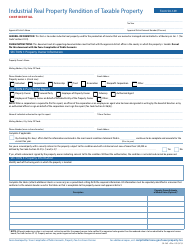

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-156

for the current year.

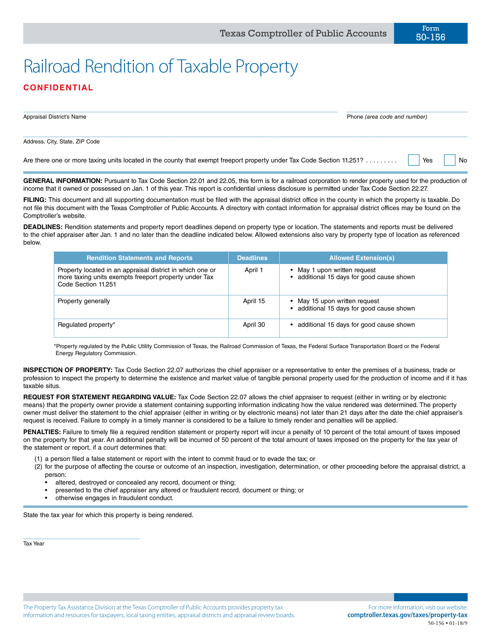

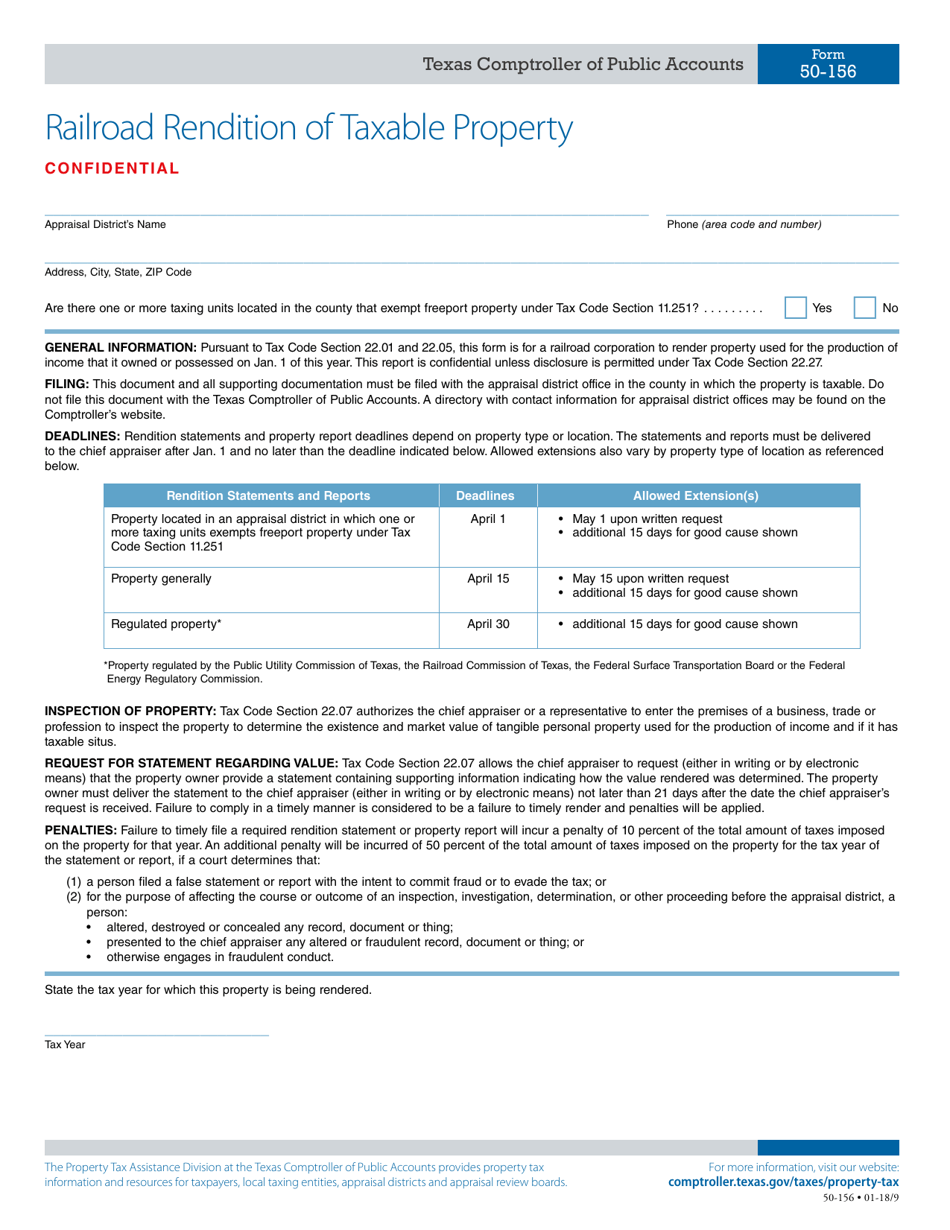

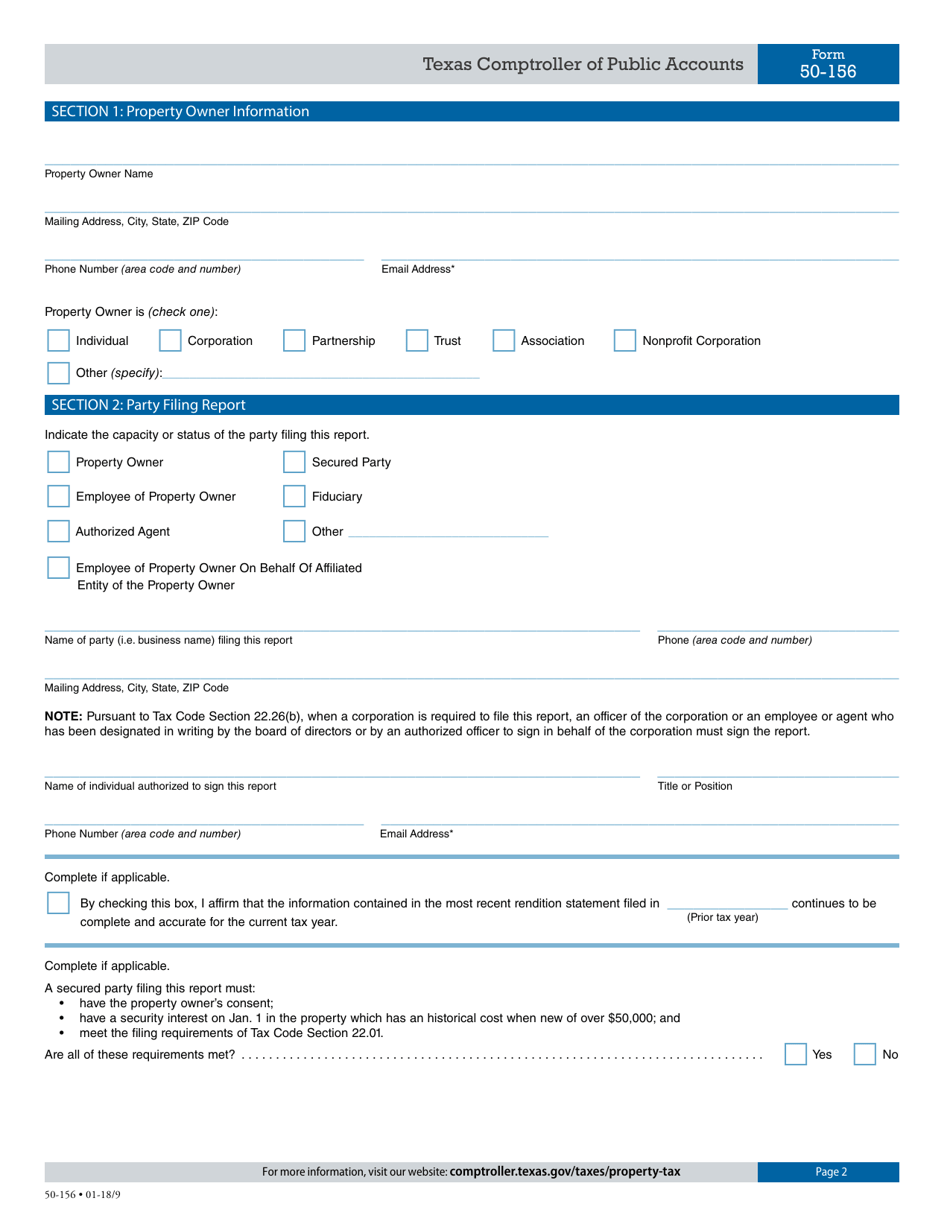

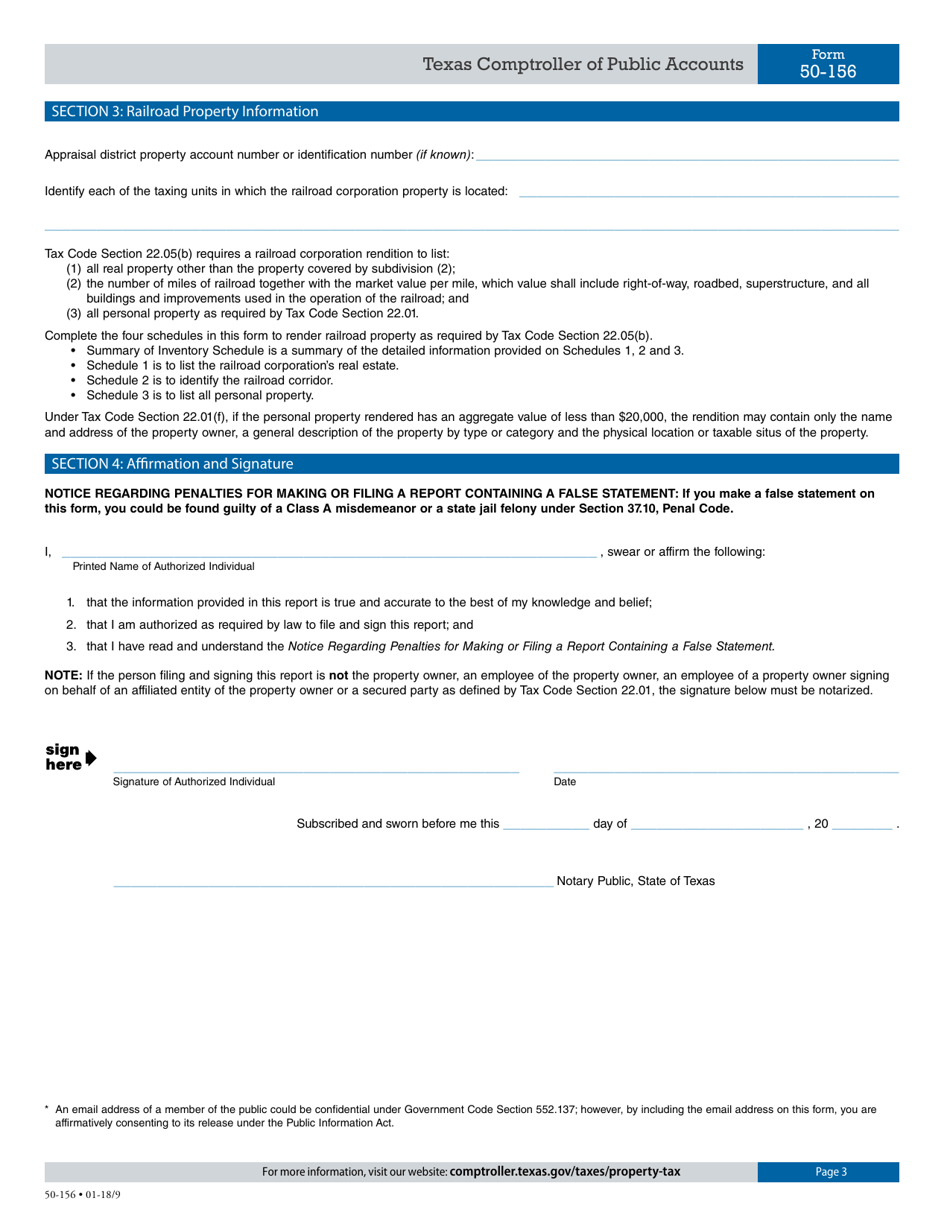

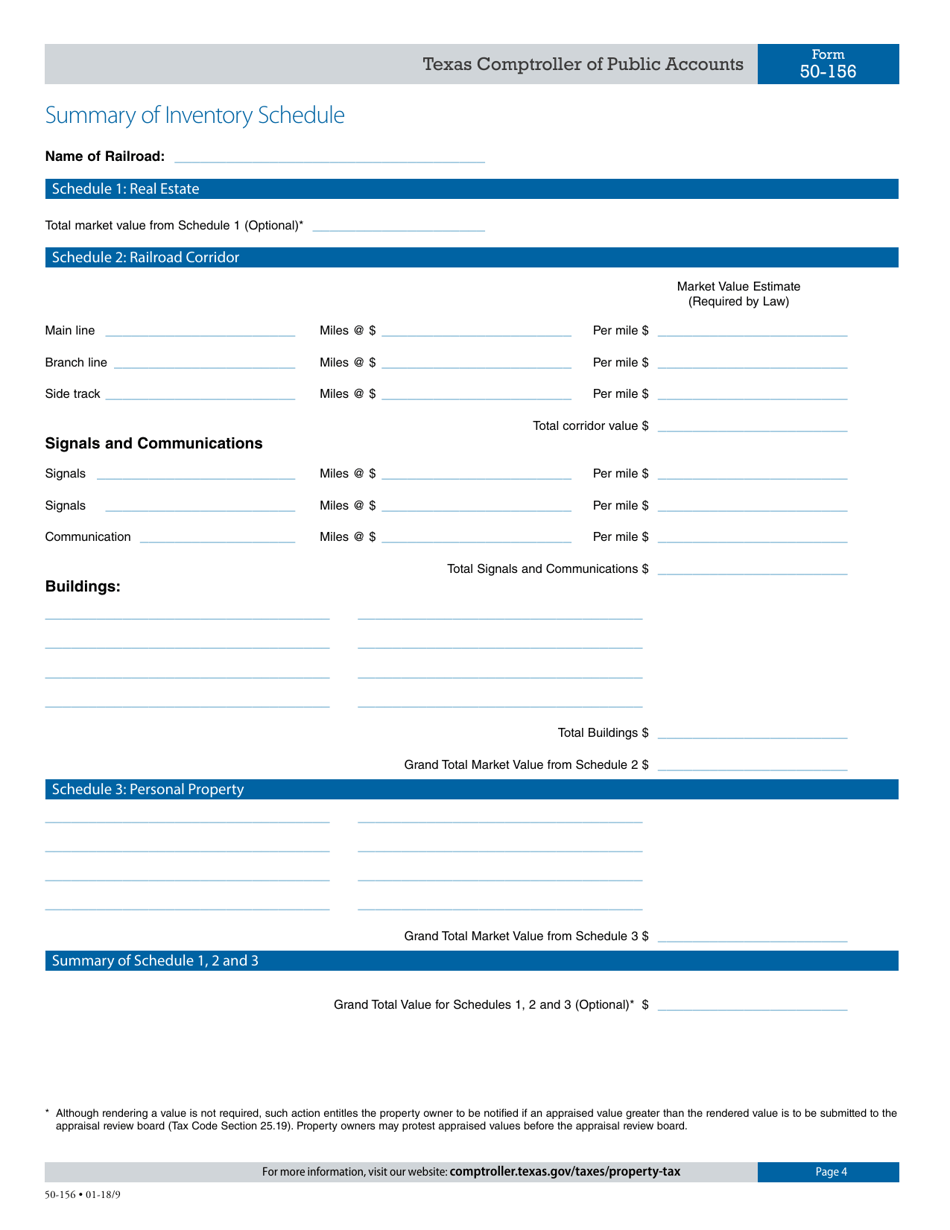

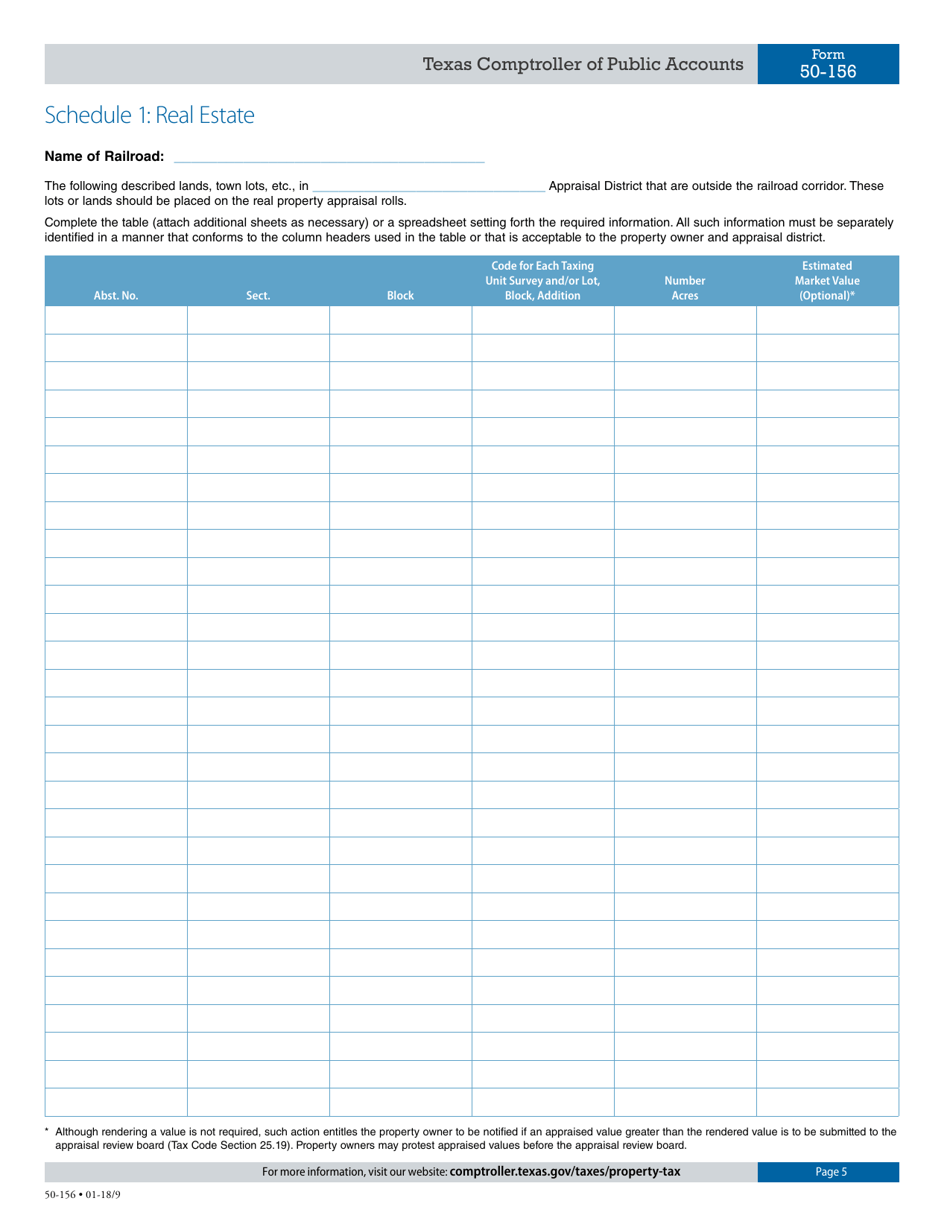

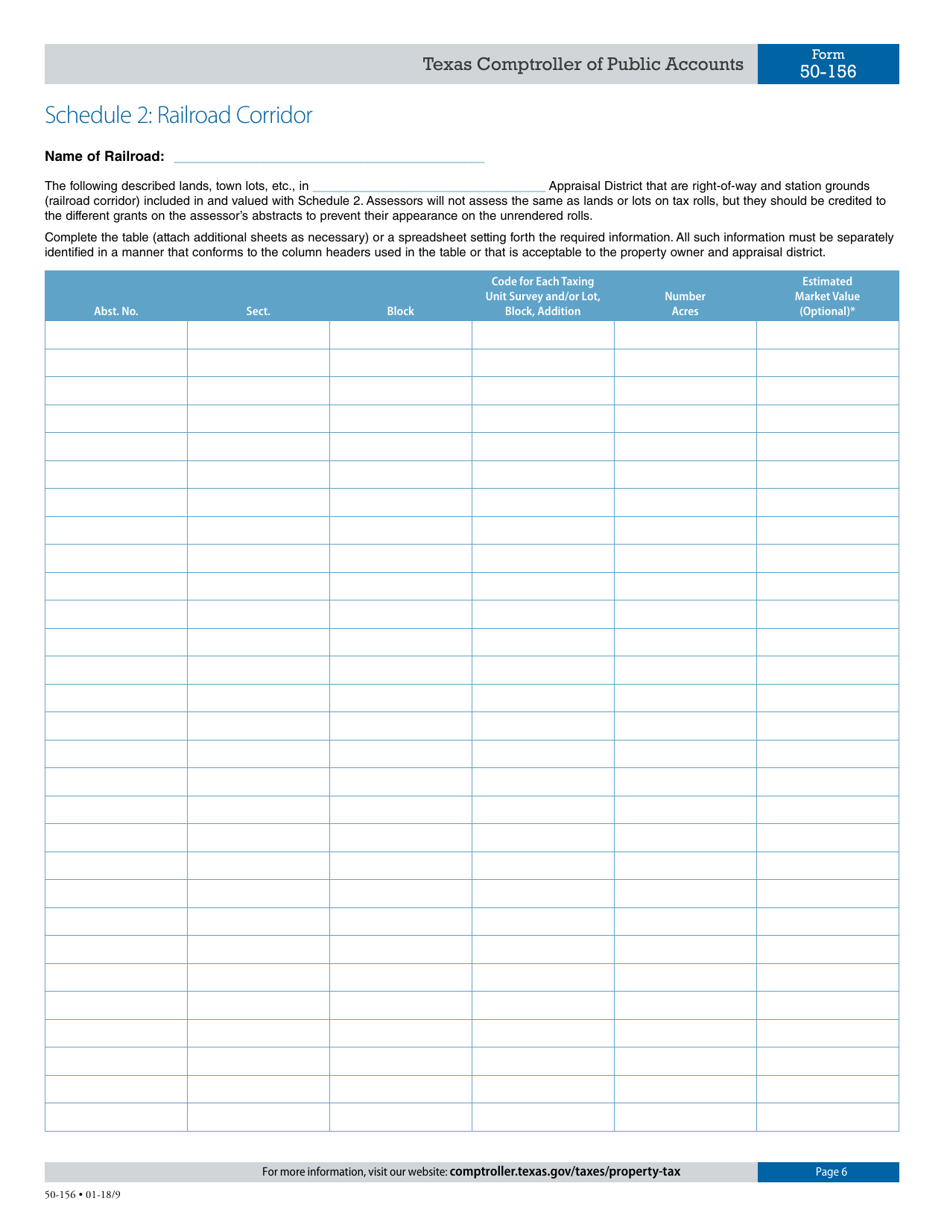

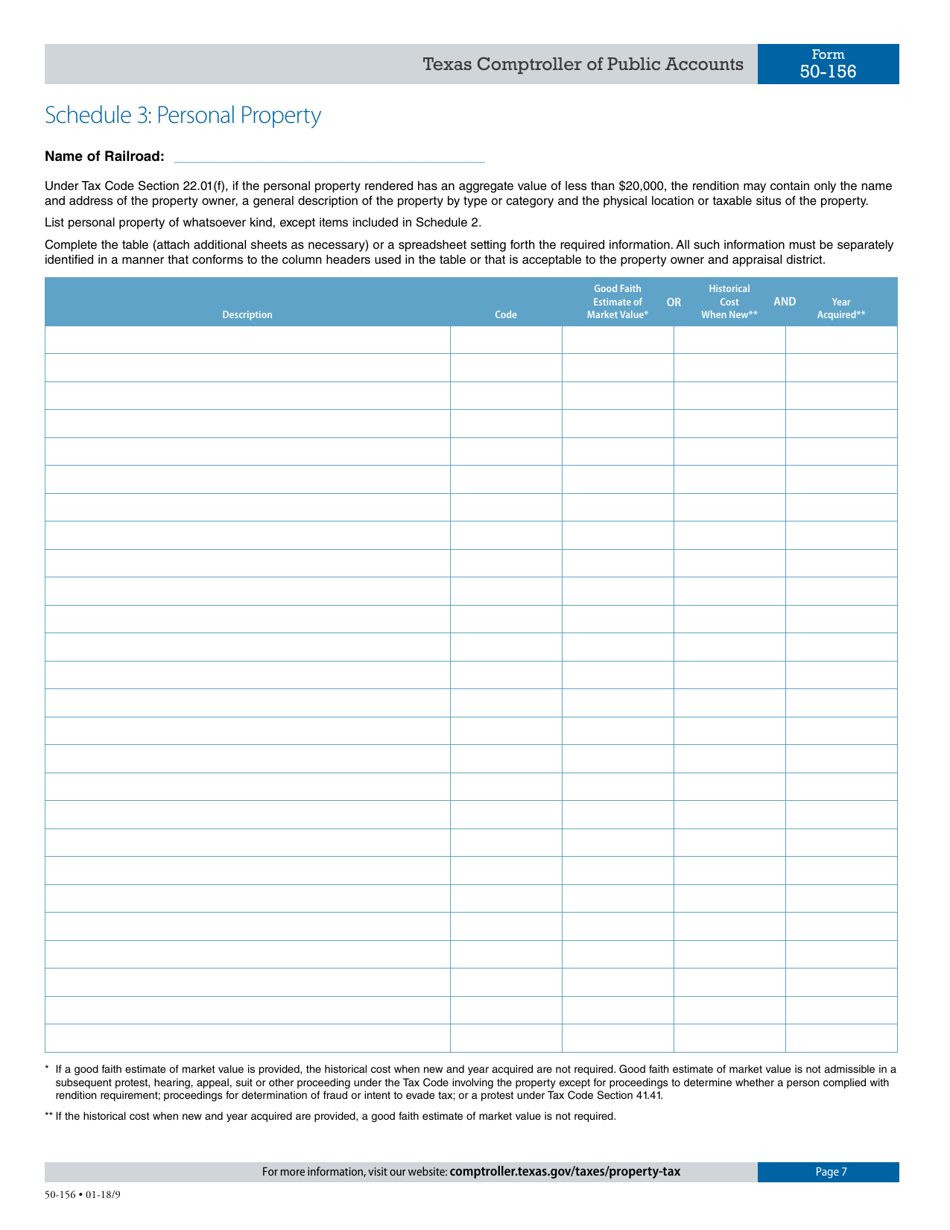

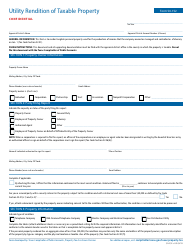

Form 50-156 Railroad Rendition of Taxable Property - Texas

What Is Form 50-156?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-156?

A: Form 50-156 is the Railroad Rendition of Taxable Property form in Texas.

Q: Who is required to file Form 50-156?

A: Railroad companies operating in Texas are required to file Form 50-156.

Q: What is the purpose of Form 50-156?

A: The purpose of Form 50-156 is for railroad companies to report taxable property to the Texas Comptroller's Office.

Q: When is Form 50-156 due?

A: Form 50-156 is due by April 30th of each year.

Q: Are there any penalties for late filing of Form 50-156?

A: Yes, there may be penalties for late filing of Form 50-156.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-156 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.