This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-152

for the current year.

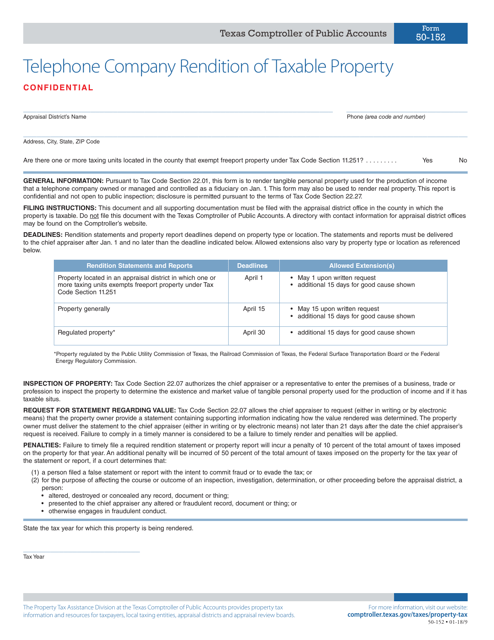

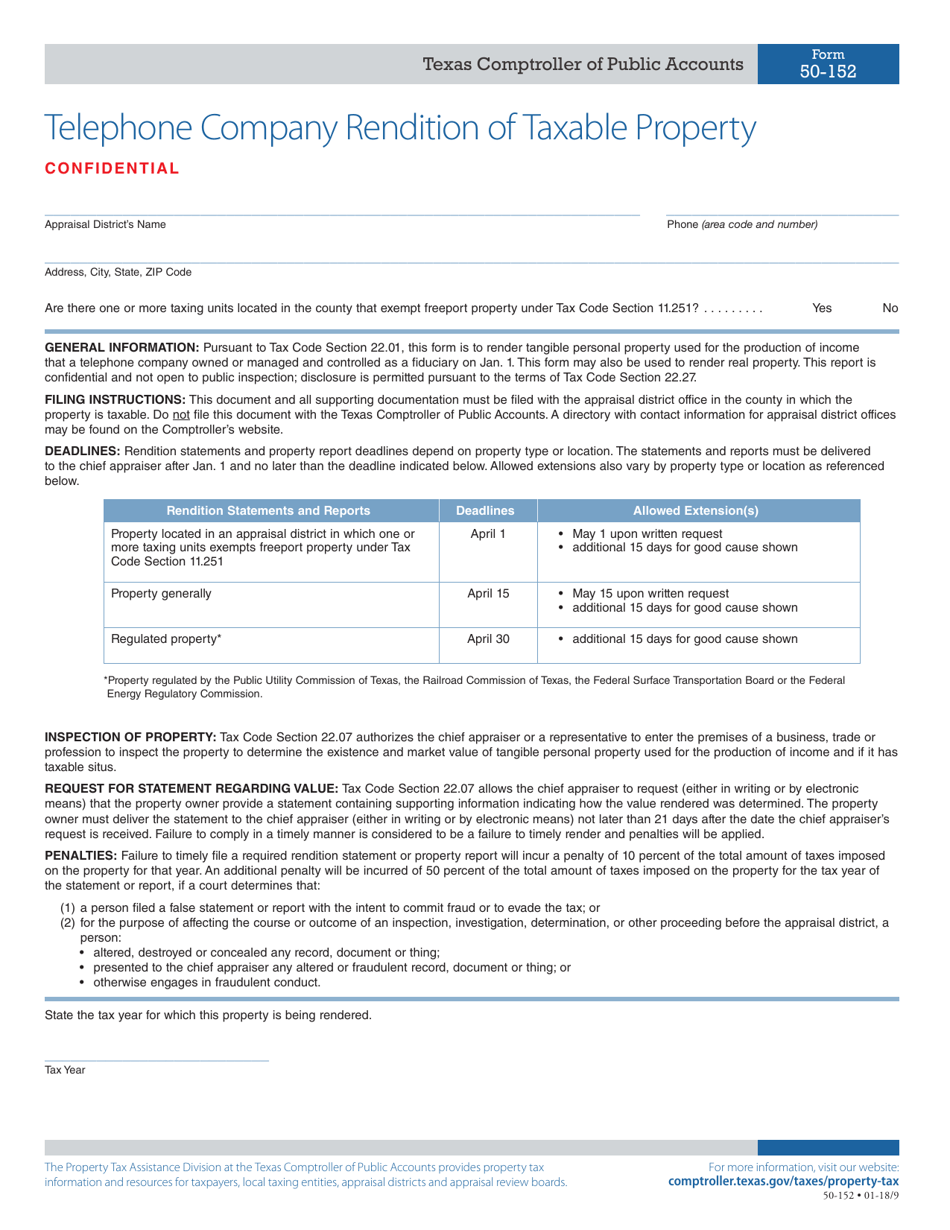

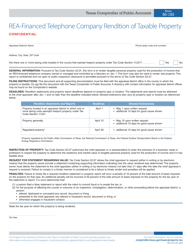

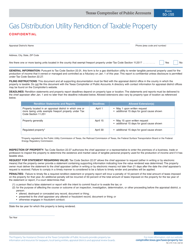

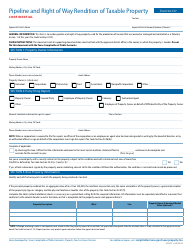

Form 50-152 Telephone Company Rendition of Taxable Property - Texas

What Is Form 50-152?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-152?

A: Form 50-152 is the Telephone Company Rendition of Taxable Property form in Texas.

Q: Who needs to fill out Form 50-152?

A: Telephone companies in Texas need to fill out Form 50-152.

Q: What is the purpose of Form 50-152?

A: The purpose of Form 50-152 is for telephone companies to report their taxable property to the Texas Comptroller's Office.

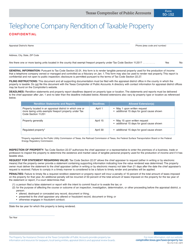

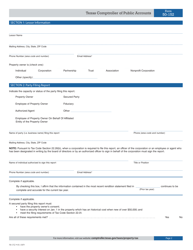

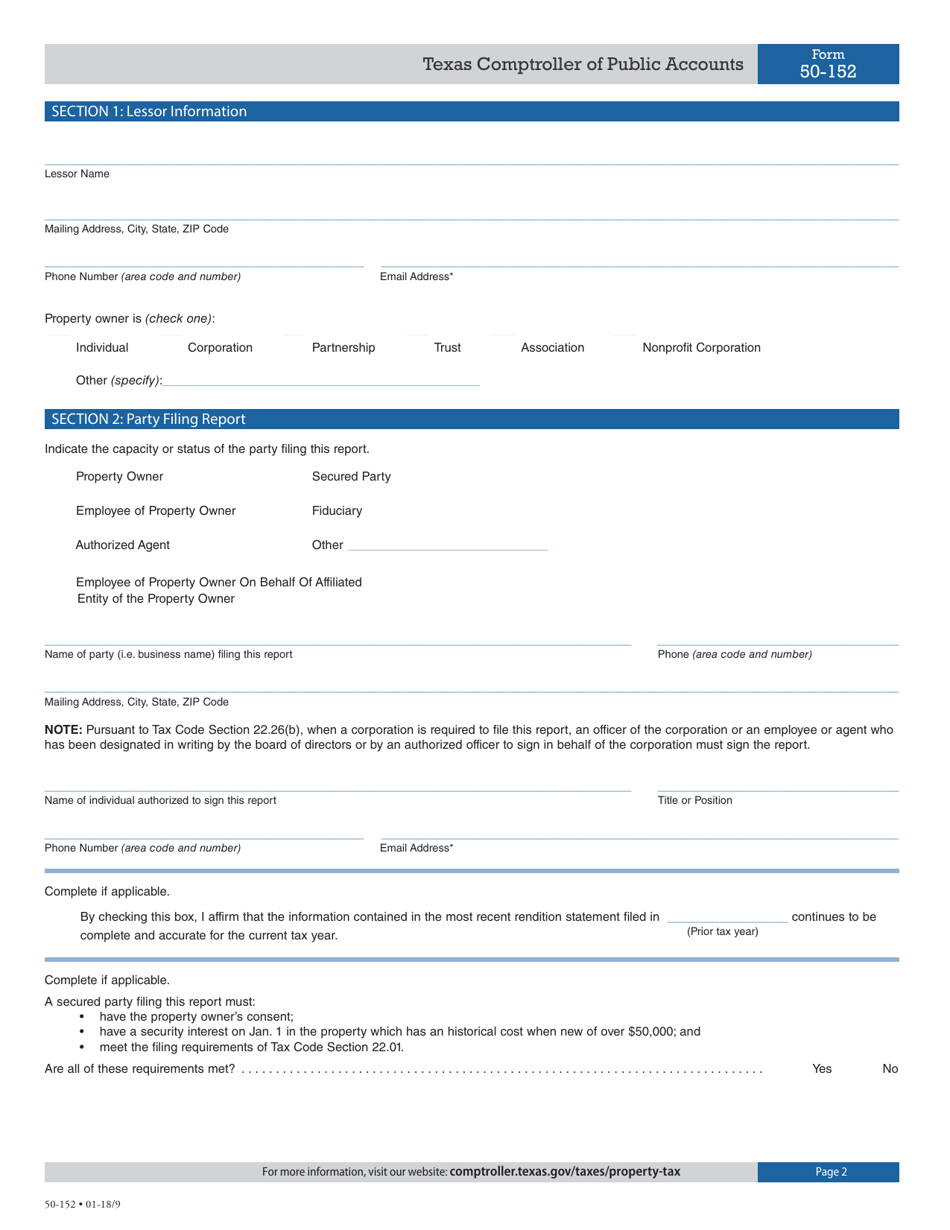

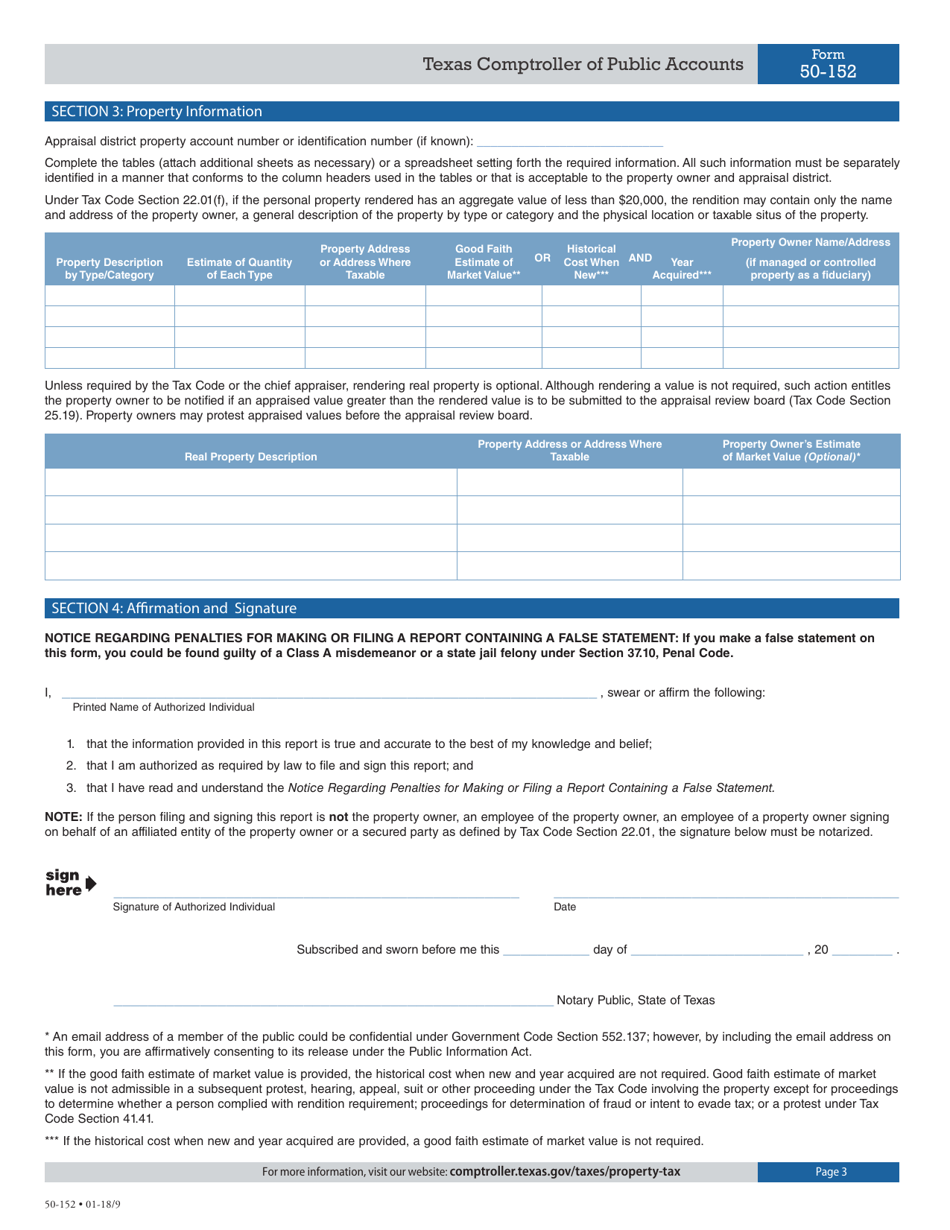

Q: What information is required on Form 50-152?

A: Form 50-152 requires telephone companies to provide information about their taxable property, such as equipment, assets, and other property used in their operations.

Q: When is Form 50-152 due?

A: Form 50-152 is due on April 1st of each year.

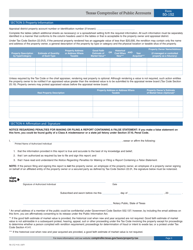

Q: Is there a penalty for not filing Form 50-152?

A: Yes, there may be penalties for not filing Form 50-152 or for providing false or misleading information.

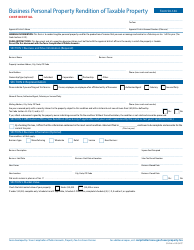

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-152 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.