This version of the form is not currently in use and is provided for reference only. Download this version of

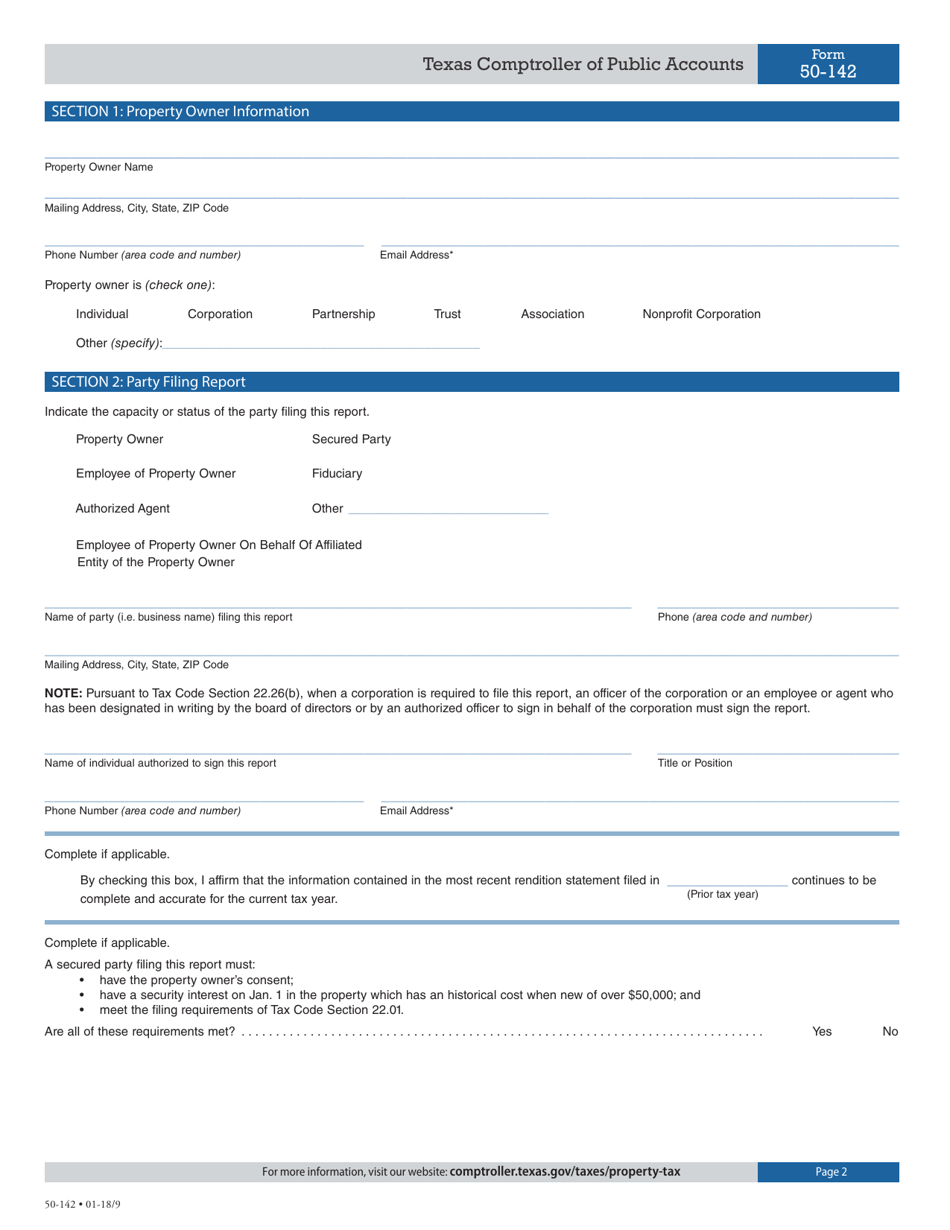

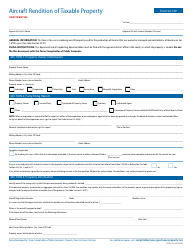

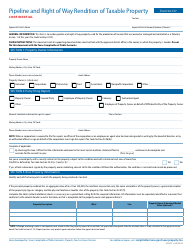

Form 50-142

for the current year.

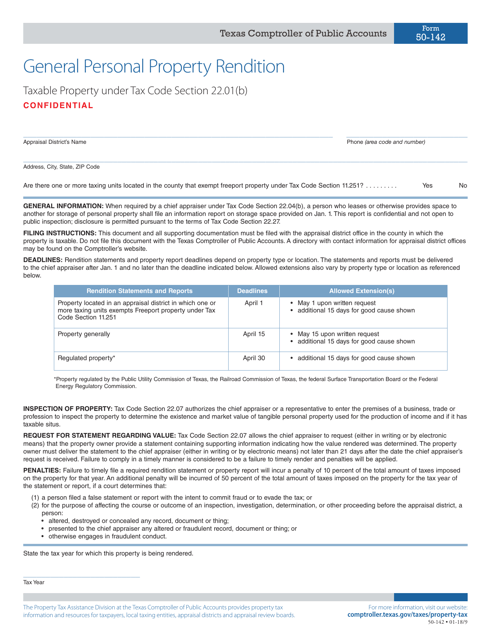

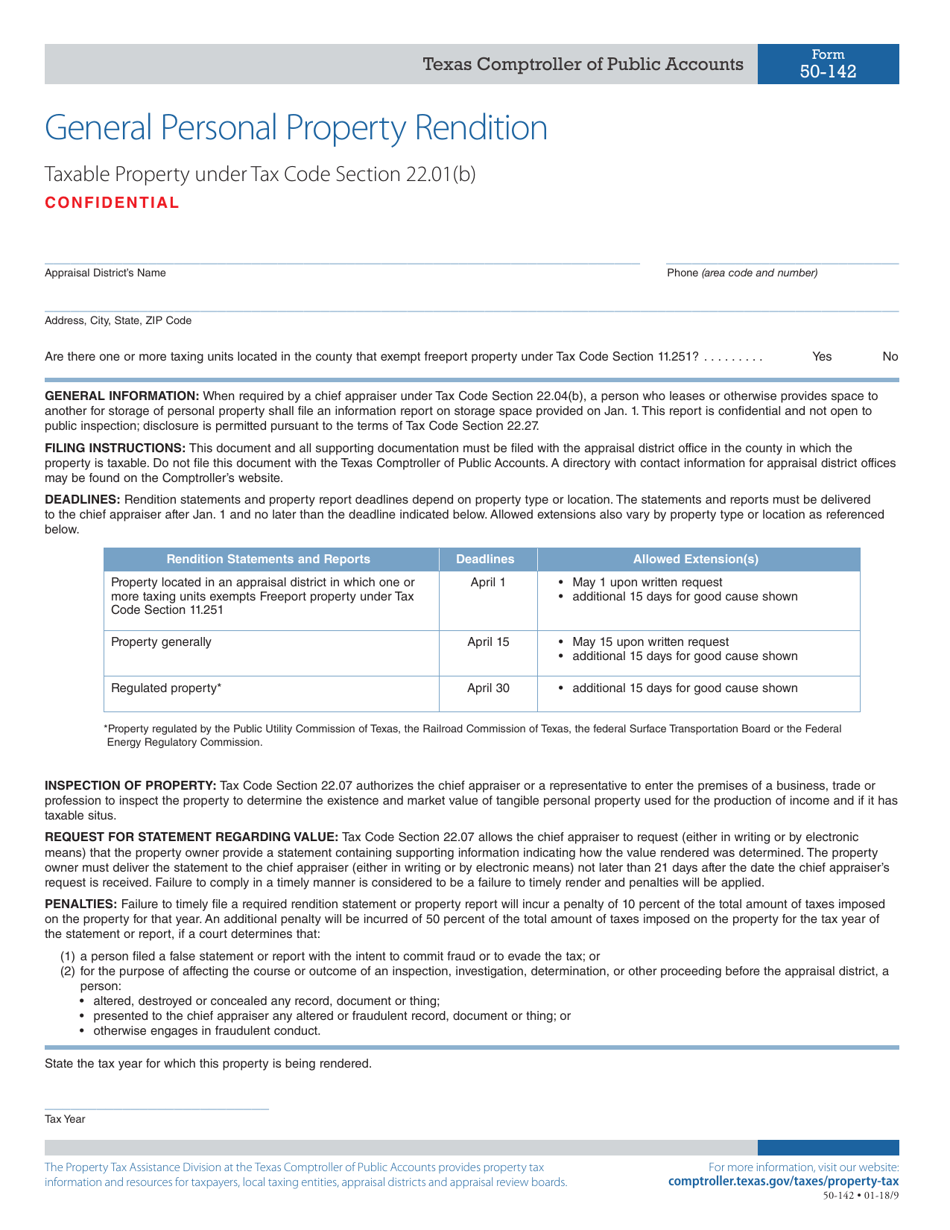

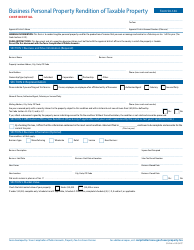

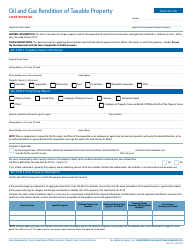

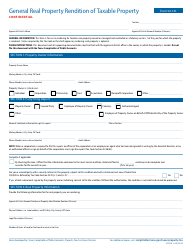

Form 50-142 General Personal Property Rendition - Texas

What Is Form 50-142?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-142?

A: Form 50-142 is the General Personal Property Rendition form used in Texas.

Q: What is the purpose of Form 50-142?

A: The purpose of Form 50-142 is to report personal property owned by businesses in Texas.

Q: Who is required to file Form 50-142?

A: Businesses in Texas that own tangible personal property with a total value exceeding $500 are required to file Form 50-142.

Q: When is Form 50-142 due?

A: Form 50-142 is due on April 15th each year.

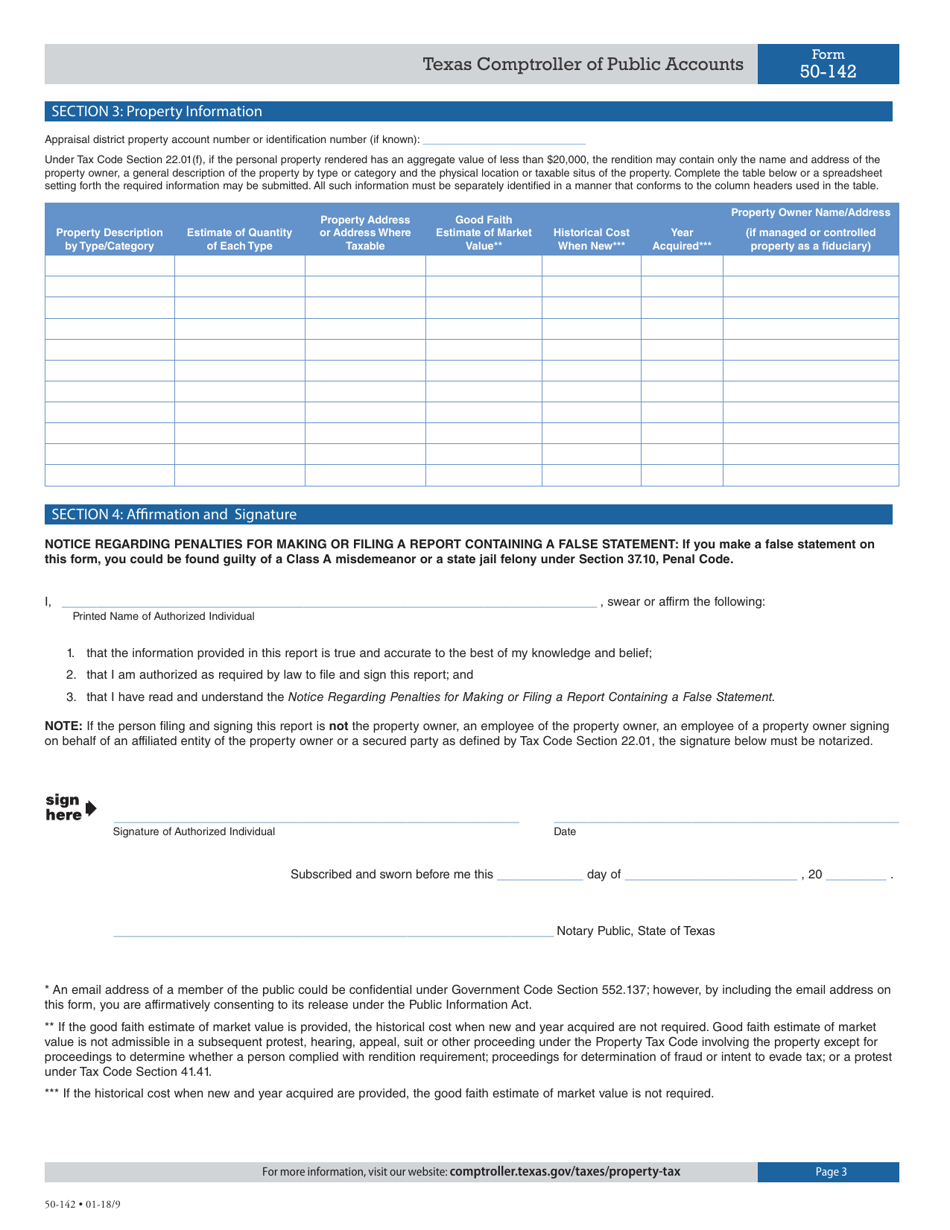

Q: What information is required on Form 50-142?

A: Form 50-142 requires basic information about the business and a detailed listing of the personal property owned.

Q: Are there any penalties for not filing Form 50-142?

A: Yes, failure to file Form 50-142 or filing it late can result in penalties, including fines and interest charges.

Q: Are all types of personal property listed on Form 50-142?

A: No, certain types of personal property, such as inventory and certain temporary personal property, are exempt from being listed on Form 50-142.

Q: Is Form 50-142 the only form for reporting personal property in Texas?

A: No, businesses may also be required to file additional forms, such as Form 50-144 for leased personal property.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-142 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.