This version of the form is not currently in use and is provided for reference only. Download this version of

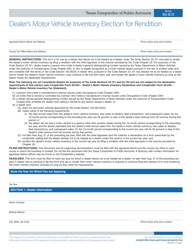

Form 50-143

for the current year.

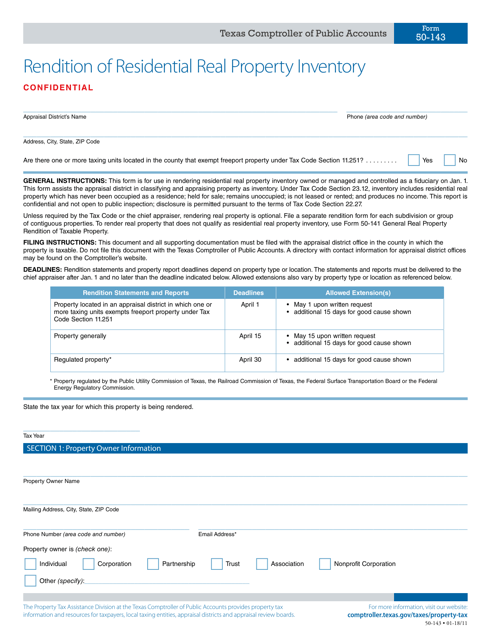

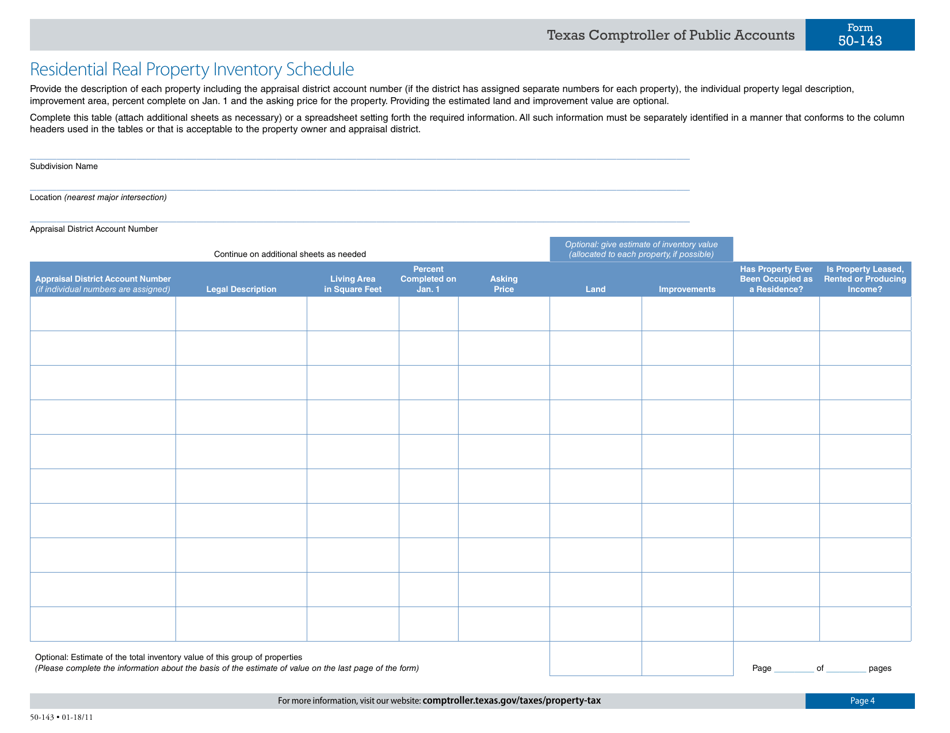

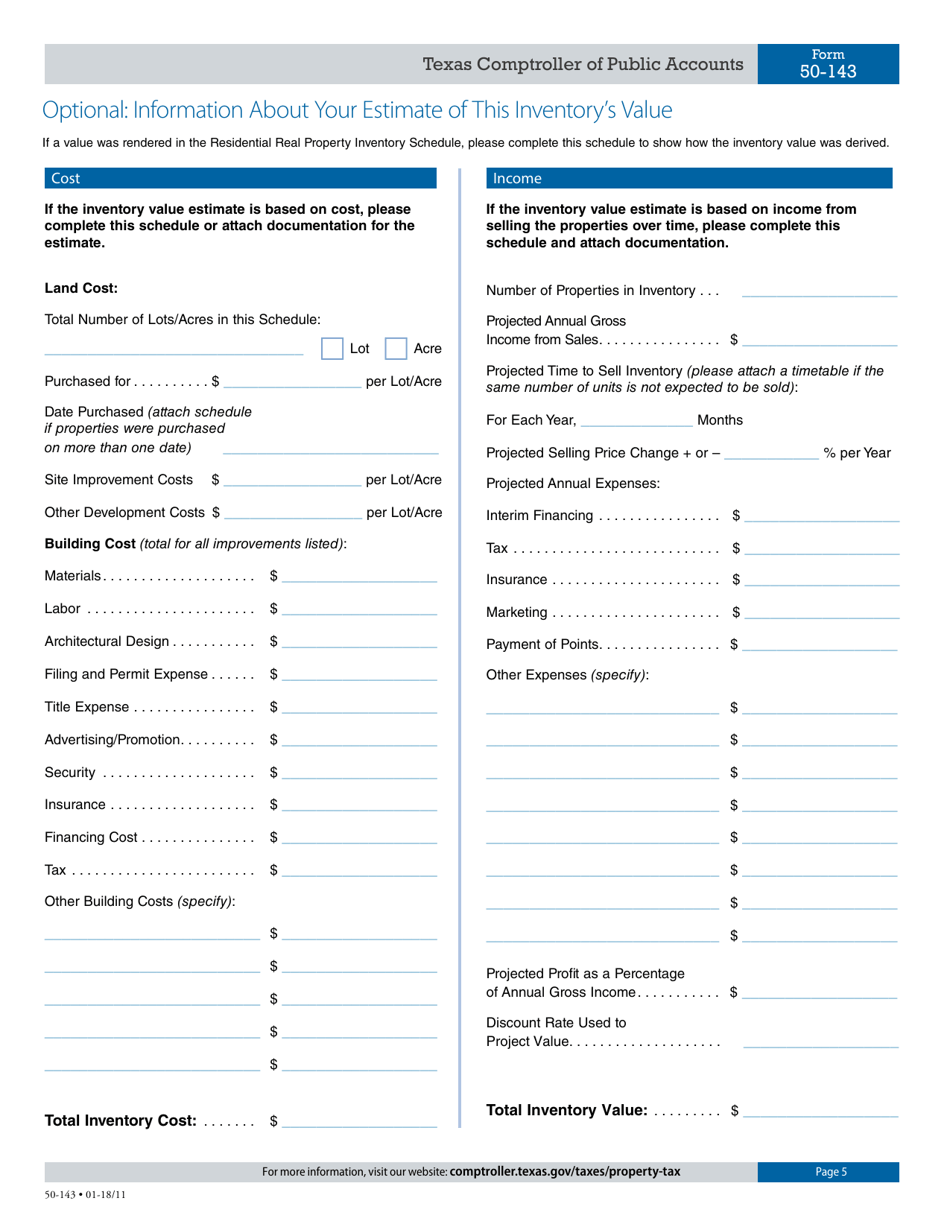

Form 50-143 Rendition of Residential Real Property Inventory - Texas

What Is Form 50-143?

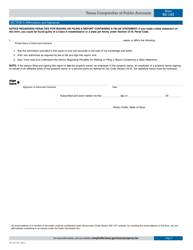

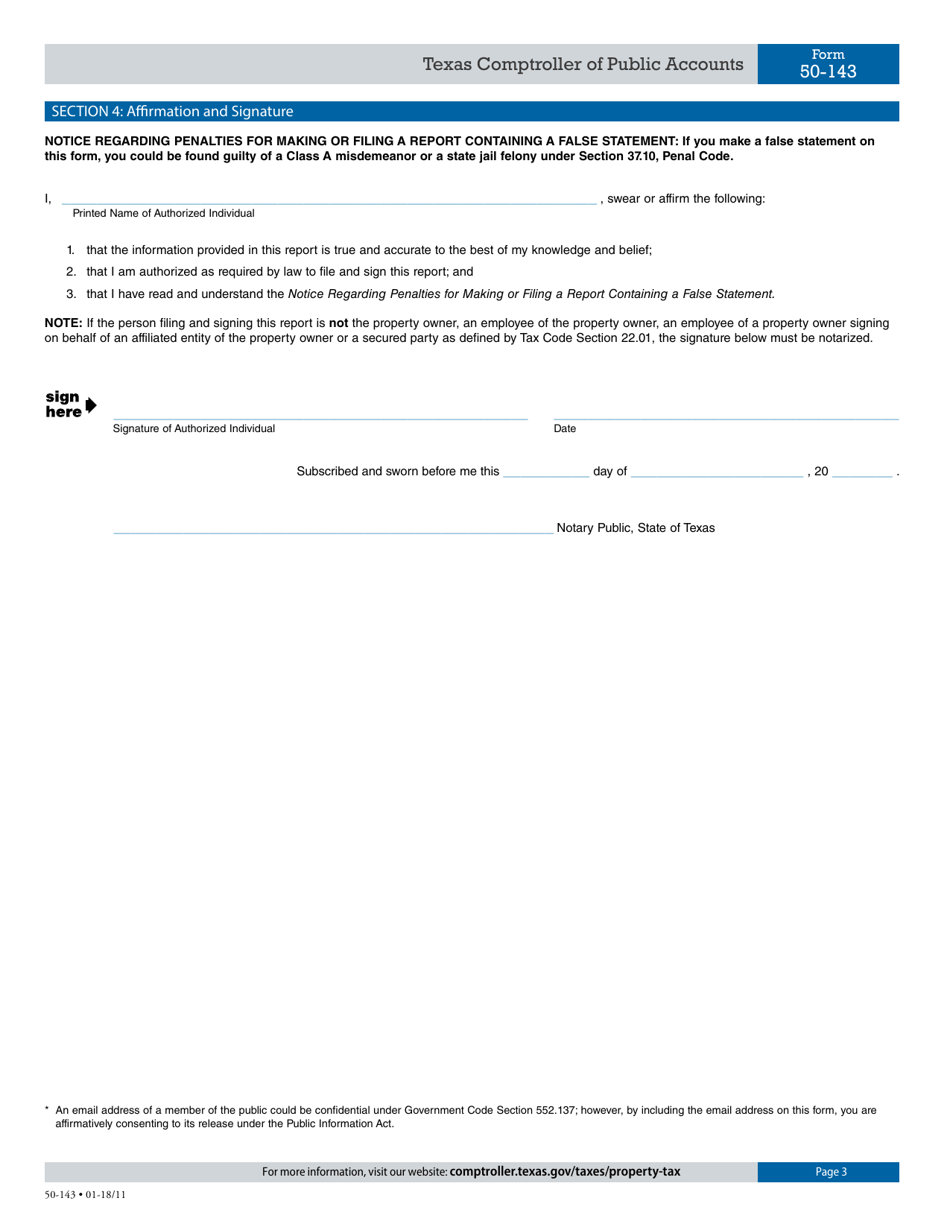

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

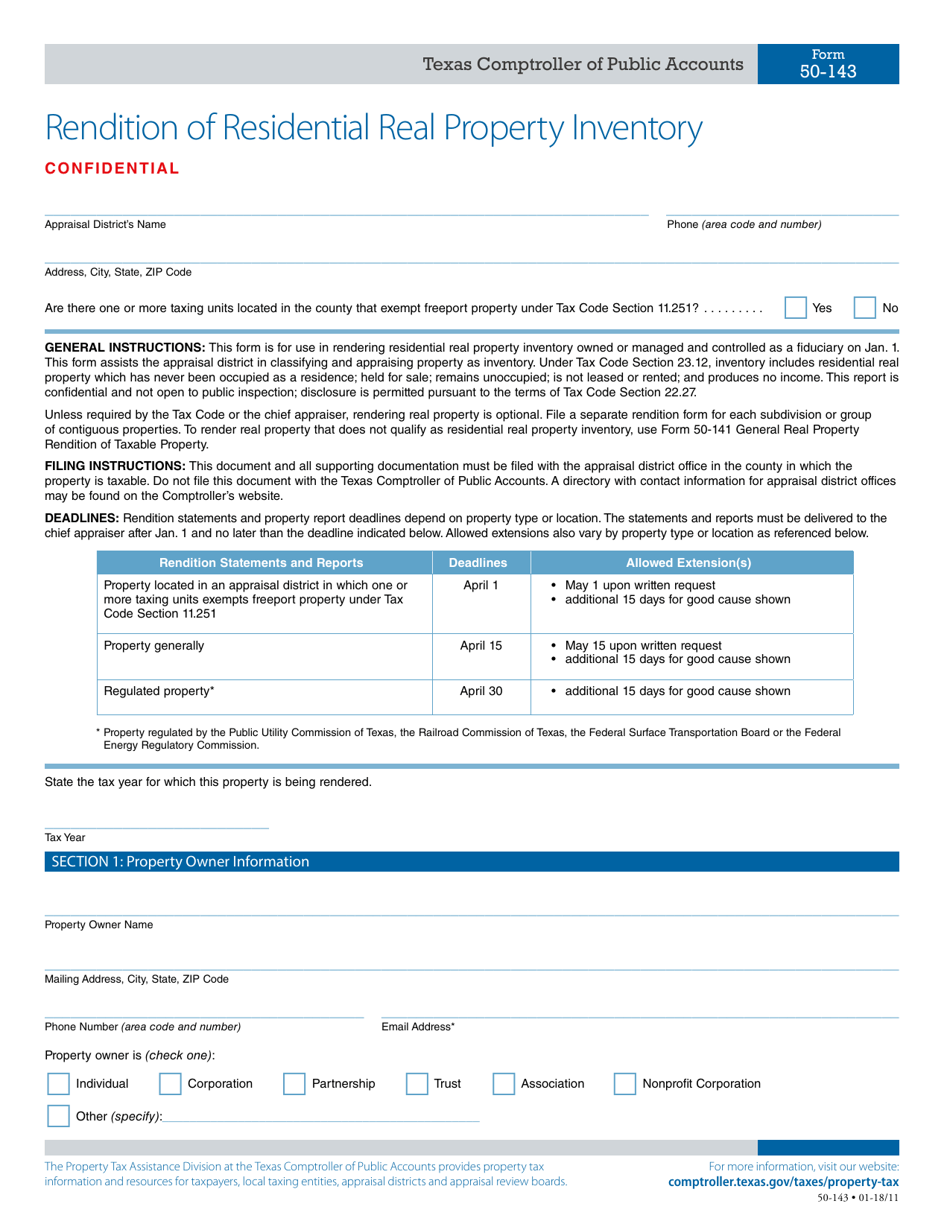

Q: What is Form 50-143?

A: Form 50-143 is the Rendition of Residential Real Property Inventory form in Texas.

Q: Who needs to file Form 50-143?

A: Property owners in Texas who own residential real property need to file Form 50-143.

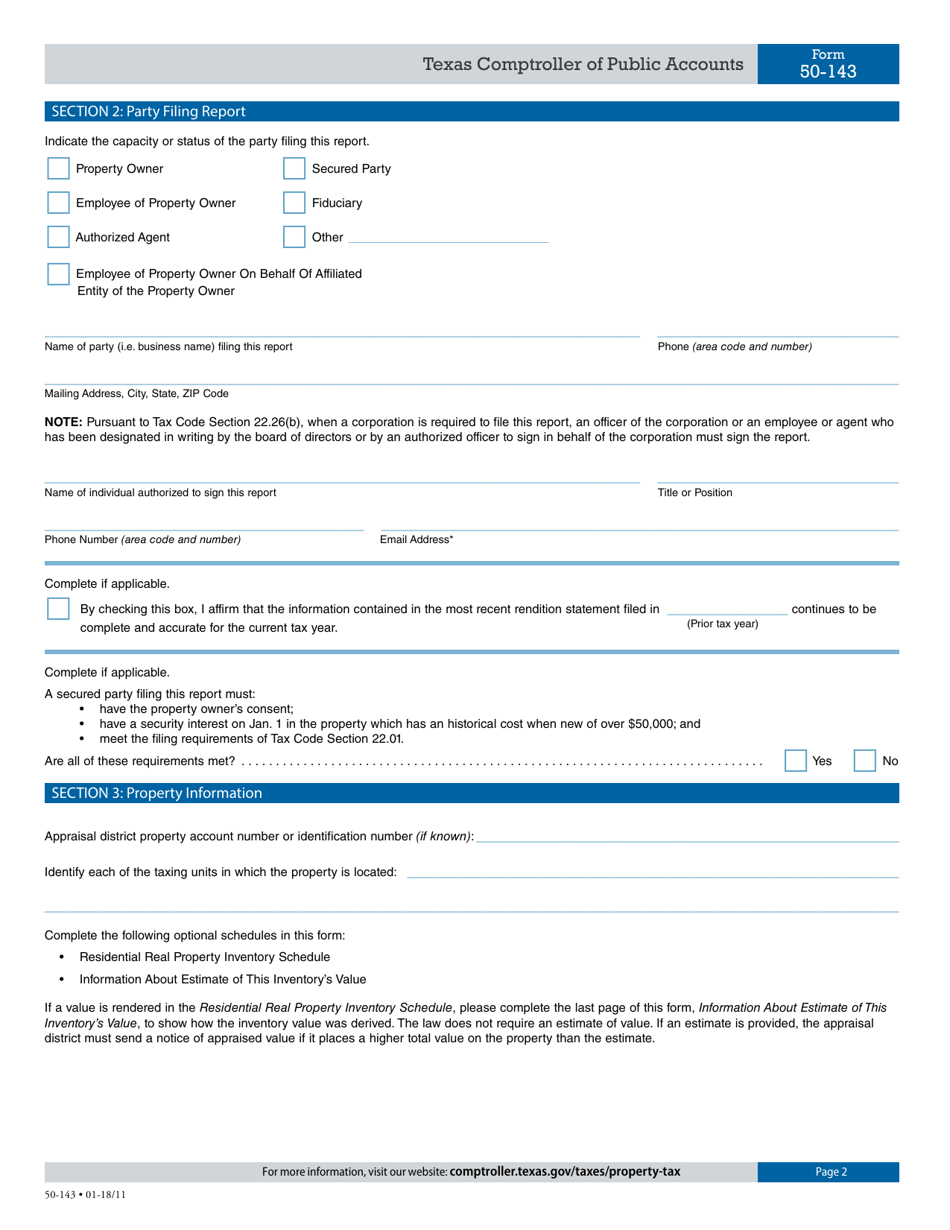

Q: What is the purpose of Form 50-143?

A: The purpose of Form 50-143 is to report the inventory of residential real property in Texas to the county appraisal district.

Q: When is Form 50-143 due?

A: Form 50-143 is typically due by April 15th of each year.

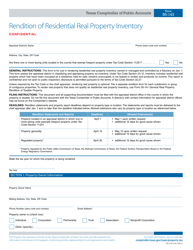

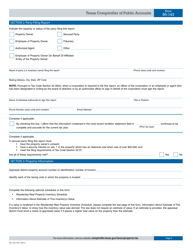

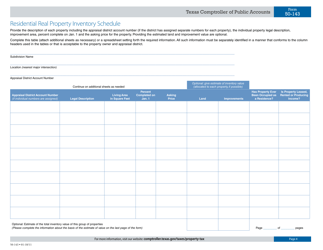

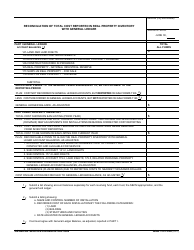

Q: What information is required on Form 50-143?

A: Form 50-143 requires information such as property description, market value, and requested adjustments.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-143 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.