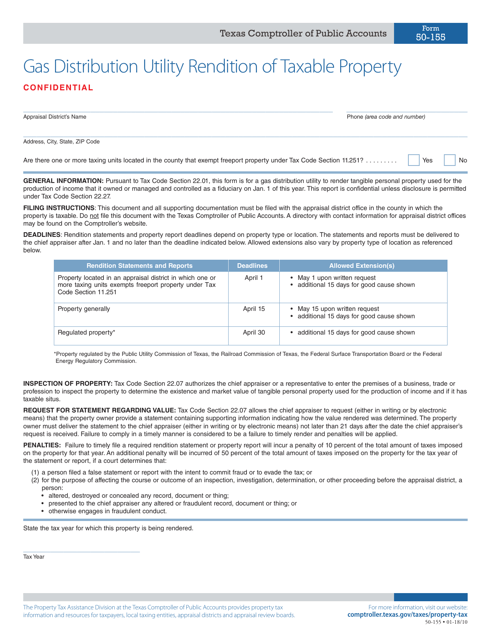

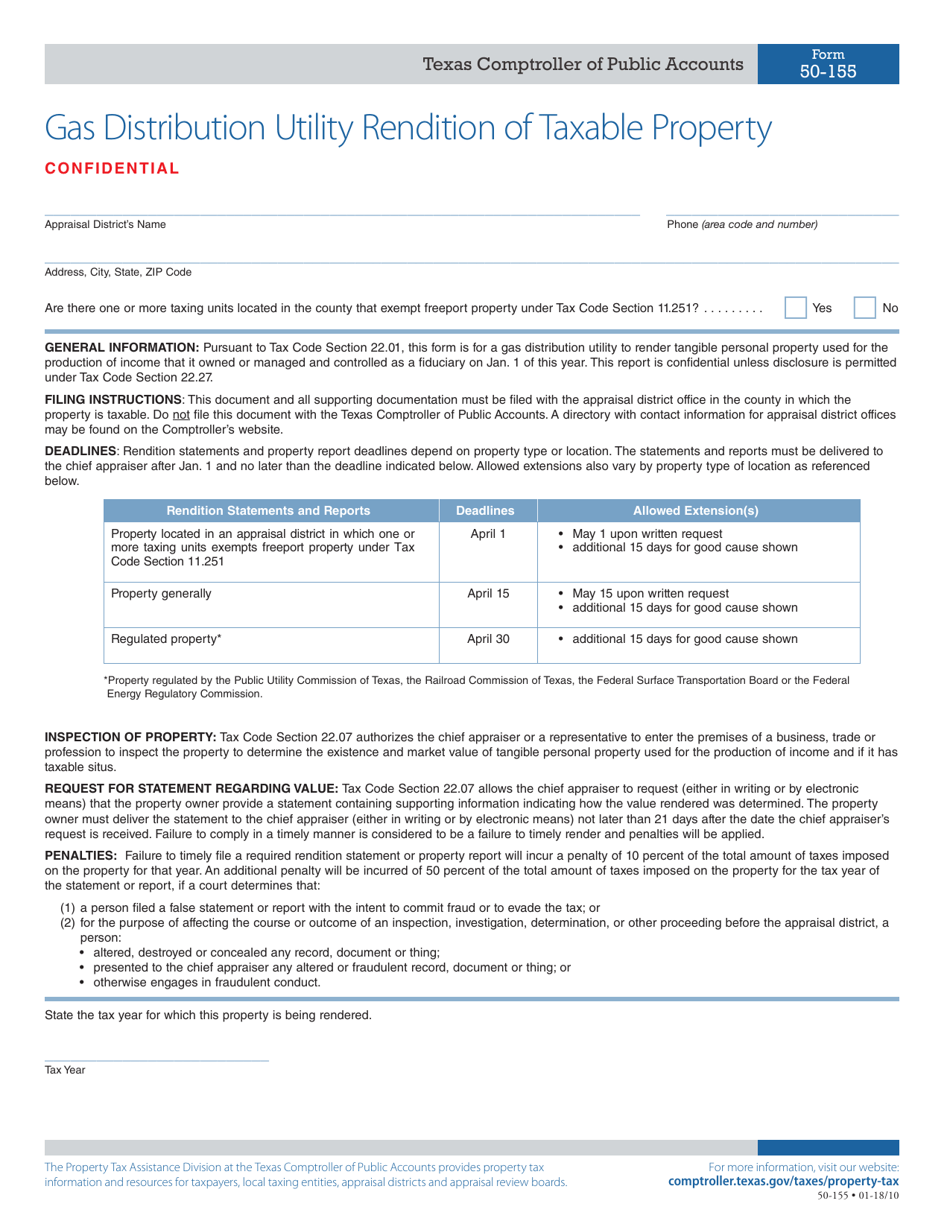

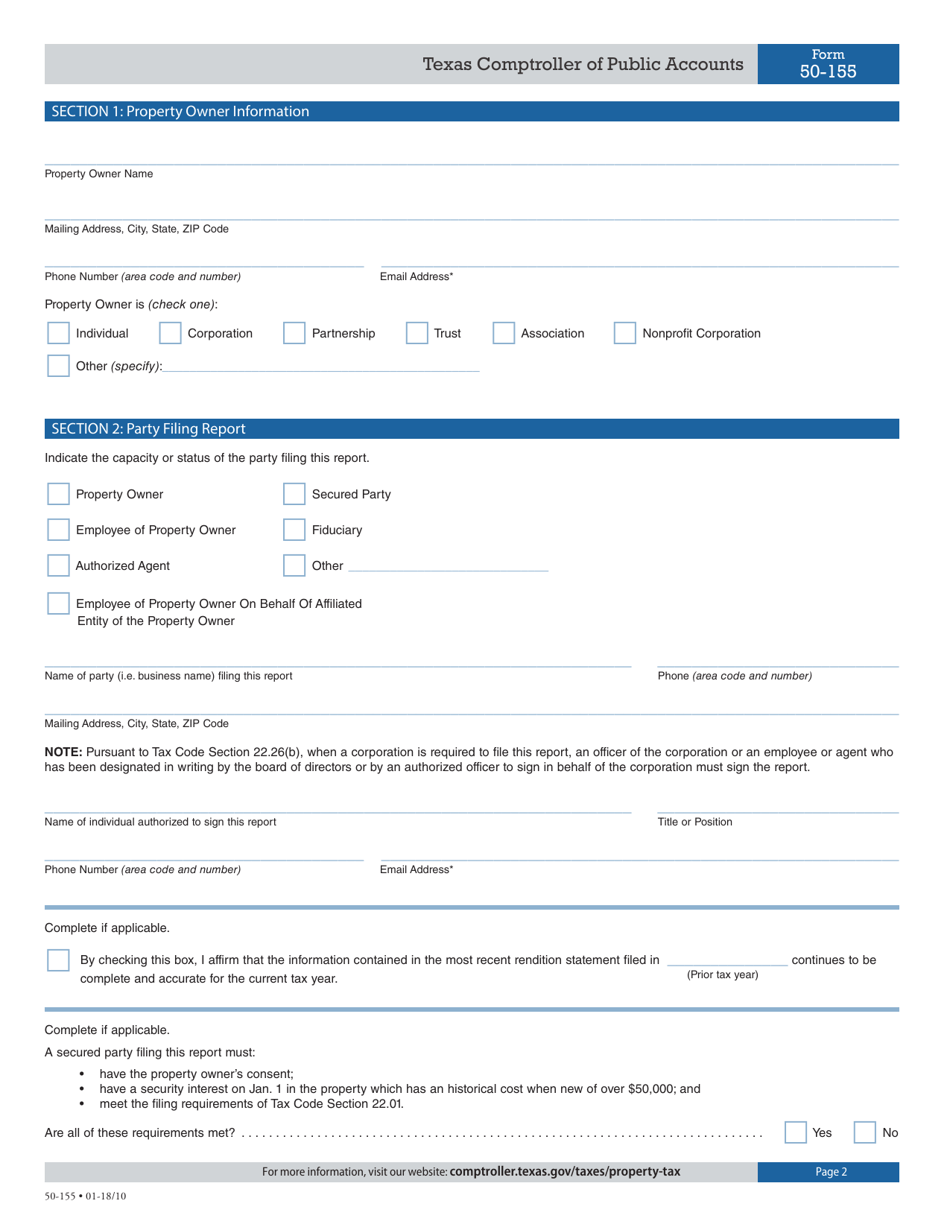

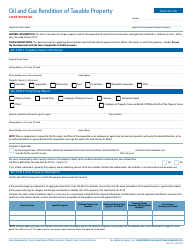

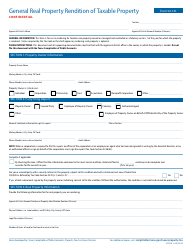

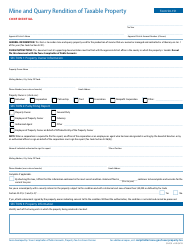

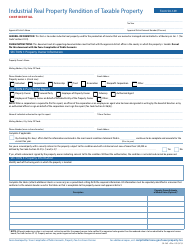

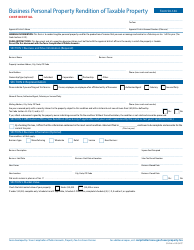

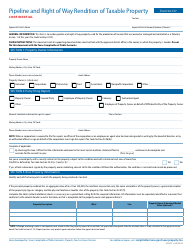

Form 50-155 Gas Distribution Utility Rendition of Taxable Property - Texas

What Is Form 50-155?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-155?

A: Form 50-155 is the Gas Distribution Utility Rendition of Taxable Property in Texas.

Q: Who is required to file Form 50-155?

A: Gas distribution utilities in Texas are required to file Form 50-155.

Q: What is the purpose of Form 50-155?

A: The purpose of Form 50-155 is for gas distribution utilities to report taxable property for assessment and taxation purposes.

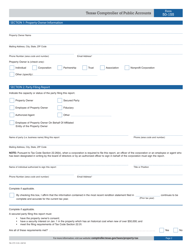

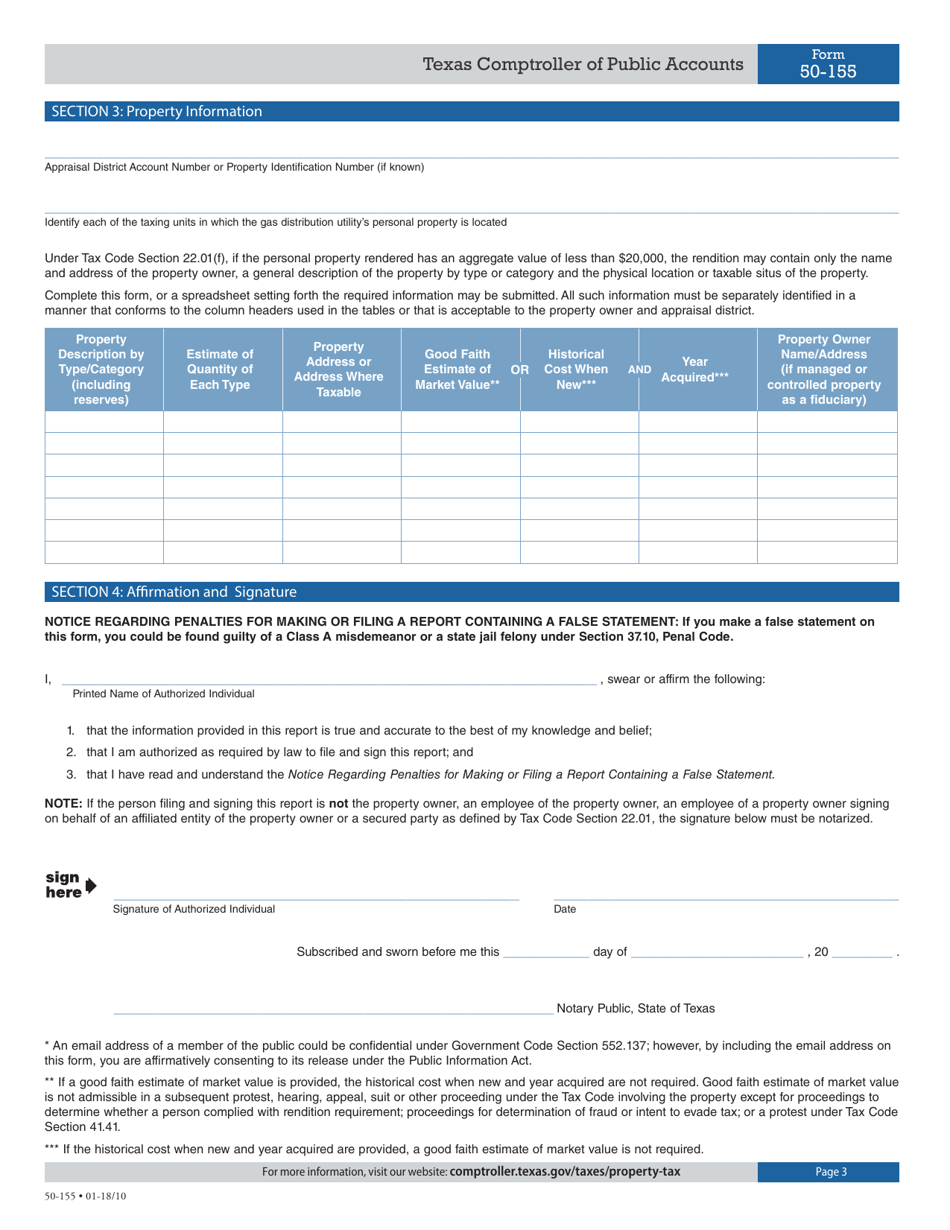

Q: What information is required on Form 50-155?

A: Form 50-155 requires gas distribution utilities to provide information about their taxable property, including details such as location, cost, and description.

Q: When is Form 50-155 due?

A: Form 50-155 is due on or before April 15th of each year.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-155 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.