This version of the form is not currently in use and is provided for reference only. Download this version of

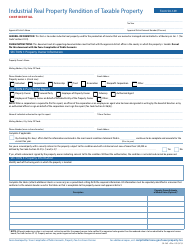

Form 50-157

for the current year.

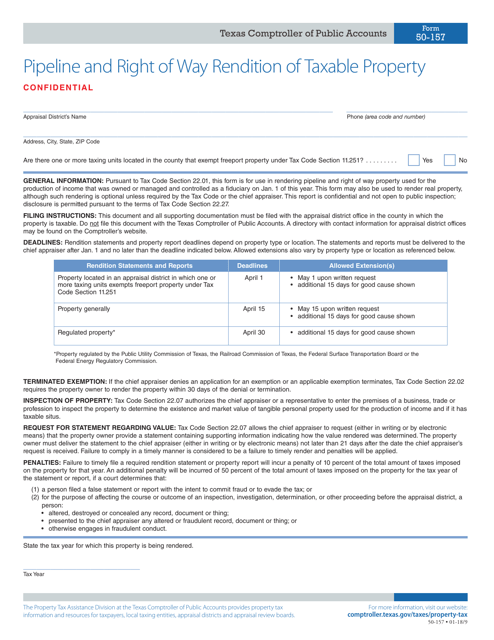

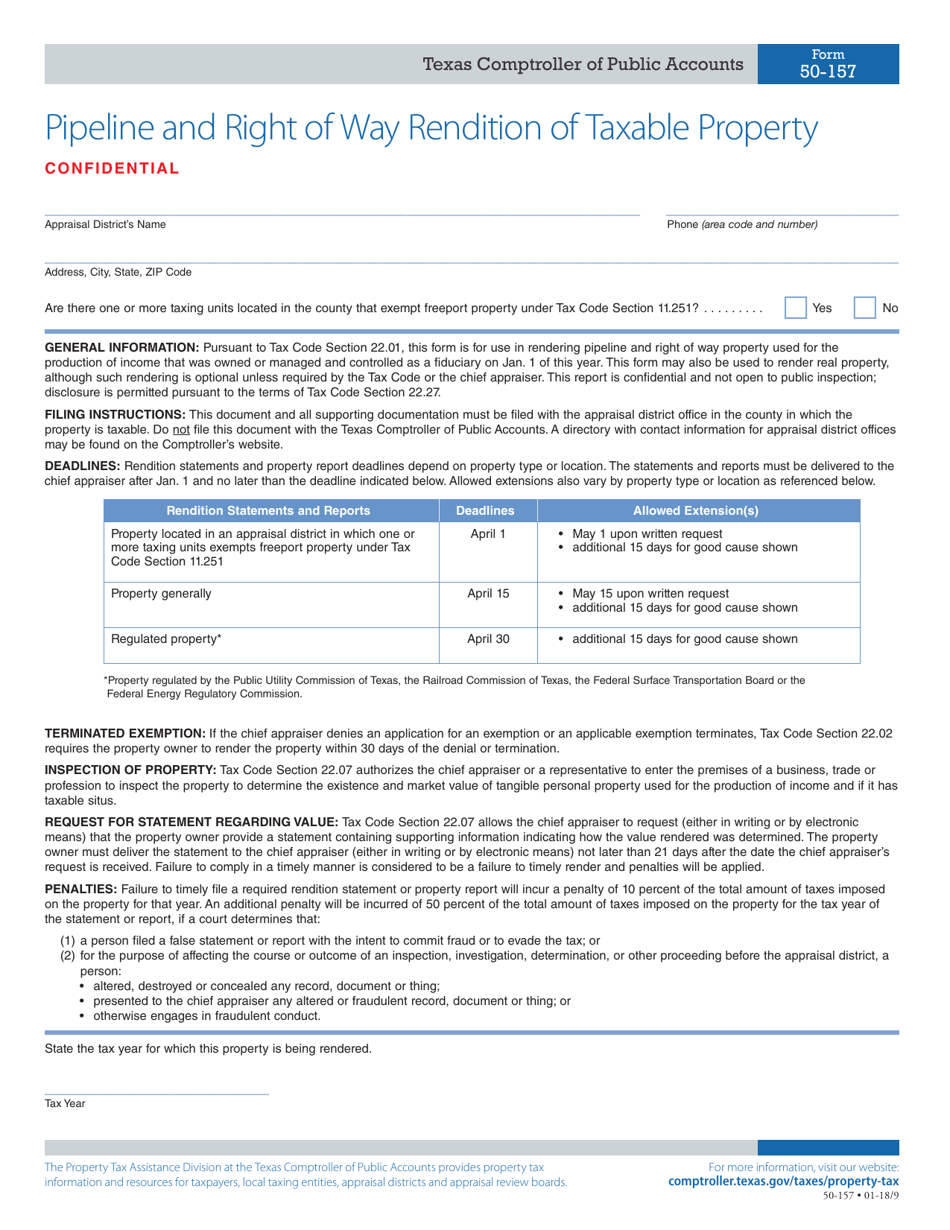

Form 50-157 Pipeline and Right of Way Rendition of Taxable Property - Texas

What Is Form 50-157?

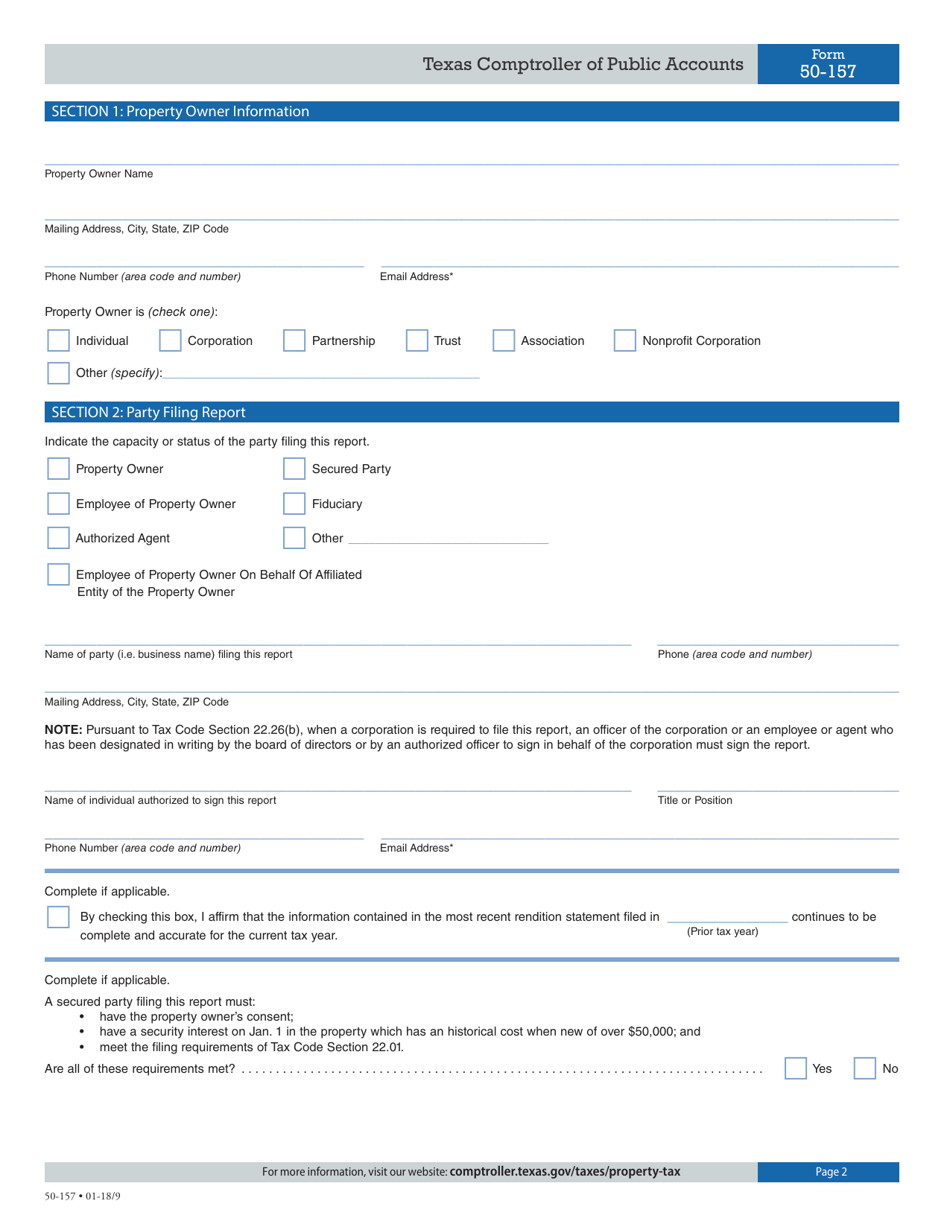

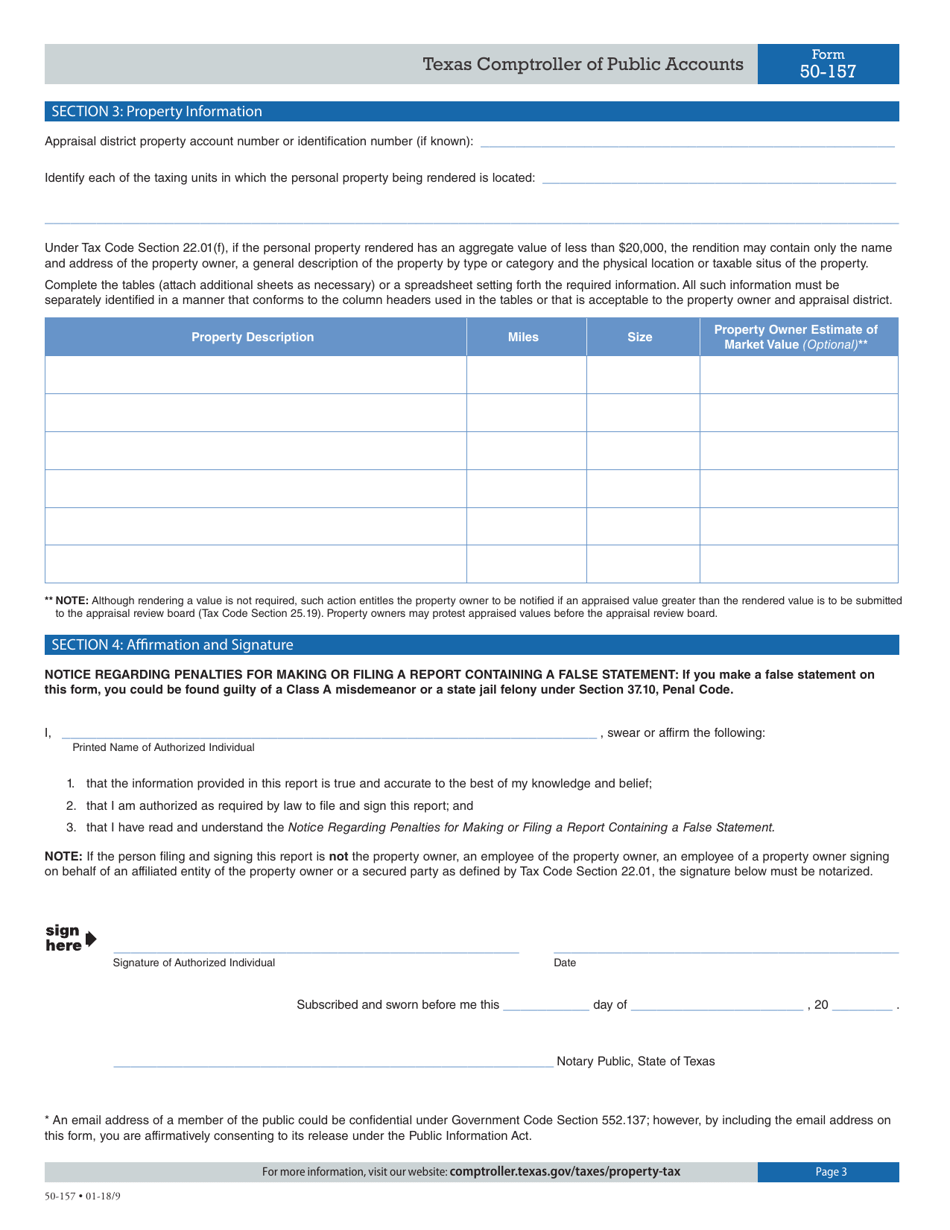

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-157?

A: Form 50-157 is the Pipeline and Right of Way Rendition of Taxable Property form in Texas.

Q: Who needs to fill out Form 50-157?

A: Property owners who have pipelines or right of way on their land in Texas are required to fill out Form 50-157.

Q: What is the purpose of Form 50-157?

A: The purpose of Form 50-157 is to report and provide information on pipelines and right of way on taxable property in Texas.

Q: When is Form 50-157 due?

A: Form 50-157 is due on April 15th of each year.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-157 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.