This version of the form is not currently in use and is provided for reference only. Download this version of

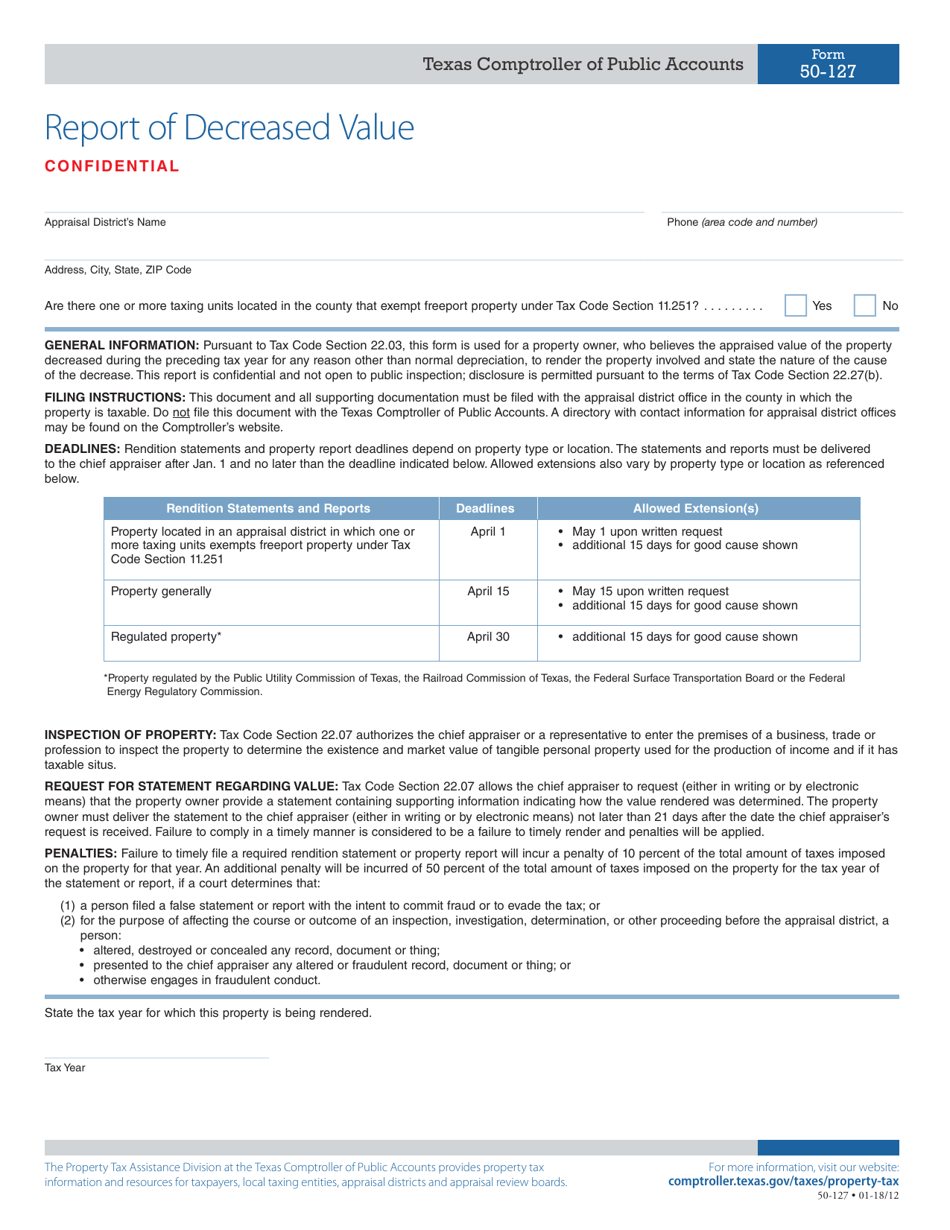

Form 50-127

for the current year.

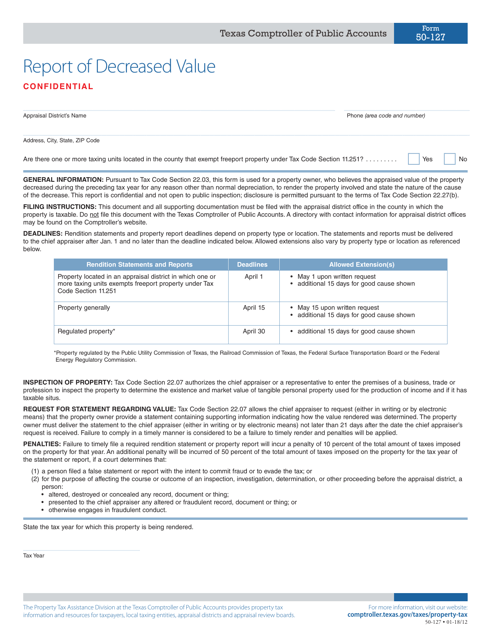

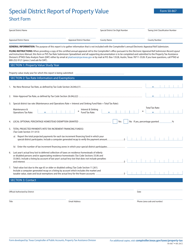

Form 50-127 Report of Decreased Value - Texas

What Is Form 50-127?

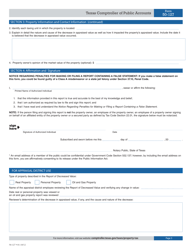

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-127?

A: Form 50-127 is the Report of Decreased Value, used in Texas.

Q: What is the purpose of Form 50-127?

A: The purpose of Form 50-127 is to report a decrease in the value of property for property tax purposes.

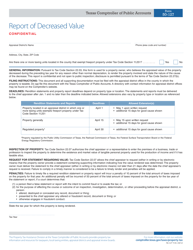

Q: Who needs to file Form 50-127?

A: Property owners in Texas who experience a decrease in the value of their property for property tax purposes need to file Form 50-127.

Q: When should Form 50-127 be filed?

A: Form 50-127 should be filed with the local appraisal district between January 1st and April 15th of the tax year.

Q: Are there any filing fees for Form 50-127?

A: No, there are no filing fees for Form 50-127.

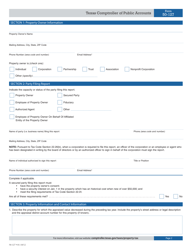

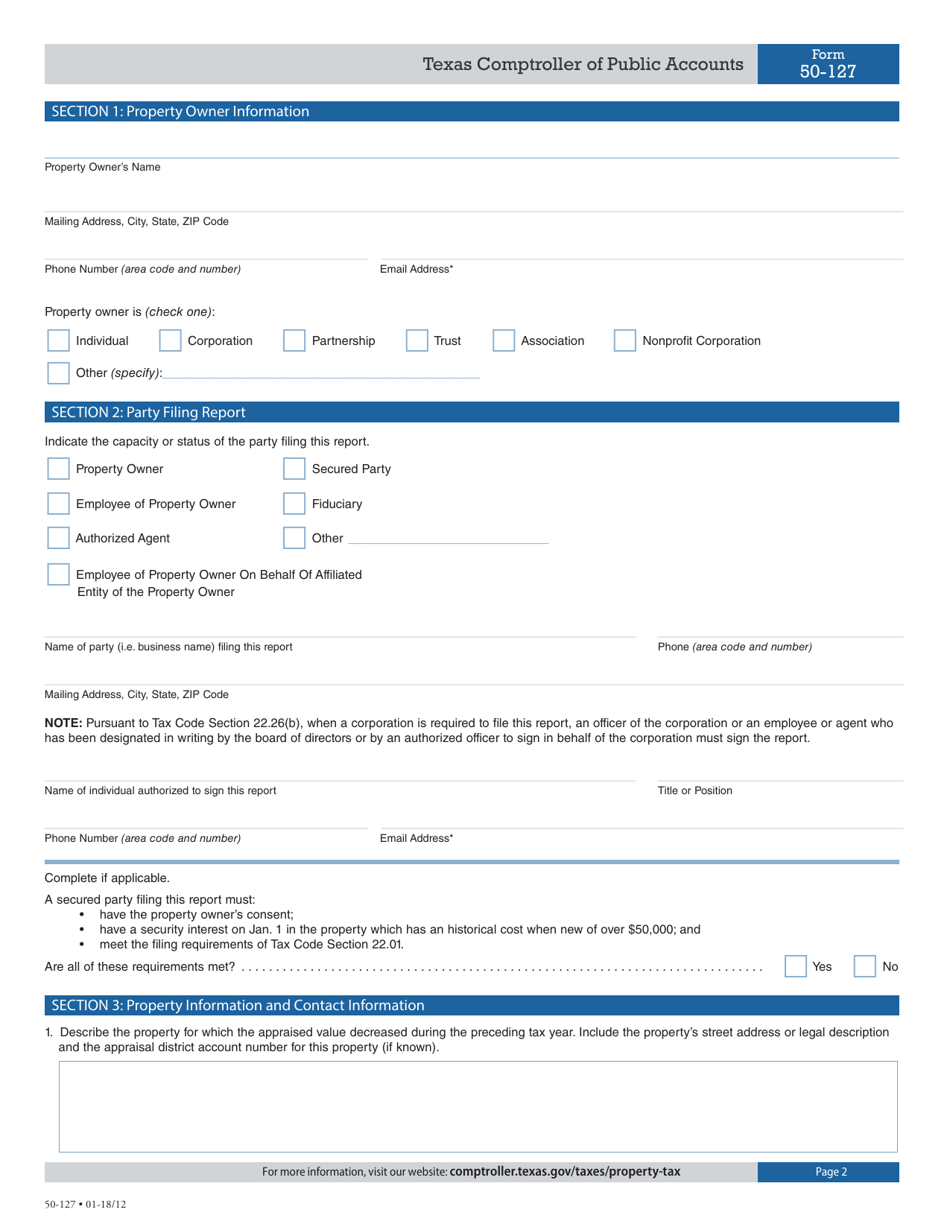

Q: What information is required on Form 50-127?

A: Form 50-127 requires the property owner to provide information such as the property description, the reason for the decrease in value, and supporting documentation.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-127 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.