purpose of Form 50-144 is to report and declare the taxable personal property owned by a business in Texas.

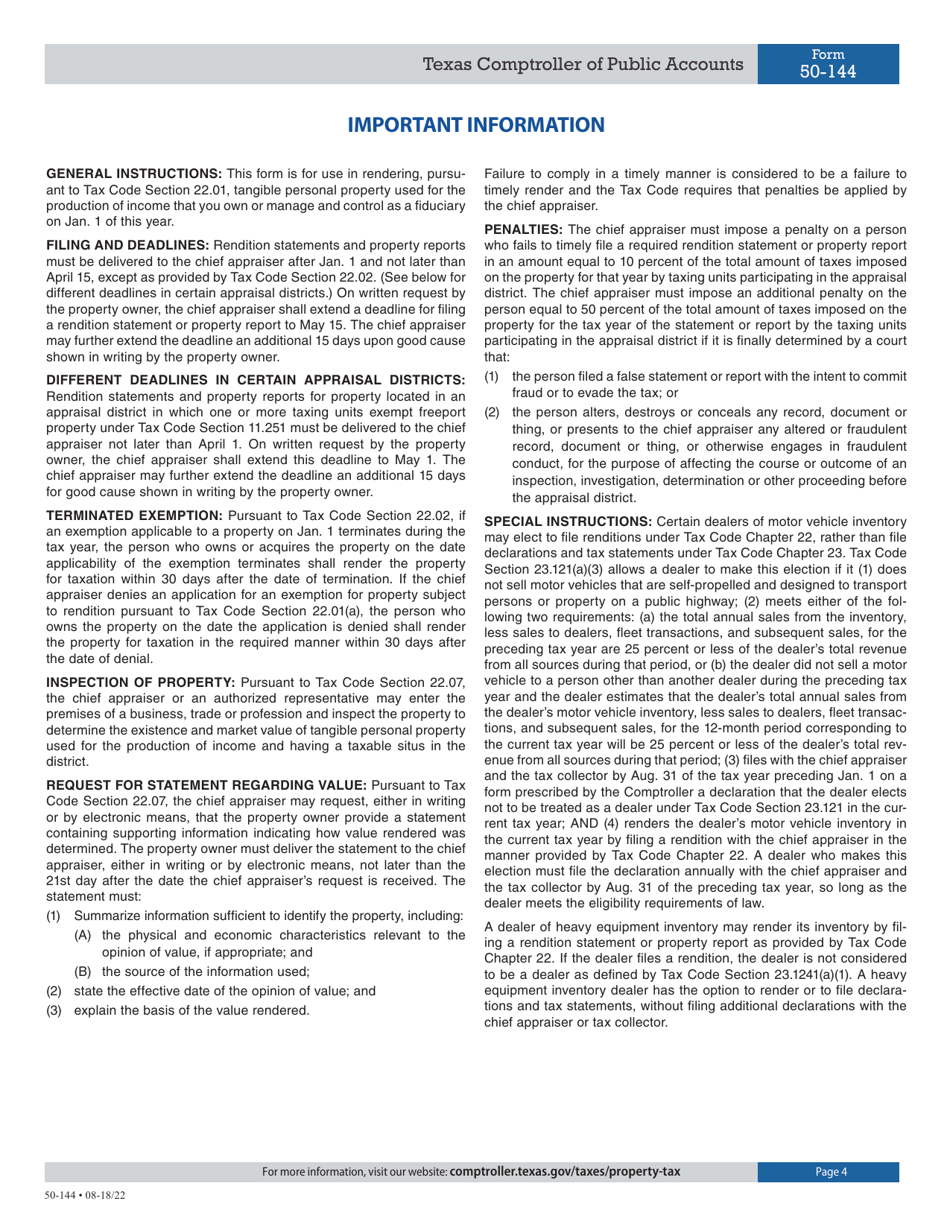

Q: When is Form 50-144 due?

A: Form 50-144 is due by April 15th of each year.

Q: What happens if I don't file Form 50-144?

A: Failure to file Form 50-144 may result in penalties and interest being assessed by the taxing authority.

Q: Are there any exemptions from filing Form 50-144?

A: Yes, there are certain exemptions available. You should check with the local taxing authority or the instructions provided with the form for more information.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-144 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.